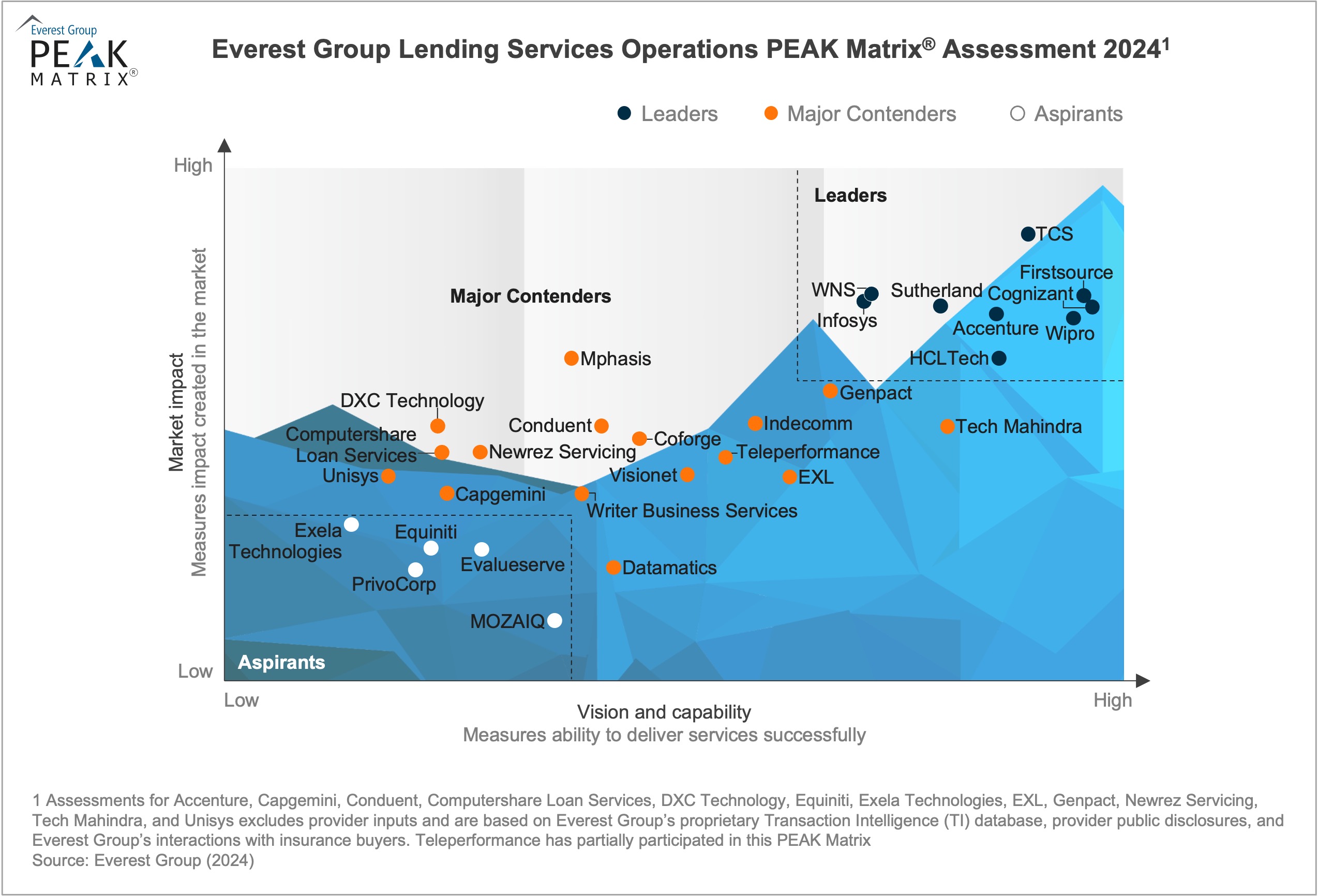

The lending services operations market has experienced significant turmoil in recent years due to high interest rates and other macroeconomic factors, leading to reduced consumer activity. Consequently, providers are continuously innovating to meet local requirements and maintain a competitive edge.

Consumer demand is shifting toward younger, digitally savvy borrowers prioritizing experience and convenience over cost. To serve this evolving demographic, service providers are differentiating themselves by leveraging their partnership ecosystems and recent acquisitions to enhance their capabilities and accelerate time-to-market for new offerings. Investments in digital lending solutions and tools are helping streamline the end-to-end lending life cycle and improve the overall customer experience.

-

Lending Services Operations PEAK Matrix® Assessment 2024

What is in this PEAK Matrix® Report

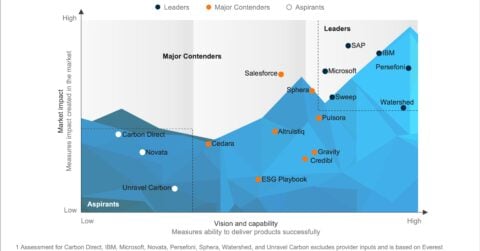

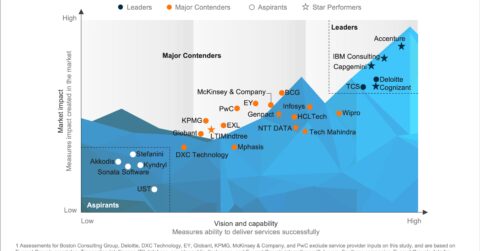

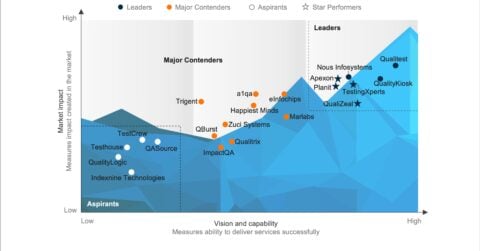

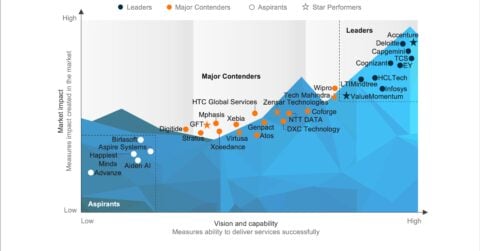

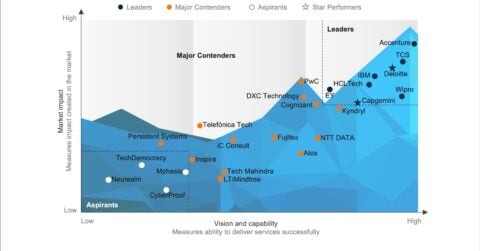

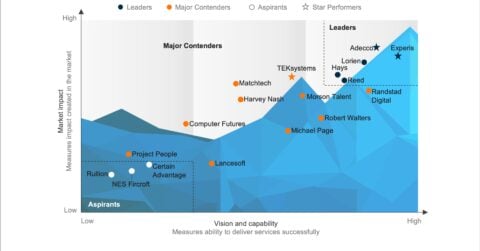

In this report, we examine the lending services operations market and its provider landscape. The report assesses 30 providers and positions them on Everest Group’s PEAK Matrix® framework as Leaders, Major Contenders, and Aspirants. Each profile comprehensively describes the provider’s vision, delivery capabilities, market success, and key strengths and limitations. The study will assist key stakeholders, such as banks, lenders, financial institutions, service providers, and technology providers, to understand the the lending operations service provider market’s current state.

Scope:

- Industry: banking and financial services

- Geography: global

- In this report, we study vertical-specific lending operations. We have not covered horizontal business processes such as finance and accounting, human resources, procurement, and contact center

Contents:

This report features 30 lending services operations service provider profiles and includes:

- Each provider’s relative positioning on Everest Group’s PEAK Matrix® for lending services operations

- Providers’ market impact, vision, and capability assessment across key dimensions

- Sourcing considerations for enterprises

READ ON

What is the PEAK Matrix®?

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.