In an era where compute is strategy, the recent Intel–NVIDIA partnership goes far beyond product collaboration. While headlines focused on NVIDIA’s $5 billion equity stake in Intel and their co-development of Artificial Intelligence (AI) infrastructure, the real story is what this deal implies about technological sovereignty, semiconductor realignment, and the future of AI infrastructure control.

This isn’t just a business move. It’s a strategic rebalancing, with multiple stakeholders, conflicting interests, and long-term global consequences.

Reach out to discuss this topic in depth.

- The sovereignty perspective: Aligning with America’s AI-industrial complex

Intel is not just another chip company; it’s a strategic national asset. With heavy US government backing via the CHIPS and Science Act, Intel is central to Washington’s push to reclaim manufacturing and control over critical technologies like AI compute.

This deal allows:

- More of the AI hardware stack to shift onshore: custom Central Processing Units (CPUs) from Intel, packaging within US borders, and the possibility of future foundry migration

- Closer coupling of NVIDIA’s Graphics Processing Unit (GPU) dominance with Intel’s US based production, offering a hedge against rising geopolitical risks, particularly in the Taiwan Strait

From this angle, NVIDIA’s investment and collaboration with Intel aligns perfectly with US interests: the strengthening of domestic semiconductor capability and the hardening of AI supply chains against external shocks. But there’s a nuance: this is not industrial policy by decree, it’s industrial coordination through incentives, investment, and existential necessity.

2. The commercial logic: Two giants with complementary weaknesses

Looked at commercially, this partnership also makes strategic sense:

- NVIDIA gets:

- Access to custom CPUs with low-latency NVLink integration, improving performance in multi-GPU AI training environments

- A new RTX SoC platform to extend into thin and light PCs and AI notebooks

- Diversified packaging supply in the face of CoWoS capacity constraints

- Intel gets:

- Attach rates on the fastest-growing segment in compute: NVIDIA’s AI stack

- A new design beachhead in the premium PC market via RTX-enabled x86 SoCs

- Credibility for its advanced packaging and long-horizon 14A process node

The $5B equity purchase by NVIDIA sweetens the deal, de-risking Intel’s manufacturing scale-up and giving NVIDIA influence without ownership control. This is commercial symbiosis, not a rescue.

3. The competitive perspective: AMD and TSMC feel the tremor

This tie-up sends clear ripples across the competitive landscape:

- AMD: Faces dual pressure. In the data center, Intel’s CPUs now pair more closely with NVIDIA’s dominant GPUs. In PCs, integrated RTX SoCs challenge AMD’s discrete or iGPU positions. AMD will need to accelerate its MI series, GPU adoption and lean harder into open interconnects like Infinity Fabric and CXL

- TSMC: Not immediately threatened, but long-term risks are forming. Intel’s packaging wins and 14A roadmap could make it a credible secondary fab, a shift with major implications if geopolitical tensions rise

- ARM and Qualcomm: With AI PCs on the rise, x86 with RTX chiplets offers a compelling counterweight. This deal may blunt ARM’s momentum in premium AI PCs unless it can match performance and software compatibility

4. A global signal, and a call to action for Europe and India

Whether intended or not, this partnership projects a strategic message globally that the United States is willing to align its tech champions to preserve leadership in AI hardware. China, which has poured billions into building its own CPU–GPU stack, will likely interpret this as a signal to accelerate self-sufficiency efforts.

China may see it as impetus to double down on self-reliance, but for Europe and India, it presents an opportunity to focus on complementary strengths, such as open chip architectures, sovereign accelerator initiatives, and trusted supply chains. Rather than viewing it as a zero-sum shift, nations can treat it as a signal to invest in differentiated, future-ready compute ecosystems.

What to watch next

As the Intel–NVIDIA partnership moves from announcement to execution, the spotlight now shifts to what unfolds in practice. This alliance has far-reaching implications across compute, packaging, and interconnect ecosystems, yet its success hinges on timely delivery, product-market fit, and ecosystem buy-in.

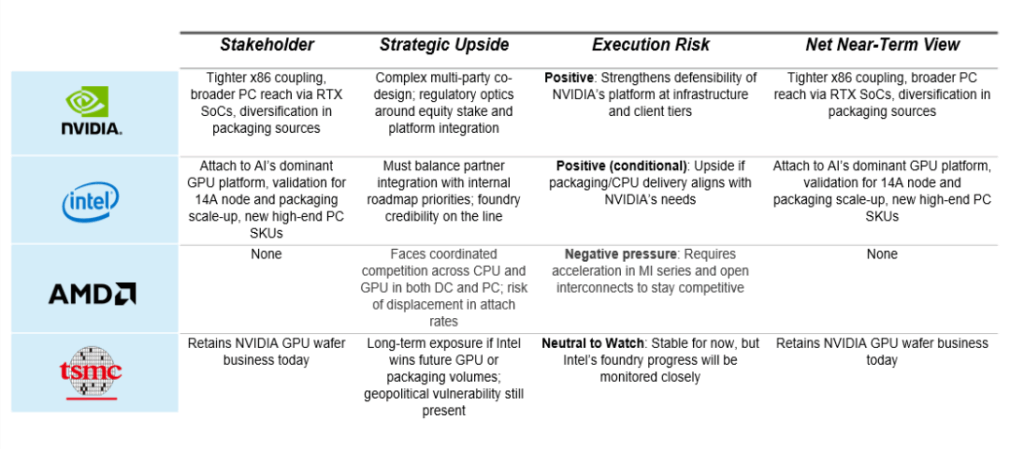

Key stakeholders across the AI hardware value chain, ranging from platform leaders to foundry suppliers, face a new competitive landscape shaped by tighter integration, manufacturing realignment, and shifting Original Equipment Manufacturer (OEM) loyalties. Below is a snapshot of how each is positioned in the near term:

For enterprises, governments, and ecosystem players watching from the sidelines, this deal is a timely reminder: AI infrastructure leadership is increasingly shaped not just by innovation, but by alignment between hardware and software, companies and countries, ambition and execution. The next 12–24 months will reveal whether this alignment sets a new standard or simply a high watermark.

In the race to dominate the AI era, integration is becoming a strategic weapon. The Intel–NVIDIA partnership isn’t just about better chips. It’s about who controls the full stack from silicon to system, from country to cloud. And for now, that stack is looking increasingly cohesive, American, and hard to replicate.

If you found this blog interesting, check out our recent blog focusing on Nvidia’s Full-Stack Ambition: Owning the AI Value Chain, which delves deeper into a similar topic relating to AI.

To discuss the latest AI trends in more depth, please reach out to Tanvi Rai ([email protected]) and Mukesh Ranjan ([email protected]).