The retirement and pension industry stands at a pivotal inflection point. For decades, enterprises – recordkeepers, Third Party Administrators (TPAs), and asset managers have served as stewards of long-term trust, safeguarding trillions in assets. But as technology reshapes every facet of Financial Services, we strongly believe that this industry needs to also plan for its own transformation as much as it helps people plan for the future.

Going from experimentation to execution with AI technology

Artificial Intelligence (AI) is no longer a theoretical advantage, it’s a competitive necessity. Our latest survey reveals that more than 50% of AI leaders now embed AI directly into operations, integrating it across benefit processing, fraud detection, investment management, and participant engagement. These early adopters are reaping measurable gains in efficiency and accuracy.

However, scaling AI remains a challenge. Talent continues to be the #1 execution barrier, as organizations struggle to find or develop AI-literate talent capable of navigating both advanced technology and stringent regulation. In parallel, less than half of enterprises trust their own data, signaling persistent weaknesses in infrastructure and governance. For an industry built on actuarial precision, this is a red flag, and a call to modernize.

Modernization: The bridge from legacy to intelligence

Most recordkeepers still operate on proprietary legacy systems that constrain agility and innovation. Modernizing data estates and infrastructure, particularly through cloud transformation, is now one of the industry’s top priorities.

Cloud platforms not only enable scalable computing and shared storage but also unlock automation capabilities that drastically reduce costs. Chatbots, Robotic Process Automation (RPA)-driven compliance, and AI-assisted reporting can transform cost centers into efficiency engines.

At Everest Group, our research shows that organizations investing in digital and cloud modernization experience higher operational resilience and improved participant satisfaction. As modernization accelerates, AI becomes a force multiplier, helping firms realize faster value from their technology investments.

Exhibit 1: Different categorization of AI and its use cases within the retirement and pension value chain

| Actuarial and regulatory reporting | Projection modeling, risk forecasting, and statutory trend analysis | Compliance testing, non-discrimination testing, tax form preparation, and statutory reporting | Plan design and consulting, creating prototype/custom plan documentation, and dynamic reporting |

| Recordkeeping and customer service | Predictive analytics for participant behavior, pre-retiree support, and financial wellness forecasting | Reconciliation of contributions, payroll integration, loan processing, and recordkeeping | Dynamic participant communication materials and gamified financial wellness tools |

| Investment management | Portfolio valuation, investment monitoring, and predictive asset allocation | Accounting, financial statement analysis, and online trading support | Investment plan creation, scenario simulation for asset allocation, and personalized portfolio insights |

| New business management | Plan sponsor onboarding, participant eligibility computation, and plan setup/ configuration | Generating plan documents, amendments, and personalized onboarding materials |

AI-driven retirement: Closing the savings gap

The Schroders 2024 US Retirement Survey1 revealed that 59% of Americans believe they will fall short of the savings needed for a comfortable retirement.

AI and digital innovation can close this gap, by empowering individuals with personalized insights, automating investment decisions, and tailoring advice in real time.

For instance, nearly 30% of participants remain unaware of how their assets are allocated. AI-driven platforms can interpret behavioral data, investment patterns, and risk tolerance to generate customized portfolios, automatically rebalancing them as life stages evolve. This level of personalization redefines engagement and builds long-term trust.

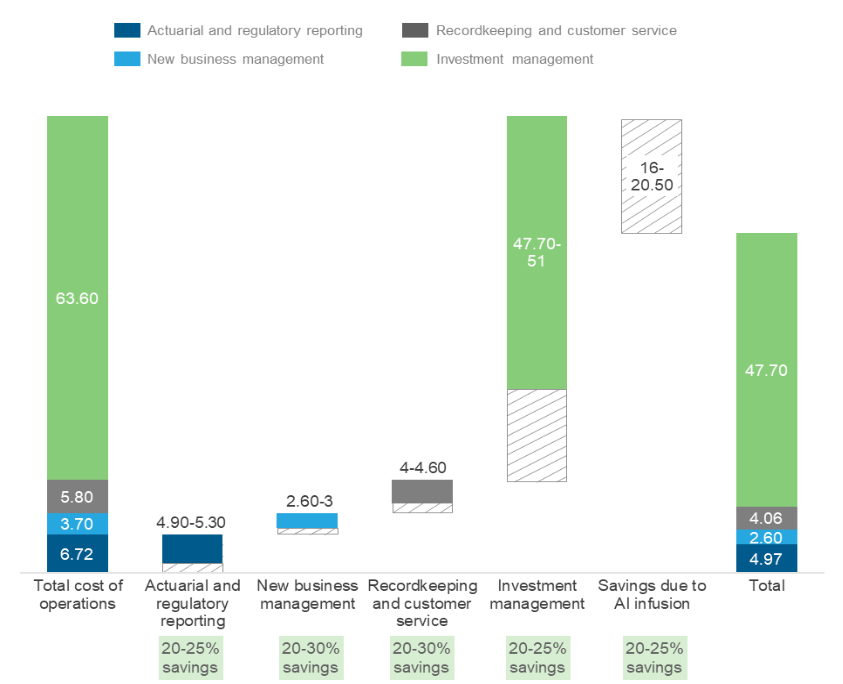

Quantifying the impact: AI’s bottom-line promise

Our analysis estimates that AI infusion can unlock between US$16–20 billion in cost savings across the U.S. retirement and pension industry over the next few years. These savings stem from automation, predictive analytics, and modernization of recordkeeping and investment systems.

But the benefits extend well beyond efficiency:

- Hyper-personalization enhances participant experience and loyalty

- Automation minimizes manual error and compliance overhead

- Advanced analytics power smarter investment and risk decisions

- Modern platforms create new revenue streams for recordkeepers and TPAs

Exhibit 2: AI infusion can save ~US$16–20 billion for the U.S. retirement and pension industry over the next few years2

Generative and Agentic AI: The next frontier

We are now entering a new phase of AI maturity. Generative AI (gen AI) powered by large language models, enables intelligent content creation, real-time insights, and conversational participant experiences.

Going a step further, agentic AI brings autonomous decisioning and orchestration, connecting data, systems, and workflows across the enterprise.

Together, these technologies can:

- Deliver hyper-personalized retirement plans

- Automate actuarial modeling and compliance testing

- Support dynamic risk forecasting and predictive asset allocation

- Enable end-to-end process automation across the value chain

We envision a future where a smarter, more resilient retirement ecosystem is capable of scaling trust and performance simultaneously.

The road ahead: From legacy to leadership

Transformation will not happen by chance; it will happen by design. Success in this new era requires orchestrating data, technology, and people into a cohesive AI-enabled strategy.

Enterprises that modernize their platforms, embed AI across operations, and empower their workforce will lead the next chapter of retirement innovation. Those that hesitate risk being left behind as the industry redefines itself around intelligence, agility, and experience.

The future of retirement is not about managing data, it’s about mastering intelligence.

Now is the time for recordkeepers, TPAs, and technology providers to:

- Modernize their digital and data foundations

- Operationalize AI for efficiency and personalization

- Empower teams to innovate with confidence

AI is not the disruptor, it’s the differentiator. The question for enterprise leaders is simple:

Will you lead the transformation, or watch it unfold from the sidelines?

Recommended readings from our research on this topic

Reach out to discuss more about the ever-evolving landscape of AI in regard to retirements and potential savings, please contact Akshay Pawar ([email protected]) and Vigitesh Tewary ([email protected]).