Blog

Financial Services Trends Fueling Outsourcing Opportunities in Emerging Markets

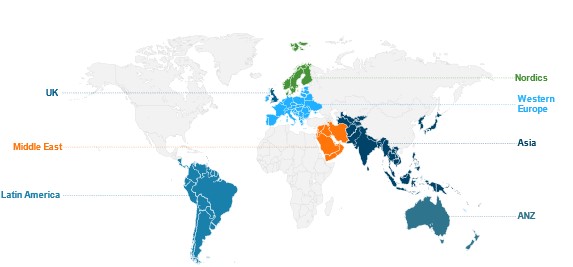

With customer demand for financial services rising across geographies, looming recessionary fears and competition is leading enterprises to expand beyond North America and enter developing markets such as the UK, Europe, Latin America, Asia Pacific, the Nordics, and the Middle East. Read on to understand the geographical differences, financial services trends driving growth, and the outsourcing opportunities in these regions.

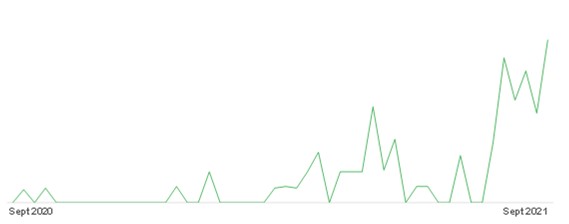

Fueled by high volumes, new technological products, and enhanced customer experience, demand for financial services is rising across developing geographies. Banks, lenders, FinTechs, and other banking and financial services (BFS) enterprises are expanding into new markets following the rising customer demand.

The saturated and competitive North American market and high-cost pressures, against the backdrop of the looming recession, are forcing enterprises to move beyond traditional markets and enter new geographies to increase their customer base. Let’s take a look at where they are headed.

The UK and Europe, along with nascent geographies such as Latin America, Asia, Australia, and New Zealand (ANZ), the Nordics, and the Middle East, are some of the geographies identified for rapid development by enterprises that have unique factors driving end customer demand.

But like the rest of the world, these markets have been impacted by the pandemic and domestic challenges that have reshaped business models and environments. Outsourcing service providers can identify these pain points and leverage capabilities to provide support.

Financial services trends driving outsourcing demand by enterprises in upcoming geographies

A few major trends impacting the enterprises in these geographies, where third-party providers can offer support:

- Environmental, social, and governance (ESG) – While a board room discussion for BFS enterprises across geographies, enterprises in Western Europe and the UK are leading other geographies in the charge for ESG adoption because of high regulatory pressure

- Super-apps and buy now pay later (BNPL) – As a result of increased technological advancement in these geographies and enhanced experience demanded by end customers, these financial services trends are making waves in Asia Pacific and Latin America

- Embedded finance and neo-banks: Traditional banks are setting up their own digital banking arms to cater to the pandemic-induced demand spike. From nearly US$47 billion in 2021, the global neo-banks market is poised to be valued at US$2.05 trillion in 2030, growing at a CAGR of 53.4%

Enterprises increasingly are leveraging third-party provider support to build scale and ramp up services in these growth areas, but various internal and external factors impact the ease of outsourcing in the respective geographies.

How can service providers help enterprises in making outsourcing decisions? What factors are pushing financial services firms to outsource?

Factors like high volumes, technology, and cost margins act as demand drivers for outsourcing from these geographies, as illustrated below.

Let’s take a closer look at some of the geographies that are uniquely placed based on their outsourcing maturity:

- Nordics, Western Europe, and the UK – High costs and wages act as major demand drivers for these areas, but tight talent markets create high-cost pressures to scale. The UK and Western Europe also face vendor consolidation issues

- Asia Pacific and Latin America – Enterprises based in these regions have to grapple with regulatory challenges and the political environment to varying degrees. Latin America is faced with political and economic uncertainty.

Geographic segments

Based on Everest Group’s assessment, the emerging geographies for BFS have been segmented into the following three categories:

- Leaders: UK and Western Europe: have high or full provider coverage in outsourcing and operate in highly competitive markets

- Major Contenders: Asia, ANZ, and Nordics: offer high outsourcing potential and scope and less competition

- Aspirants: Middle East and Latin America: have high potential but low outsourcing penetration because they are riddled with challenges such as complex regulations, rigid culture, low volumes, etc.

Service provider strategies to seize opportunities in emerging geographies

Each region has unique outsourcing-related differences that should be met with targeted approaches. Service providers willing to make inroads into these geographies must carefully assess the demands and challenges enterprise face. Talent and skill availability, geopolitical risks, and regulations can be obstacles to outsourcing for enterprises and impact costs.

In our report, Emerging Geographies’ Specialized Banking, Mortgage, and Risk and Compliance Needs, we detail these specific nuances and provide recommendations for service providers to approach and expand coverage in each geography.

Some takeaways from our research include:

- Enterprises in Asia need a customized, comprehensive services suite to address regional requirements

- Providers should increase their focus in ANZ on the underserved mid-tier and smaller banks buying segment

- Uruguay and Peru are the outsourcing locations to watch in LATAM

- Know Your Customer (KYC) and related procedures are in demand in the Middle Eastern market

- Outsourcing demand by enterprises will increase in the financial crime and compliance area in the Nordics

- In the UK, traditionally less outsourced segments such as commercial lending and payments are witnessing an uptick

- The Western European market is observing the need for ESG operations support from mid and smaller banks in countries such as France and Germany

Please reach out to Sameer Das, Shrey Jain, and Sahil Chaudhary to gain additional insights into the research and to discuss financial services trends.