Blog

The Rise of Retail Investors in Global Capital Markets

Retail investors are here to stay. As global capital markets face macroeconomic headwinds and a liquidity crunch, retail investors are gaining volume in traditional equity and debt markets as well as emerging alternate investments. Read on to understand the new global capital market trends, the staying power of retail investors, and the impact on investment banks, asset and wealth managers, and service providers.

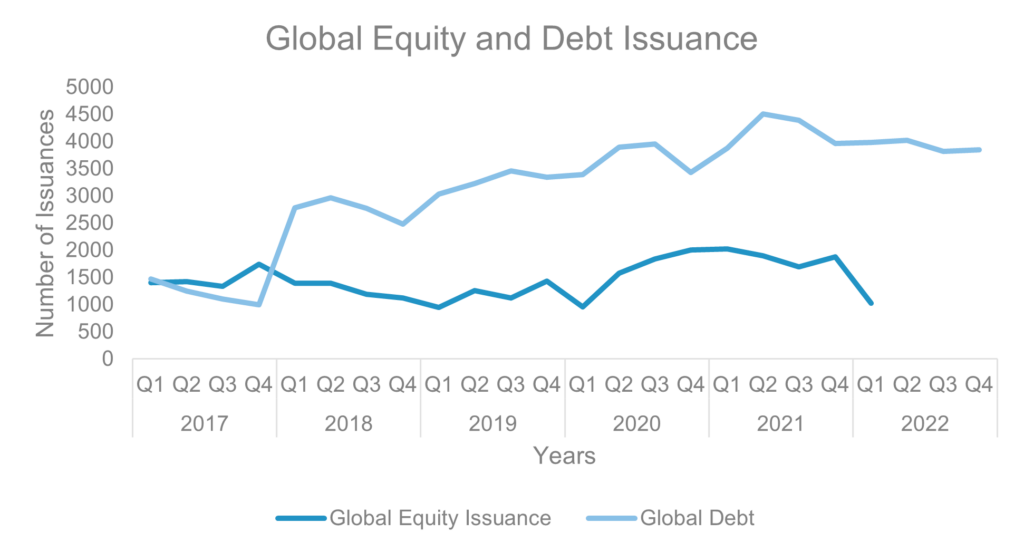

Watching global capital markets over the past few years has been a rollercoaster ride of issuances and investments. Concerns of market volatility and issuances softening started way before the recent collapse of global banking giants, Silicon Valley Bank (SVB) and Credit Suisse. As illustrated below, overall global equity issuance was stagnant from 2017-2019, while global debt issuance has been steadily rising since 2017.

Driven by the pandemic, total equity issuance increased significantly starting in the third quarter of 2020 and remained high until the fourth quarter of 2021, resulting from regulatory support, major rate cuts, and gradual liquidity pumped into the markets by governments across the world.

Similarly, global debts in capital markets witnessed a significant increase in borrowing levels from the first to the third quarters of 2020. Interest rates across the globe reached historic lows during 2020 and remained down in 2021, leading to continued low borrowing costs for activities such as refinancing existing debt or financing mergers and acquisitions.

After the booms in 2020 and 2021, equity and debt issuance slowed in 2022 due to various macro-economic headwinds that resulted in volatile and low-growth capital markets.

The current market volatility has been impacted by the following factors:

- Tightened money supply

- Aggressive interest rate hikes

- Inflationary pressures

- Heightened geopolitical risks that triggered supply chain issues; Russia’s invasion of Ukraine has resulted in higher global costs for energy, minerals, and grains

- Tensions between the US and China and regulatory pressures

Rise of retail investors

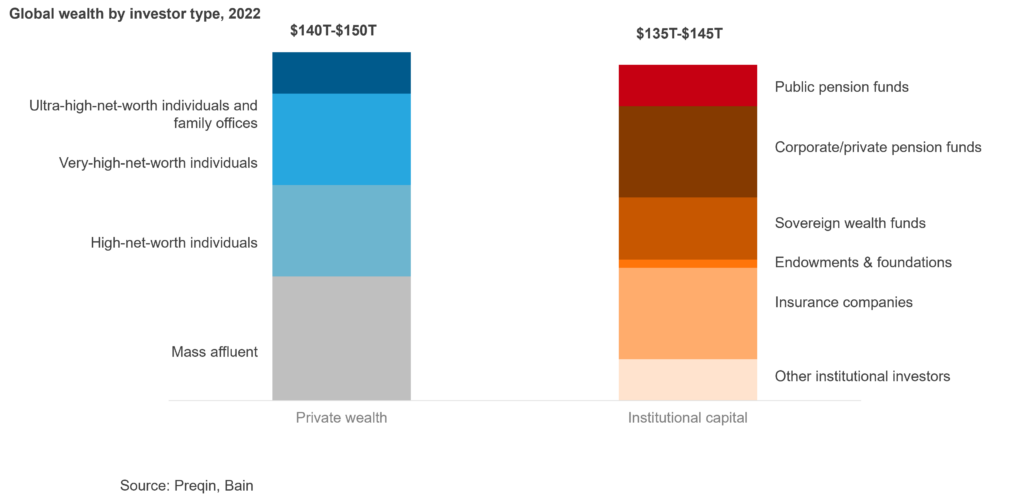

Despite the ups and downs in global capital markets through the recurring macroeconomic headwinds, the growth of retail investors reshaped investing trends starting in early 2020 and by 2022, individual investors held roughly half of all global wealth.

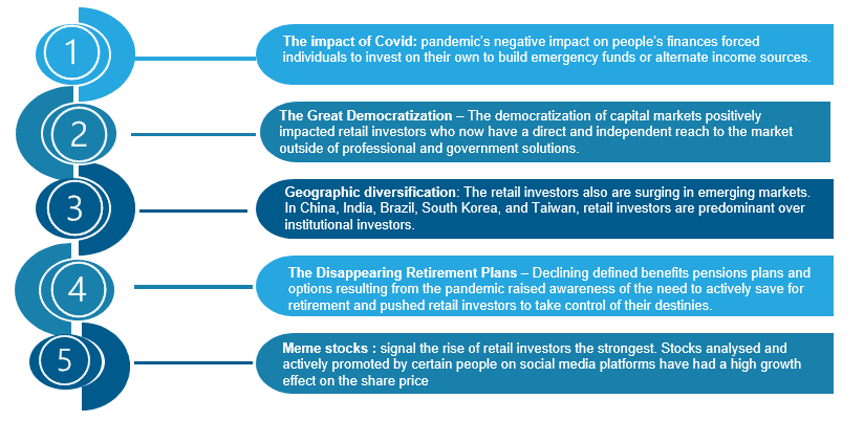

The strength of retail investors has been fueled by both demand and supply side factors. The exhibit below shows the contributing demand-side factors that include:

Drivers for expanded retail volumes

Now let’s explore the various supply-side drivers for the increased participation of retail investors:

- Growth of blockchain technology-backed assets – Retail investors have had a huge influence on the performance of cryptocurrencies, non-fungible tokens (NFTs), and other similar assets/stocks

- New retail investment platforms – Newly available stock trading, investment platforms, and apps that provide better customer experience and real-time information to investors at a low commission/brokerage or subscription model have grown

- Innovative debt, equity, and other assets investment offerings – As the market matures, banks and fund managers are delivering innovative and customized offerings, bridging the gap between retail investors and the ticket size. Concepts such as fractional investments and ownerships have highly encouraged and facilitated market entry for retail investors with smaller trades. These fractional investments can cross investment classes, such as real estate investment trusts (REITs). These tokenized options to invest in real estate allow retail investors to gain returns from fractional investments in real estate that otherwise require huge investments with low liquidity

- New equity investment options – Similarly, investing in private companies that are not yet listed through debt instruments, invoice discounting, or sale of shares in private markets have drawn retail investors’ attention to realize high returns that are less impacted by volatility compared to stocks

- Central Bank Digital Currency (CBDC) – The introduction of a digital currency issued by a central bank is expected to especially appeal to cash-rich yet risk-averse retail investors

- Alternative investment funds – Private investment funds such as private equity firms and hedge funds that historically catered to institutional investors are now increasingly looking to tap wealthy individuals. According to reports, individual wealth invested in alternatives will grow more than institutional capital allocated in the next decade

As retail investors increase their volume and market participation, enterprises are rapidly scaling operations to support demand from growing retail investors as well as institutional investors.

Enterprises also are building capabilities across the traditional equity-debt markets and exploring building alternative investment offerings such as gold commodities, invoice discounting, crypto, and NFTs. To enable this, enterprises require support for back-end operations and to manage declining margins.

What does it mean for Business Process Services (BPS) on the sell side:

Amid the global rise in interest rates and capital markets volatility, investment banks have begun to feel margin and cost pressure. The subdued demand was visible in the quarterly earnings results of some major investment banks. In the fourth quarter of 2022, Morgan Stanley reported a 49% drop in its investment banking business compared to the prior year, Goldman Sachs registered a 48% plunge, and Citi Group witnessed a 58% decrease, among others.

The margin strain trickled down to operational cost pressure that led to job cuts in the investment banking division of all the big banks, including Barclays, Citi Group, Deutsche Bank, and Goldman Sachs.

The volatile environment is expected to drive the industry to look for support from service providers to stem costs and sustain business profitability in the following ways:

- Offshoring: Tier 2 and tier 3 banks that may feel more heat are expected to move more back-office and regulatory reporting operations to low-cost nearshore and offshore centers by partnering with BPS providers

- Accelerated shift to digitally-enabled operations: Banks are keeping IT investments restricted to core offerings and focusing on intelligent automation transformation, cloudification, and deploying machine-learning-based platforms, among other strategies

- Captive carve-outs: Banks scrambling with extreme cost pressures are expected to carve out their captives to service providers, giving them responsibility for operations and accountability for business risks

What does it mean for BPS on the buy-side:

Increasing demand for retail as well as private investments is driving many banks, fintechs, private equity firms, and hedge funds to make inroads or expand their existing asset and wealth management operations.

For instance, Morgan Stanley acquired E*TRADE in 2020 to strengthen its wealth management offerings, while JP Morgan bought digital wealth manager Nutmeg in 2021.

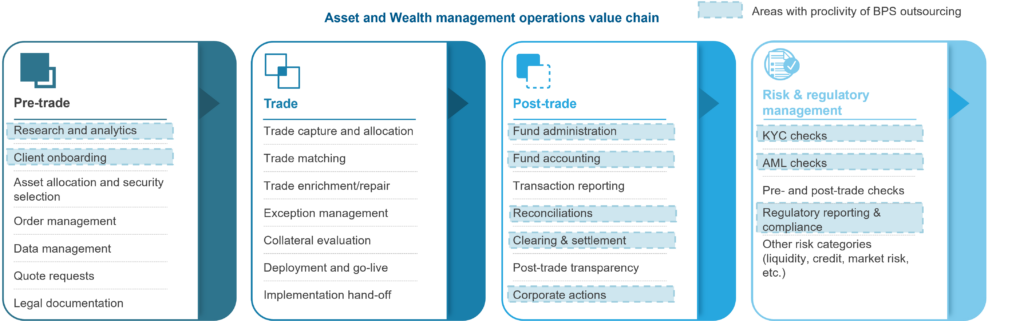

With enterprises scaling up and the regulatory environment changing, the need for low-cost and seamless operations is fuelling outsourcing spend in some of these key areas:

- Technology-enabled and data-enabled services for better user experience

- Asset servicing, such as fund administration and accounting

- Corporate actions

- Automated workflow for client onboarding, reconciliation, settlements, etc.

- Support for existing regulations as well as up-and-coming regulations on Environmental, Social, and Governance (ESG), and cryptocurrencies

- Increase in cyber security and data safety platforms and services

Changing yet challenging times

The fast-changing financial services landscape and the recent collapse of banking giants such as SVB and Credit Suisse are expected to influence investor sentiment as well as operating models and capital requirements of banking enterprises.

Watch this space for further updates on how the changing banking landscape opens additional risks and opportunities for service providers.

For more information on trends in global capital markets, reach out to the authors, Sakshi Maurya, Shrey Jain, Dheeraj Maken, and Suman Upardrasta. To learn more about BPS market trends, the competitive landscape, and our latest research findings, see Capital Markets Operations PEAK Matrix Assessment 2023.