In case you missed the plot twist, long-time frenemies Veeva and IQVIA buried the hatchet and inked commercial and clinical partnerships.

The headline isn’t just “we’re friends now.” It’s that customers can finally use the two portfolios together without the historical friction, contractual, technical, and, yes, legal.

Here’s our take on what has actually changed, why it matters and what this means for life sciences teams planning their 2026 roadmaps.

Reach out to discuss this topic in depth.

What actually happened:

IQVIA and Veeva settled their multi-year disputes (with no damages paid by either party) or signed two big bridges:

- Commercial interoperability: streamlined Third-Party Access (TPA), meaning IQVIA data can now flow into Veeva apps (Network, Nitro, Artificial Intelligence (AI), etc.) and Veeva data can be used across IQVIA’s products/services

- Clinical collaboration: IQVIA becomes a Veeva’s CRO Clinical Data Partner, meaning IQVIA can run trials on Veeva’s Clinical Suite (including EDC study builds)

Historically, customers have got bogged down in approvals and edge-case contracts. The new setup promises cleaner, faster, default-allowed integrations, meaning less “ask-per-use” and more “switch it on.”

The backstory:

The legal fight began in 2017, with IQVIA alleging trade-secret misuse and Veeva counter-suing on antitrust grounds. Through the years of 2019–2020, the scope widened to additional Veeva products and alleged anti-competitive behavior. The settlement shutters those cases and replaces friction with frameworks: instead of one-off carve-outs, customers get platform-level permissioning and a path to standardized TPAs.

Why this matters:

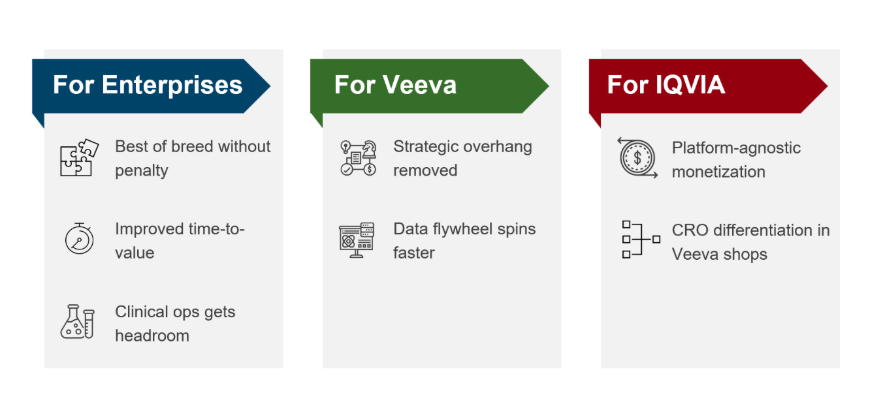

For Biopharma and MedTech enterprises:

- Best-of-breed without penalty. Pair Vault CRM / Vault apps with IQVIA data and analytics, or keep IQVIA orchestration with Veeva’s data without the old TPA drag

- Time-to-value improves. Faster TPA approvals, quicker deployments for Master Data Management (MDM) (Veeva Network), analytics (Nitro), and AI assistants consuming IQVIA assets

- Clinical ops gets headroom. If you standardize on Veeva’s EDC, having the largest CRO able to operate natively on that stack should then cut the study build and database lock timelines

For Veeva:

- Strategic overhang removed. No more IQVIA litigation cloud. That’s oxygen for product roadmaps, especially as Vault CRM becomes the center of gravity

- Data flywheel spins faster. Easier, sanctioned access to IQVIA datasets makes Veeva Network/Nitro/AI stickier in global deployments

For IQVIA:

- Platform-agnostic monetization. IQVIA can now operate fully across both commercial platforms customers care about (Veeva’s Vault universe and the Salesforce-aligned world)

- CRO differentiation in Veeva shops. The ability to execute on Veeva Clinical Suite strengthens bid competitiveness when sponsors are EDC-agnostic or Veeva-first

Who feels the heat?

- CRM / Commercial: The real contest is Vault CRM vs Salesforce Life Sciences Cloud (LSC), but IQVIA is now well-positioned on both. Expect sharper bake-offs and better enterprise pricing leverage for you

- Clinical data platforms: Veeva EDC gets an IQVIA tailwind. Medidata Rave remains entrenched, but more Request for Proposals (RFPs) will now consider dual EDC options at the study level

- Data vendors/MDM challengers: The lowered friction for IQVIA-Veeva data flows raises the bar for everyone else. Pure data providers will need richer connectors, faster TPAs, or specialty depth to stay sticky

What this really signals:

- Interoperability is now a differentiator. Not a checkbox. Vendors that make contracts, consent, and lineage dead simple will win renewal cycles

- AI assistants will follow the data. With cleaner pipes, expect agentic use cases (targeting, segmentation, call planning, evidence generation) to accelerate, if governance is baked in.

- The stack is going bi-modal. Enterprises will standardize on a primary CRM/clinical platform but mix the rest. Your architecture should assume plug-and-play rather than monoliths

Veeva-Salesforce dynamics: what changes now?

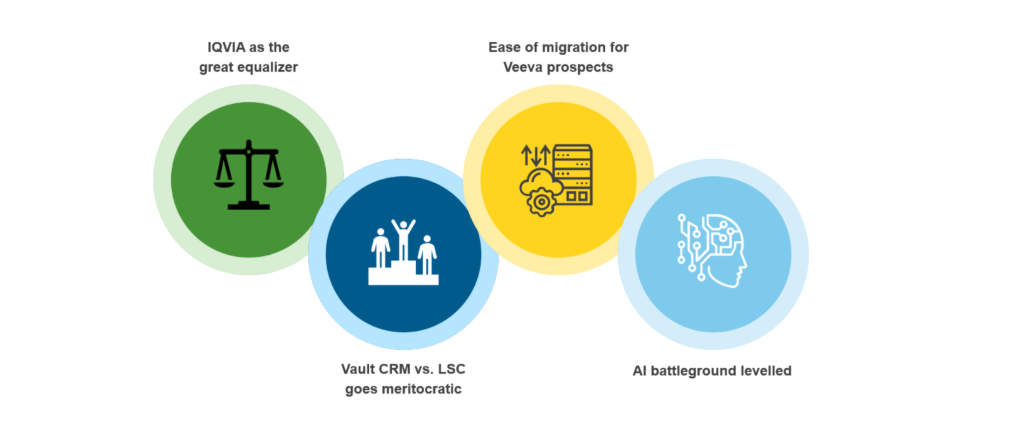

- IQVIA as the great equalizer. Before the truce, Salesforce could lean on its deep ties with IQVIA (through LSC/OCE lineage) to argue for a tighter commercial stack. With IQVIA now explicitly interoperating with Veeva’s data and apps, that quasi-advantage blurs. IQVIA becomes credibly neutral, able to power either ecosystem

- Vault CRM vs. LSC goes meritocratic. As Veeva exits the Salesforce platform and Vault CRM matures, the decision shifts from platform dependency to capability-per-dollar: field orchestration quality, AI copilots that actually move the needle, and time-to-integration with syndicated data. IQVIA, working cleanly on both sides, forces feature velocity and packaging innovation from Veeva and Salesforce alike

- Migration calculus gets simpler for Veeva prospects. A key blocker to moving from Salesforce-based stacks to Vault has been data friction around IQVIA assets. With TPAs and sanctioned flows in place, the switching cost narrative weakens

- AI battleground: assistants ride the same rails. With IQVIA signals available to both, next-best-action and content intelligence assistants will converge on similar ingredients. Differentiation shifts to how quickly models learn from feedback, how explainable they are to medical/legal/regulatory, and how cheaply they scale

Risks and watch-outs (let’s be real):

- Paper vs practice. If “fast TPAs” still take months, the magic fades. Put time-bound Service Level Agreements (SLAs) into contracts

- Hidden premiums. Cross-use can sneak in platform or data uplift fees. Model total cost across 3–5-year horizons

- Change fatigue. Dual-stack reality can swamp enablement. Budget for training and operational runbooks, especially across affiliates

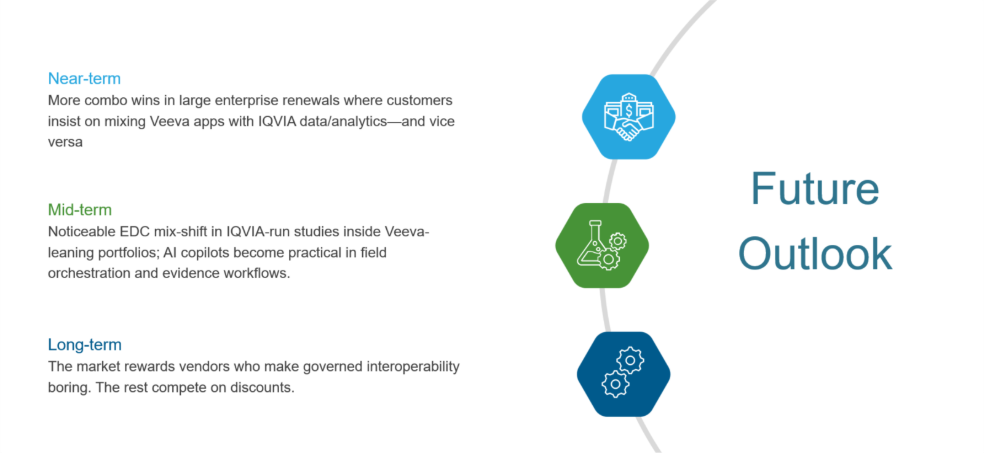

Future outlook:

Bottom line:

The Veeva–IQVIA truce doesn’t end competition, it weaponizes interoperability. For enterprises, that’s leverage – faster integrations, more credible bake-offs, and a cleaner path to AI at scale. Use it. Set your guardrails, tighten your SLAs, and make your stack modular on purpose.

If you found this blog interesting, check out our recent blog focusing on Salesforce And IQVIA’s Partnership – A Match Made In Heaven? | Blog – Everest Group, which delves deeper into a similar topic.

To discuss how the partnership unlocks value for enterprises and service providers in more depth, please reach out to Rohit K ([email protected]) and M Mihir ([email protected]).