Recent news announcements on several third party service providers’ pullouts from Costa Rica may lead people to believe that the country is losing its luster as a sourcing destination for outsourcers and global in-house centers (GICs). But, before jumping to any conclusions, let’s gain some perspective on these announcements.

HP

HP in February 2013 announced it was scaling back the English-language customer support team in its Global Services Center by 400 employees. However:

- HP has nearly 6,500 employees in Costa Rica, spread over multiple sites and processes/functional areas, and this move affects only 400 working in just one of the company’s 20 different units operating in the country

- This particular reduction in headcount was part of a global restructuring plan announced in May 2012 by CEO Meg Whitman

- Most of these 400 employees will be given the opportunity to apply for one of the 300 new jobs being created in the other 19 units

- HP is planning to hire 150 employees into the Global Engineering Services unit it opened late in 2012

Rather than signaling that HP’s confidence in Costa Rica is shaken, this move indicates a strategic shift in how the company plans to utilize the location, and that the kind of work supported in the country may be moving up the value chain.

Stream and Teletech

Reportedly driven by rising wages and other operational costs, TeleTech is expected to cut ~ 160 of its 1,250 positions in Costa Rica. And while Stream Global Services recently shuttered its 700-750 FTE operations in the country, it opened a new center in Honduras with a capacity of 750 FTEs.

Everest Group believes these developments are the result of the providers’ evolving location portfolio strategies to control/optimize service delivery costs with rebalanced footprints.

Costa Rica Facts

While the country has traditionally been, on average, 30-40 percent more expensive than other less-developed locations in Central America for delivery of bilingual (Spanish-English) voice-based BPO services, it is still fairly attractive due to its:

- High cultural affinity and solid English language skills

- Geopolitical stability, and relative safety and security

- Well- established depth and breadth of ITO/BPO service offerings

- Opportunities to support European languages per its ability to attract people from countries in Latin America and Europe

And although wage inflation and attrition levels increased steadily over time, and are now at levels that make its cost profile less attractive than lower-cost and lesser-developed options in Latin America (Managua, Guatemala City, San Salvador, Tegucigalpa, Santo Domingo, Peru, and Colombia) and the Caribbean, sourcing activity in the country has not slowed down for third party providers or GICs.

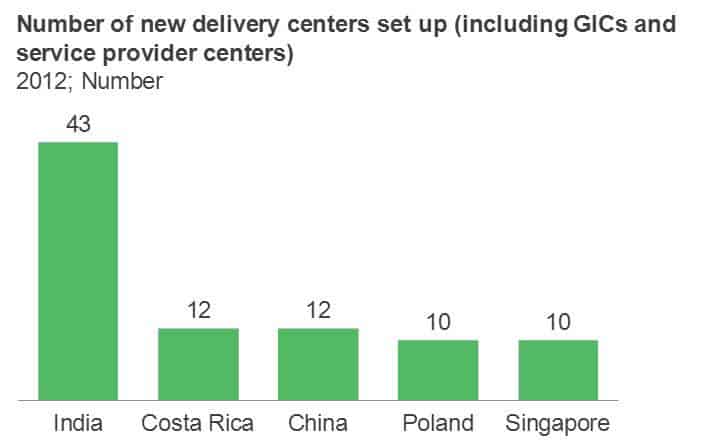

In fact, Costa Rica experienced record delivery center establishment activity in 2012, on par with China, and behind only India (see Exhibit 1). Amazon and Bridgestone are among the most notable companies that setup GIC operations in Costa Rica last year.

Exhibit 1

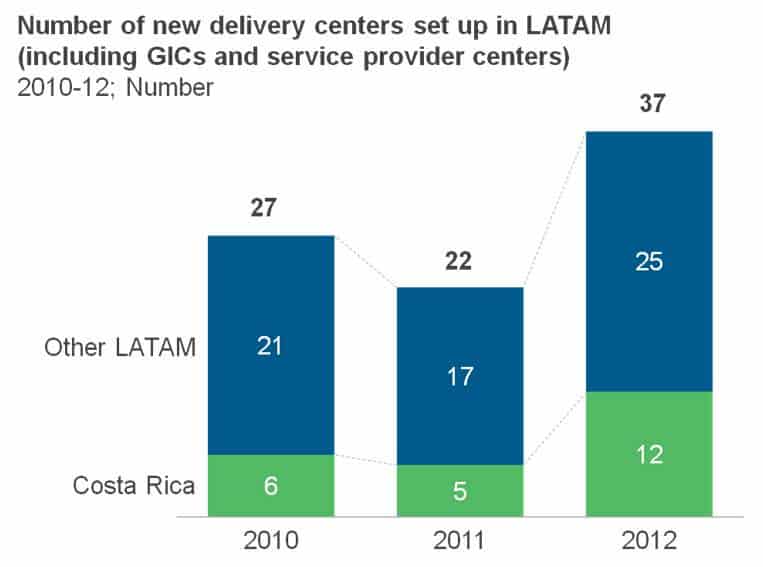

Moreover, as depicted in Exhibit 2, it has dominated center set-up activity in Latin America for the past three years.

Exhibit 2

Costa Rica clearly continues to present an attractive mix of skills and opportunities, and these often outweigh the higher cost of operations in service providers’ and GICs’ tradeoff analyses.

So what’s in Costa Rica’s future as a sourcing destination? Everest Group predicts the market will continue to mature across multiple dimensions, and will exhibit the following major shifts/trends:

- It will increasingly be leveraged for up-the-value-chain, more complex work, not just in business processes such as F&A, but also in areas including knowledge processes, IT, and creative media. This will be driven primarily by a maturing talent market, synergies with customer service work, and efforts by companies to optimize facility costs

- Wage inflation and attrition for bi-lingual (English-Spanish) professionals will plateau in the next 18 months, driven by a moderate slowdown of growth

- Call center players will rebalance their Latin American portfolio footprints, and transactional contact center work, especially that requiring a medium level of English proficiency or monolingual Spanish delivery, will move to emerging locations

- Large new investments in the contact center space, or existing players scaling to more than 1,500-2,000 in the country, are unlikely. There will be a gradual decrease in size of new centers as companies start to support higher-order work that is less FTE-intensive

- Players will continue to leverage some unique talent and operating models to continue operations/grow in the country. These will include tapping into pools from areas adjacent to the Greater Metropolitan Area (GMA), leveraging part-time students and diploma holders, and even opening satellite centers outside the GMA

- GICs will continue to play a significant part in the increasing maturity of Costa Rica. They will find value in expanding the depth and breadth of services supported from Costa Rica, in part to better utilize their sunk costs

While we do not expect Costa Rica’s magic to fade away anytime soon, some of its charm will shift from some specific areas, especially English-Spanish voice delivery, to emerging areas of work such as IT, knowledge processes and F&A. Moreover, the recent developments in Costa Rica are an inevitable part of the natural evolution/maturation of a delivery location; we’ve seen, and continue to see, similar trends in other sourcing destinations such as India and the Philippines.

For a deeper analysis of the GIC landscape in Costa Rica, please refer to our recently-released report, Global In-house Center (GIC) Landscape in Costa Rica and Trends in Offshore GIC Market