The services industry is facing a big issue. The market for ERP implementation cycle and corresponding transformation projects has matured and is coming to an end.

We can see the ERP decline in the reported results from IBM and Accenture and HCL. These three providers have had very big SI practices around large-scale ERP implementations. I’m not saying there are no more ERP implementations or transformation projects; it’s just that this market is in decline.

Factors driving the market decline

One of the contributors of the decline is maturity. Most large companies that need ERP now have ERP. Furthermore, they are now in their second or third generation of their ERP and are much smarter about how they use ERP. So there is much less transformation.

The green field is gone. Much of the ERP market it now add-ons to the existing base. And companies have learned how to implement ERP within the guidelines of ERP manufacturers, SAP and Oracle, which enables less costly implementation when new releases come out. Further, moving into an as-a-service or cloud future will continue to erode or diminish the re-implementation markets driven by software upgrades because they become a monthly occurrence via SaaS products.

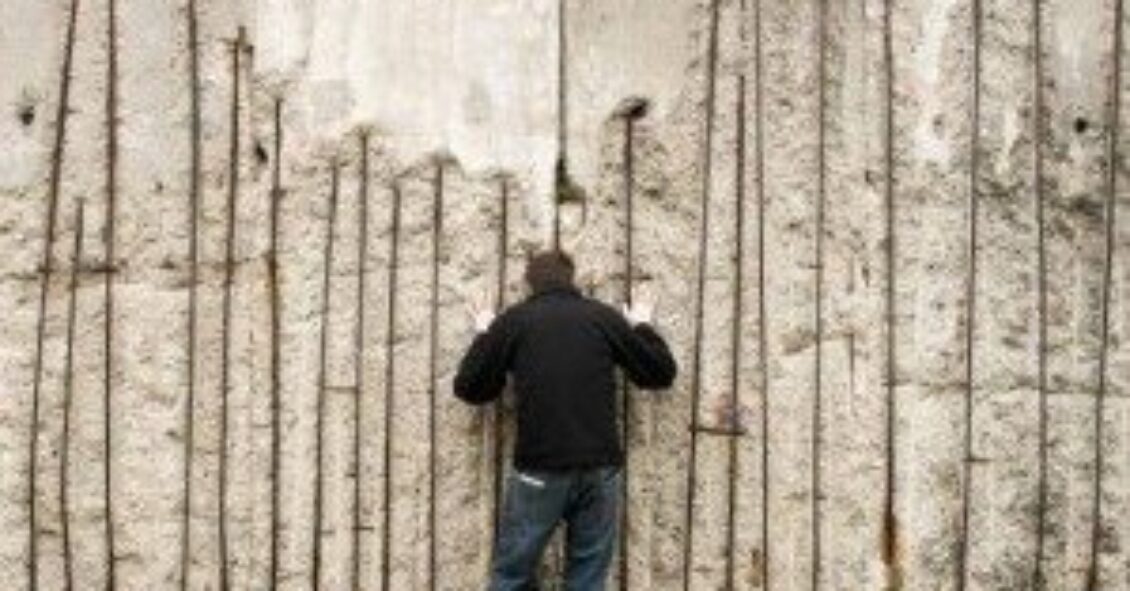

So ERP implementations and its associated SI and transformation projects is hitting a wall, and we’re going to see far less of it in the future.

What will drive future growth?

The decline is a big issue for the industry because much of the discretionary spend used to be captured by the ERP implementation and renewal cycle. It has been one of the big secular drivers of growth in the services space since the mid-1990s, but we’re now seeing its decline as a primary driver for growth.

Many SI consultants, shared services consulting companies and BPO firms that ride the ERP wave have, wittingly or unwittingly, linked their growth engines to the dislocation and transformation activities that happen around ERP implementations.

So the current decline has very significant implications in terms of where these service providers will find growth in the future services market.

What we know about technology is that, given enough time, there is always another big technology disruption that will drive large integration services. Right now the best case for this is the digital revolution and the huge company-wide implications that embrace the digital marketplace for large organizations. Much like ERP, digital affects everything and requires significant transformation for alignment.

So the open question is: will digital take up the mantle that ERP is shedding?