I’ve been blogging about why certain companies such as Accenture, ADP, and TCS are such successful service providers. In contrast, let’s look at HP and examine why it’s breaking up.

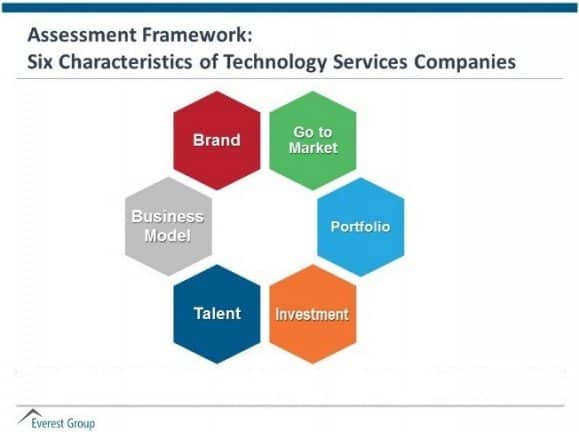

I’ve explained in prior blogs that the most successful companies have six operational elements aligned, as shown in the Everest Group assessment framework below.

In successful companies, their promise is consistent with their business model, their talent model is consistent with their promise and model. Their investments align with the talent and business models, and the portfolio they end up with aligns with the other components. In addition, they tune their go-to-market approach to maximize their advantages in these components.

HP, as much talked about, is breaking up, separating its printers and PCs division from software and services. Printers and PCs are late-stage, mature devices and represent a market that is commoditized, mature, and saddled with slow growth. Software and services give the promise of growth.

HP is taking the first steps to create better alignment in both their businesses between the functions of brand, go-to-market, investments, and the other components of the framework illustrated above.

HP’s printers and PCs business is well aligned in terms of its brand promise of high-quality, cost-effective end-user devices. Its go-to-market approach is consistent for both printers and PCs, and the portfolio is rationalized around those devices and the warranty services that support them. Its investments can focus on maintaining market share. The firm can harmonize talent to ensure it’s appropriate for a mature business. And its business model and supply chain are consistent across their offers and can be further refined and focused. So I see the break-away from software and services as a no-brainer.

HP’s software and services area is a more complicated story; here, I think they have further to go. A smaller, more focused organization will allow HP over time to refine its brand to focus on large enterprises. Its go-to-market approach can be more easily integrated. Its portfolio, which is still very diverse, will probably need further refinement over time.

Although they clearly don’t have all six components harmonized for the software and services business, the break-up gives HP a much better fighting chance to work through that. They have further work to do across all these areas – particularly in brand and portfolio. As they get a crisper brand promise into the market and a portfolio aligned with that brand, the firm’s business model, go-to-market approach, and investment choices will become clearer.

HP is still early in this reformatting of the company. But history tells us that, as they succeed in getting these aspects clarified and aligned, the firm’s performance will improve.

Photo credit: Flickr