Blog

Inside the United Kingdom’s CXM M&A Activities: What It Means for the Future of CXM

Mergers and Acquisitions (M&As) in the Customer Experience Management (CXM) industry have long been a key trend across the globe. This year, the United Kingdom in particular has attracted multiple CXM providers, in order to make acquisitions, and propel their growth journeys.

Let’s explore what this means for other service providers, enterprises, and broader market.

Reach out to discuss this topic in depth.

The CXM market in the Europe, Middle East and Africa (EMEA) region has been standing strong in the face of a difficult global macroeconomic environment, driven by the diverse economic landscape and accelerated digital transformation.

Within the EMEA region, the United Kingdom is the largest market for CXM outsourcing and has seen the rapid adoption of CXM technologies across verticals such as retail, Banking, Financial Services and Insurance (BFSI), and telecommunications, where competition is fierce, and customer expectations are constantly evolving.

The UK operates with a mature digital infrastructure and a strong culture of customer-centricity, which has given rise to several CX outsourcing firms in the country. The market’s willingness to embrace emerging technologies has also accelerated its growth, making the UK a prime target for global service providers looking to establish or expand their presence. This has, in turn, fueled mergers and acquisitions activity in the UK by CXM providers.

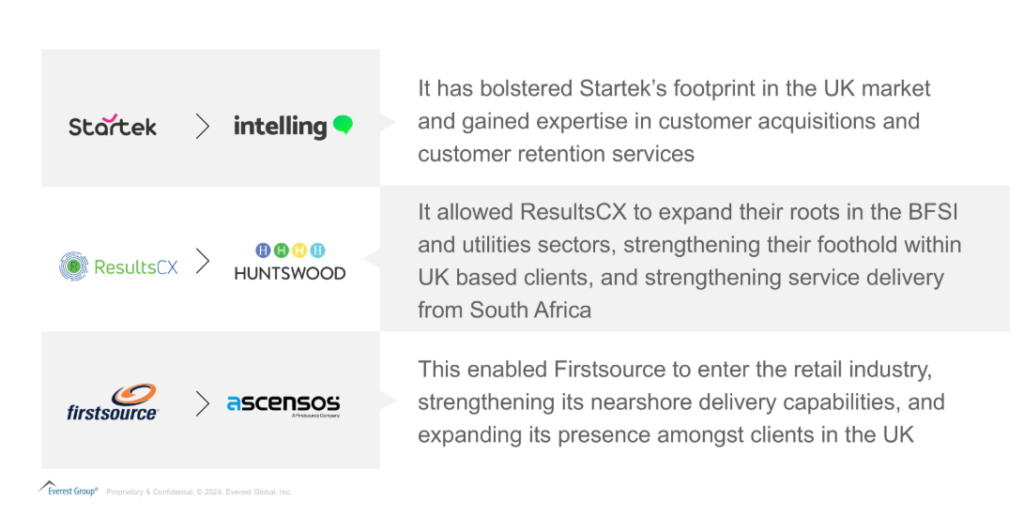

Some notable examples from this year include:

With the onset of these acquisitions, the UK is emerging as a focal point for M&As in the CXM space. We believe there are multiple factors at play which are driving CXM providers towards the UK market as discussed below:

- The UK is the second largest market for CXM services globally and many CXM providers view it as a strategic entry point into the larger European region. Many North American, Asia-Pacific (APAC), and even European Union (EU)-based CXM providers are using M&As to establish or strengthen their presence in the UK, positioning it as a central hub for both UK and broader European expansion in the future

- Brexit has brought specific regulatory changes and operational challenges in sectors such as financial services and retail, making customer experience more critical than ever, leading to more appetite from enterprises to partner with strategic providers. Due to this, the UK is seeing many more acquisitions of CXM providers, many of which that offer industry-specific expertise and compliance capabilities

- The UK has a unique CXM ecosystem characterized by many smaller providers that have carved out strong niches for themselves. These specialized firms have developed advanced capabilities in areas such as personalization, customer data analytics, and omnichannel customer experiences. Unlike many other countries in the region, where the market is still developing, the UK’s developed landscape of niche CXM providers creates a rich field for acquisition opportunities

- The UK has long embraced outsourcing and offshoring models, particularly in customer service functions. This makes the UK a mature market with established service delivery models, trusted outsourcing relationships, and a strong understanding of the business process outsourcing (BPO) industry. Additionally, many UK-based CXM providers have long-standing relationships with enterprises across Europe, which are valuable for outside firms looking to expand their own customer base or enter new markets from a client-perspective

What does this mean for the EMEA CXM market?

- For service providers:

The rise in M&A activity can lead to greater market consolidation across the region. As larger firms acquire smaller providers, it creates fewer but more powerful competitors with greater market shares. An aftermath of market consolidation is often a push towards the standardization of services and the introduction of innovative solutions in the market. This will further boom the digital CXM industry and accelerate the digital transformation efforts of the providers and enterprises. Service providers that are not taking action will find themselves at risk of falling behind. Hence, this will increase the competition and the number of strategic providers across the EMEA region

- For enterprises:

The biggest beneficiary of this wave of M&As within CXM’s will be the enterprises. Enterprises in the United Kingdom will have access to robust technology, a greater number of offerings, and more options to work with providers who can help in their growth and expansion. This will provide enterprises with access to more strategic providers, best practices from other global markets, innovative solutions, and competitive prices, due to fierce competition between the fewer providers.

The way forward

This wave of CXM M&A activity in the UK reflects a broader recognition of the country as a critical hub for innovation and scalability in CXM. With its unique mix of market maturity, digital talent, and established infrastructure, UK-based CXM providers have become highly attractive acquisition targets for global service providers.

As the global demand for digital CXM solutions continues to grow, the UK is positioned to remain a focal point for strategic investments. Companies seeking to enhance their customer engagement strategies or expand their geographical reach will continue to look to UK-based providers as valuable assets.

This trend signals a consolidation phase that is likely to reshape the global CXM ecosystem, making it crucial for service providers to stay agile and responsive to these dynamic changes. Moving forward, we can expect more cross-border acquisitions as providers aim to capitalize on the UK’s CXM expertise to deliver exceptional customer experiences.

If you found this blog interesting, check out our recent blog focusing on Bringing The Vision Of Unified Customer Experience (CX) To Fruition: Shining A Spotlight On Sprinklr | Blog – Everest Group, which delves deeper into another topic relating to CX.

If you have questions or want to discuss your M&A strategy, contact Chhandak Biswas [email protected], or Kartik Arora [email protected].

Additionally, enterprises looking to partner with a CXM outsourcing firms in EMEA or improve their understanding of the CXM outsourcing market can benefit from our recently published Customer Experience Management (CXM) Services PEAK Matrix® Assessment, which assesses service providers across the CXM services value chain.