During a global pandemic with a dire economic outlook, one surprising segment experienced its fastest growth in recent years – Customer Experience Management (CXM) services. Driven by increased demand for digital and other factors, this market seems to have long enough legs to extend into the coming years. But what’s behind this unexpected growth in CXM in an otherwise subdued economy, and will it last? For more on our analysis of this promising area, read on.

COVID-19 impact

As most major economies were shut down partially or almost completely in the first half of the year to contain the spread of the COVID-19 pandemic, businesses across the globe were adversely impacted in 2020. And while some industries such as high-tech or Fast Growth Tech (FGT) fared comparatively better than others like travel and hospitality, overall, the economy looked grim.

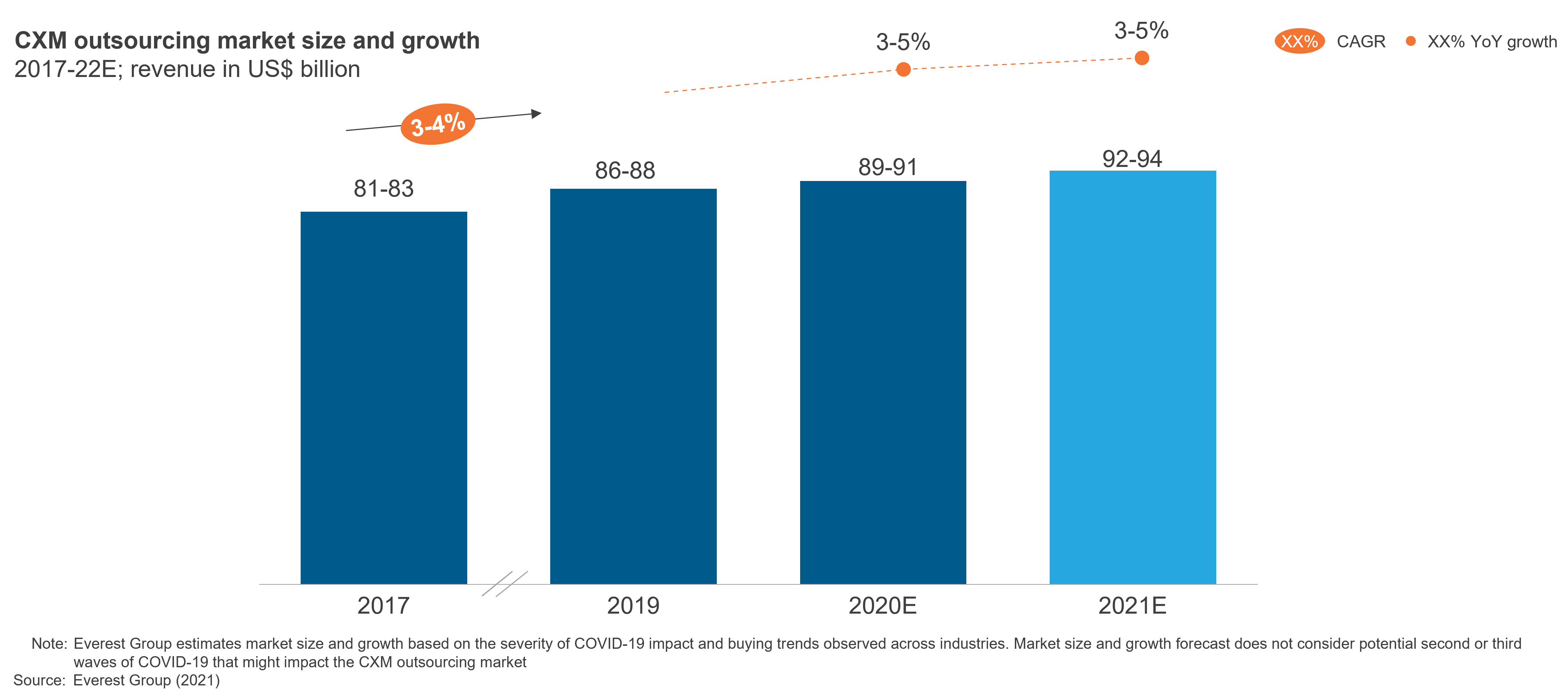

With such a dire economic outlook, it was largely assumed that the same would hold for the Customer Experience Management (CXM) services market, given the segment’s dependence on overall economic health for its growth. Gauged by the slow first half of the year, the downcast business outlook, and the huge challenge facing CXM service providers to shift to a Work from Home (WFH) model to continue running their businesses, Everest Group projected the market would shrink by 4-5 percent in 2020 compared to 2019.

Market stunner

However, in a complete reversal of early trends, the CXM market managed to grow at one of the highest paces in recent years, recording 3-5 percent growth in 2020 to stand at around US$90 billion. And it doesn’t look like growth is coming to an end for this sector, as the numbers reported by some of the largest publicly-listed CXM service providers in 2021 look robust and point towards an optimistic future for this market.

This begs the question: Why hasn’t the CXM market been impacted as severely as was widely expected during the early phase of the pandemic spread? We see several underlying factors that have been at work. In our upcoming CXM State of the Market Report slated for release later this year, these factors will be explored in greater depth. Below we discuss some of the factors that contributed to the segment’s growth and raise questions that need to be addressed further.

The following factors are playing a role in CXM services growth:

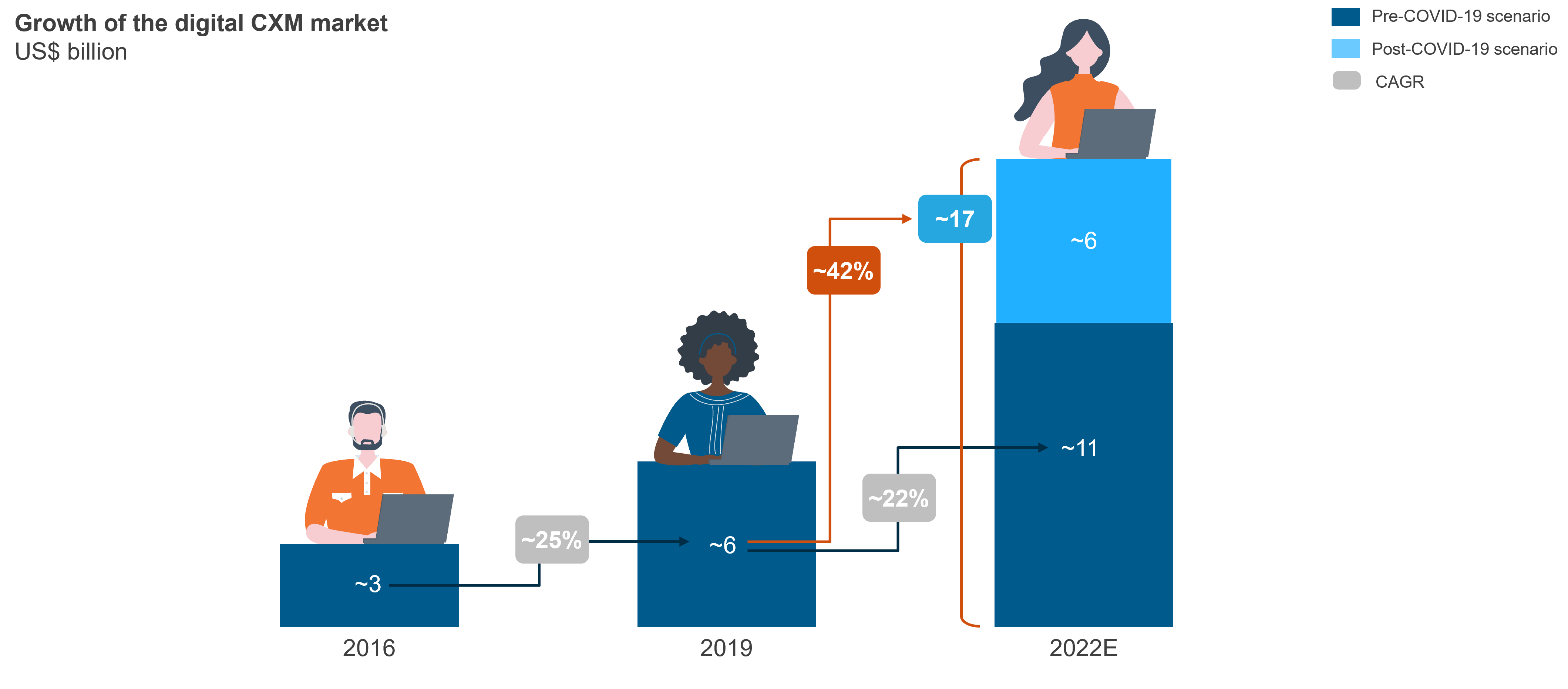

- Increasing demand for digital: It is no secret that businesses have come to terms with the importance of digital Customer Experience (CX) after the events of 2020. They understand the need for digital CX, not only to create superior customer experience but also to ensure continuity of services in adverse times when traditional methods no longer work. Additionally, customers are increasingly leveraging digital channels to communicate with brands, further fueling the pace of change. Enterprises are exhibiting a new wave of urgency to adopt digital technologies such as automation, analytics, self-service technologies, and digital channels to better prepare for the future and reduce dependence on a human workforce. This new demand is helping the digital segment of the CXM market to post an annual growth of over 40 percent

- Exceptional performance by certain sectors of the market: While most traditional businesses were severely hit as businesses moved to an online model, those that were already strong in this space did well. Industries such as high-tech and FGT fared exceptionally, and their success also translated into more demand for CXM services from this industry

- Demand due to COVID-19 response: Even mature markets such as North America and Western Europe saw good growth in 2020 driven by demand for government support in these regions. The massive push to contain the spread of COVID-19 and to vaccinate the masses fueled demand for CXM services. Programs such as contact tracing and vaccination support are expected to drive new growth for CXM service providers. However, these demand drivers are expected to wind down once the pandemic is controlled and the vaccination programs cover a large portion of the population

Here are some of the issues we see that need further exploration:

- Is market consolidation hiding within the growth numbers? Given the challenges that 2020 posed around the changing business model, not everyone could thrive and survive in this market. The CXM services market has a very long tail with thousands, if not a magnitude more, of small service providers catering to enterprises globally. It is highly possible that a lot of these small (typically under 50 seats) providers were not prepared to handle the challenges thrown by the pandemic and saw their clients migrate to larger, more organized service providers. Given that a lot of these small players go untracked, a large part of this growth could well be just moving business from one player to another, which, in true essence, wouldn’t be actual growth. That said, it does not mean that the market did not see new growth at all. Based on our research, several providers have been successful in bringing new business to the table. While it may be difficult to determine full impact of the consolidation of smaller service providers on the overall market, our view is that the market is still experiencing net growth

- Is CXM growth being driven by new demand or a shift from in-house to outsourcing? With major economies globally under pressure, a lot of new demand for CXM services seems unlikely, barring, of course, certain sectors that were highlighted above. A lot of the work that was previously being done internally through in-house centers could have moved to an outsourced model, given enterprises’ inability and inflexibility to adapt to new working models. Our research pegged the size of the total CXM services market (including in-house and outsourced) to be around US$350 billion at the end of 2019, with outsourcing accounting for ~25 percent of that spend. While a strong possibility exists that the overall CXM services spend declined in 2020 due to the challenging economic conditions, we believe the share of outsourcing is increasing, thus, resulting in net growth for the outsourced portion of the market

Positive outlook

Despite these factors, the long-term prospects for the CXM services market look favorable, especially with a heightened awareness around the need for superior CX to build differentiation in the market. This change will be hinged around digital CX, where most enterprises lack enough experience and require third-party support to execute the vision they have for their business. Along with green shoots of economic recovery emerging in several regions after a difficult year, service providers who possess CX capabilities have plenty of opportunities to look forward to.

Sharang Sharma, Practice Director: [email protected]

David Rickard, Vice President: [email protected]

Shirley Hung, Vice President: [email protected]