Blog

Metaverse: Opportunities and Key Success Factors for Technology Services Providers

While the metaverse may seem way out there, the opportunities for technology service providers in this next evolution are very real. While sci-fi movies such as Ready Player One introduced this concept of an interactive virtual reality (VR) world, leading technology giants including Facebook, Nvidia, and Microsoft are investing in this future. What will it take for tech service companies to seize a stake in this alternative universe that could be coming very soon? To learn more about the five factors providers will need to succeed in the metaverse, read on.

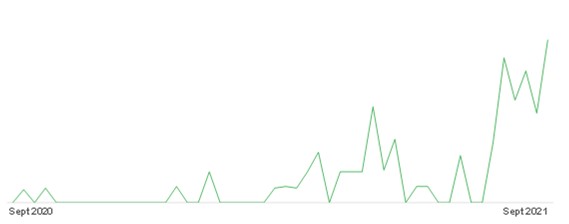

With digital technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and the cloud, buildings and other physical locations have become “smart spaces,” as we recently wrote about in this Viewpoint. The metaverse – a confluence where people live a seamless life across the real and virtual universe – can be thought of as the “mega smart space.” Google trends analysis of the word “metaverse” below suggests a growing interest in it.

As the underlying powerhouse running the metaverse, the internet is expected to evolve to this next-generation model. Driven by the growing acceptance of virtual models as a standard way of living during the pandemic, many evangelists believe the metaverse may become a reality sooner than expected.

News such as a Gucci virtual bag selling for more than its physical value is grabbing attention. Virtual avatars are already attending corporate meetings and large audience forums with real people. The physical motion of body parts is being replicated in the digital world and vice versa, as witnessed at the recent SIGGRAPH 2021 conference. Even if we discount the hyperbole of vendors, there is merit in evaluating what this means for the technology services industry.

Opportunities to build a new world

Interestingly, the metaverse has no standard building blocks. Since it’s a parallel universe, things that exist in the real world are imitated. Therefore, blockchain-driven non-fungible tokens (NFTs) and payments, computing power to run the universe, connectivity through 5G and edge, cyber security, interactive applications, Augmented Reality (AR) and VR, digital twins, and 3D/4D models of the real world all become important. Of course, integrating these seamlessly with enterprise technology will be a demand to cater to.

The entire metaverse is based on technology. And with more technology spend comes more technology services spend. Although some of these enabling technologies, such as AR/VR, are still in their infancy, but technology vendors are accelerating their development, which will only help technology service providers.

Five factors needed for tech service providers to succeed in the metaverse

- Innovative client engagement: Gaming companies may end up taking a lead in this area given their inherent capabilities to build engaging life-like content. Unfortunately, few technology services work meaningfully with gaming companies. Vendors who can build product development competence for this set of clients will benefit from the metaverse. Service providers also will need to scale their existing engagements with BigTech and other technology vendors. The current work focused on maintaining their products or providing end-of-life support must change. Service providers will need to engage technology vendors upstream in ideating and designing products and not only developing and supporting them. The traditional client base in segments such as Banking, Financial Services, and Insurance (BFSI), retail, manufacturing, and travel will continue to be important. These industries will build their version of the metaverse for consumers for specific business use cases or participate in/rent out others. Technology service providers will need access to business owner spend in these organizations. Other industries such as education, which do not currently provide large technology service opportunities, may also take the lead in the metaverse adoption. The takeaway is service providers will need to expand their client coverage and rely less on their traditional client base

- Capabilities to work with “unknown” partners: Most service providers have a very long list of 200-300 technology partners they work with. However, they usually prioritize five or six as strategic partners who influence 70-80% of their channel revenue. This will need to change for the metaverse. With its complexity, the metaverse will require service providers to not only work with other peers but also innumerable smaller companies. Niche partners could be manufacturing smart glasses, tracking technologies, or virtual interfaces, etc. Building viable Go-to-Market (GTM) and technical capabilities will be critical

- Product envisioning and user experience capabilities: While many service providers now have interactive businesses, their predominant revenue comes from building mobile apps, next-gen websites, or commerce platforms. Most have very limited true interactive or product envisioning capabilities. The metaverse will reduce the inherent need for “screens,” and the experience will be seamless. Most enterprises rely on specialist providers to brainstorm with and push their thinking to envision newer products. Other service providers are still catching up and are bucketed as “technical partners.” Envisioning capabilities will become critical. Therefore, service providers who are yet to get to even product design opportunities have a big road to traverse. Although these technology service providers can continue to focus on the downstream work of core technology, they will soon be sidelined and become irrelevant

- Infinite platform competence: The metaverse will need service providers to closely work with cloud, edge, 5G, carriers, and other vendors. However, the boundless infrastructure and platform capabilities needed will change. Service providers have already tasted success in cloud. However, the metaverse infrastructure will stress their capabilities to envision, design, and operate limitless infrastructure platforms. Their tools, operating processes, partners, and talent model will completely transform

- Monetization model: Service providers will need to bring and build innovative commercial models for their clients to monetize the metaverse. Much like the internet, no one will own the metaverse. However, every company will try to be its guardian to maximize their business. Service providers will need to understand the deep working of the metaverse and advise clients on potential monetization. To do this, they will not only need traditional capabilities such as consulting and industry knowledge but also breakthrough thinking around potential revenue streams. For example, a bank or telecom company will want its metaverse to influence growth and not just become one more channel of customer experience

Who will take the lead?

Without adding to the ongoing debate on the metaverse and its social impact, it is safe to assume that it can create significant opportunities for technology service providers that will continue to grow as this nascent concept evolves further. These service providers already have many technical building blocks that will be needed to succeed.

However, given the metaverse conversations are not even at infancy in their client landscape, service providers are not proactively thinking along this dimension. Since the metaverse will initially be dominated by technology vendors, who outsource a lot less than their enterprise counterparts, service providers will struggle unless they proactively strategize, and their traditional client base will need a significant push to think along these lines to create opportunities.

Currently, this all may appear too farfetched or futuristic. Indeed, there are too many “unknown unknowns.” Unlike technology vendors, technology service providers do not proactively invest until they size up the market opportunity. However, as enterprise-class technology vendors such as Microsoft launch offerings like Mesh, it is quite apparent that the metaverse, in some shape or form, will become enterprise-ready sooner than we expect.

What has your experience been with metaverse-related opportunities? Please share your thoughts with me at [email protected].