Insurance fraud is escalating across Life and Annuities (L&A) and Property and Casualty (P&C) segments, with fraudsters exploiting digital channels, automation gaps, and artificial intelligence (AI) tools.

The regulatory environment is responding with stricter requirements on explainability, oversight, and fraud control documentation. Insurers are rethinking how to prevent, detect, and investigate fraud across the lifecycle.

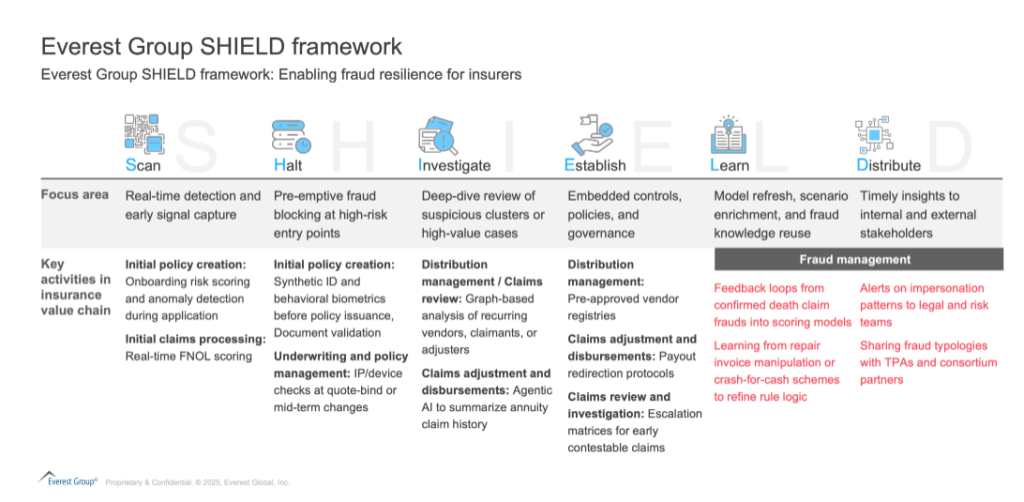

This blog outlines how fraud has evolved, where it manifests globally, and how insurers and service providers can adapt their strategies and capabilities. The Everest Group SHIELD model helps insurers design fraud operations that integrate detection, governance, and intelligence-sharing across onboarding, servicing, and claims.

Reach out to discuss this topic in depth.

Fraud’s evolving frontlines: A rising threat to insurer trust, profitability, and operations

Insurance fraud erodes not only insurers’ profitability but also the experience of their customers, both in retail and institutionally. Policyholders often endure processing delays or onerous documentation requests when overly sensitive risk-scoring models are triggered. Small businesses can also find themselves subject to re-underwriting or non-renewal after being linked to flagged risk clusters.

Meanwhile, micro-segments including healthcare and life sciences , agriculture, logistics & supply chain, small and medium-sized enterprises (SMEs), and independent contractors are increasingly singled out, as the flexible coverage they require is especially vulnerable to misuse.

Insurance fraud is increasingly fueled by internal collusion (employees, agents, and brokers) who manipulate records, legitimize staged incidents, or fast-track contestable claims alongside external customers who employ synthetic identities, forged documents, and other technological deceptions.

Three major shifts are shaping today’s fraud landscape:

- AI-driven manipulation – Technology is enabling emerging fraud threats. Generative AI (gen AI) is now used to forge documents, alter images, create synthetic identities, automate bots for small claims, and simulate identities via deepfakes often evading legacy fraud detection systems

- False positives and customer disruption – Legitimate policyholders are increasingly flagged by sensitive risk scoring models. Life claims are delayed due to minor mismatches in onboarding data. P&C claimants face repetitive documentation requests, particularly in property or auto lines. This erodes trust and increases service burden

- Cross-channel fraud networks: This involves coordinated actors blending internal and external players who exploit multiple policies, insurers, or distribution channels simultaneously. Fraud rings leverage stolen or synthetic identities, use insiders to bypass verification checks, and submit orchestrated claims across L&A and P&C insurance

Fraud is no longer just a claims issue: Unmasking the full enterprise threat

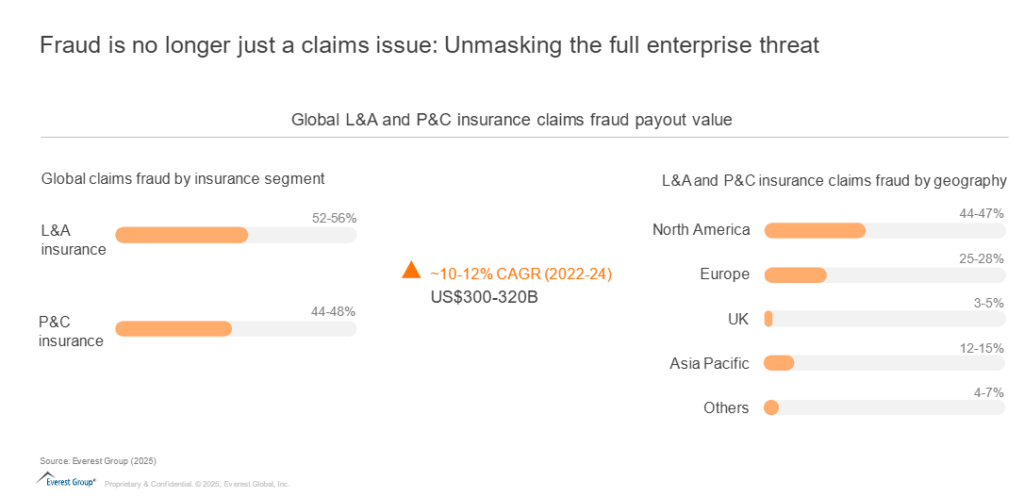

Fraudulent claims siphoned off more than US$300 billion from L&A and P&C insurers worldwide in 2024 and is swelling by over 10% each year. Nearly half of that bill (44-48%) falls on North American insurers, with Europe absorbing the next-largest share.

However, fraud is no longer confined to claims. It now affects application accuracy, account servicing, payout processing, and even marketing channels across various product lines within L&A and P&C insurance areas. For instance:

- Ghost broker: In 2022, an individual broker was convicted of pocketing £200,000 by selling over 900 fraudulent motor insurance policies was sentenced to 24 months imprisonment

- Synthetic identity: In UK, a policy holder, changed his name multiple times by deed poll and used the identities of his family and friends to make bogus travel insurance claims worth an estimated total of £75,000

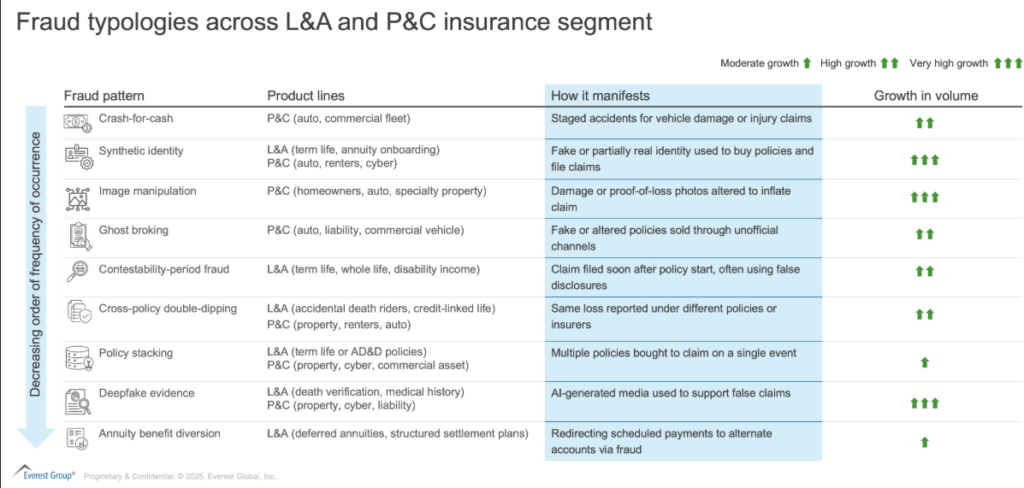

Exhibit 1 presents a comprehensive overview of emerging fraud typologies across insurance products, highlighting those expected to scale rapidly. It acts as a strategic signal map to help insurers prioritize fraud vectors requiring immediate attention from analytics and risk management functions.

Exhibit 1: Fraud typologies across L&A and P&C insurance segment

Expanding fraud battlefield: New vectors across onboarding, servicing, and beyond

Fraud has evolved into a lifecycle risk. It begins at the point of application and continues through policy management and claims.

In L&A, insurers face risks like synthetic applications, falsified disclosures, early death claims, and unauthorized annuity redirections. In P&C, fraud takes the form of altered loss of evidence, duplicate filing across policies, and staged accidents involving collusion.

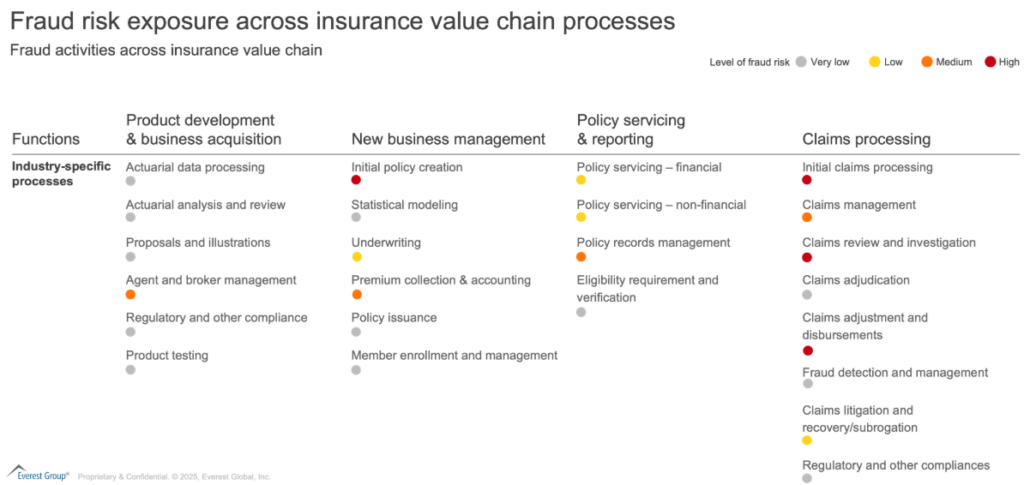

Fraudulent activities have been increasing at various stages in the value chain:

- Product development and business acquisition: Ghost-broking rings sell forged policies or place risks with fictitious carriers

- New business management: Synthetic identity use at onboarding, falsified disclosures during contestability window, multiple policies bought to stack future claims

- Policy servicing and reporting: Annuity-benefit or refund diversion via fake payees; policy-stacking by quietly raising limits; premium diversion in agent-billed books

- Claims processing: Crash-for-cash staged losses, deep-fake death/medical proofs, image manipulation of damage, cross-policy double-dipping, payment rerouting

Exhibit 2: Fraud risk exposure across insurance value chain processes

As fraud becomes more sophisticated, insurers need lifecycle-aligned defense strategies that integrate technology, regulation, and operational control. Insurers are now embedding early detection and decision triggers across systems to manage fraud upstream rather than relying on post-claim investigation alone.

Regulators across the geographies are also upping their arms to tackle the menace created due to the evolving nature of fraudulent activities through stricter monitoring, regulated use of AI in decisioning, data protection acts, and bias monitoring.

Compliance under the microscope: Building transparent and auditable fraud defenses

Insurers must navigate evolving compliance landscapes while building fraud operations that are both effective and auditable.

United States

State regulators such as the New York Department of Financial Services require insurers to file anti-fraud plans and show how fraud scoring is applied during underwriting and claims. Consent orders have been issued against several L&A insurers such as John Hancock Life & Health Insurance Co., Lincoln Life & Annuity Co., etc., for the opaque use of AI models. Such as against regulators, who expect documentation, bias monitoring, and human-in-loop decision workflows

United Kingdom

The UK Financial Conduct Authority (FCA) has launched reviews into P&C denial practices linked to automated scoring for several insurers such as Direct Line Insurance Group. This has required insurers to audit the models, document their logic, and put right any customer harm uncovered. Shared databases and fraud registers are actively used to track ghost broking, personal injury fraud, and coordinated rings. Insurers are expected to justify how risk-based decisions are made and escalate when needed

European Union

The European Union (EU) AI Act classifies fraud scoring in insurance as high-risk AI. It requires auditability, transparency, model testing, and impact documentation. Insurers operating in EU markets must maintain explainability of logs and ensure that no claims or applications are declined solely based on automated outputs.

Asia, Latin America (LATAM), Middle East and Africa

Jurisdictions across Asia and LATAM are deploying real-time detection tools and contributing to regional fraud registries. In India, the Digital Personal Data Protection (DPDP) act limits personal data use to lawful and consented purposes, which affects fraud analytics pipelines. In the Middle East and Africa, local regulators are mandating the creation of fraud units and formal case escalation procedures for motor, life, and commercial lines.

Across markets, the emphasis is on transparency, fairness, and evidence-backed decisions.

Everest Group SHIELD Framework: A strategic blueprint for end-to-end fraud lifecycle transformation

To respond to rising fraud and the rise in regulatory scrutiny, insurers now need a comprehensive fraud management model. The Everest Group SHIELD framework supports insurers in the creation of a blueprint to identify, prevent and detect fraud across the full lifecycle.

This spans early detection, governance, continuous learning, and multi-party collaboration.

Exhibit 3: Everest Group SHIELD framework

Enterprise priorities such as customer trust, regulatory readiness, innovation, and cost control can be directly supported by aligning programs to SHIELD pillars.

The rise of outcome-driven fraud partnerships in insurance

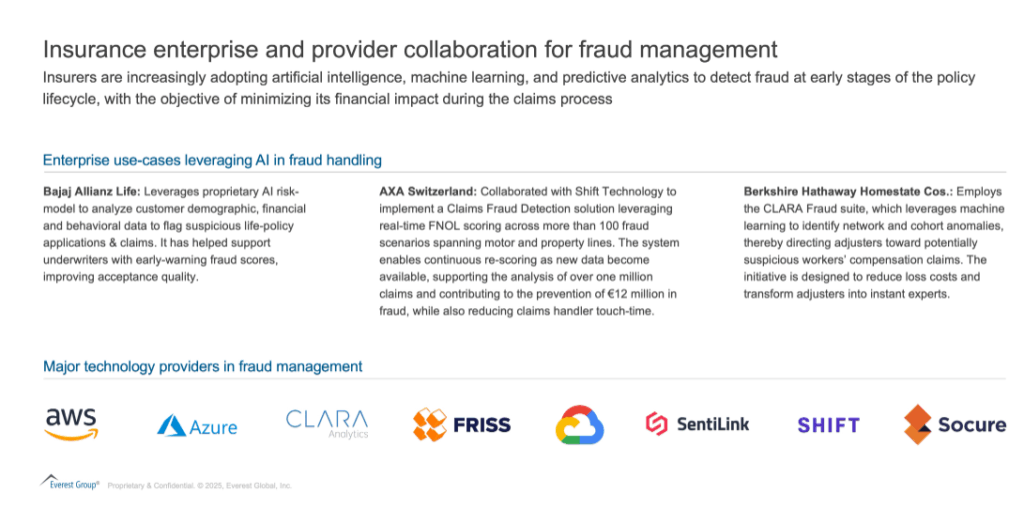

As insurance fraud evolves in complexity and technological intensity, insurers are looking to service providers not just for support, but for modular, domain-specific fraud capabilities. This includes advanced analytics, digital identity tools, multilingual investigations, and integration with insurer workflows. Providers are now being asked to deliver outcomes such as fraud savings, reduced false positives, and faster triage, not just full-time equivalents or ticket resolution.

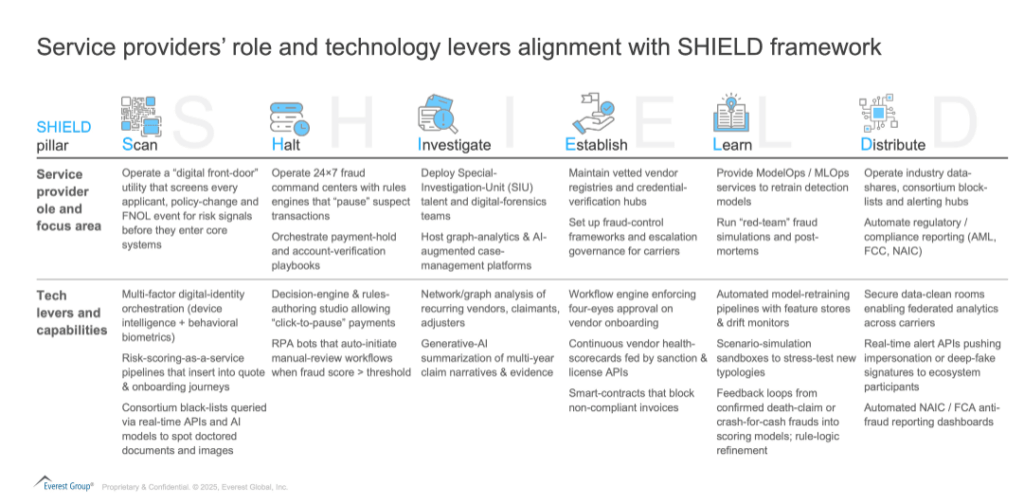

Service providers are increasingly integrated into insurer fraud workflows. They enable detection, triage, escalation, and feedback loops. Using the SHIELD model, service providers can build domain-specific offerings that support key fraud operations.

Exhibit 4 illustrates the alignment of service provider opportunities across the various SHIELD pillars, along with the corresponding technology levers they can deploy to support insurers in managing fraud.

Exhibit 4: Service providers’ role and technology levers alignment with SHIELD framework

The following exhibit 5 depicts several use-cases which enterprises are deploying to handle fraud insurance in collaboration with technology and BPS providers.

Exhibit 5: Insurance enterprise and provider collaboration for fraud management

- Providers such as Shift, FRISS and CLARA continue to dominate mature P&C deployments, offering off-the-shelf fraud-scoring engines integrated with core systems

- Traditional Sophistication of Internet Usage (SIU) support providers (such as Verisk, SAS, BAE) are evolving to embed real-time AI and decision intelligence

- Identity & onboarding risk tools (such as SentiLink, Socure) are critical for Life and Digital P&C carriers fighting synthetic identity and application-stage fraud

- Large tech/cloud players (such as Google, AWS, Microsoft) now offer AI building blocks for insurers wanting custom, embedded fraud-detection models

While L&A carriers historically lagged but are catching up via gen AI and document-AI, especially in medical-claim heavy markets.

Wearables, Internet of Things (IoT) sensors, and GPS trackers are now widely employed to detect diverse fraud schemes, from image and deepfake manipulation to benefit diversion and crash-for-cash incidents.

Insurers report two consistent benefits: straight-through processing gains (speed and Customer Experience (CX)) and measurable loss-cost reduction through earlier detection and fewer false positives.

Looking ahead, we expect wider application of LLM-based document understanding and graph/network analytics to unmask organized fraud rings across both segments.

Service providers have also been leveraging partnerships with industry associations such as the Association of Certified Fraud Examiners (ACFE) and Communications Fraud Control Association (CFCA) to enhance their workforce through domain-specific training and certifications in fraud management.

Additionally, they should prioritize investments in regulatory awareness, modular delivery frameworks, and privacy-by-design architectural principles to ensure compliance and operational effectiveness.

Competing on fraud resilience – The new advantage

Fraud affects every aspect of the insurer’s value chain. It compromises underwriting precision, slows down claims, and undermines customer experience.

As insurers digitalize, the threat surface grows, and traditional models cannot scale. To compete and protect in the digital age, insurers must embed fraud intelligence into product design, operations, compliance, and partner collaboration.

To explore how leading insurers are enabling fraud resilience across operations, data, and governance, and how your organization can accelerate that journey, connect with Everest Group’s Banking, Financial Services and Insurance (BFSI) analysts – Suman Upardrasta, Dheeraj Maken, Abhimanyu Awasthi and Saket

Access our latest research on intelligent compliance platforms, advisory evolution, and our newly published FCC tech research reports covering digital identity, fraud management, transaction monitoring, KYC/CDD (customer due diligence), sanctions screening, and next-generation compliance technology: