In this second post in our blog series on impacts from U.S. immigration reform, we explore the likely outcomes that will affect the Indian heritage providers and their customers. As explained in our first post, Critical Impacts on the Global Services Industry Due to Upcoming Immigration Reform, the large Indian providers are the most aggressive users of H-1B visas and, therefore, are the biggest target for negative impacts from several onerous provisions in the proposed legislation.

Targets of the legislation

Recapping our analysis in our first post, we do not believe multinational providers (MNCs) such as Accenture or IBM nor the Global In-house Centers (GICs) will experience adverse impacts; in fact, they may receive some competitive advantage because of the visa reform tied into the immigration reform.

Technology firms such as Microsoft and the large Indian providers will experience the biggest impacts. However, while the tech companies will gain increased availability of H-1B visas, the Indian firms will suffer a hit to their operational costs in addition to having to depend on fewer visas for their U.S. workforces.

Through two lenses, or scenarios, we analyzed the impacts of the impact to Indian providers with current aggressive use of H-1Bs. The scenarios in our analysis are very difficult to calculate and are based on several current assumptions regarding the proposed legislation, but this is our best analysis at this time.

Case in point: likely financial impacts to Cognizant from H-1B visa reform

We used Cognizant in the scenario analyses because, as far as we can see, they have the highest proportion of H-1B use (85 percent) in their U.S. population of employees. This is far above the proposed thresholds that the reform will mandate.

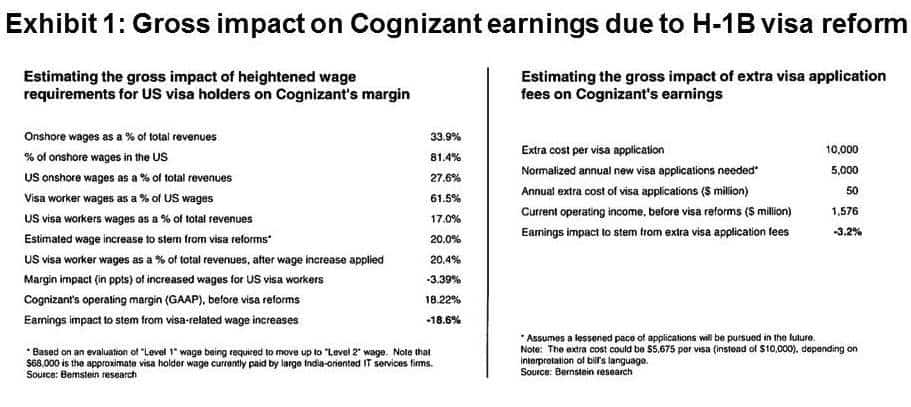

In the first scenario — with only the most modest impacts from the reform provisions — the unmitigated hit to Cognizant’s earnings (not costs) would be in the range of 21-22 percent (see Exhibit 1).

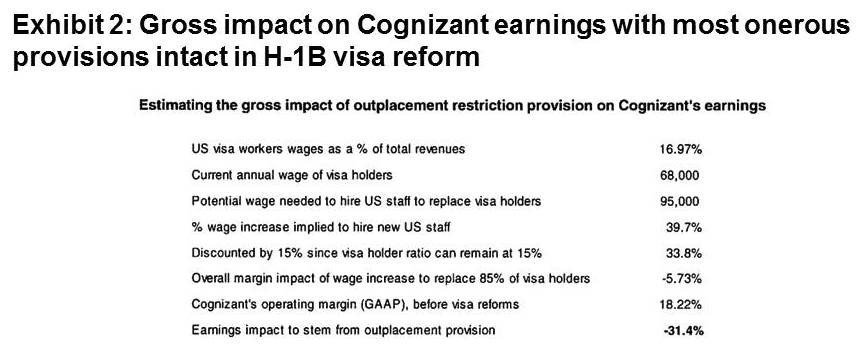

Exhibit 2 details the impact if the legislation passes with the current most problematic language in the most onerous provisions intact. In this scenario, the unmitigated hit to Cognizant’s earnings could rise to 31 percent.

Source: Bernstein research

Clearly, the impact will be significant in both scenarios. The visa reform provisions will impact other Indian firms in a similar manner as Cognizant but to a lesser degree.

How will the H-1B visa reform provisions affect customers of the Indian providers?

To alleviate the impact of diminished margins, we can assume that the Indian service providers may want to try to pass the increased costs through to customers. However, when we view this possible tactic in light of the current global services market, we believe they would not succeed in cushioning their impact by using this tactic.

The industry has clearly moved into a more mature phase. Competitive intensity in the market has been rising and service provider margins have been falling. (This is particularly evident if we take into account the impact of the pronounced rupee depreciation over the last few years.) A look at the competitive dynamics reveals the following:

- Global services customers are not just adding new work that has not been offshored. Increasingly, work that was already offshored is coming up for bid. As the outsourcing titans tussle for that work, market share is shifting. Frankly, deals are not as sticky as they used to be. Large enterprises that use outsourcing services are now more comfortable with it and are willing to allow that work to shift to new players.

- The MNCs, which have been been taking share away from the Indian firms for the last 10 years, have lowered their cost base and have implemented robust offshore delivery abilities. MNCs are now close to parity with the Indian service providers. The Indian firms have been operating at an advantage because of their lower cost base for U.S. workforce using H-1B visas, but structural changes in the H-1B visa laws will level the playing field. As a result, the MNCs will be even closer to parity and stronger competitive forces against the Indian heritage firms.

In these competitive dynamics, we think it is reasonable to believe that the Indian firms will have little, if any, success of passing the visa reform costs on to their customers. Customers are ready to switch providers, and providers are available at the same price point as the Indians firms’ current price point.

Furthermore, the margins that the Indian players currently enjoy would still be significant after the adjustment due to visa reform.

Therefore, we believe the impacts to the Indian service provider’s margins will have little effect on customers and may, in fact, be a silver lining for them. While it’s conceivable that the Indian providers would try to pass the cost increases through to their customers, we strongly believe the competitive dynamics in the current market will render that strategy unsuccessful. Instead, we believe these firms will most likely take a hit to their earnings.

Thus, this outsourcing model will remain intact for those companies that want to leverage it and the legislation will not cause prices to rise significantly.

Will lower margins reduce service providers’ willingness to invest in services capabilities and innovation? At this time, we believe that reduced margins will not motivate the providers to reduce investments and thus lower the quality of services to customers. Our belief is anchored in history with the Indian players’ strong demonstration of successfully navigating wage inflation impacts in India as well as other market changes that impact their margins. Furthermore, we estimate that it will require several years for the the changes in visa law to fully take effect; so the Indian providers will have plenty of time to adjust.

In fact, we believe their service quality may improve. Why? Because pressure on their margins, especially in today’s highly competitive market, will motivate them to create more attractive offerings (such as SaaS or BPaaS offerings) and develop greater differentiation through increased value in order to secure increased pricing. We see that the market’s competitive intensity will likely remove any constraints for investing in customers, innovation or intellectual property in order to sustain their margins.

In addition, paying higher wages and increasing the use of U.S. citizens in the Indian players’ workforce could in many cases contribute to greater client intimacy.

In our next post in this blog series on H-1B visa reform tied to impending immigration reform, we’ll provide some guidance on mitigation strategies available to the service providers that will be hit the hardest by the new law.

Check out Peter’s other blogs on immigration reform here and here.