Reimagining third-party risk management for speed, value, and measurable results

The use of Artificial Intelligence (AI) is revolutionizing Third-Party Risk Management (TPRM), transforming it from a labor-intensive, spreadsheet-driven function into a tech-enabled, intelligence-driven discipline. This post explores the evolving aspects of third-party risk management services pricing, work processes, productivity gains, and deal-making innovations.

Reach out to discuss this topic in depth.

New commercial models powered by AI

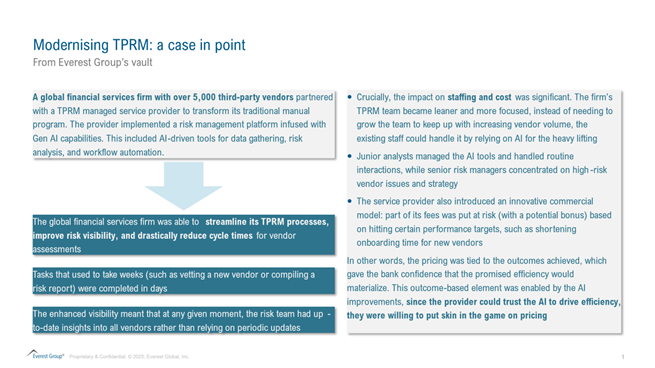

Traditionally, third party risk management engagements mostly used fixed fees or unit-rate pricing. However, there is a shift towards hybrid and value-based pricing models that align costs with outcomes. Providers are now introducing flexible commercial structures, such as milestone-based fees, usage-based fees, differential pricing (tier based hourly pricing based on multi-risk domains), and outcome-based pricing.

Outcome-based pricing means the service provider’s pay depends on delivering results, a concept not too common in risk services. Another emerging idea is “price-per-AI-assessment”, charging a set fee for each vendor for risk assessment performed, as AI tools can perform tasks faster and cheaper than humans.

These models are often hybridized, but the trend is clear: AI is enabling new pricing logic, reducing manual effort, and improving consistency. This shift is redefining how clients pay risk management, making contracts more focused on results.

- From manual templates to AI-driven workflows

Traditional TPRM was heavily human-intensive and template-driven, with risk managers sending questionnaires, compiling responses, and manually reviewing documents. Today, AI and tech-enabled workflows have accelerated these processes, enabling real-time analysis across extensive vendor networks.

AI-driven systems can generate tailored questionnaires based on a vendor’s risk profile, pre-populate answers, and analyze vendor responses. This accelerates vendor screening, improves accuracy, and reduces manual labor.

Report writing is also assisted by AI, with first drafts of risk assessment reports or remediation plans produced by AI. Continuous monitoring is now supplemented by AI systems, alerting teams to anomalies or compliance violations. This results in a faster, more proactive, and less burdened overall process.

- Leaner teams and bottom-heavy staffing models

AI and automation have significantly impacted the staffing pyramid in TPRM delivery. Traditionally, teams were senior and mid-heavy, with experienced consultants overseeing tasks, due to the reliance on human judgment and manual analysis.

However, with the advent of automation and standardization, organizations are shifting to a more bottom-heavy pyramid structure. This means a greater share of junior analysts and fewer mid-level and senior staff in each team. This shift lowers costs and improves scalability, as a larger pool of junior talent can run the operational engine.

Companies have also globalized their delivery models, embracing offshoring parts of TPRM to tap cost advantages. Service providers have set up centers of excellence in low-cost locations, such as India, Philippines, and Latin America, where trained analysts and AI support tools can operate around the clock.

IT-Business Process Services (BPS) providers lead this trend, often executing services with a high offshore ratio, managing large-scale transactional work from global delivery hubs. This offshoring is enabled by mature processes and technology that ensure quality and data security even when work is remote.

The net effect on staffing is leaner, more cost-effective teams, with programs now covering additional vendor assessments with less analysts.

- Productivity boosts and new focus areas

AI is transforming the way TPRM is implemented, resulting in significant productivity gains. Initial implementations typically lead to a significant productivity increase within the first three years, allowing organizations to eliminate or repurpose nearly a sixth to a third of their work.

This efficiency leads to shorter cycle times, quicker onboarding and risk assessment, and capacity to cover more third parties without proportional headcount increases. The gains compound over time, with providers reporting continuous year-over-year improvements in efficiency, especially those investing heavily in AI/Machine Learning (ML) automation.

This shift in focus allows professionals to focus on continuous risk monitoring, interpreting insights, and managing exceptions that require judgment. Routine vendor checks can be run by AI, while human analysts address only exceptions or red flags.

This “continuous monitoring and exception management” approach improves risk coverage and makes the best use of human expertise. As automation increases, TPRM functions become more proactive and intelligent, preventing issues rather than reacting, and the productivity baseline keeps rising.

- AI’s impact on deal solutioning

AI is revolutionizing the design, proposal, and sale of managed TPRM solutions by service providers. The process has become more tech-driven, using internal data and AI-driven estimation tools to quickly model the effort and staffing needed for a client’s scope.

This allows for faster and more accurate staffing estimations and effort baselining during presales. Modern deal teams can simulate different scenarios, adjust the delivery mix and observe the impact on cost and timelines. For example, how the effort and overall solutioning varies with multiple factors like client geography, complex processes, technology adoption, and process complexity.

The structure of deals is evolving in the AI era, with engagements often being pitched as platform-enabled solutions, highlighting proprietary or partner technology as a key differentiator in proposals. The deal constructs include more flexibility and innovation, with shorter contract terms and modular engagements.

Presales efforts are also benefiting from AI-driven tools, with some providers using AI to draft proposal content or analyze client Request for Proposals (RFPs). Pricing teams can run “what-if” simulations more easily, optimizing price and value for the client.

However, providers that stick to rigid pricing models or fail to showcase tech-enabled approaches are increasingly finding it hard to win deals. Winning proposals should emphasize how AI and analytics will be leveraged, how the provider will continuously improve the process, and how the commercial terms align with the client’s business outcomes.

In conclusion, TPRM is evolving from a compliance checkbox exercise to a dynamic, intelligence-led function, with AI at the heart of this evolution. Commercial models tie fees to outcomes, automating processes, and optimizing staffing models.

Real-world examples show faster cycle times and better risk control. Solution providers are infusing AI into service design and pricing, providing clients with more options for managing third-party risk in a flexible, cost-effective way.

Finally – if AI reduces the mechanics of TPRM to near-zero-marginal-cost clicks, will the true competitive edge hinge on which provider is bold enough to underwrite the very risks they assess, putting real skin, and maybe equity in the game instead of just quoting a rate card?

If you enjoyed reading this blog, check out Contracting Services With Intelligence: Adapting To The Agentic AI Shift | Blog – Everest Group, which delves deeper into other topics regarding AI.

Have questions on pricing, solutioning, contracting and impact of gen/agentic AI? Feel free to reach out to Kunal Verma ([email protected] or Debajyoti Banerjee ([email protected]), conversation is the first step to resilience.