Alternative assets are outgrowing the “alternative” label

Alternative assets are rapidly shedding their niche status. Assets under management in alternatives will grow to US$30 trillion by 2030, according to the Chartered Alternative Investment Analyst (CAIA) Association, reflecting a 9% percent compound annual growth rate.

The expansion of alternative assets is driven by global investor demand for higher yields, stronger diversification, and inflation-resilient income streams, and is set to accelerate further as recent U.S. legislation now permits alternative investments within 401(k) retirement plans.

This landmark change opens vast pools of retirement capital to private equity, private credit, real estate, and other alternative assets, potentially unlocking fresh, long-term inflows and reinforcing the asset class’s continued growth.

Reach out to discuss this topic in depth.

Four forces that are amplifying the alternative assets growth are:

- Institutional rotation as pensions and insurers cut public bond exposure in search of yield

- Retail democratization through semiliquid feeder funds that accept ten-thousand-dollar tickets, multiplying the number of limited partners each platform must serve

- Regulatory velocity with quarterly fee statements, three-day stress notices, and leverage caps turning compliance into an always on discipline

- Technology maturity as tokenization pilots, cloud data fabrics, and Application Programming Interfaces (API) ecosystems move from lab to production

Long viewed as a tactical yield enhancer, private capital is now a structural pillar of many portfolios. The appeal is reinforced by semi-liquid products that allow retail customers to invest small amounts, and new tokenized feeder funds that finish sign-ups in minutes instead of days.

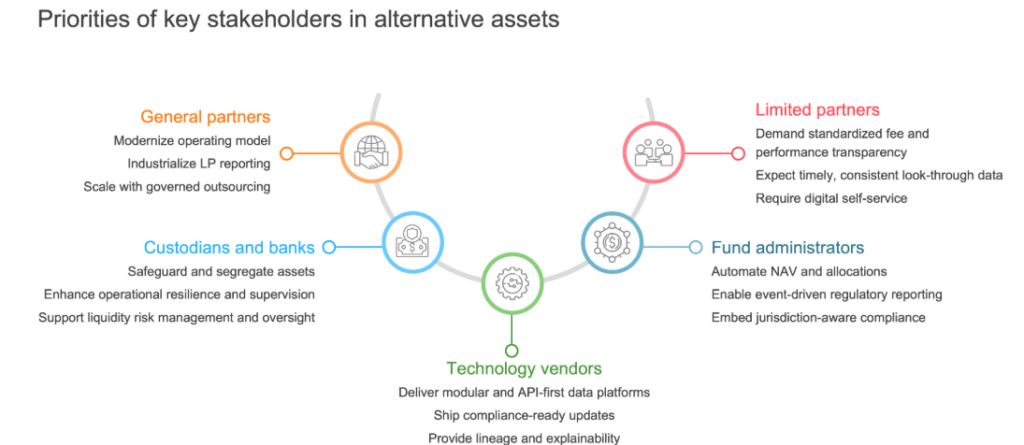

How expansion reshapes every stakeholder

The growth wave is not uniform. Operating leaders at management firms must now reshape processes for faster settlement cycles. Limited partners expect digital clarity, service partners handle larger data volumes, and custodians reinforce cyber safeguards as regulators highlight custody weaknesses. These differing priorities explain why some organizations focus on process efficiency while others invest first in user-facing portals or resilient infrastructure.

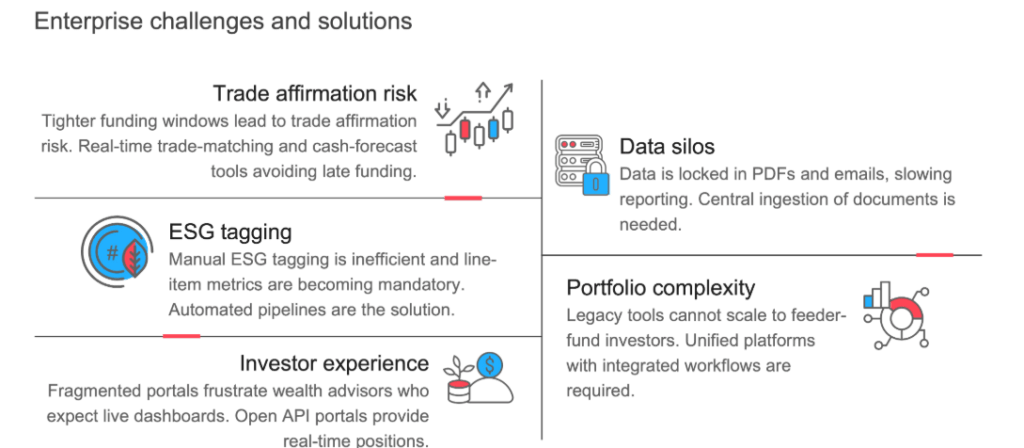

Persistent friction points that slow scale across the ecosystem

Despite record fundraising, many workflows still rely on documents scattered across emails, investor portals, and bespoke spreadsheets. Tighter funding windows amplify trade affirmation risk when data is not synchronized.

Sustainability metrics must now be captured at a line-item level as supervisors increase their reviews of environmental and social disclosures. These issues recur for GPs, LPs, fund administrators, and custodians, with their severity varying by operating maturity and regulatory footprint. Common threads include manual document handling, fragmented data, and rising disclosure expectations that raise both operational load and time-to-report.

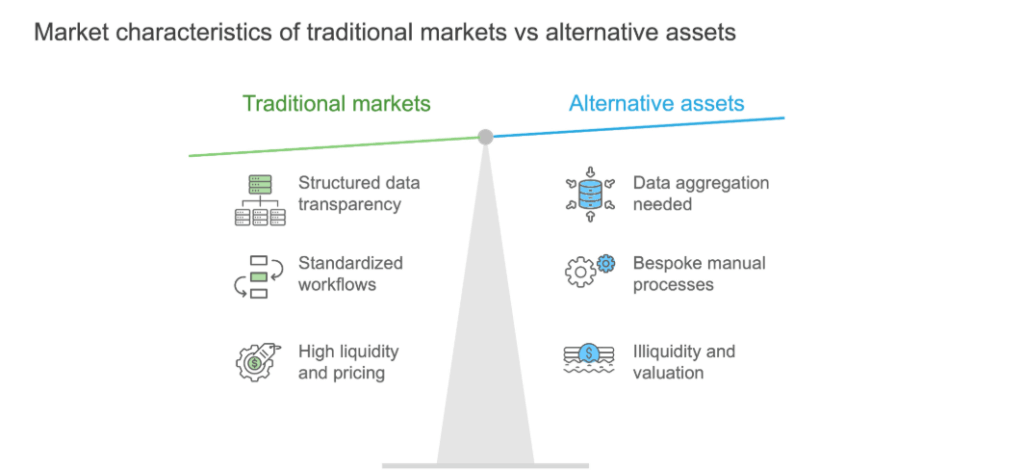

Alternative assets versus listed market norms

Data inside listed markets flows through standard ticker feeds that machines parse with ease, whereas alternative investments still arrive as bespoke waterfalls, capital-call notices, and Portable Document Format (PDF) statements. Natural Language Processing (NLP) and Optical Character Recognition (OCR) engines now capture and structure those files with accuracy rates that exceed manual processing while freeing analysts for higher-value tasks.

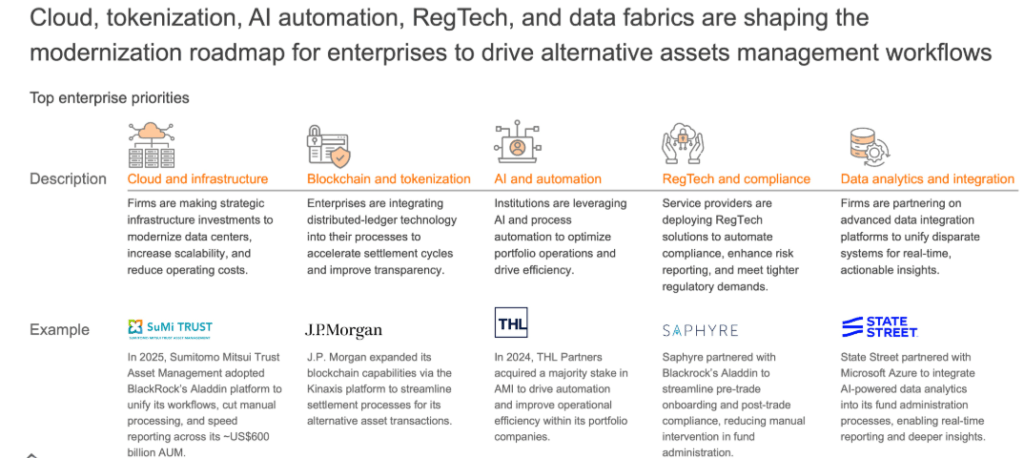

Technology is now a core infrastructure rather than just a support

Technology has become the core infrastructure, because regulatory reporting, investor transparency, and operating resilience now depend on integrated data platforms rather than point tools.

This shift is reinforced by AIFMD II changes to supervisory reporting and delegation, SEC Form PF event reporting, and the rise of front-to-back private-markets platforms that unify books-and-records with client reporting.

Investments in cloud data fabrics, blockchain ledgers, automation, regulatory technology, and advanced integration architecture now sits at the center of modernization budgets.

Asset owners are looking to consolidate legacy systems into a single cloud platform to cut manual hand-offs, while banks are extending their distributed ledger capabilities to accelerate settlement in alternative transactions

Specialized platforms are carving distinct lanes

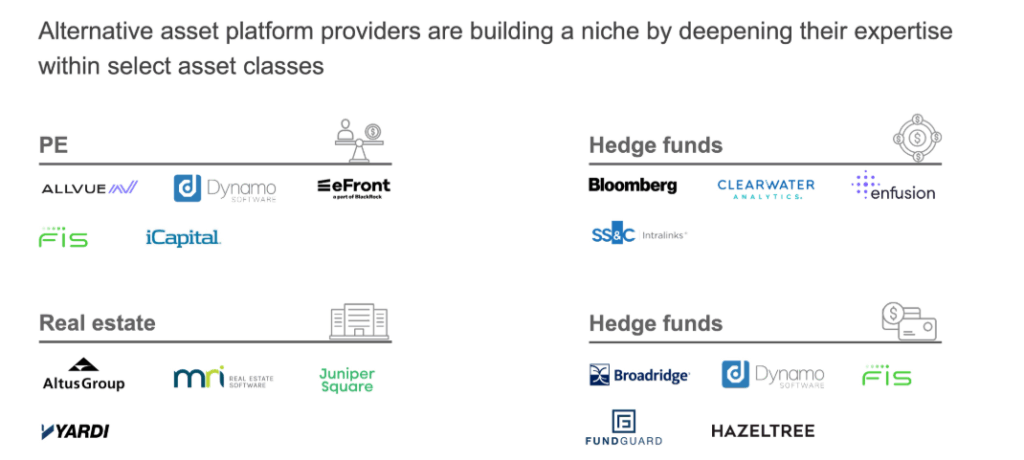

Platform capabilities vary based on the unique requirements of different asset classes. Platforms focused on private equity differ from those built for hedge funds or private credit. Service buyers therefore curate multi-provider stacks that combine best-in-class functionality with domain expertise. The landscape below illustrates how solutions cluster around specific strategies.

Converting friction into strength: The S C A L E playbook

The SCALE playbook, which is a five-point roadmap, shows how leading managers can translate these gaps into delivery: a practical operating model that turns today’s frictions into gains in speed, accuracy, and scalability

- Standardize data into a single cloud lake so every team works from one trusted record. For instance, Apex Group’s INDIE Asset Pro helps auto extract unstructured deal and fund data

- Compliance as code bakes fresh rules into weekly releases. For example, Simcorp’s Regulatory Center of Excellence publishes quarterly Solvency II templates and ongoing NAIC update packs that clients can deploy without bespoke projects, keeping filing logic current while avoiding one-off workstreams

- Artificial Intelligence (AI) with explainability logs into every valuation and Environmental, Social & Governance (ESG) metrics for instant replay. BlackRock’s Asimov virtual analyst already scans filings and research overnight, retaining the full reasoning trail so portfolio teams and auditors can see precisely why a metric moved

- Ledger tokenization ready architecture lets books and records mint digital shares on demand. For instance, Hamilton Lane opened its multi-billion-dollar Secondary Fund VI to investors through a Securitize feeder that issues tokenized interests on blockchain infrastructure

- Elastic operations pairing platforms with managed services under unified service level agreements allows rapid scaling without proportional headcount growth, a pattern already visible in global operating models. State Street’s Alpha for Private Markets combines a front-to-back data platform with global fund administration delivered under one service agreement

Talent demand

Alternative-asset teams lean on a different mix of skills than those serving liquid, exchange-traded products. Portfolio managers still drive investment decisions, but they now sit beside data engineers who pipe unstructured deal documents into cloud warehouses, AI specialists who convert that raw feed into valuations and risk flags, and compliance technologists who embed cross-border reporting rules directly in code.

This blend contrasts with traditional-asset desks that mainly depend on market-data analysts and trade-ops staff because their workflows already run on standardized feeds, automated settlement, and continuous liquidity.

Sourcing playbook

Sourcing for alternative-asset services works best when managers secure an integrated platform-and-operations bundle that scales without adding headcount, comes with quarterly regulatory code updates, and is designed for tokenized workflows from day one.

Contracts should lock in service-level commitments for data quality, audit transparency, and regional data residency so managers can meet fast-evolving disclosure rules while expanding into new strategies and geographies.

Implications for technology providers, service providers, and consulting firms

Alternative assets are not just reshaping managers; they are reshaping the provider ecosystem. Managers now expect platforms that plug and play, with clean APIs, event-driven workflows, and changes that arrive as product updates, not projects. The core stack does not need to be replaced, but it does need to keep pace with rising expectations around data quality, controls, and investor transparency.

The bar is rising. Technology providers that only surface features will not be enough. Managers will look for native capability where reporting, controls, and audit trails are built in, not bolted on. Give teams clear data models, simple integrations, and logs that make reviews straightforward. Build sensible guardrails so people can see how results were reached. Help investors trust what they see by default.

Service partners will play a key role in turning plans into steady operations. As firms move from fixes to repeatable runs, partners should blend platform and manage services under one promise: accurate reporting, timely filings, and fewer back-and-forth. The value is in modular design, interoperability, and proving resilience with visible controls and independent attestations. Run compliance that adapts to each jurisdiction without rework and raise transparency with straightforward portals and statements.

Consulting firms, meanwhile, need to shape the path and keep score. Tie programs to business outcomes, not feature lists. Map tradeoffs, set milestones, and establish the basics of data and governance that last beyond year one. Help select vendors, track benefits in the open, and keep momentum through funding cycles and leadership changes.

In alternatives, the near-term finish line is trust and time. LP reporting is standardizing, and supervision is stepping up, which gives managers a clear window to tighten data, controls, and investor portals. Expect more co sourced operations as margins stay tight and scale matters, along with a push to shorter close cycles, faster Net Asset Value (NAV), and cleaner disclosures. Providers that make these outcomes the default will win the next mandate.

Looking forward to 2026

Amid volatile markets and favorable regulations in the US, alternative assets are expected to continue growth momentum. Institutional interest remains strong in private equity, private credit and real estate.

Tokenized money-market instruments launched in 2025 demonstrate growing confidence that real-time settlements can be achieved for mainstream assets, not only for niche pilot funds. Meanwhile regulators continue to refine custody and disclosure standards, signaling that transparency expectations will only rise.

Firms that standardize data, code compliance, explain AI, future proof ledgers, and run elastic operations, will meet the market’s call for speed and transparency while opening fresh growth channels.

If you are interested in delving deeper into another topic relating to IT Services and Technology, you can now read our latest Alternative Assets IT Services and Technology State of the Market 2025 – Everest Group Research Portal report.

If you found this blog interesting, check out our AI Infusion In Private Equity: A $200 Billion+ Opportunity | Blog – Everest Group, which delves deeper into another topic relating to PE.

If you have any questions, or would like to gain insights on our asset and wealth management research, please contact Kriti Gupta ([email protected]) or Sakshi Maurya ([email protected]).