While cost arbitrage for global services delivery is impacted by numerous factors, e.g., wage and rental cost inflation, currency fluctuations are often the ignored wild card.

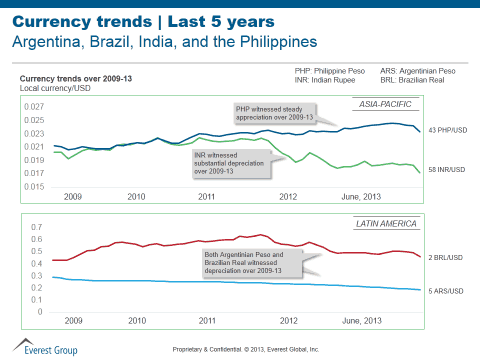

Most currencies have varied significantly in the past few years (see the graphic below). For example, in Asia-Pacific, the Indian rupee has depreciated considerably compared to the U.S. dollar, with an average yearly decline of 5.4 percent in the last three years. On the other hand, the Philippine peso has appreciated substantially against the dollar, recently reaching a four-year high. The currencies from major outsourcing locations in Latin America and Europe have also been volatile in recent months.

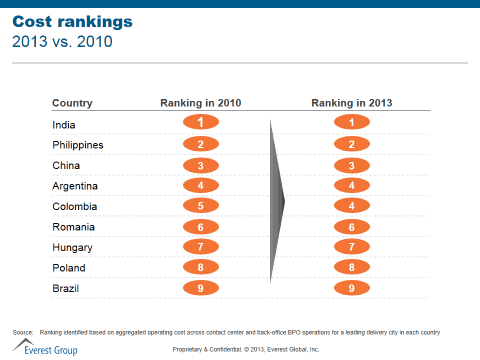

While one would have expected the large currency variations to have a big impact on delivery costs, a closer analysis reveals that the relative cost rankings of locations in 2013 have remained nearly the same as in 2010 (see the graphic below). This counter-intuitive result is because the currencies in most global services delivery destinations have depreciated over the last few years. In addition, all these locations have experienced moderate-to-high wage inflation, thus having a similar net impact on cost across locations.

Further, the interplay of wage inflation and exchange rates is leading to interesting trends in absolute value of operating costs among locations. Let’s look at two extreme examples to understand this phenomenon:

- The cost differential for customer service operations between Argentina and Colombia has decreased given the interplay of wage inflation and exchange rates resulting in comparable rankings (see the graphic above)

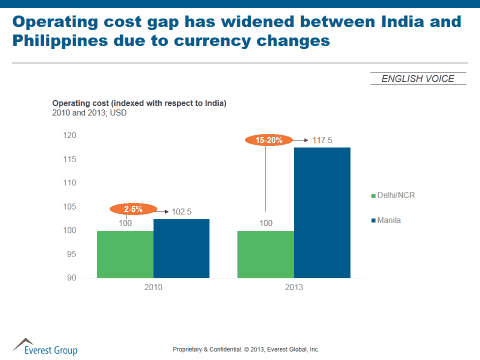

- India and the Philippines are competing locations for most transactional processes. While the costs for English voice services in these two countries were quite similar in 2010, costs in the Philippines are now 18-20 percent higher than in India (see the graphic below). This significant cost differential was driven by a combination of moderate wage inflation (10-15 percent per year) and the appreciation of the peso.

It is important to note that these cost changes among competing locations for similar type of work has not resulted in changes in work distribution. For example, India has not gained greater share of contact center voice work relative to the Philippines. This is because while cost is an important factor, location selection and work placement decisions are dependent on several other factors, e.g., talent availability and scalability, niche skills, risk considerations, and the organization’s existing footprint. Short-term currency changes may result in companies optimizing some work among locations in their portfolio, but this alone is not likely to significantly change the role and standing of locations in their portfolio.