The “build vs. buy” debate has defined core-platform decisions for a decade. Guidewire’s Niseko release quietly adds a third, more pragmatic option: package, assemble upgrade-safe, modular capabilities on the cloud platform, combining provider assets with your own differentiated Intellectual Property (IP) and solutions.

Furthermore, packaging preserves speed (like buy), preserves control (like build), and protects upgrades, matters for carriers balancing change velocity and total cost of ownership, and for service partners seeking repeatable, scalable revenue.

Niseko’s highlights set the context. Guidewire introduced Insurance Data Models (Policy, Claims, and the new Billing model) that auto-generate curated datasets from the InsuranceSuite entity models to feed out-of-the-box financial reporting in Explore.

The release also adds Guidewire Functions, a serverless approach for discrete business logic, Extension Layer to keep customizations update-safe and packaged, Autopilot activity handling in PolicyCenter, Azure Maps geocoding support, and the latest HazardHub Wildfire Risk Score 3.0. Together, these updates tilt the platform toward composability and faster change.

Reach out to discuss this topic in depth.Why “package” beats a binary choice

Our market tracking shows convincing signs that the market is moving from indiscriminate buying to purposeful integration, assembling capabilities that compound value on a platform. The framing aligns with Guidewire’s direction: carriers don’t need to rebuild; they can simply package customizable modules that stay current with provider upgrades while preserving differentiation.

- Build still has a place for proprietary User Experience (UX), rating logic, or workflow nuance, but it carries upgrade risk and specialist staffing. While Niseko aims to reduce friction with Bring Your Own Code (BYOC) functionality, you still own lifecycle and regression complexity

- Buy accelerates time-to-value. Think Explore’s premium/loss Business Intelligence (BI) content and built-in HazardHub risk models. However, you must keep an eye out as this can converge you toward competitors if adopted “as is”

- Package blends both: use vendor-maintained artifacts for common needs; encapsulate differentiators as extension layer modules and functions that are decoupled from the core and resilient to updates

A decision lens – “Where do we differentiate vs. where do we converge?”

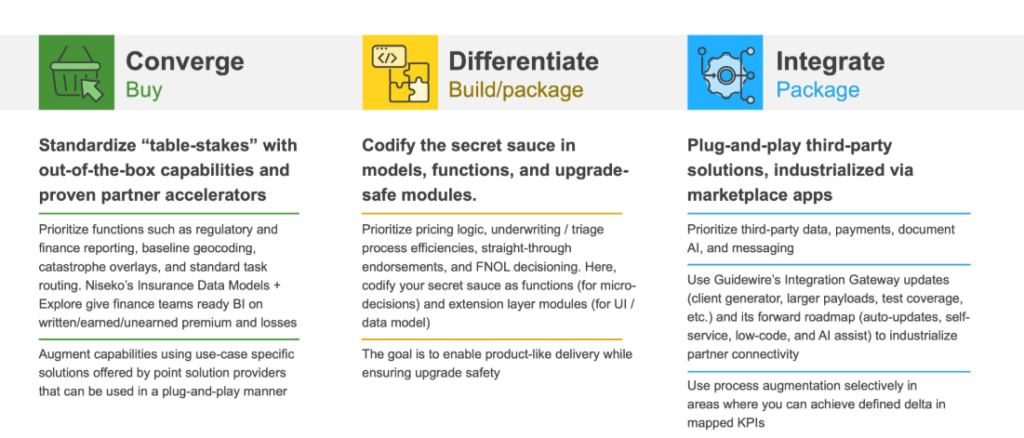

Leaders can sort initiatives into three buckets:

- Converge (buy): Regulatory and finance reporting, baseline geocoding, catastrophe overlays, and standard task routing. Out of the box, Niseko’s Insurance Data Models + Explore give finance teams ready BI on written/earned/unearned premium and losses. Meanwhile, Azure Maps replaces Bing Maps and Autopilot patterns systematize underwriting work queues. Additionally, point solution providers offer use-case specific solutions that can be used in a plug-and-play manner.

- Differentiate (build/package): Pricing logic, underwriting / triage process efficiencies, straight-through endorsements, and First Notice of Loss (FNOL) decisioning. Here, codify your secret sauce as functions (for micro-decisions) and extension layer modules (for User Interface (UI) / data model). The goal is to enable product-like delivery while ensuring upgrade safety.

- Integrate (package): Third-party data, payments, document Artificial Intelligence (AI), and messaging. Use Guidewire’s Integration Gateway updates (client generator, larger payloads, test coverage, etc.) and its forward roadmap (auto-updates, self-service, low-code, and AI assist) to industrialize partner connectivity. Use process augmentation selectively in areas where you can achieve defined delta in mapped Key Performance Indicators (KPIs).

What does this mean for carriers?

1) Treat finance insights as table stakes. Normalize Profit and Loss (P&L) views across lines of business. Use Explore to deliver day-one dashboards for written, in-force, earned, and unearned premium alongside loss analysis, without months of modeling. Start with a narrow scope (such as Personal Auto + Home) and expand.

2) Productize your custom logic. Shift from projects to packages. Put repeatable customizations into your extension layer and encapsulate decision points as functions to reduce regression risk and enable continuous upgrades. Institute guardrails for function sprawl across naming, versioning, and observability.

3) Automate the underwriting inbox. Use Autopilot activity handling to route tasks to underwriters based on rules, capturing metrics like manual-touch rate and quote Turnaround Time (TAT) before/after. This bridges human-in-the-loop with end-to-end workflow automation.

4) Get ahead of the maps transition. With Bing Maps Enterprise sunsetting and Azure Maps as the Microsoft path forward, test coverage, licensing, and Application Programming Interface (API) behavior now; validate catastrophe heat-map parity and geocoding accuracy in your key geographies.

5) Strengthen risk selection. Pilot HazardHub Wildfire Risk Score 3.0 in exposed regions, A/B compare against your current property risk signals to quantify combined ratio impact before full rollout. Explore third-party solutions to augment granularity.

What does this mean for service providers?

Move from Time and Materials (T&M) to products. Niseko opens new packaging surfaces:

- Finance BI accelerators (Insurance Data Models + Explore): Package prebuilt dashboards that ride Guidewire’s Policy and Claims Insurance Data Models, so carriers get near-real-time premium and loss views, localize KPIs for regional filings. Guidewire Explore pulls curated, dimensional datasets from the models/Data Studio, letting you ship finance insights and iterate quickly

- Underwriting micro-automations (Functions + extension layer): Deliver triage, referral, and rating tweaks as serverless functions and keep UI/data tweaks in the Extension Layer so they’re upgrade-safe and reusable across clients. Where appropriate, pair with Autopilot activity patterns in PolicyCenter to route work to the right underwriter, turning custom workflows into productized modules

- Azure Maps migration kits + HazardHub calibration services: Offer a turnkey transition from Bing Maps to Azure Maps and Computer-Assisted Translation (CAT) heat-map validation. In parallel, run HazardHub Wildfire Risk Score 3.0 calibration pilots to quantify selection/pricing uplift and operationalize model governance

Commercially, that means recurring maintenance and Service Level Agreements (SLAs). Strategically, it aligns with the industry’s broader platformization and purposeful integration trend.

What’s next?: From packaged features to packaged ecosystems

Expect Guidewire to keep deepening the package story along three vectors:

- Unified finance data: With the Billing model joining Policy and Claims, a consistent source for receivables, commissions, and disbursements should become default, simplifying finance close and compliance

- AI- and low-code-assisted integration: The Integration Gateway roadmap points to more automation (auto-updates, visual tooling, and AI code/test suggestions), shrinking cycle times and institutionalizing best practices

- User-productivity UX: With multi-tab support across InsuranceSuite that reduces costs associated with employee effectiveness, expect incremental rollouts to claims and service teams next

Zooming out, capability-led consolidation echoes the winner’s play is not to own everything, but to package the right things, and do it in ways that apply across lines, geographies, and partners. Niseko gives both carriers and service providers the scaffolding to do just that.

Everest Group’s ongoing flagship Guidewire Services PEAK Matrix® Assessment 2026 explores distinctive capabilities in the Guidewire services market. We invite service providers to enhance brand visibility and uncover prospective engagement opportunities.

Reach out to Aurindum Mukherjee ([email protected]), Rugved Sawant ([email protected]), and Vanshika Notani ([email protected]) for participation details. To explore our full portfolio of insights, visit our Insurance IT Services hub.