“There is a big difference between a satisfied customer and a loyal customer.”

- Shep Hyken, Customer service expert

Loyalty has moved from promotions to a system for profitable growth. With AI in loyalty, the strongest programs are built into purchase and service journeys, deliver value beyond discounts through benefits and memberships, and extend usefulness through partners.

Two forces are accelerating this shift: rising media costs and privacy regulations that reduce the value of third-party data. Budgets are tilting from acquisition to retention. Leadership also expects proof of incremental impact and tighter control of reward cost, fraud risk, and liability.

In response, operating models are changing. AI in loyalty now powers decision engines that make eligibility, award, and redemption calls at the moment of choice. Identity is accurate and consented across channels, so audiences and preferences move from data to action within a defined time window.

Reach out to discuss this topic in depth.

As these foundations mature, Artificial Intelligence (AI) is becoming pivotal. It speeds up what already works and adds intelligence where it matters most: selecting relevant offers in real time, keeping identity and preferences current across channels, shortening campaign setup with quality checks, preventing fraud and misuse before points or discounts are granted, and validating results with clean tests.

The question now is how AI in loyalty delivers returns and in what order. High-performing programs such as Starbucks Rewards, Tesco Clubcard, and others use AI to accelerate core mechanics first: fast decisioning, clean identity, and reliable measurement. They then expand into model-driven optimization and richer member experiences. In short, get the infrastructure right, then add intelligence.

In this post, we look at where AI investment in loyalty pays today, what to build for scale, and what to pilot carefully so spend converts to revenue, margin, and satisfaction.

Let us now look at the current scenario of the loyalty platform market.

Market reality: how loyalty platforms are delivering today

Four execution shifts are evident in live deployments and near-term roadmaps.

- Decision engines now do the heavy lifting

Providers are strengthening the core: real-time eligibility, offer, and award calculation at checkout, clear program and tier setup, and Application Programming Interface (API) integration to web, app, and point-of-sale systems. Eagle Eye has shown sub-second basket decisions (about 200 ms). Fast, accurate decisioning is the foundation for effective AI in loyalty and makes later investments pay off

- Identity-led activation is growing, with privacy in lockstep

Activation starts with consented identity and permissions. Consent is captured and honored across channels, and profiles stay current so new audiences and preferences move from data to action within a defined time window. Merkle describes a pipeline that resolves identities and moves audiences from the data platform to the loyalty system and email, with auditable workflows. This enables confident personalization without privacy or response-time risks

- AI is moving from pitch to product

Practical features are shipping. Admin copilots summarize programs, assistants speed audience and journey setup, and auto-configuration drafts rules and offers for human approval. Antavo has introduced Planner and Optimizer to design programs and quantify Return on Investment (ROI), and previewed auto-configuration with human validation. Decision engines are also adding predictive insights and budget-aware targeting

- Proof over promises is the new standard

Measurement is built in, not ad hoc. Leaders ask for three things: time saved for teams, live response-time targets for selection and offer calculation, and control-group results that show incremental revenue or retention after costs. Merkle’s Loyalty Plus includes dashboards for engagement, conversion, and lifetime value anchored in control-group measurement

Taken together, these patterns point to a practical sequence for AI investment: prioritize quick, proven wins, build the capabilities that scale, and pilot higher-risk ideas with tight controls.

How to prioritize AI in loyalty: Effort and cost vs. proven impact

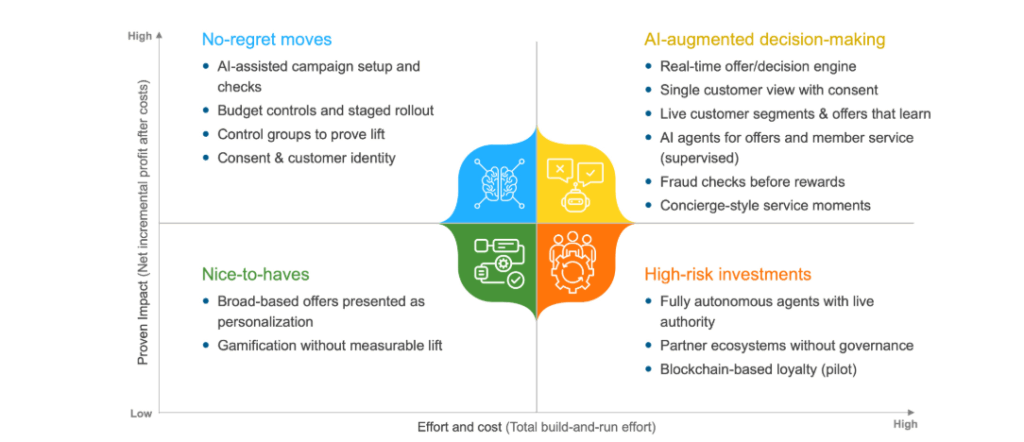

We rank AI-powered use cases on a 2*2 matrix by Effort and cost to implement and by proven impact on revenue, margin, or retention. Fund quick, reliable wins. Build the capabilities that scale. Limit low-yield ideas. Pilot high-risk items under tight controls.

Exhibit 1. AI Investments in Loyalty: Effort and Cost vs. Proven Impact

The exhibit organizes options; the guidance below translates it into what to fund now, what to build for scale, what to limit, and what to pilot.

Quadrant A: no-regret moves (low investment, high gains)

Use AI to speed setup and checks. Keep budgets tight and measure lift with control groups. This cuts errors and shortens time to launch.

For example, Tesco Clubcard tested personalized challenges against standard offers, measured incremental lift, and then scaled to about 10 million members.

Quadrant B: strategic bets (high investment, high gains)

Build real-time decisioning, a single customer profile with consent, and offers that learn inside the app and at checkout. These create repeatable results at scale.

For example, Starbucks Rewards uses real-time data on purchase patterns, time of day, and store preference to show dynamic challenges and recommendations in the app.

Quadrant C: nice to haves (low investment, low gains)

Easy to ship but often weak on results. Fund only if a clean test shows net lift after costs.

For example, Zomato (India) added live cricket scores and prediction games during World Cup 2023 so customers earned points while ordering. Treat this as a test and scale only if it drives purchase or retention.

Quadrant D: pilots or pause (high investment, low gains)

High cost or higher risk. Keep work in small pilots with clear success metrics, spend limits, audit, and a tested rollback plan.

For example, Marriott Bonvoy runs a large partner network across hotels, airlines, cards, and merchants. New partners should start in controlled pilots with clear rules and settlement before broader rollout.

With the priorities clear, here is how to put the matrix to work.

How to operationalize the matrix: implications and execution roadmap

The below investments shorten the time to launch, enforce budget and liability discipline, and establish defensible measurement so AI can scale safely.

- Performance targets for decisioning and activation

Set response-time and quality thresholds for offer selection, award calculation, and channel activation. Assign owners and review live performance weekly.

- Control groups to measure incremental impact

Use a small, randomized holdout for every campaign to isolate true lift. Report results as net revenue or retention after reward and fulfillment costs.

- Budget controls and staged rollout

Configure spend caps and contact-frequency limits. Start with a small cohort, validate results, then scale. Keep a tested rollback plan.

- Identity and consent across channels

Keep profiles and permissions current and ensure updates flow to web, app, email, store, and partners within a defined time window. Use an identity-confidence indicator to reduce mistargeting.

- AI-assisted setup and checks

Use copilots to draft rules, audiences, and test plans and to run pre-flight quality checks. Retain human approval with an audit trail to reduce configuration time and errors.

- Pre-award fraud checks

Score risk before issuing value using device, behavior, and velocity signals. Block obvious abuse while keeping genuine members fast.

- One “concierge” moment to prove the concept

Deliver a benefit or fix at the moment of need, for example, surfacing an entitlement on arrival. Track usage, satisfaction, and churn against a small control group.

With these priorities set, focus on foundations, scale the core, and use AI to speed decisions and proof. The summary below distills the outlook.

Spend like leaders

Loyalty growth will come from disciplined execution, not shiny features. The programs that outperform, treat loyalty as a system of decision and proof. It should shorten the time to launch, improve targeting within defined limits, prevent abuse before value is issued, and elevate service at critical moments.

The outlook for the next 12 to 24 months is pragmatic. Supervised agents will gain authority in narrow, high-volume tasks where outcomes are measurable. Fraud and abuse controls will be implemented earlier in the flow, resulting in minimal member friction. Partner ecosystems will expand where governance is strong and settlement is reliable.

Blockchain-based constructs will remain pilot-only until their adoption and economic viability are proven. The bar for funding will rise: every proposal should state response time targets, expected incremental impact after costs, budget, and fraud controls, and evidence of privacy compliance. Leaders who adopt this Moneyball discipline will convert AI spend into durable revenue, margin, and satisfaction.

To discuss this further, please contact Tanishqa Singh ([email protected]) or Aakash Verma ([email protected]).

Learn more about the loyalty platform provider landscape, Loyalty Platforms PEAK Matrix® Assessment 2025 and the loyalty market, Reloaded for Resilience: Loyalty Platforms State of the Market 2025.

If you found this blog interesting, check out our Agentic AI In CXM: Early Signals On What It Is And What It Is Not | Blog – Everest Group, which delves deeper into another topic regarding AI.