Blog

Declining Headcount at Major IT Service Providers: Are Macroeconomic Factors the Sole Reason for the Tech Hiring Slowdown?

From increased hiring growth after the pandemic to recent layoffs, the tech talent market has experienced great volatility.Recognizing the need for a more sustainable approach, top employers have increasingly focused on building and developing talent internally. In this blog, we examine the major factors contributing to declining tech hiring and the outlook for IT services talent.Reach out to us

to discuss further.

The demand for IT tech talent has fluctuated widely in recent years, moving from a post-COVID hiring surge as enterprises accelerated digital transformation to the challenging Great Resignation, marked by record-high attrition rates and wage inflation.

IT service providers grappled with the dual challenge of retaining skilled professionals and attracting new talent. Now, the pendulum has swung the other way, with organizations implementing rounds of layoffs, imposing hiring freezes, and reducing overall headcount.

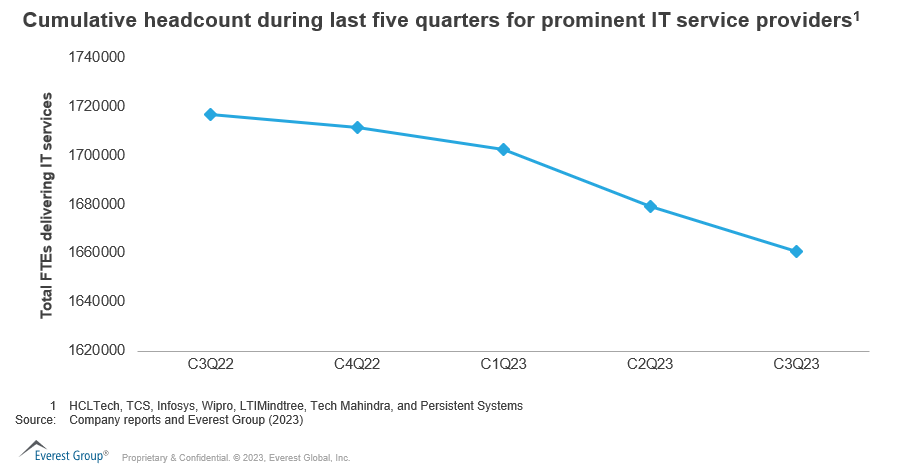

This rapid shift underscores the dynamic nature of the tech talent market and the evolving challenges both employers and professionals in this field face. The exhibit below shows the cumulative downward trend in headcount for major IT service providers.

Over the past five quarters, from the second quarter of FY23 to FY24, 56,000 positions were eliminated, translating to an overall 3.26% headcount reduction for this period. This decline contrasts with the significant headcount growth in FY22 and the first half of FY23.

Let’s examine the following major trends contributing to this downward trend and take a look at the talent outlook in the IT services industry:

- A tectonic shift from hiring to building and developing talent internally

According to Talent Readiness for Next-generation IT Services PEAK Matrix® Assessment 2023, the strategic priority for the majority of service providers for the next 12 to 18 months from a talent perspective is learning and development. Employers are focusing more on providing best-in-class opportunities for internal talent to upskill/reskill. This effort is backed by implementing structured frameworks to accelerate career progression through internal movement within the firm, aligned with the associates’ aspirations and business requirements.

Consequently, service providers have made significant investments to drive these efforts, including Artificial Intelligence (AI)-based internal talent marketplaces, AI-enabled skill profile matching platforms, personalized skilling recommendations based on an associate’s skill profile, roles, and projects, among others.

The combined result of quality upskilling initiatives and robust internal movement frameworks is that service providers can fulfill a substantial portion of niche talent requirements with specialized skills from their internal talent pool.

One leading service provider reported it has filled 60,000 open positions through upskilled and cross-skilled employees. Additionally, internal mobility also offers multiple other professional benefits, including higher retention rates, lower employee costs, and enhanced succession planning, to name a few

- Strategic pivot from external hiring to optimal resource utilization

Service providers are focusing on increased internal workforce utilization and optimizing resource allocation to projects. This is evident from the increased utilization rate most service providers have reported in the last few quarters.

Some notable examples include Infosys, where the bench utilization rate increased from 76.6% in the second quarter of FY23 to 80.4% in the same period this year, and Wipro’s bench utilization rate increased from 79.8% to 84.5% during the same period. Additionally, TCS, HCLTech, LTIMindtree, Tech Mahindra, and Persistent Systems also indicated higher bench utilization rates

- Hiring recalibration amid shifting dynamics in enterprise client demands

Due to the ramped-up digital transformation initiatives of enterprise clients during FY22 and the first half of FY23, most service providers ramped up hiring, resulting in significant net new additions to meet the surge in demand.

With the current demand slowing, service providers are focusing on upskilling and rotating already-hired resources. They are cautiously approaching hiring, delaying onboarding, and planning to forego hiring recent college graduates for the current year

- Service providers navigate margin compression, opt for prudent cost management

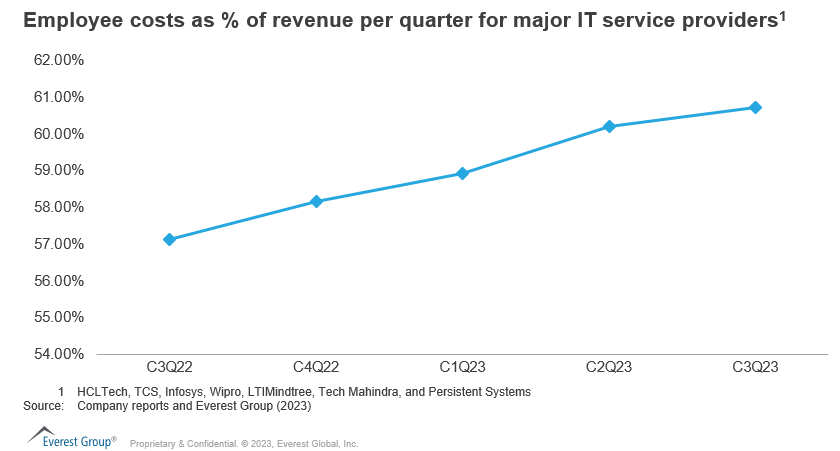

Even with the headcount reductions, employee costs are at an all-time high for most of the top service providers. As illustrated in the exhibit below, employee costs have grown faster than revenues in the last few quarters, adversely affecting margins

Apart from this, multiple other factors are affecting margins, including service providers’ back-to-office initiatives. To counter these effects, service providers are focusing on the current internal workforce and significantly ramping down net new additions to lower overall recruitment and onboarding costs.

- Macroeconomic headwinds impact demand drivers in the IT services industry

Current global macroeconomic conditions are significantly contributing to the downward trend. The IT and business process services industry is expected to grow at a slower 2.7-3.2% in year-over-year organic constant currency terms (base case), a deceleration from the 4-6% growth in the last 12 months.

The global economic slowdown, supply chain disruptions, elevated inflation, geopolitical instabilities, wars, and oil conflicts, among other factors, are driving this decline and contributing to a negative outlook.

Hence, enterprises feel obligated to decelerate the pace of transformation initiatives and focus on cost optimization. This leaves the services industry dealing with challenges such as project cancellations, delayed ramp-ups, tougher negotiations, pricing wars, settling for new deals with lower margin profiles, a lack of long-term client commitments, and so on

Tech talent outlook

Over the past few years, service providers have come to a crucial realization that merely relying on external talent acquisition to match enterprise demand is not enough.

Recognizing the need for a more sustainable approach, they have increasingly focused on building and developing talent internally. This shift has given rise to the need to strengthen internal talent development processes.

Consequently, service providers have now started reaping the rewards, efficiently managing a substantial demand volume by leveraging their internal workforce. The benefits extend beyond the organizations themselves, positively impacting employees through enhanced career growth opportunities, skill development, and a sense of loyalty fostered by internal mobility programs.

To gain further insights into how leading IT service providers are tailoring internal talent development and management strategies to drive optimal workforce utilization, manage associate aspirations, and efficiently meet client needs, reach out to Arpita Dwivedi [email protected], Amit Anand [email protected], and Abhigyan Kumar [email protected].