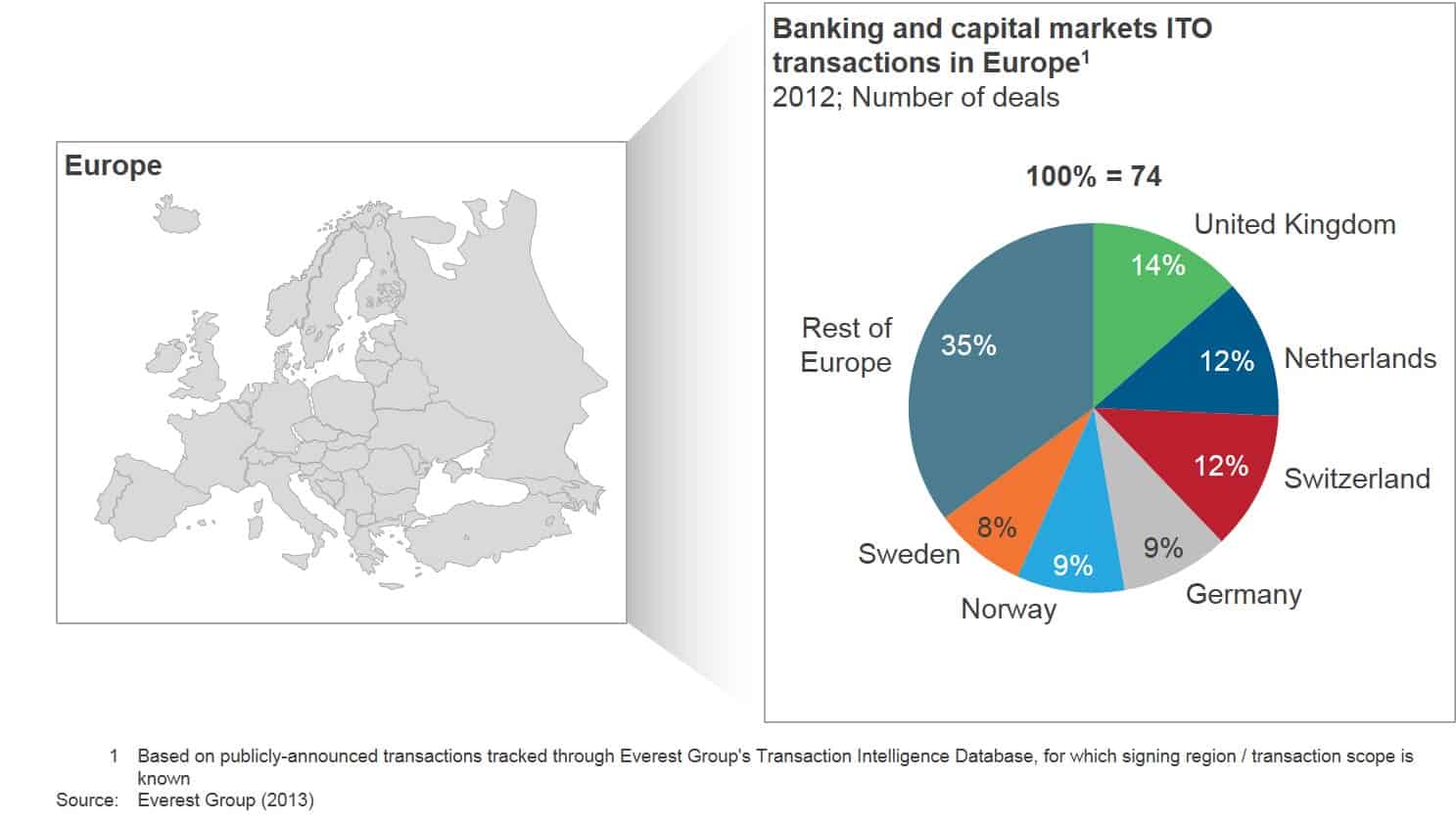

A couple of years ago, we wrote a blog on the common pitfalls of a broad-brush sourcing strategy for Europe. At the time, we talked about the variations in ITO demand profiles across different Continental European markets such as France and Germany. Examining the vertical-specific demand structure for IT services in Europe today, we discovered that the market in Europe remains distributed across various countries instead of being concentrated in any one. This is especially true for the banking and capital markets space, as illustrated in the figure below.

Delving deeper into the nuances of the banking and financial services (BFS) industry in Europe, it’s clear that the need for a customized strategy for this space has become increasingly relevant. There are multiple reasons driving this:

- Variations in demand profile: Unlike North America, where the U.S. is the key geography on which to focus, Europe has multiple disparate markets. The leading western European powers, the U.K., Germany, and France, are mature users of ITO, and are focusing their investments in next generation technologies. In contrast, the Nordic countries are focusing on IT modernization, and need greater end-to end-support. Southern European countries such as Greece, Italy, Spain, and Portugal need support to control costs and achieve efficiency.

- Stressful regulatory environment: Locally-driven rules in Europe have created regulatory uncertainty. Banks and financial firms in Europe need to be prepared for regulatory changes in the near term, e.g., enabling ease of cross-border trading and transactions. European buyers find themselves with limited time and a strong need to make a quantum leap to adopt solutions/services for regulatory compliance.

- Strained financial health: Most European countries have been under tremendous economic and financial strain in the recent past. European banks and financial firms are impacted by low interest rates, the Eurozone debt crisis, and increased need of capital adequacy. Since each country has a differing economic environment, the key imperatives for banks and financial institutions in each country vary. As we move into 2014, some of these countries have started witnessing recovery in demand.

To address these variances across different European countries, both buyers and service providers must be more mindful of geographic dynamics. Buy-side banks and financial services companies need to ensure that they maintain a balanced localized focus, while also maintaining global synergies and leveraging best practices from global operations. And to succeed, service providers must understand the unique demand profile and nuances of each individual European geography, and target each one accordingly to accommodate geographic interests.

Everest Group recently completed a PEAK (Performance, Experience, Ability, Knowledge) assessment of 30 leading service providers for the banking and capital markets domain in Europe. Following is a snapshot of the assessment’s key results:

Additional insights are available in the full report, IT Outsourcing in European Banking and Capital Markets – Service Provider Landscape with PEAK MatrixTM Assessment 2013.

We believe the service provider landscape will continue to further evolve. That said, the mantra for success is adopting a bespoke approach to serve the diversified European region!