Blog

Broadcom’s Acquisition of VMware Sparks Unprecedented Chaos in the Virtualization World

Broadcom’s staggering US$61 billionacquisition of VMware in January marked one of the largest technology deals ever. Broadcom’s reputation for radical cost-cutting and focus on short-term shareholder value following acquisitions has raised concerns about VMware’s future direction. Read on for recommendations for enterprises, service providers, and competitors to deal with the aftermath of the acquisition of VMware. Connect with us

to discuss this acquisition further.

Broadcom’s acquisition of VMware has ignited worries that Broadcom’s aggressive cost-slashing and financial optimization measures will harm VMware’s reputation as a trusted partner and hinder its ability to innovate.

Let’s look at Broadcom’s troubling past track record of taking over companies and then selling off non-core assets:

- Broadcom acquires CA Technologies: After Broadcom bought CA Technologies for US$18.9 billion in 2018, it sold the software company’s Veracode platform the following year for US $950 million and intermittently laid off CA Technologies employees. Moreover, CA Technologies’ mainframe business customers regularly expressed dissatisfaction post-acquisition, citing a lack of client focus, with many looking for a way out. Everest Group followed the acquisition of CA Technologies in detail in our blog, Broadcom, CA Technologies, and the Infrastructure Stack Collapse

- Broadcom buys Symantec’s enterprise software business: Following its purchase of Symantec’s enterprise software business for US$10.7 billion in 2019, Broadcom sold Symantec’s cybersecurity services business to Accenture and the enterprise consulting group to HCL Technologies in 2020

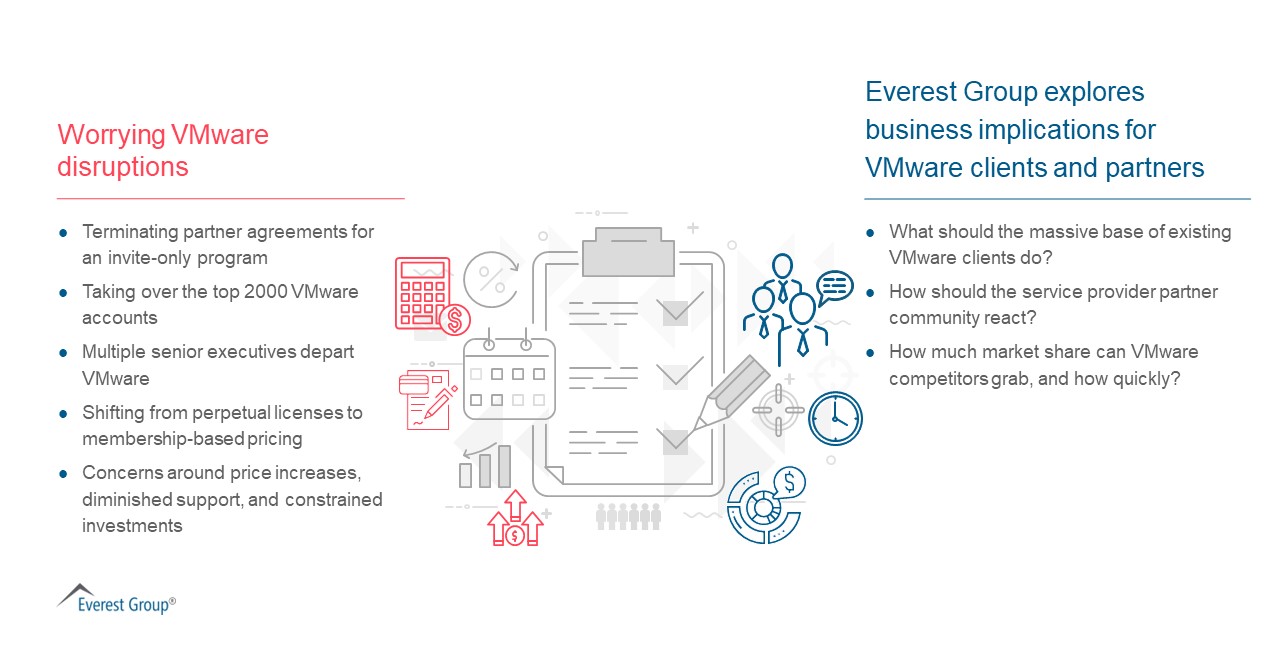

Broadcom might be treading a similar path with VMware. As its acquisition history suggests, Broadcom’s actions will likely be drastic and swift. Within only a month, Broadcom has already created worrying disruptions, posing serious concerns for VMware clients and partners as outlined below:

A brief history of VMware and Broadcom

Founded in 1998, VMware pioneered virtualization technology, allowing multiple virtual machines to run on a single server, eventually creating the multi-billion cloud market. Over the years, VMware grew its product offerings, such as vSphere, ESXi, and Workstation, to become a dominant cloud and infrastructure player. VMware created multiple software solutions for data center management, networking, security, and the digital workplace. The company has maintained a reputation for innovation, working closely with its service partners and creating a positive client experience.

Established in 1991, Broadcom initially specialized in developing semiconductors, focusing on communication and networking chips. The company expanded over the years into many other areas, including security, infrastructure storage and management, and industrial solutions. In recent years, Broadcom consolidated its portfolio and now reports revenue in two areas – semiconductor solutions and infrastructure software. Broadcom is known for its aggressive acquisition strategy and focus on financial returns, often raising concerns about its commitment to product innovation and long-term support.

VMware and Broadcom merger leaves enterprise CIOs flummoxed

Since its launch over a decade ago, VMware has held massive dominance in cloud computing, with nearly all enterprises licensing its virtualization technology. Its slowdown started when the giant hyperscalers, such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform, developed public cloud offerings with multiple advantages beyond VMware’s in private cloud settings.

However, most enterprises eventually realized that both public and private clouds had their advantages and drawbacks and settled for a hybrid environment to leverage the strengths of each cloud type.

- Enterprise recommendations

CIOs who had settled on hybrid cloud strategies have been left with pressing questions by Broadcom’s acquisition of VMware. They must decide whether to stay with VMware, immediately look for alternatives, or wait and watch what peers do. This also allows organizations to reevaluate service providers’ innovative problem-solving abilities or rebalance hybrid cloud portfolios.

While the answers to these critical questions will depend on their specific situations, all enterprises should take the following steps:

-

- Reexamine the hybrid cloud portfolio mix – Most enterprises today have an ineffective blend of workloads on public and private clouds, leading to low-value realization. Enterprises should first reevaluate workloads and create a strategic migration and modernization plan

- Assess the Virtual Desktop Infrastructure (VDI) need – VMware and Citrix have been the leading VDI vendors despite the technology’s performance challenges. Fortunately, managing the VMware disruption in the VDI space should be relatively straightforward given the low penetration of VDIs among employees and a flurry of VDI-as-a-service offerings from BigTechs such as Azure Virtual Desktop, AWS WorkSpaces, Citrix DaaS, and specialist players like Anunta, Dizzion, and Parallels

- Evaluate the implications of staying with or leaving VMware – While each organization should undertake a thorough cost-benefit-impact analysis, they should consider the following factors:

- Expect an increase in total cost of ownership (TOC): Broadcom’s move from perpetual licenses to membership-based pricing will likely result in higher TOC

- Consider the impact on customers engaged with Dell: Organizations engaged with Dell as the VMware reseller will see an even higher price impact since Broadcom eliminated Dell’s preferred pricing with VMware

- Recognize the cost of change: Most enterprises have been using VMware software for a long time. Shifting away will require a significant transformation with upfront investment, talent management, and business continuity planning

- Engage actively with service provider partners – Most enterprises have adopted VMware solutions through third-party service providers. Clients should accept their help to understand the alternatives, advantages, limitations, and integration risks and engage them to create innovative options.

- Service provider recommendations

Service providers play a critical role as the conduit between technology providers and enterprises in helping provide guidance and the next steps to navigate this uncertainty.

While service provider partners are also grappling with sudden, unexpected terminations of partner agreements with VMware, they must act quickly to determine the best step for their enterprise customers. Delaying and watching is not an option, and we recommend the following actions:

-

- Understand and evaluate all alternatives – A thorough understanding of all available alternatives to VMware is the first step to retaining credibility with enterprises. Nutanix, Microsoft, Citrix, Scale Computing, and ComputerVault are options for virtualization, while Microsoft Azure virtual desktop, Amazon workspaces, and Citrix workspace are contenders for VDI. Not to be forgotten, hyperscalers, including AWS, Azure, GCP, Oracle, and IBM, also offer virtual private cloud and full-stack solutions

- Refine and accelerate hybrid cloud go-to-market – Every cloud has a silver lining, and the VMware uncertainty has created an opportunity to add new energy to a stabilized cloud go-to-market and messaging. Many enterprises claim a lack of service provider cloud innovation over the last two or three years, and this is an opportunity to start new conversations and deepen relationships

- Push Desktop-as-a-Service (DaaS) offerings – DaaS or VDI-as-a-service offerings have been available from vendors, including hyperscalers, BigTechs, service providers, and specialists, but haven’t taken off. Despite the many DaaS benefits, enterprises have shown interest spikes but lacked an external stimulus to kickstart large-scale transition. The VMware frenzy could be a catalyst for the transition to DaaS

- Collaborate with Broadcom without biases – The sudden and shocking actions by Broadcom have led to many preconceived negative perceptions. However, service providers should be open to what Broadcom will offer as it aims to set a level playing field for VMware’s partners. Keeping an open mind will allow providers to leap ahead of their peers on VMware partner status. VMware’s huge client base cannot be ignored despite the current upheaval

- Competitor recommendations

Since VMware has shown its belly to competition, it’s now a mad rush. VMware’s competitors have a rare opportunity to grab its clients, potentially giving them considerable future revenue. Competitors understand this and have launched a scathing attack on VMware through email and social media campaigns, as well as direct outreach. While the desire to capture a larger market share is understandable, competitors should take a more balanced and pointed approach for higher conversion rates. We recommend the following strategies:

-

- Create a structured attacker strategy – Going after as many clients as possible might sound attractive but is most likely inefficient. Identify a long list of accounts to target, prioritize them based on relevance, and create dedicated teams with established Objectives and Key Results (OKRs) and Key Performance Indicators (KPIs)

- Build deeper account intelligence to win more clients – Winning new clients requires a more nuanced approach beyond the marketing tactics to connect with distressed clients initially. Understanding the specific context of each potential client, including pain points, decision-making stakeholders, existing software, integration challenges, etc., can significantly increase deal conversion rates

- Maximize channel partner leverage – Develop joint attacker strategies in collaboration with service providers who often understand clients’ needs better. Aggressively expand partnerships with service providers

We will continue to follow this space and watch how Broadcom’s acquisition of VMware unfolds. If you would like to discuss this further, reach out to [email protected] or [email protected].

Catch our upcoming webinar, Engineering Services in 2024: The Market Outlook and Commercial Trends, for insights into the pricing outlook, commercial dynamics, market attractiveness, and evolving buyer expectations for engineering services.