In The Evolution Of Core Banking Technology: From Foundations To A New Horizon | Blog – Everest Group, we explored the three ages of core banking technology – the Iron, Silver, and Golden Ages. Each era marked a leap in capabilities, from the resilient but siloed systems of the Iron Age to the integrated, customer-centric innovations of the Silver Age. Today, we find ourselves in the Golden Age of core banking. This era is defined by modular, API-first architectures, SaaS delivery models, and cloud-native designs, all coming together to create a vibrant banking ecosystem.

Banks’ enterprise priorities are rapidly shifting toward agility, flexibility, and speed – with core platforms expected to be strategic enablers rather than operational bottlenecks. In response, leading providers have launched next-gen digital platforms such as CoreAdvance by Fiserv and Modern Banking Platform by FIS.

The current market environment presents an opening for new core providers. Many banks, having stretched aging core systems to their limits, are on the cusp of major core renewal decisions. Drivers such as rising customer expectations, fintech competition, regulatory pushes such as open banking, and cost pressures are all converging. Unlike a decade ago, banks today are more willing to consider cloud-based solutions.

Moreover, the Golden Age’s focus on ecosystem collaboration means banks are seeking partners rather than just vendors – they are open to working with fintechs and new age technology providers if it helps them leap forward. This confluence of factors makes it an ideal inflection point for disruptor platforms to enter and gain traction.

Reach out to discuss this more in depth.

Understanding the market opportunity

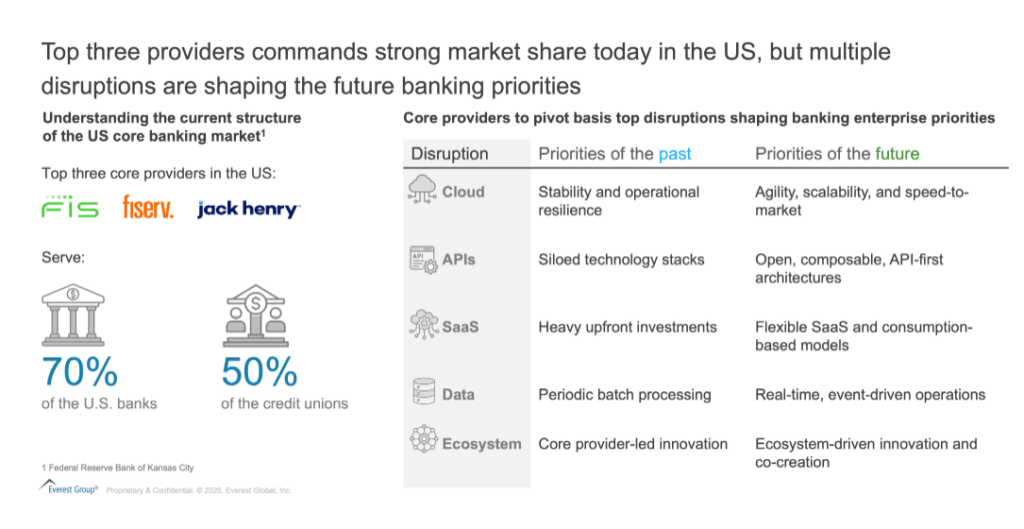

To appreciate the scale of the opportunity, consider the current structure of the U.S. core banking market:

- According to the Federal Reserve Bank of Kansas City, the top three core providers – Fiserv, FIS, and Jack Henry serve:

- About 70% of U.S. banks

- Nearly 50% of credit unions

- Fiserv alone supports over 40% of banks and 30% of credit unions, driven by platforms like Premier, Precision, and DNA

- Jack Henry supports about 20% of banks and 12% of credit unions, largely through Silverlake and CIF

This concentrated landscape highlights the scale of opportunity for disruption. As modernization becomes non-negotiable and banks reevaluate long-standing partnerships, new-age providers have the chance to carve out meaningful share by targeting whitespace segments and underserved regions.

The big opportunity in core banking modernization

Core banking is no longer a back-office agenda – it has become a strategic imperative for financial institutions globally. Rising customer expectations, demand for real-time services, regulatory shifts, and competitive pressures are collectively placing the core platform at the center of the transformation agenda.

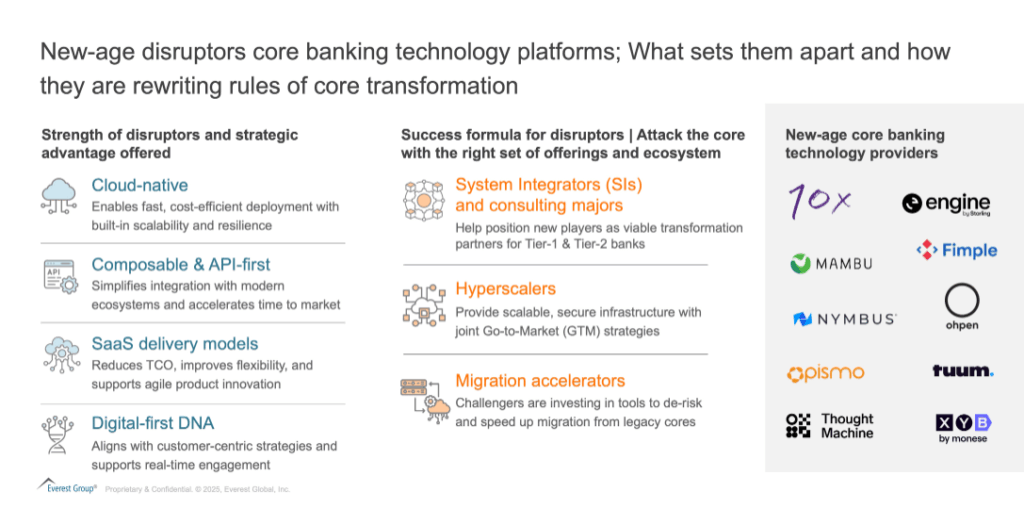

Traditional core banking providers now face a wave of next-gen providers that are rewriting the rules of transformation. These challengers leverage cloud-native, composable architectures to deliver faster deployments, easier integrations, and lower Total Cost of Ownership (TCO), forcing traditional providers to accelerate their own innovation.

Disruptors being born in the cloud and built with a digital-first mindset gives them agility that is difficult for older systems to match.

Incumbents are adapting – even by acquiring disruptors

It’s important to note that incumbent providers aren’t standing still during this shakeup. In fact, the legacy giants have been catching up by investing heavily in modernization and even acquiring next-gen core innovators. An example is Fiserv’s acquisition of Finxact in 2022 – a move that gave Fiserv a proven cloud-native core platform to augment its own offerings.

By “buying in” new capabilities, incumbents aim to neutralize the threat from disruptors and offer their clients a modernized path forward. In practice, incumbent firms are rolling out next-gen versions of their cores or brand-new cloud-based platforms (often the very ones they acquired) to ensure their install base doesn’t jump ship.

What it takes for core banking providers to succeed

To succeed in today’s fast-evolving core banking market, providers must reframe their approach. It is no longer just about platform capabilities — success hinges on how well providers align with enterprise priorities, reduce transformation risk, and enable long-term agility. Three core pillars will define market leadership:

- Ecosystem-backed execution:

Regardless of their market position, providers must establish strong implementation ecosystems. This means forging deep partnerships with System Integrators (SIs) and consulting. These alliances not only scale execution but also lend credibility, integration expertise, and joint go-to-market strength – especially important in risk-averse buying environments.

- Alliances with technology enablers:

Providers to collaborate with hyperscalers such as AWS, Azure, and GCP, Independent Software Vendors (ISVs), and data/process orchestration platforms. These alliances help deliver scalable infrastructure and accelerate innovation cycles.

- A differentiated “attacker playbook”:

Providers need to clearly define the ‘why‘ change narrative – tailored to segments such as credit unions, regional banks, or large institutions. This includes articulating a value proposition anchored in modular transformation, cost efficiency, regulatory alignment, and speed-to-market. Messaging should reflect real-world coexistence strategies, not theoretical full replacements.

- A robust solutions portfolio:

Winning providers will invest in migration accelerators, core-to-core toolkits, reference architectures, and compliance-ready frameworks. These assets help de-risk transformation and reduce the time, cost, and complexity for banks looking to modernize. Supporting multiple deployment models and delivering pre-integrated capabilities will be essential to compete at scale.

Not all disruptors will win the race

Given the intensifying competition, not every disruptor will come out on top. The disruptors that ultimately survive and thrive will be those that manage to check a few critical boxes:

- Proven deployments on a scale: Banks will trust platforms that have proven success at major institutions. Disruptors need to demonstrate that their core system can handle the scale, complexity, and regulatory demands of large bank environments – not just small fintechs or niche banks

- Sustainable business models: The long-term viability of the provider is a key concern for banks making a core decision. Disruptors must show they have a sustainable business model and financial stability – for example, a steady revenue stream or strong backing – so they can support a bank’s core for the long haul

- Ability to coexist with legacy cores: Contrary to the “rip-and-replace” approach, banks prefer a phased approach to core transformation. The winning platforms will be those that can work in tandem with existing legacy systems, enabling gradual migration or co-existence

What’s next: implications for the future of core banking

The core banking platform ecosystem is poised for significant change in this “golden” era. For disruptors, the mandate is clear: double down on partnerships, keep refining those migration playbooks, and aggressively convert pilot projects into full-scale successes. We can expect to see deeper alliances form – for instance, more joint offerings between new core providers and big consulting firms, or hyperscalers investing in fintechs. It’s also likely to witness further consolidation; some disruptors will merge or get snapped up by larger players as the market matures.

As this plays out, one thing is certain: core banking transformation has moved to the top of the agenda for the entire ecosystem. Banks are taking a 2030 view for their core banking estates. The coming years will likely redefine who the leading core platform providers are as innovation cycles shorten and collaboration increases.

For a closer look at the leading providers shaping the future of core banking technology, explore our Leading 50™ Core Banking Technology Providers 2024 report. Discover the rankings, market insights, and innovations driving transformation in the banking industry.

To learn more about core banking, contact Ronak Doshi, [email protected], Kriti Gupta, [email protected], Saumil Misra, [email protected], Laqshay Gupta, [email protected], and Ketan Kumar, [email protected].