Tariffs are the red shells of global sourcing

You are a sourcing leader, comfortably ahead in your transformation journey. The delivery engine is efficient, partners are aligned, and budgets are committed. Then, without warning, a policy shift lands like a red shell in a racing game, suddenly, everything is disrupted.

This is what tariffs feel like in the services world.

While tariff-related headlines often focus on physical goods and direct materials, it is important for sourcing leaders to understand the broader implications. Volatility in trade policy has deep, indirect consequences for global services, cutting into discretionary spending, reshaping delivery models, and straining provider relationships.

Reach out to discuss this topic in depth.

The hidden threat to services spend

Tariffs are rarely framed as a services issue. However, they trigger budget pressures and operational shifts that directly impact the services portfolio, particularly in categories such as Information Technology (IT), engineering, research and development, analytics, and Customer Experience Management (CXM).

As downstream clients in Manufacturing, Retail, and Pharmaceuticals reprioritize capital, services sourcing leaders are often required to pause or downscale initiatives that do not support immediate cost takeout or compliance.

As sourcing organizations navigate dynamic market conditions, supply chain disruptions, and increasing regulatory scrutiny, it has become more critical than ever for them to optimize their outsourcing partner portfolios.

We are conducting a survey to understand how buyers are shaping their supplier strategies across IT, engineering, and Business Process Outsourcing (BPO) to balance costs, risks, and productivity. This survey takes about 10–12 minutes to complete, and we will be sharing the results with the respondents, a complimentary summary analysis of our study findings, which will offer you insights on supplier portfolio management: Navigating Outsourcing Supplier Strategy – 2025 Trends.

Who is being impacted the most?

Some services categories are more vulnerable to tariff-driven volatility:

- Engineering and research and development services: budget reductions in manufacturing, electronics, and semiconductor industries are resulting in pricing pressure and reduced demand for outsourced design and development initiatives

- IT and digital services: enterprises are postponing non-essential transformation programs, reallocating resources toward automation and artificial intelligence (AI)-driven efficiencies that reduce dependence on offshore talent

- Customer experience services: retail and consumer products companies are revisiting investments in large-scale customer engagement platforms, pivoting instead toward leaner, AI-enhanced alternatives

Even industries such as life sciences and banking are recalibrating sourcing strategies, emphasizing resilience, nearshoring, and supplier consolidation to insulate against policy shocks.

Why should CPOs pay closer attention?

Services have become a primary lever for competitive advantage. Intelligent automation, data-driven decision-making, and personalized customer engagement are all service-enabled. In this context, any disruption to service delivery is not just a cost issue, it is a risk to business agility and long-term differentiation.

Tariffs introduce that risk. Without the right sourcing design, service leaders may find themselves unable to flex budgets, scale support models, or adjust contracts in time to respond.

Impact on provider commercials: a shift toward buyer power

As tariffs continue to strain discretionary budgets and redirect enterprise priorities, service providers are adjusting pricing strategies to remain competitive. This shift is particularly evident across the following dimensions:

- Standard IT and operations services, including finance and accounting outsourcing, are facing downward pricing pressure, especially where delivery remains offshore and margin compression is ongoing

- Engineering services are under heightened commercial stress as impacted industries reduce spend and turn to more cost-efficient models. Time-and-materials contracts are particularly exposed in this environment

- In life sciences and analytics-heavy sectors, select capabilities such as supply chain planning and advanced analytics are experiencing price inflation as buyers seek resilience and agility

- Predatory pricing is increasing, particularly in managed services. Providers are bidding aggressively to win or retain business, which may create cost advantages in the short term but could lead to delivery risks in the long term

- Reshoring and nearshoring are being considered more frequently, especially in politically sensitive sectors. While these shifts address tariff exposure, they may also raise per-unit costs due to higher regional labor rates

The overall trend suggests a transition to a stronger buyer market, but sourcing leaders will need to balance pricing advantages with long-term viability and delivery quality.

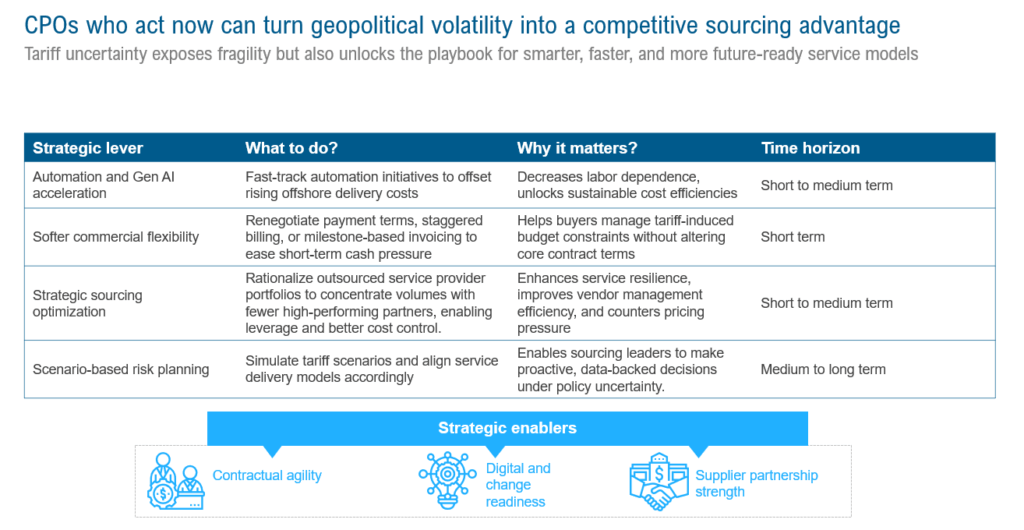

Strategic levers for services sourcing leaders

Sourcing and procurement executives can mitigate these risks by activating the following strategies:

These recommendations reflect the current market landscape, where buyers are gaining leverage amid pricing pressure and delivery uncertainty.

Closing thought: you cannot always avoid the red shell, but you can be ready

In the sourcing world, trade disruption is not a one-time event, it is becoming a recurring pattern. While tariff outcomes remain fluid, service leaders who build resilient models today will be best positioned to stay competitive tomorrow.

The takeaway is simple: move from reactive risk mitigation to proactive service optimization. When the next red shell comes your way, your organization will not be derailed, it will be ready.

For more information regarding the US administrations tariffs and to see what the US tariffs mean for the global services market, please visit https://www.everestgrp.com/us-administrations-tariffs/.

If you found this blog interesting, check out our How Will The New Tariffs Affect The Global Services Market? | Blog – Everest Group, which delves deeper into another topic regarding the latest tariffs and how this may affect various sectors in the US and beyond.

To discuss about how you can turn geopolitical volatility into a competitive sourcing advantage, please reach out to Amy Fong ([email protected]), Bhanushee Malhotra ([email protected]), and Khushboo Hanjura ([email protected]).