Blog

3Cs of Emerging Risks – How Insurers Can Capitalize on the Opportunity

Insurance carriers need to transform their risk function, become more agile, and proactively create new offerings that protect against the threats of 3Cs: climate risk, cyber risk, and crypto risk. Read on to learn how this environment can create opportunities for insurers.

In today’s evolving risk landscape, insurers need to seek new technologies to improve efficiency, streamline workflow, and fill coverage gaps. Insurers must carefully navigate the detrimental effects of these volatile threats and evolve from being risk insurers to risk guardians. But are insurers putting enough emphasis on exploring the lurking threat areas that can pose imminent risks? Let’s take a look at how this will reshape the insurance industry moving forward.

Hardly anyone could predict a global crisis such as COVID-19 leading to insured losses amounting to nearly US$44 billion, making it the third most costly catastrophe to the industry. After any such black swan event, insurers need better preparedness and foresight to manage their response. The impact of unforeseen risks is becoming increasingly evident. Insurers need to foresee, pre-empt, and prepare for future risks to reduce uncertainty, and underwrite risks in a better way.

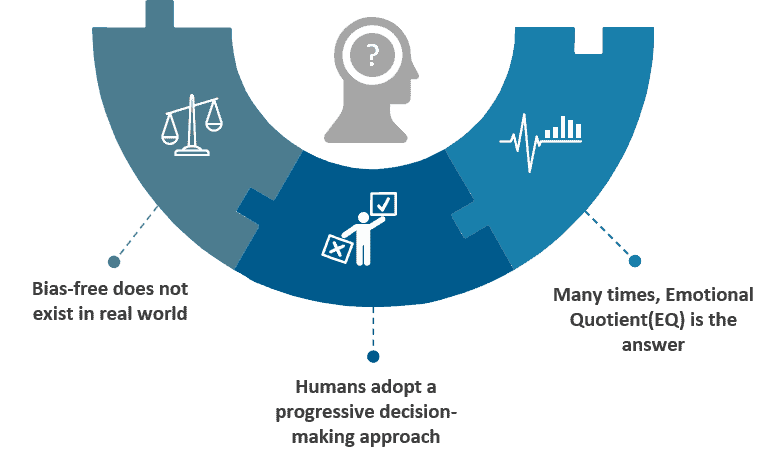

Due to spiking losses caused by emerging risks in insurance, traditional rating models are losing relevance to advanced solutions developed by InsurTechs and niche solution providers that enable data-driven decision-making powered by next-generation technologies such as Artificial Intelligence (AI)/Machine Learning (ML) and internet of things (IoT).

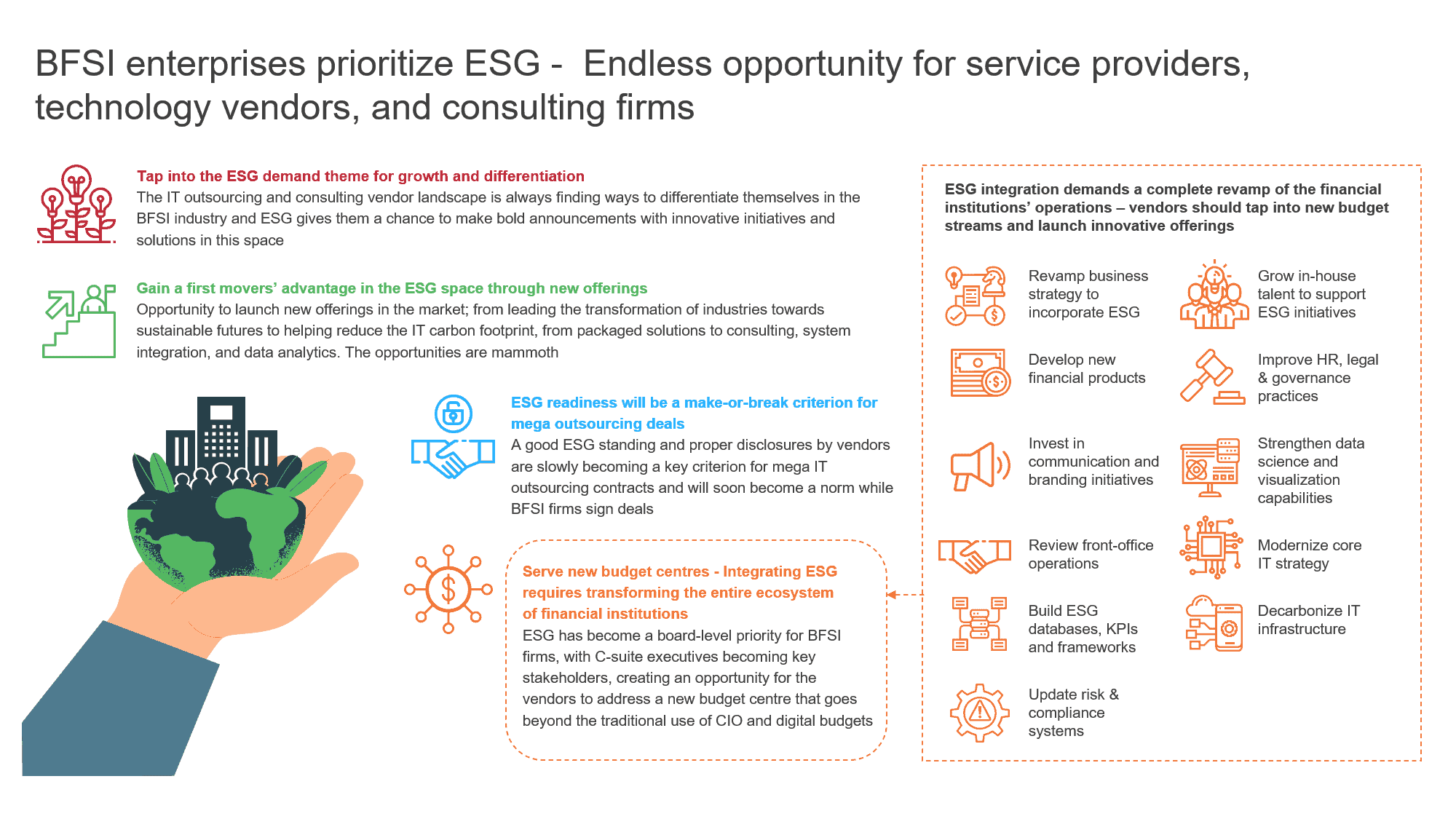

With insurance products being largely commoditized, carriers need to differentiate their offerings by rapidly creating newer products for emerging risk segments. We have explored three key emerging risk segments that are complex to evaluate and increasingly gaining prominence, as illustrated below:

Exhibit 1

Market landscape and challenges faced by Insurers

- The pandemic forced insurers to adopt newer technologies, scale up digital-first operations, and expand data estate leading to added risk and exposure. The average data breach costs jumped about 13% from 2020 to 2022, according to the IBM Cost of a Data Breach Report 2022

- The increasing frequency and costs of extreme weather events is putting a greater burden on insurers. Traditional insurer risk models are not sufficient to face the challenge of accurately capturing and testing climate-related risks

- Cryptocurrency presents a diverse risk landscape. Risky investments in digital assets and unexpected losses tied to cryptocurrency curtails their viability, triggering surety claims. Product development and coverage pricing become challenging because of the dynamic nature of these assets

In response to the challenges illustrated in Exhibit 2 below, insurers need to assess the risks and create personalized products and zero-touch claims processes.

Exhibit 2

Next steps in the right direction

With rising losses, insurers can no longer shut their eyes to the devastating impact of these emerging risks on pricing, underwriting, and investment decisions. Insurers need to strategically rethink their risk function.

Carriers must prioritize investment bets across the insurance value chain and evaluate InsurTechs and specialists that bring in niche talent, industry expertise, speed, and experience to help them meet their key business priorities.

According to Everest Group research, specialist providers (illustrated in exhibit 3) can act as catalysts for value realization by quantifying the financial impact of climate change, providing comprehensive cyber risk visibility, and offering innovative digital asset protection solutions.

Contextualized solutions from InsurTechs are gaining prominence to fill capability gaps, enhance value propositions, and streamline workflows across the insurance value chain.

Exhibit 3

Let’s explore some of the solutions providers offer for addressing the 3Cs of emerging risks in insurance.

Climate risk:

- The quantitative consequences of risks must be appropriately assessed and addressed to minimize the impact. Real-time analytics providers use resiliency insights, risk engineering, probabilistic hazard maps, and historical catalogs to recognize the likely risk from natural disasters across the globe

- Insights on possible hazards can be conveyed via geospatial web-based applications, reports, or application programming interfaces (APIs). Using asset and portfolio-level climate risk analytics, insurers can tap into these insights that affect crucial aspects of the value chain, starting from product development and portfolio planning to underwriting and pricing

Cyber risk:

- Cyber risk analytics platform providers use telemetry and threat intelligence from across customer workloads, endpoints, identities, IT assets and configurations, DevOps, AI, and blockchain. Using this intelligence, they identify and map shifts in adversary tactics and create actionable data to automatically prevent real-time threats

- As insurers navigate through uncertainty, they need to tap into the plethora of data they possess along with third-party data to unlock immense value. They must infuse data analytics at every step, starting with identifying, protecting, and detecting cyber-attack risk to proactively computing the cyber control performance. This will enable early identification of weaknesses and detect advanced attacks

Crypto risk:

- Storing crypto assets is creating new risks. To quantify loss exposure, actuarial teams can draw on forecasting analysis of cryptocurrency crimes to build actuarial models around cold wallets (coverage against damages or theft of the physical storage device) and hot wallets (coverage against abuse of the private key that enables access to digital assets)

- Insurers need to develop the tools to implement dynamic policy limits/pricing that increase or decrease based on the price changes of these assets, enabling insurers to respond and act upon real-time market changes and ensuring the policyholder is always protected even with innumerable value fluctuations during the policy period

Insurers have a critical role in leading society to navigate these looming threats. Carriers need to change their approach, become more agile, and proactively build products while safeguarding these risks.

It has never been more important to assess and address the 3Cs of insurance risks. To learn more about them in detail, check out our Insurance Solutions Specialist Trailblazers – 2023.

To discuss emerging risks in insurance, please reach out to [email protected], [email protected], [email protected], and [email protected].