Over the last three years, the Environmental, Social and Governance (ESG) data management platform market has evolved at breakneck speed. Once fragmented, populated by niche providers offering carbon calculators or reporting tools, the sector has now entered a period of rapid consolidation.

In just the past few months, we’ve seen Position Green acquire Greenomy to strengthen its EU compliance suite and Green Project Technologies acquire Emitwise to deepen its Scope 3 capabilities. These are not isolated moves, they signal the next phase of a market where scale, breadth, and integration are becoming essential.

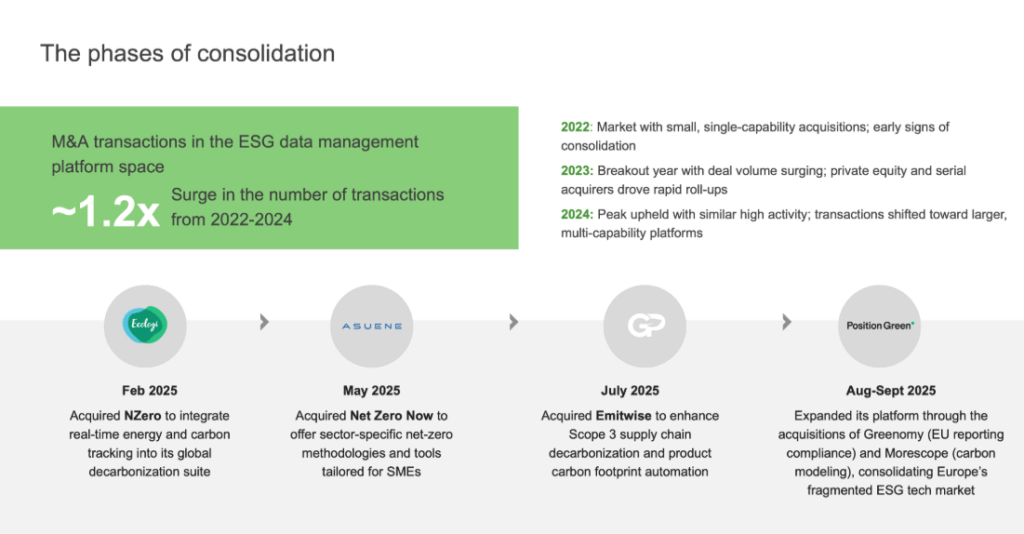

A wave of acquisitions between 2022 and 2024 has reshaped the competitive landscape, and while deal volumes are moderating in 2025, the market is entering its next chapter: fewer, larger platforms with broader scope and deeper capabilities. The story here is not just about deal counts or valuations. What matters is what this consolidation means for providers, buyers, and investors, and what lies ahead.

Reach out to discuss this topic in depth.

Why consolidation is happening now

Three forces have aligned to make consolidation inevitable.

- Regulatory tailwinds: Global sustainability regulations are entering into a phase of balance and refinement. In markets like the EU, frameworks such as the Corporate Sustainability Reporting Directive (CSRD), Corporate Sustainability Due Diligence (CSDDD), and the Carbon Border Adjustment Mechanism (CBAM) continue to expand, but regulators are also cautious to avoid red tape that could hinder business growth. At the same time, the Asia-Pacific (APAC) region is emerging as a strong regulatory driver, with Singapore’s mandatory climate disclosures, Japan’s Task Force on Climate-Related Financial Disclosures (TCFD)-aligned rules, and India’s Business Responsibility and Sustainability Reporting (BRSR) Core standards. This maturing environment is pushing companies to adopt robust, auditable systems rather than fragmented, tactical solutions.

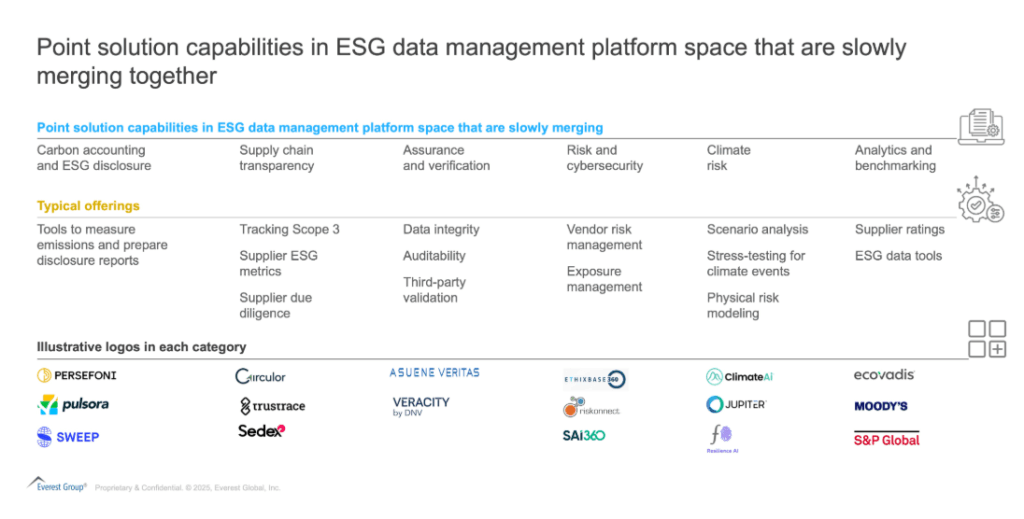

- Fragmentation of point solutions: Over the past few years, we’ve seen an explosion of specialist tools, focused on various domains such as carbon accounting, supply chain visibility, assurance, climate risk, or benchmarking. Each tackles a narrow but important piece of the ESG data challenge. This patchwork of point solutions has been essential in driving innovation, but it also creates complexity for enterprises that ultimately need more integrated, end-to-end workflows.

Exhibit 1 highlights the diversity of categories and players across the ESG data management platform space.

The market is already re-ordering itself along predictable fault lines:

- Carbon and operational data are at the center of consolidation. Acquisitions such as Sustain.Life (by Workiva) and SupplyShift (by Sphera) show that carbon and Scope 3 data have become the backbone of credible ESG reporting

- Geography is also shaping acquisition strategies. Europe remains the center of gravity, with Position Green actively stitching together compliance assets across the EU. But the story is broadening, Australia’s new disclosure regime is setting a high bar, while APAC players such as Asuene, through its acquisition of NZero, are buying their way into US and global markets

- Buy-over-build dynamics: Large governance, risk, and compliance (GRC) and Environment, Health, Safety and Quality (EHSQ) software providers already serving corporates are under pressure to offer ESG tools. For them, buying is faster than building. Acquisitions allow immediate response to customer demand and access to proven technology, especially when customers are proactively asking for these tools.

The phases of consolidation

Looking at this evolution over the last three years, we can see distinct phases emerging.

Phase 1: Initial Market Entry (2022):

In the early stage of this market, acquisitions were primarily about securing an initial foothold in the space. Large technology and professional services firms acquired single-capability solutions to respond to client demand and regulatory signals. For example, IBM acquired Envizi to add carbon and energy management into its enterprise software ecosystem, while S&P Global added The Climate Service to strengthen its climate risk analytics. These transactions were not yet about building comprehensive platforms, but rather about establishing presence and optionality in a rapidly emerging market.

Phase 2: Expansion and Scale (2023–2024):

The following two years saw an inflection point. Transaction volumes rose sharply as both Private Equity sponsors and strategic buyers pursued acquisitions to broaden capability scope and accelerate scale. This period marked the beginning of platformisation, moving from single-purpose tools to integrated solutions combining reporting, carbon management, supply chain visibility, and risk. EcoOnline’s acquisition of Ecometrica and Cority’s acquisition of Greenstone exemplify this trend of serial acquirers consolidating adjacent functionalities. Larger transactions, such as Hg’s acquisition of AuditBoard and Workiva’s acquisition of Sustain.Life, underscored growing valuations and investor conviction that ESG data management is becoming a core enterprise infrastructure.

Phase 3: Strategic Consolidation (2025 and Beyond):

By 2025, transaction volumes moderated, but the strategic intent of acquisitions became clearer. Rather than broad-based roll-ups, we are now observing targeted consolidation aimed at filling specific regulatory, regional, or capability gaps. Position Green’s acquisitions of Greenomy (EU compliance reporting) and Morescope (carbon modelling) highlight a deliberate effort to consolidate Europe’s fragmented landscape. Clarity AI’s acquisition of ecolytiq reflects an extension into climate-focused fintech and retail engagement, while Diginex’s acquisition of Findings integrates cyber and vendor risk into sustainability platforms. The common thread is precision: acquirers are seeking differentiated assets that strengthen their positioning in a market that is maturing and converging around fewer, larger platforms.

Implications for market participants

For providers, the pressure is intensifying. Niche players without clear differentiation risk being acquired or marginalized. Survival strategies include specializing in high-demand areas such as Scope 3 emissions, biodiversity, or sector-specific reporting, or finding ways to integrate into larger ecosystems. Larger platforms will continue to dominate by offering breadth, integration, and the ability to serve multiple compliance needs at once.

For buyers, the landscape is shifting in complex ways. In the near term, consolidation is positive: enterprises get access to more comprehensive platforms, often at lower prices, as providers bundle capabilities. But there is a trade-off. As the field narrows, vendor lock-in risks grow. Enterprises will need to evaluate vendors not just on features, but on interoperability, data portability, and long-term viability. Strategic procurement will shift from buying tools for discrete use cases to selecting platform partners for the long haul.

For investors, the story is also changing. The hyper-growth, land-grab phase of 2023–2024 offered opportunities to back rapid roll-ups and billion-dollar deals. Going forward, the opportunity lies in deeper bets: funding platforms that expand regionally, add specialized capabilities, or move into industry-specific solutions. Returns will increasingly come from building depth, not just breadth.

What’s next: a forward view

The ESG data management market is moving into its next phase of maturity. In the near term, consolidation will narrow the field to a handful of platforms with the breadth, scale, and assurance capabilities enterprises require. These will become the default partners for regulatory compliance and investor-grade reporting.

At the same time, two new frontiers are already emerging. First, specialized capability niches such as biodiversity measurement, supply chain traceability, and Artificial Intelligence (AI)-driven reporting, will create fresh fragmentation at the edges as innovators move faster than incumbents. Secondly, industry-specific platforms will take shape, particularly in sectors such as financial services, real estate, and supply chain–intensive industries, where generic ESG platforms cannot fully capture sector complexities.

The trajectory is clear: scale and integration will define the winners of today, while tomorrow’s differentiation will come from depth in emerging domains and industry specialization. Providers that can consolidate in the core while positioning early for these new frontiers will set the pace for the next chapter.

If you found this blog interesting, check out our Carbon Accounting Platforms 101: What They Are And Why They Matter | Blog – Everest Group, where we take a deeper look at another topic relating to ESG.

If you have any questions or want to discuss the evolution of ESG in more depth, please contact Ambika Kini ([email protected]) or Arpita Dwivedi ([email protected]).