The capital markets operations landscape is rapidly evolving as enterprises strive to meet the demands of a new generation of customers, reduce cost pressures in a recessionary environment, and adhere to regulatory changes. They are also building operational resiliency in the post-pandemic environment by formulating transformation strategies that create a digitally-enabled value chain, including the retirement of legacy platforms, cloud migration, and process automation.

Providers are scaling up their capabilities across the trade life cycle by adopting an advisory-led approach and transformation frameworks. They are offering solutions that accelerate the shift from robotic process automation to intelligent automation and bringing in technologies such as predictive and prescriptive analytics, ESG profiling, and distributed ledger technology. Providers are also extending greater support for compliance, including regulations such as MiFID, EMIR, FATCA, and upcoming T+1 settlement frameworks.

-

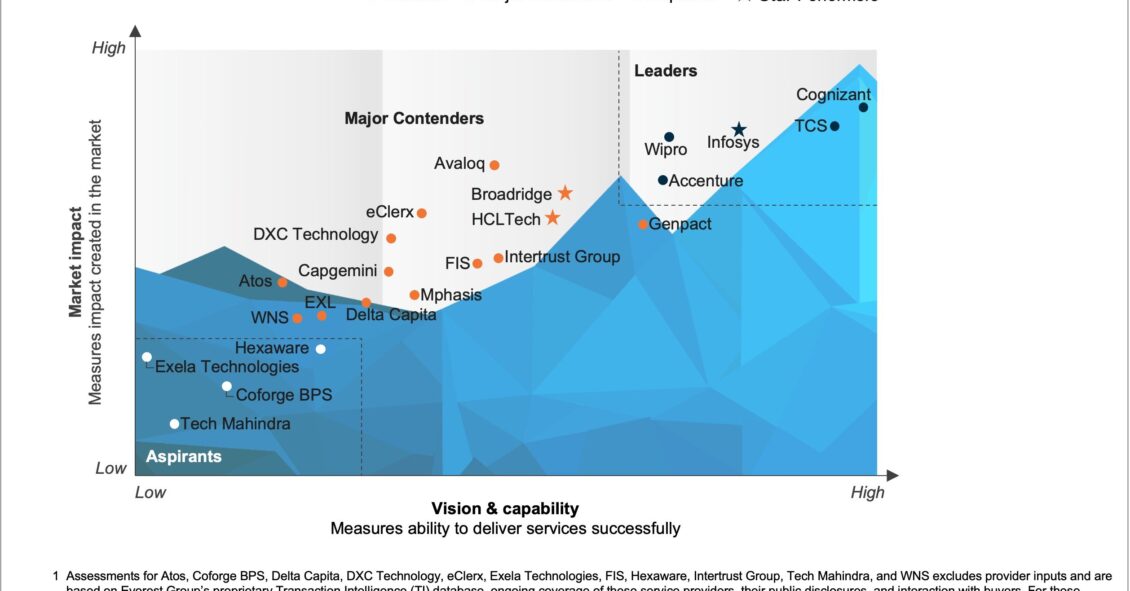

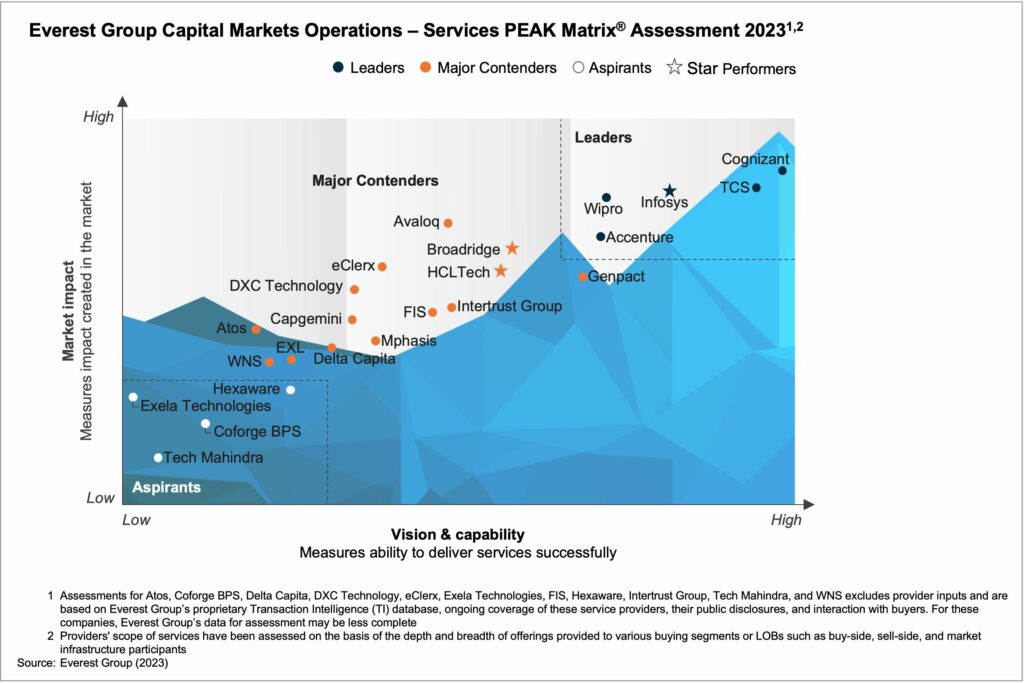

Capital Markets Operations – Services PEAK Matrix® Assessment 2023

What is in this PEAK Matrix® Report

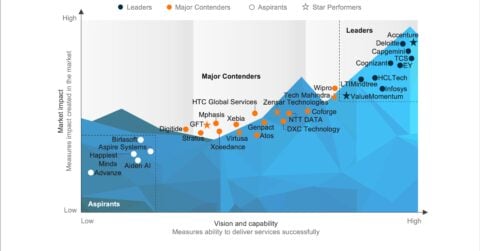

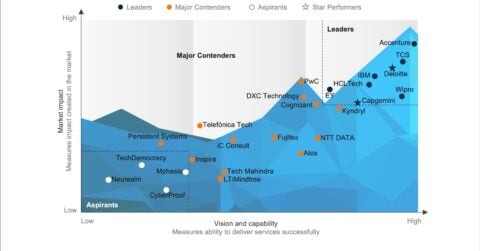

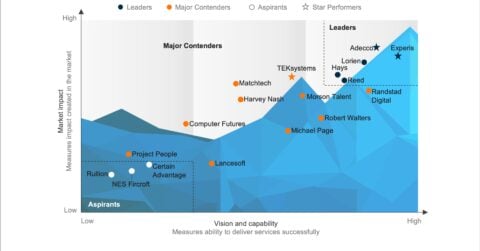

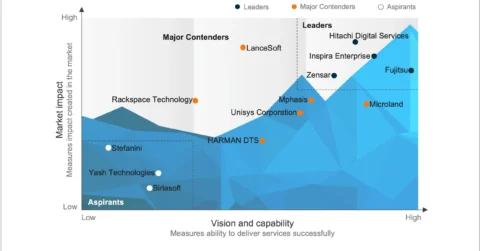

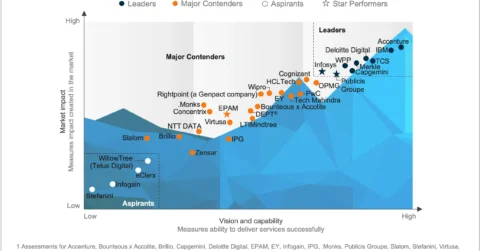

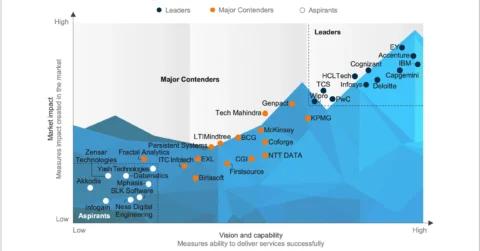

In this report, we analyze 23 capital markets operations service providers and position them on Everest Group’s PEAK Matrix® as Leaders, Major Contenders, and Aspirants based on their capabilities and offerings. The report will assist key stakeholders, such as banks, financial institutions, and providers, in understanding the current capital markets service provider landscape and making informed sourcing and partnership decisions.

Content:

- Providers’ relative positioning on Everest Group’s PEAK Matrix® for capital markets operations

- Providers’ market impact

- Providers’ vision and capability assessment across key dimensions

- Enterprise sourcing considerations

Scope:

- Industry: banking and financial services

- Geography: global

- The report covers vertical-specific capital markets operations and does not include horizontal business processes, such as Finance and Accounting (F&A), Human Resources (HR), procurement, and contact center

- This assessment is based on Everest Group’s annual RFI process and an ongoing analysis of the capital markets operations industry

READ ON

What is the PEAK Matrix®?

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.