Blog

The Evolution of Core Banking Technology: From Foundations to a New Horizon

The heart of the banking world lies in its core systems – with those unseen engines powering everything from simple transactions to intricate financial products. Over decades, core banking technology has undergone a remarkable evolution, transforming to meet the demands of an ever-changing world.

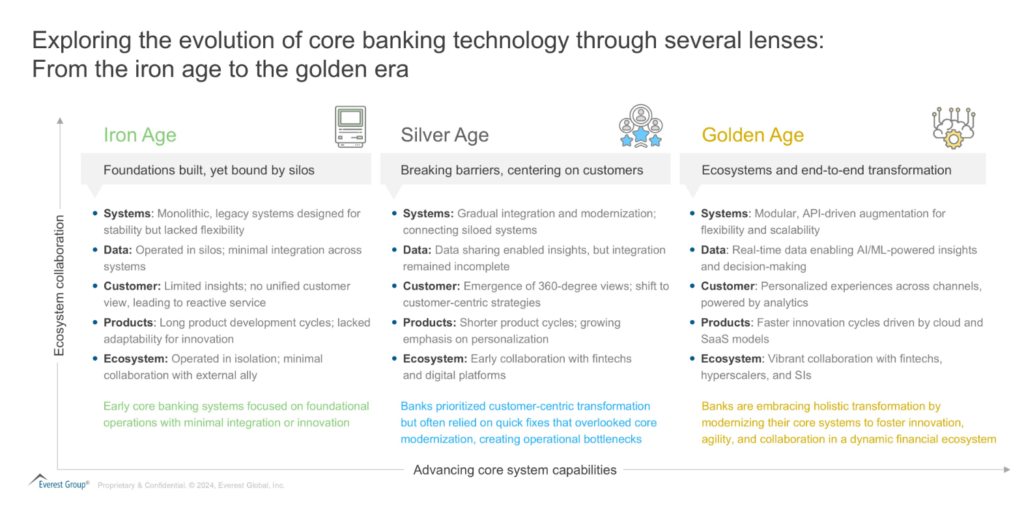

From its early, rigid foundations to today’s dynamic, customer-centric ecosystems, the journey of core banking can be charted across three distinct eras: the Iron Age, known for its resilient yet siloed systems; the Silver Age, defined by customer-centric breakthroughs and incremental integration; and the Golden Age, where holistic transformation and collaboration take center stage.

Each era not only reflects the technology of its time, but also the shifting priorities of the industry itself. Let’s explore these transformative ages and discover why today’s era is a defining chapter in the core banking technology space.

Reach out to discuss this topic in depth.

The driving forces behind core banking evolution

Banking is more than just numbers; it’s a vital part of people’s lives. Traditionally, it was built around physical branches, face-to-face interactions, and trust earned over decades. But as the digital revolution unfolded, customers began to expect more – services that were not just faster but also more personal, more intuitive, and always available. Suddenly, banking had to transform from being a place you visit to something you experience, no matter where you are.

At the same time, regulators demanded greater transparency, security, and accountability, while FinTechs burst onto the scene, redefining innovation and agility. Legacy systems, once the backbone of banking, began to feel like an anchor slowing the industry down. These forces – customer expectations, competition, and compliance – pushed banks to rethink their most foundational systems.

Iron age: resilient systems and operational silos

The journey of core banking technology began with what we can call the Iron Age. In this era, systems were robust but unyielding, built to last but not to change. These monolithic setups were designed for stability, managing essential operations like deposits and loans. However, they operated in silos, with little to no interaction between different parts of the system. Banks struggled with fragmented data that was hard to aggregate and analyze, leaving them without a cohesive view of their operations.

Customer service was reactive rather than proactive. If you walked into a branch, the bank might not even know about your last interaction at another branch. Product innovation was glacial, requiring years to launch a new offering. While these systems laid the foundation for modern banking, they were unprepared for the speed and complexity of the digital era.

Silver age: breaking down barriers and rise of customer-centric banking

With the advent of the Silver Age, banks began to chip away at the barriers of the past. The siloed systems of the Iron Age gave way to more integrated setups, where data began to talk to each other, albeit in halting whispers. The industry’s focus shifted from products to people, indicating a customer-centric revolution.

Banks began striving for a 360-degree view of their customers – knowing not just what accounts they held but understanding their preferences and needs. Digital channels became integral, allowing customers to bank from their phones or computers, no longer tied to physical branches. Product cycles shortened, and personalization emerged as the new standard.

Yet, this era wasn’t without missteps. Many banks pursued quick fixes: layering shiny new interfaces on top of legacy cores. These solutions impressed at first but disintegrated under the weight of growing demands. This era brought significant progress, but it was not without its share of challenges and lessons.

Golden age: ecosystem collaboration and core transformation

Today, we are living in what can only be described as the Golden Age of core banking technology. Unlike previous eras, this is not just about patching gaps or adding layers. It’s about reimagining the very core of banking systems to thrive in a world that demands agility, innovation, and resilience.

Why is this the Golden Age?

-

- Ecosystem collaboration: Banks are no longer working in isolation. System integrators, technology providers, FinTechs, and regulators are co-creating solutions that are greater than the sum of their parts

- Modular, application programming interface (API)-enabled systems: Banks are adopting modular and componentized core systems with API-driven architectures, allowing for flexibility, scalability, and seamless integration with third-party solutions

- Core augmentation: Surround services and process technologies are being built on top of core systems to enhance functionality, streamline workflows, and improve overall operational efficiency

- Cloud and SaaS models: The shift to cloud -native platforms and Software as a Service (SaaS) delivery models has enabled banks to scale operations, reduce costs, and innovate faster than ever before

- Next-gen technologies: Artificial intelligence (AI), Machine Learning (ML), Data and Analytics (D&A), and automation are no longer futuristic concepts but integral components of modern core systems, enhancing efficiency and customer experience alike

- Emergence of neo-cores: Over the last decade, core banking technology providers have introduced neo-core – streamlined, cloud-first systems designed with smaller functional footprints but enhanced integrability. These solutions prioritize APIs and connections, offering flexibility and agility to banks

- Regulatory alignment: Built-in compliance tools are making it easier for banks to navigate complex regulatory landscapes while ensuring security and trust .

This era is vibrant, dynamic, and full of potential. The emphasis is no longer just on keeping systems running but on creating a foundation for continuous innovation.

Implications for core banking technology providers

The Golden Age brings profound implications for core banking technology providers who must rise to meet the needs of this transformative time. Banks are no longer looking for providers – they want strategic partners who understand their goals and can co-create value. Here’s what it takes to succeed:

-

- Think beyond tools: Providers must align their solutions with the strategic objectives of banks, offering not just technology but also insights, guidance, and end-to-end support

- Embrace cloud and modularity: Flexibility is key. Banks need systems that grow with them, seamlessly integrating with third-party services and evolving with market demands

- AI integration: Embedding AI into core systems is no longer optional. Providers must enable banks to leverage AI for personalized experiences and operational efficiency

- Sustainability and environmental, social and governance (ESG): Providers should support banks’ sustainability goals through energy-efficient platforms and compliance-driven designs

- Focus on regional relevance: One size does not fit all. Providers must tailor their offerings to address regional regulations, market dynamics, and customer expectations

- Enable ecosystem innovation: By fostering collaboration through open architectures and API-driven platforms, providers can help banks unlock new growth opportunities

A bright future for banking

The evolution of core banking technology is more than a story of systems; it’s a story of transformation, resilience, and vision. From the Iron Age of rigid legacy systems to the Golden Age of vibrant ecosystems, each era has brought the industry closer to its goal: empowering customers and driving innovation.

As we move forward, the collaboration between banks and technology providers will be pivotal. Together, they can turn challenges into opportunities, creating systems that are not just built to last but built to lead. The future of banking is not just digital – it’s dynamic, collaborative, and, above all, human.

If you found this blog interesting, check out our blog focusing on Agentic Artificial Intelligence (AI): The Next Growth Frontier – Can It Drive Business Success For Banking & Financial Services (BFS) Enterprises? | Blog – Everest Group, which delves deeper into another topic covered by the BFSI service line.

For a closer look at the leading providers shaping the future of core banking technology, explore our Leading 50™ Core Banking Technology Providers 2024 report. Discover the rankings, market insights, and the innovations driving transformation in the banking industry.

To learn more about core banking, contact Ronak Doshi, [email protected], Kriti Gupta, [email protected], and Laqshay Gupta, [email protected].