Reimagine growth at Elevate – Dallas 2025. See the Agenda.

Day 12 | Forward-Looking Options to Address Talent Challenges

On the twelfth day, we’re revealing high-level, new year business planning recommendations for 2022 and solutions to the talent challenge.

Over the past “11 Days of Insights,” we focused on many of the hard facts gathered in our 2022 Key Issues study. In this graphic, the spotlight is on the options to solve the talent challenge.

Given the structural nature of decreasing population trends, the solution will have to be multi-pronged. In our triage period for the next 6-18 months, there is going to be real budget pain that can only be partially offset by technology investments that improve both the customer/employee experiences. New sourcing techniques will also be a required part of the equation.

These solutions will require structural changes that completely rethink processes to enable 20-50% productivity improvements. It will require us to find new sources of talent, whether it be in new geographies or overlooked pockets of talent within our own backyards.

And of course, the real long-term solution for a declining population is “more babies,”…but that is a complicated suggestion and, at a minimum, requires 20 years of planning.

Day 11 | ESG Areas Companies Are Looking to Address

On the eleventh day, we’re focusing on ESG and sustainability, their evolution, and how they intertwine with the 2022 Key Issues study.

ESG (Environmental, Social, and Governance) initiatives are a trending topic in the outsourcing/services industry. It is not a new concept, but it is being applied in new ways. In our analysis on ESG and sustainability for the 2022 Key Issues study, we classified the various dimensions into corporate citizenship and the human/employee dimension.

Our criteria consisted of asking which dimensions were the most challenging, and it was no surprise that “employee health and wellness” was at the very top of the list of challenges. This makes sense, given our recent experiences with COVID and all the physical and mental disruptions over the past two years.

On the corporate citizenship side of the ledge, “data security” was at the top of the list in terms of challenges. With so many headlines around ransomware, identity protection, and state/corporate espionage, among many other scary elements, it is not surprising to see it as a top concern. This is an issue that we are focusing on in 2022, so stay tuned.

Day 10 | Business Leaders' Sentiments About Anticipated Salary Changes for 2022

On the tenth day, we’re focusing on departmental raises, the effects on your 2022 budget, and other talent options like impact sourcing.

We got it…there is a talent shortage, we heard all about it. But what does that mean in terms of my 2022 budget? Our 2022 Key Issue study participants indicate that they intend to give raises in the 5-8% range. While there is no doubt that those numbers are up significantly over prior years, they are also well aligned with inflation numbers, which are also in the 5-8% range as measured over the past few quarters.

So, where do we go from here? It’s hard to say exactly, but as long the economy is doing well and companies are looking to grow, the talent shortage will likely create chronically higher salaries. This could bring about two things:

One is a good old-fashioned business downturn (I’m not liking that option) or doing what well-run businesses do best and innovate (I’m liking this option). That innovation will manifest itself in many ways, but technology that drives worker productivity and improves the employee work experience will be at the very top of the list.

The other logical solution will be to scour the planet for new sources of human resources. Impact sourcing, which used to be considered CSR.

Day 9 | Business Leaders' Sentiments About Headcount Changes for 2022, by Department

On the ninth day, we’re focusing on how individual departments intend to grow their teams in 2022 despite the talent shortage.

When drilling down to the departmental level for expected 2022 headcount growth, we see strong hiring intentions across sourcing, IT, GBS (Global Business Services), and the engineering groups. In 2021 the departmental view showed much more muted growth, with only the GBS organization looking for healthy growth. This year, IT and Engineering groups will be leading the way in hiring.

We can all agree that technology will be one of the answers to our talent shortage and part of the hiring strategies for the growth of any company going forward, if it can make our existing employees more productive (and satisfied). But this is one of those chicken and egg dilemmas – will you be able to hire enough IT talent to implement those solutions?

Day 8 | Top Industry Segments with Talent Shortage Challenges

On the eighth day, we’re focusing on which roles are being impacted by the talent shortage.

Our theme for 2022 was “It’s Not a Talent War, It’s a New Reality.” We all know the digital talent shortage has been a challenge for quite some time. What is different now is the widespread nature of the challenge. The IT talent shortage still leads the pack, with 42% of respondents indicating a highly challenging environment. You can look across the entire spectrum of roles and see that right at a quarter of companies are reporting that the hiring environment for nearly all their roles is highly challenging.

Let’s net this down, we have optimistic business expectations, big hiring plans, and declining population demographics bringing a perfect storm for a big swing in the balance of power between employees and employers. Stay tuned for the big reveal later in the week when we show you how much it will impact your budgets in 2022.

Day 7 | Top Geographies with Talent Challenge Shortages

On the seventh day, we’re taking a geographic perspective on the global talent challenge.

One topic that we wanted to get a clear picture of was the geographic scope of the talent challenge. We asked, “was it limited to one region or more widespread?” The answer was clear; the ability to hire was highly challenging in three key geographies. North America led the pack with just under half, followed very closely by Western Europe. You might think India would be packed with new talent coming into the workforce, and while that might be true, the demand is still overwhelming supply, with 39% of respondents indicating that it is a highly challenging environment for hiring.

Were there any regions where hiring was easier to do? The three “less challenging” regions were Latin America, the Middle East/Africa, and the rest of APAC (China, Philippines, and Malaysia). It might be a good time to check out these locations for your next recruiting drive.

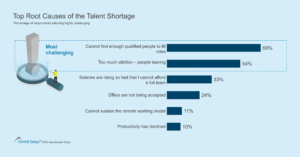

Day 6 | Top Root Causes of the Talent Shortage

On the sixth day, we’re focusing on the root cause of how the talent shortage is manifesting itself.

There is very little controversy that the talent shortage is the 2022 business challenge. But how is it manifesting itself in terms of day-to-day operations?

Just over two-thirds of the study participants said it comes to a simple supply issue; they cannot find enough qualified people to fill the open roles.

Then, just over half of the participants expressed concern about too much attrition as the second root cause of the shortage.

And finally, just over a third said the other aspect of the shortage is the inflationary nature of salaries rising so fast they can’t afford to staff a full team.

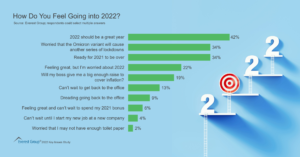

Day 5 | How Do You Feel Going into 2022

On the fifth day, we’re focusing on how individuals are “feeling” about 2022.

Today we focus on a softer set of statistics related to new year business planning. We asked participants from the webinar “how they felt” about going into 2022. The top answer was optimistic, with 42% of the audience thinking that “2022 should be a great year.” But we know to be precautious after the twists and turns of COVID over the past two years. The second-place answer at 34% was that they were “worried that the Omicron variant will cause another series of lockdowns” (also tied with “ready for 2021 to be over”).

Net-net, you could call that optimism with a cautious tone. On the bright side, only 2% of you are worried about toilet paper shortages…. but let me express a bit more caution. My weekend trip to the big-box retailer (Target) showed a paper aisle that was virtually wiped out…I know my stash is plentiful, is yours?

Day 4 | Talent Shortage Is Complicated ... and Not Going Away Any Time Soon

On the fourth day, we’re focusing on the key business challenges for our industry.

Adapting to new business models has been the key business challenge for our industry for the past two years. But it has slipped to number three on the list as companies come to grips with the talent shortage and rising prices/costs.

The talent shortage is not a new thing. Our industry has been lamenting about the lack of talent in IT and key digital roles for quite some time. But as you saw earlier in the week, the macro trends are going to create ongoing pressure for our industry for many years to come.

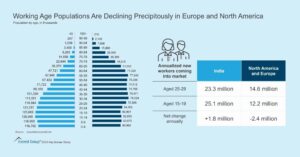

Day 3 | Working Age Populations Are Declining Precipitously in Europe and North America

On the third day, we’re showcasing how absolute demographics are the heart of the challenge that will be with us for decades.

The talent shortage has become the number one business constraint, and companies are intent on expanding their staff by the most in years (7.4%).

But having a plan to hire is not the same as the ability to hire. And that challenge is going to become increasingly difficult if you look at the population demographics that are staring us in the face. The retiring of the baby boomers has been well anticipated, but what hasn’t been discussed as much is the substantial slowing of new workers that are about to enter the workplace. In the graphic, we show how significant that number is, with 2.4 new million fewer workers annually across Europe and North America.

Day 2 | Leaders Are Bullish About Headcount Growth Going into 2022

On the second day, we’re exploring sentiments about anticipated headcount growth.

A measure of growth is to ask people how fast they will grow their headcount in the upcoming year. Companies only hire when they are confident about future revenue growth prospects. We have been asking this question now for the past three years. Going into 2020, before COVID, the average expectation was for just over 5% net growth. Right in the middle of the COVID spike at the beginning of 2021, we saw that drop to less than 3%.

Going into 2022, companies are the most optimistic they have been in the past three years, with a growth of more than 7% overall. That translates into a 10% expectation of a greater than 10% revenue growth depending on your industry.

Day 1 | Top Business Constraints Going into 2022

Day 1 of our Insights is top business constraints going into 2022.

If you have been following some of our “real-time” data over the recent quarters, you won’t be surprised to see “talent” at the very top of the list.

In a typical year, you would expect clients to say, “Hey, I wish it was easier to get more customers,” and yes, it was there at the number three spot. But right now, the fundamentals of logistics and getting enough raw materials occupy the number two and four spots (and that says something in an increasingly more services-based economy).