The Era of “Industrialization of Experience” Is Heralding the Metaverse and Web 3.0 Revolution: Are You Embracing It?

The advent of Web 3.0 is creating exciting new opportunities for Banking, Financial Services, and Insurance (BFSI) firms who invest in digital technologies to deliver next-generation customer engagement and enter the metaverse. To learn more about enterprises taking the lead in piloting metaverse and Web 3.0, read on.

With Web 2.0 laying the foundation for unique customer interactions, BFSI firms are increasingly adopting an omnichannel approach as industry trends indicate consumer mindshare often translates into wallet share. Driven by consumer demand for newer experiences as well as the limited potential for further innovation in Web 2.0, industry leaders are looking at Web 3.0 as the future.

Let’s explore how Web 3.0 is enabling firms to evolve from customer interactions to engaging customer experiences in a connected ecosystem.

Defining Web 3.0 and metaverse

Web 3.0 is the next phase of web hyperscale systems built on decentralized, autonomous, and distributed technologies. It enables decentralized protocols and technology stacks that can be used to build new communities and economies such as metaverse.

Movement over the past seven years toward Web 3.0 stalled because of the lack of superior computing power availability and supporting systems to drive sustained momentum. Now, with changing consumer behavior following the pandemic, the rush toward digitalization has taken off.

The need to build differentiated experiences backed by the rapid maturity of cloud-based processes and overall sophistication of systems supporting the digital agenda are healthy signs for the next wave of innovation based on Web 3.0 – metaverse.

Metaverse is a persistent immersive mega virtual smart space, akin to a universe, where people have seamless digital experiences that can extend to the real world.

Metaverse creates a virtual community that can provide immersive client experiences, collaborations, and employee trainings. To meet this demand, technology and services providers need to invest in next-generation technologies such as cloud, Artificial Intelligence (AI), and blockchain to extract the best out of Web 3.0.

Today’s metaverse is focused on allowing users to build a digital imitation of the physical world, leverage mixed reality devices to engage in various activities, conduct commercial transactions using digital assets, and drive collaboration and engagement through virtual events.

Web 3.0 and metaverse will enable next-generation experiences and alter economic and business models. Excitement about the potential significantly outweighs concerns.

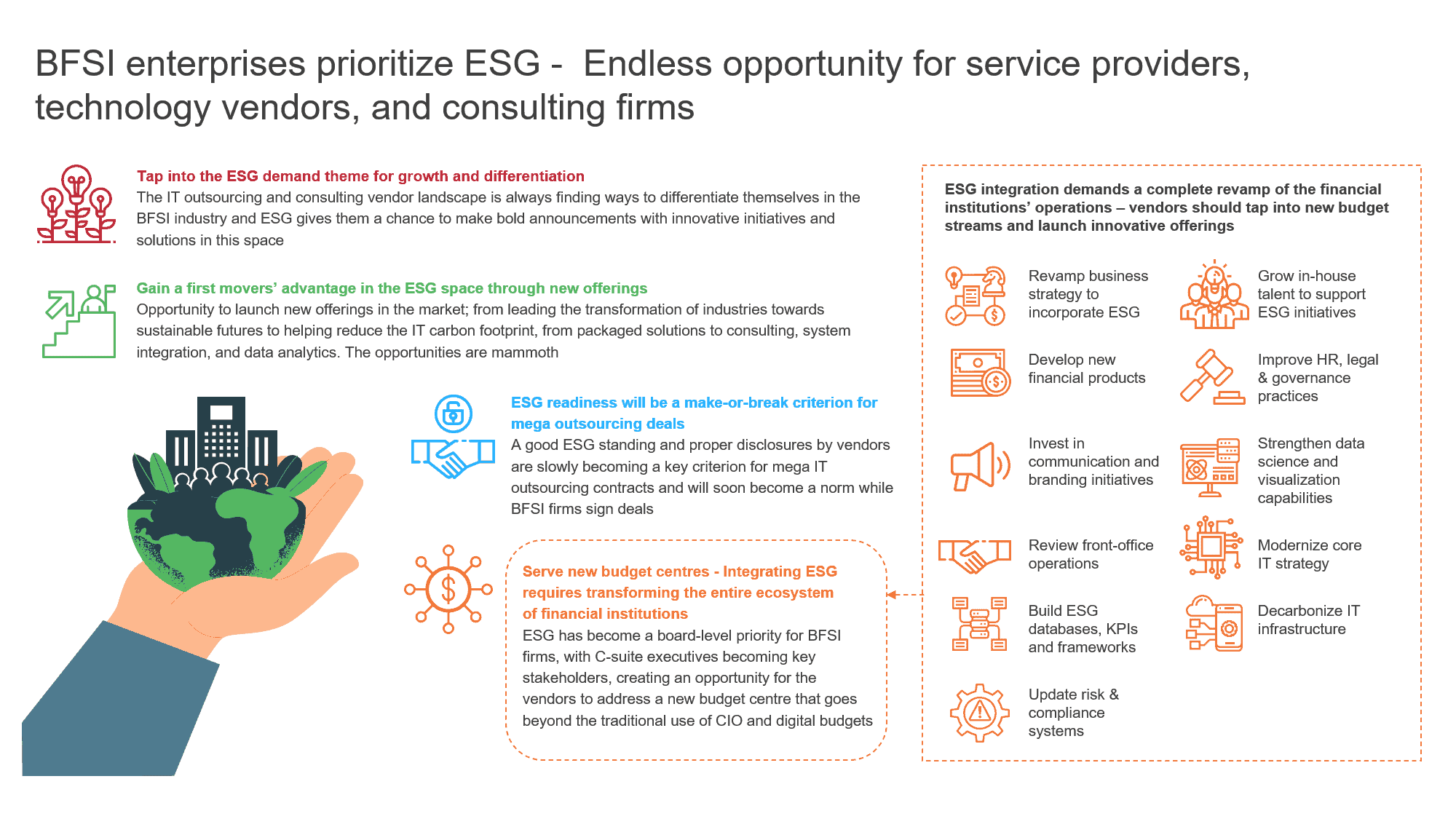

Exhibit 1: Everest Group

Pioneers piloting Web 3.0

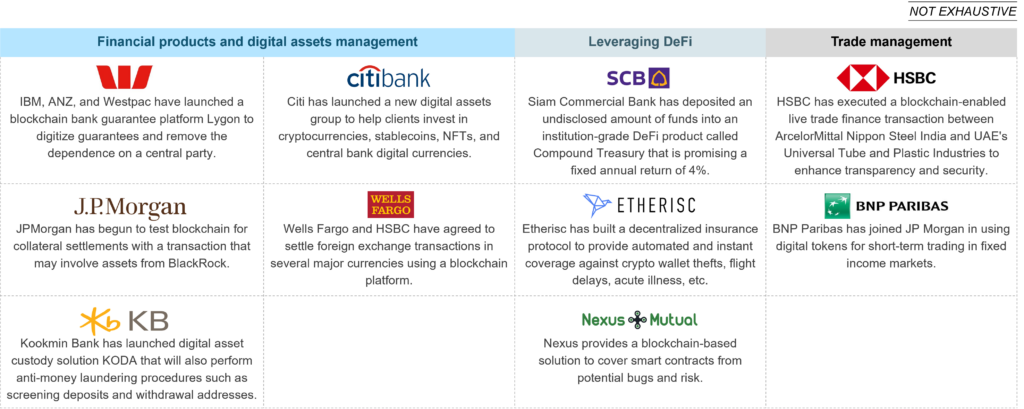

Leading financial services players have started piloting Web 3.0 concepts and experimenting with metaverse to test the market response. We believe this marks the start of an evolutionary change that will undergo multiple refinements rather than be revolutionary.

Exhibit 2: Everest Group

Most use cases we see are capitalizing on the following modular demand themes:

Banking:

- Financial products and asset classes in the metaverse

- Customer management through immersive technologies

- Virtual branch inception

- Affiliates and partnerships in the digital world

Financial services:

- Portfolio management and client enablement

- Front, middle, and back-office efficiency

- Trade lifecycle management in the metaverse

- Digital asset custody services

- Decentralized brokerage systems

Insurance:

- Decentralized insurance services

- Risk profiling

- Claim processing

- Restructured underwriting services

Where is the market moving with regulations?

Despite the recent efforts, policymakers still need to be convinced to embrace the new possibilities of Web 3.0 to make it real for banking consumers and investors. Web 3.0 and allied technologies, such as metaverse, require a novel approach to regulatory thinking. Many governing bodies grapple with the nuances around Web 3.0 and the challenges it manifests. Governance and interoperability are critical elements to successfully scale Web 3.0 and metaverse.

Addressing these three regulatory areas can kickstart the formal growth of Web 3.0:

- Investor protection – With blockchain-based transactions picking up pace, preventing fraudulent actions and safeguarding investors’ interests has become a priority for organizations such as the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC)

- Privacy and disclosures – The intricacies around the nature and type of disclosures and the effect these may have on individual privacy could have serious implications as this technology gains momentum

- Jurisdictional concerns – The key concerns around decentralized internet are around control, individual laws applied, and interpretations across different markets

The new computing possibilities of Web 3.0 has the potential to dynamically impact the BFSI industry structure. Data decentralization and democratization can bring investment opportunities to enterprises as well as IT providers. To seize this potential, technology and services providers must invest in cloud, AI, and blockchain to realize the many benefits Web 3.0 can deliver.

At Everest Group, we are closely tracking the developments in BFSI based on metaverse – both from the demand and supply side. For more insights, see our report, Future of Financial Services – Web 3.0, Metaverse, and Decentralized Finance, which sheds light on the future of financial services in the Web 3.0 and metaverse era.

We would like to hear your thoughts on Web 3.0 and metaverse and its growing adoption in the BFSI industry. Please reach out to us with your inputs at [email protected], or [email protected].

Listen to our experts as they deliver their perspectives on Web 3.0 and Metaverse and provide actionable insights to enterprises, service providers, and technology vendors in our webinar, Web 3.0 and Metaverse: Implications for Sourcing and Technology Leaders.