The Next Frontier of Insurance Experiences: The Power of CX Orchestration and Marketing Technology

Insurers earlier often relied on monolithic experience platforms for web content and account self-service. Today, over 70% of customer interactions in insurance occur through digital channels, with rising frequency across web, mobile, contact centers, and chat interfaces.

The surge in digital claims, embedded affinity programs and hyper-personalized campaigns has driven a need for specialized components that can scale independently and integrate through Application Programming Interfaces (APIs) and event-based triggers.

Customer Experience (CX) spend already accounts for US $15-20 billion of insurance Information Technology (IT) spend and is expected to grow at 5-7% CAGR between 2024-26. Leaders are therefore decoupling front-end experience layers from marketing data engines so that each can mature on its own cloud and artificial intelligence (AI) roadmap.

The experience platform market in insurance is comprised of two product stacks: a Customer Experience Orchestration Products (CXOP) layer that powers sales and distribution journeys, and a Marketing Technology (MarTech) layer that fuels data-driven growth marketing.

CX Orchestration Products acts as the face–brain–voice of the live customer journey, while Marketing Technology forms the data–content–activation backbone that feeds those journeys. Together they support a shift from static web portals to real-time, insights-led orchestration across every value-chain touchpoint. This blog unpacks the evolution, drills into capability and functionality, insurance-specific use-cases, and maps each capability and functionality to where it creates value in the insurance life-cycle.

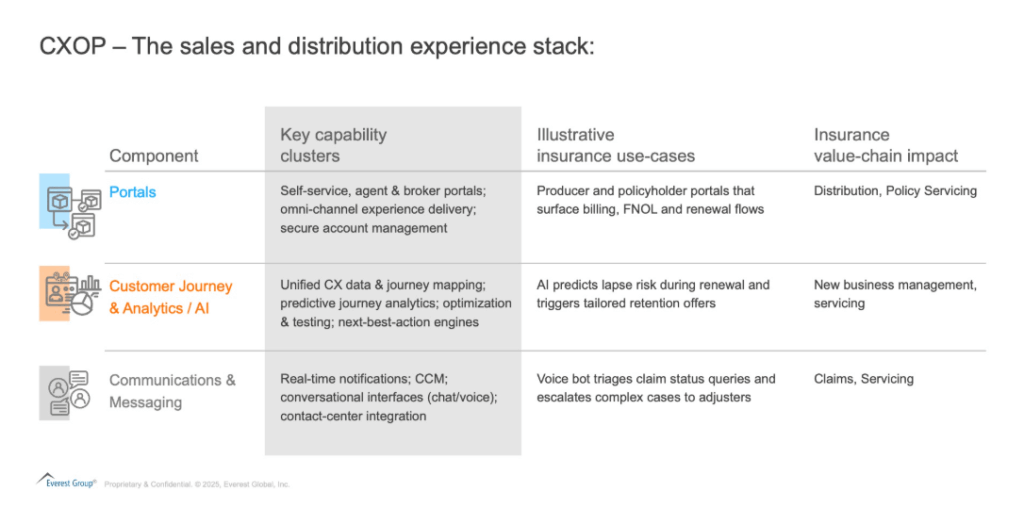

CX Orchestration Products – The sales and distribution experience stack:

CX Orchestration Products (CXOP) brings together the “face, brain, and voice” of insurance journeys:

-

- Face – Portals expose intuitive and interactive User Interfaces (UIs) for policyholders, agents and partners

-

- Brain – Journey & AI engines fuse claims, policy and behavioral data to steer journeys in real time

-

- Voice – Communications engine pushes proactive nudges, secure docs and live-chat support across channels

Together they orchestrate human‑digital interactions for policyholders, agents, and brokers.

These components sit atop open integration layers – APIs, webhooks and data pipelines, that connect to core administration, underwriting, Customer Relationship Management (CRM) and payment gateways, ensuring straight-through workflows from quote to claim.

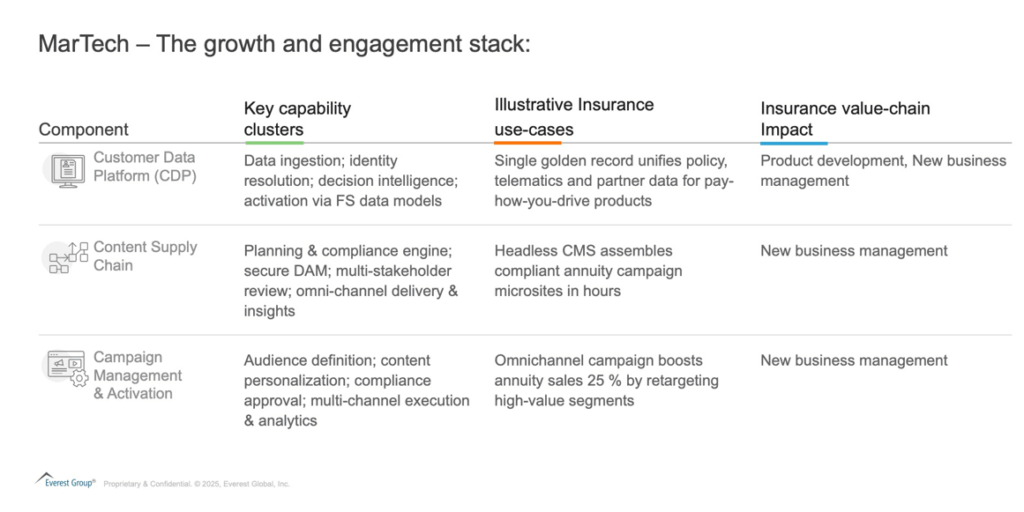

MarTech – The growth and engagement stack:

Growing embedded-insurance and direct-to-consumer models demand rapid micro-segmenting, compliant content and always-on optimization. A marketer can now:

-

- Ingest usage data from Internet of Things (IoT) devices into the Customer Data Platform (CDP)

-

- Auto-assemble offer pages via Digital Asset Management (DAM) components

-

- Trigger personalized push, email and social ads managed in one orchestration canvas

-

- Measure channel attribution and feed insights back into the journey hub – closing the loop between MarTech and the CXOP stacks

Technology enablers underpinning both stacks:

To enable seamless orchestration across both CXOP and MarTech stacks, insurers depend on a core set of cross-cutting technology enablers. These capabilities are not standalone layers, they are embedded within, and around, the journey and marketing engines to ensure scale, agility, and compliance.

-

- Developer experience & Low-code – Open APIs, reusable widgets and embedded SDKs help insurers compose journeys without heavy coding

-

- Collaboration tools – Integrated workflows route content and journey changes to underwriting, legal and brand teams

-

- AI & agentic AI – Autonomous agents now triage routine claims, surface underwriting insights and trigger next-best actions without human prompts—pilots show 20-30 % faster claim resolution and higher CSAT thanks to always-on conversational copilots

-

- Data management & Privacy – Zero-copy data architectures and consent frameworks comply with strict regulations like General Data Protection Regulation (GDPR)

-

- Cloud & security – Hyper-scalable platforms on AWS, Azure or GCP ensure resilience; encryption and IAM protect sensitive PII

What this means for insurers:

As insurers rethink experience through the lens of modular CXOP and MarTech stacks, the question becomes: where to start, and how to scale. The answer lies in aligning capability investments with business priorities across the value chain. Below are five strategic actions insurers can take to unlock measurable impact:

-

- Prioritize modular investments – Start with the capability that smoothens high friction touchpoint, e.g., launch self-service portals, then layer in journey analytics

-

- Establish a data fabric – A unified CDP is foundational; without clean, first- party data, AI and identity resolution – personalization gets hampered

-

- Drive synergy between marketing and distribution strategies – Break down silos: campaign performance data should feed journey orchestration, and vice versa, to drive continuous optimization. Such as – prior claims history used for new product launch campaigns and previous cx interaction giving way to intelligent cross-upsell strategies for new insurance coverages

-

- Adopt a test-and-learn culture – Leaders run controlled experiments on portal journeys and marketing offers, using analytics to validate conversion impact such as sell through rates for D2C insurance products

-

- Choose ecosystem-ready suppliers – Favour platforms that expose robust APIs, m arketplace connectors and industry accelerators to reduce integration overhead

For insurers, the imperative is clear: move towards orchestrated ecosystems that delight customers, empower agents and drive measurable business outcomes.

What this means for suppliers:

Suppliers must pivot from having point solutions to outcome-centric, holistic ecosystem-based solutions which plug into the insurance value-chain. Below are six supplier imperatives, each tied to the capability clusters outlined in the new CXOP and MarTech landscape:

-

- Design for open composability – let insurers embed journey analytics into PAS, billing and CRM ecosystems

-

- Embed autonomous process orchestration logic to automate repetitive service steps and recommend next-best-actions, either via human agents or AI agents

-

- Provide packaged, compliance-ready content such as – embedded approval workflows, rule libraries (FINRA, state DOI) and templatized assets

-

- Unify data at source, not in ETL silos – deliver cloud-native CDPs that stream first-, second- and third-party feeds with consent metadata

-

- Make journey analytics action-oriented – move from dashboards to embedded in-journey experiments and closed-loop optimization

-

- Extend value-chain coverage with pre-built use-cases mapped to underwriting, claims, billing and renewal micro-journeys

Looking Ahead:

We will see accelerated synergies between CXOP and MarTech stacks. Expect AI copilots that auto-generate compliant content, recommend optimal channels and execute personalized nudges – all triggered directly from live journey signals.

Suppliers that can unify face-brain-voice with data-content-activation will shape the next wave of experience-led growth.

Everest Group is launching Banking, Financial Services, and Insurance (BFSI) Products PEAK Matrix® Assessments 2025. As part of this initiative our team is refreshing its coverage on the technology provider landscape for the following four Everest Group PEAK Matrix® assessments:

-

- Banking Customer Experience Orchestration Products (CXOP) Products PEAK Matrix® Assessment 2025

-

- Asset and Wealth Management (AWM) Customer Experience Orchestration Products (CXOP) Products PEAK Matrix® Assessment 2025

-

- Insurance Customer Experience Orchestration Products (CXOP) Products PEAK Matrix® Assessment 2025

-

- BFSI Marketing Technology (MarTech) Products PEAK Matrix® Assessment 2025

These assessments will evaluate CXOP and MarTech products across multiple dimensions such as market impact, vision and strategy, functional capabilities, innovation, and market impact.

Participate in the assessment or reach out to [email protected], [email protected], and [email protected] for more information.