Blog

Future-proofing Insurance: Embracing Sustainability in Insurance for a Resilient Future

Sustainability in insurance transcends traditional practices, weaving Environmental, Social, and Governance (ESG) elements into the core of day-to-day operations, thereby safeguarding the future of stakeholders and the planet. In this evolving industry, embracing sustainability is no longer optional but essential for mitigating climate risks, meeting regulatory demands, and ensuring long-term value in a world facing complex environmental and social challenges. Reach out to us to explore this topic further.

The shift toward sustainability in insurance

Sustainability is becoming increasingly critical

in the insurance sector due to the escalating unpredictability of losses driven by climate change, economic instability, and social inequalities. As per a report by the National Oceanic and Atmospheric Administration (NOAA), in 2023 alone, the United States witnessed 25 climate-related disasters that each resulted in damages exceeding US$1 billion, nearly doubling the annual average from the previous five years and leading to 464 fatalities. Such extreme weather events, occurring in regions where they were previously uncommon, are compelling insurers to acknowledge their responsibility in environmental protection. Additionally, shifts in consumer behavior are influencing the move towards sustainable practices. A growing number of consumers, about 25%, are now willing to pay a premium for environmentally friendly products, such as electric vehicles and sustainably sourced clothing, expecting that the companies they patronize uphold similar ethical standards.

Regulatory changes are also pushing the insurance industry towards greater transparency and sustainability. In the first half of 2023, there were over 1,715 adjustments to the US state insurance regulations, many of which address climate issues. A notable example is the California Climate Risk Disclosure Survey, which requires insurers to disclose how they are managing climate-related risks. Moreover, entities such as the Securities and Exchange Commission (SEC) are preparing to enforce new mandates requiring climate risk disclosures, potentially impacting publicly traded insurance firms that do not proactively address climate change.

As a result, insurers have started developing and offering new products across personal, commercial, and specialty lines. In personal lines, companies have begun offering green property insurance, which covers eco-friendly materials and energy-efficient upgrades following a loss, as well as discounts for hybrid or electric vehicle owners to encourage sustainable transportation choices. In commercial lines, insurers in geographies like the US and EU now provide insurance for renewable energy projects and green building coverage, helping businesses transition to sustainable practices. These include coverage for renewable energy equipment, green construction materials, and tools to manage climate-related risks. Specialty lines see innovations driven by InsurTech, such as parametric insurance for climate risks and the use of IoT devices for real-time environmental monitoring, enhancing risk mitigation and encouraging eco-friendly behaviors.

Sustainable insurance in action

Insurers integrating sustainable practices into their value chains include:

- AXA (2015), launching the AXA Climate School to educate clients on climate risks, enhancing client trust and risk management

- Zurich Insurance Group (2017), initiating the Zurich Forest Project for reforestation, boosting their brand reputation and environmental impact

- Allianz (2018), incorporating ESG factors into underwriting and investments, improving investment resilience and attracting ESG-conscious clients

- Swiss Re (2019), ceasing re/insurance for the most carbon-intensive oil and gas companies, aligning with climate goals and reducing exposure to high-risk industries

- Aviva (2020), setting a net-zero carbon target by 2040, enhancing long-term sustainability and appealing to eco-friendly investors

- Munich Re (2021), investing in green bonds and applying ESG criteria to their investment portfolio, supporting sustainable projects and strengthening their market position in the green economy

Currently, while the integration of sustainability into corporate strategies is becoming crucial for many firms, the actual implementation of these strategies in a tangible way remains a very early stage for many companies. According to a global survey, 25% of insurers identified “grasping ESG-related regulations and guidelines” as their primary challenge in advancing their ESG initiatives. This was followed by 17% who cited “determining the most effective actions to take on ESG” as a key hurdle and 15% who pointed to “aligning ESG efforts with customer expectations” as a significant concern.

Challenges in implementing sustainable insurance

Besides the difficulties of managing risks in a world altered by climate change, the insurance sector also contends with issues arising from regulatory, operational, and market-related complexities.

- Regulatory uncertainty – Insurers need to navigate a complex web of local and international ESG-related regulations that can vary significantly from one jurisdiction to another. The lack of standardized regulatory frameworks makes it difficult for global insurance companies to implement uniform strategies across all markets. This regulatory complexity requires insurers to invest heavily in legal expertise and compliance functions to ensure they meet all applicable guidelines

- Lack of standardized metrics and data deficiency – The insurance industry relies heavily on accurate data to assess risks and set premiums. However, there is currently no universally accepted methodology for quantifying ESG risks, which complicates the integration of sustainability into traditional risk models. This lack of standardized data not only hinders the assessment and pricing of risks but also makes it difficult to track progress and measure the impact of sustainability initiatives

- Liability risks – One of the significant challenges for insurers in implementing sustainability is managing liability risks stemming from compensation claims related to climate change damages. As climate change increases the frequency and severity of extreme weather events, the potential for substantial claims also rises, impacting the liability side of insurers’ balance sheets. Additionally, there is an increased risk of litigation, with insurers potentially facing legal challenges for failing to manage or disclose climate-related risks adequately

- Affordability and availability of coverage – Affordability and availability of coverage pose significant challenges in implementing sustainability in the insurance industry. As climate change leads to more frequent and severe natural disasters, insurance costs rise, making coverage less affordable. High-risk areas, such as flood or hurricane-prone regions, for example, face higher premiums or loss of coverage, leaving communities vulnerable. This not only affects individual policyholders but also has broader economic implications, leading to underinsurance or no insurance in these zones

- Aligning sustainability with market and customer expectations – Insurers must balance the need to implement sustainable practices with the need to remain competitive and meet the expectations of their clients. This involves developing new insurance products and services that not only comply with ESG standards but also appeal to a market that is increasingly sensitive to sustainability issues

Shaping tomorrow’s insurance industry

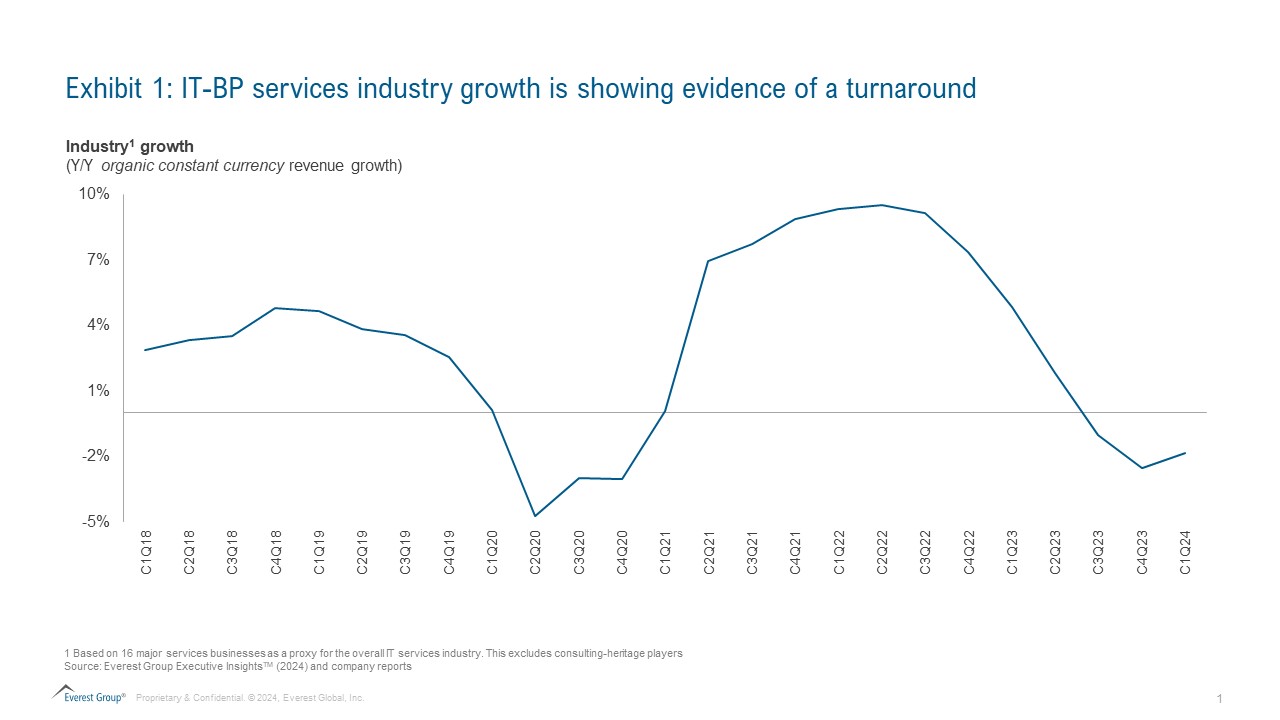

In the insurance sector, several unpredictable developments stand out, including emerging risks such as an aging population, climate change, and cyber threats, along with the rise of the sharing economy affecting freelancer, auto, and home insurance markets and the integration of technology in the smart economy. Social factors, such as evolving consumer expectations for corporate responsibility and equitable services, also play a crucial role, as do governance issues like regulatory changes and corporate transparency. While accurately forecasting the future remains a challenge, identifying catalysts for market changes is possible. By combining historical data with industry insights, we can use a specifically designed model to construct various future scenarios. These scenarios illustrate potential outcomes and opportunities driven by key trends in environmental, social, and governance (ESG) aspects under different conditions [Exhibit 1]. With this approach, we can strategize effectively, choosing paths that optimize financial gains, enhance social impact, or minimize risks.

Driving sustainability in insurance is not just about compliance with regulatory changes and risk management; it also involves capitalizing on new opportunities and fostering a more sustainable, resilient world. As financial intermediaries and risk managers, insurers have a unique ability to drive and support sustainable practices across different industries and communities. The following strategic key objectives present a structured approach for insurance companies to embed sustainability into each stage of their value chain, along with key performance metrics to align with broader societal goals [Exhibit 2].

By embedding sustainability into its core identity and fostering innovation, the insurance industry can go beyond managing risks to actively stewarding the planet and its people. This transformation will not only reshape the industry but also significantly contribute to a sustainable, resilient, and equitable global future.

To discuss more on the importance of sustainability in the insurance space, please reach out to Debasruti Mitra at [email protected] and [email protected] and stay updated by accessing Everest Group’s latest research on Insurance Business Processes.

Watch the webinar, What’s Next in Financial Services? Driving Transformation Through Sourcing, Technology, and Operations, to learn how the banking, financial services, and insurance (BFSI) industry is driving business transformation in response to evolving customer needs and the rapid adoption of AI and cloud technologies.