Blog

Navigating Disruptions in BFSI: The Role of Desktop Infrastructure Transformation (DIT)

The Banking, Financial Services, and Insurance (BFSI) industry faces various challenges in today’s evolving environment, from inflation and cybersecurity to increased competition from fintechs, and changing customer expectations. Desktop Infrastructure Transformation (DIT) has emerged as an attractive solution to combat these market disruptions because of its ability to optimize costs, empower users, and enhance IT efficiency. In this blog, we’ll explore how DIT can help the BFSI industry tackle pressing issues. Contact us directly

to discuss this topic further.

BFSI in the “Age of Disruption”

Benjamin Franklin’s wise words, “When you’re finished changing, you’re finished,” still hold true today, particularly in the rapidly evolving world of BFSI. Recent events such as the collapse of Silicon Valley Bank and UBS Bank’s acquisition of Credit Suisse show that those who fail to adapt will be left behind even quicker than they can Google “subprime mortgage crisis.”

Facing various internal and external disruptions, BFSI enterprises struggle with difficult questions. However, a recent Everest Group survey of 500 senior stakeholders supports that “fortune favors the bold.” The survey found 59% of respondents identify digital transformation maturity as a critical priority to withstand disruptions.

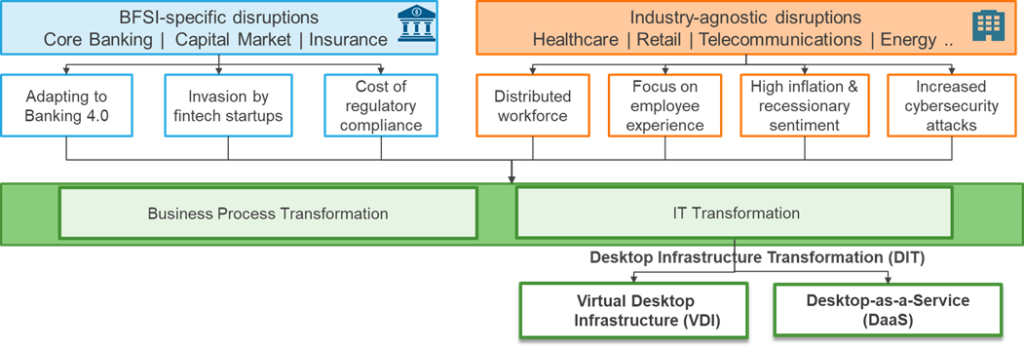

Considering these findings, the following framework provides an overview of disruptions BFSI enterprises face and outlines the actions to offset them:

Source: Everest Group 2023

BFSI enterprises need to act swiftly and effectively to mitigate the impact of these disruptions. As highlighted in the framework above, DIT and its two sub-components – as part of an overall mature digital transformation approach – can provide a strong buttress against disruptions.

These sub-components can be broadly defined as follows:

- Virtual Desktop Infrastructure (VDI): Technology that allows a user to access a desktop operating system and its applications from a remote server and thin clients

- Full-stack Desktop-as-a-Service (DaaS): Cloud computing environment with bundled pricing for hardware, software, and ancillary management services in a pay-per-use model

In the following section, we examine the most pressing disruptions BFSI enterprises face and explore how DIT can provide a solution to address them:

| Disruption | Evidence | Complication | Question | DIT to Rescue |

| Compounding impact of concurrent inflation and recession | Inflation is at a 40-year high in most developed countries such as the US and UK | – Reduction in banking payments and transactions

– Dip in insurance investments and higher payout expenses – Deterrence of new bond issuances and Initial Public Offerings |

How can enterprises offset the impact of inflation and be prepared for a recession? | Cost effective and pay-as-you consume model through DaaS or VDI |

| Embracing Banking 4.0 and seizing new business opportunities | The customer acquisition cost for a physical branch is approximately 50 times higher than for digital banking | – BFSI companies are under pressure to digitize their platforms/services immediately

– Automation and data-driven decision-making has become pertinent |

How can BFSI enterprises effectively leverage the Banking 4.0 approach and seamlessly launch related businesses and products? | Cloud-based desktop infrastructure for agility and to ensure faster time-to-market for digitized products/services |

| Increasing prevalence of cybersecurity attacks | More than 60% of global financial institutions with at least $5 billion in assets were hit by cyberattacks in 2022 | – Higher risks of financial losses and reputational damage

– Increased regulations and compliances, creating operational complexities |

How can BFSI companies manage cybersecurity threats while maintaining productivity and profitability? | Embedded security over bolt-on security through centralized security controls and Artificial Intelligence (AI)-based threat analytics within VDI |

| Encroaching fintech startups, reshaping traditional BFSI | Venmo’s users increased by 11% year over year in 2022, while the traditional bank growth on average is about 2-5% | – Increased pressure for collaborations between fintech startups and traditional banks

– M&As leading to business process changes |

How can enterprises seamlessly transition to new business models and strengthen collaborations? | On-demand desktop infrastructure scalability and seamless integration across enterprises through VDI and DaaS |

Source:

Everest Group 2023

Empowering BFSI Organizations through DIT

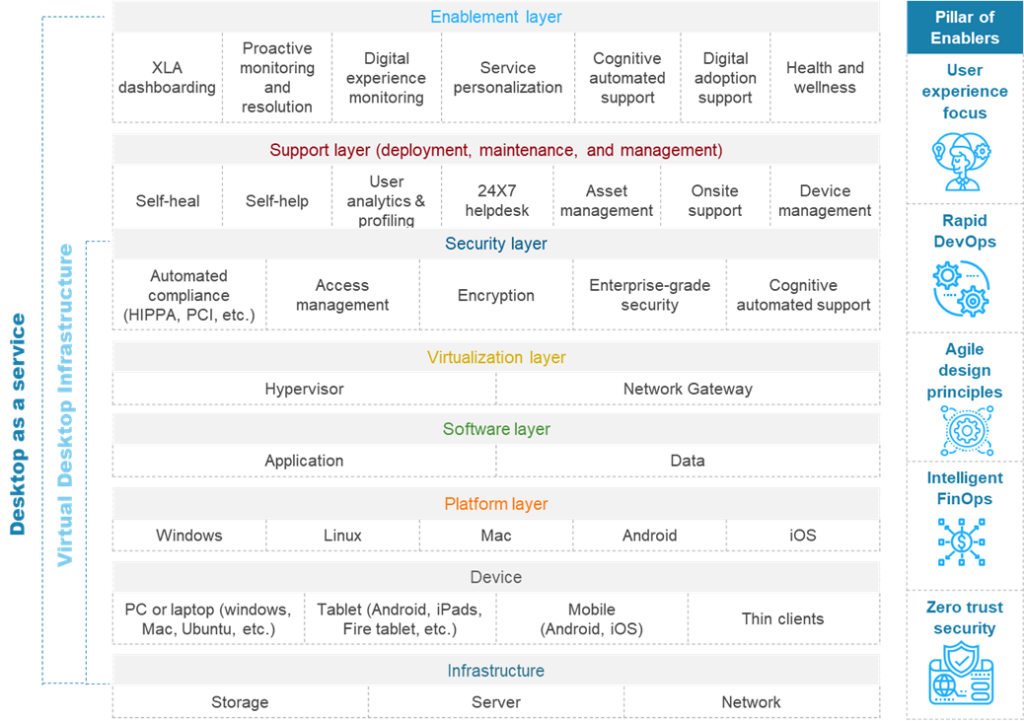

To better understand the composition of VDI and full-stack DaaS in a typical enterprise environment, the below framework provides more detail of the two previously defined key DIT components and their enablers:

Note: The above framework is not an exhaustive representation of all the components within DaaS and VDI.

Source: Everest Group 2023

Now, let’s take a look at the benefits of this transformation initiative by exploring some applications of DIT that ideally align with the needs of the BFSI sector:

- Cost optimization: With agile capacity management, increased device lifespan, and a pay-as-you-consume model, BFSI organizations can achieve cost efficiency while maintaining desktop infrastructure quality

- Single pane of observability: AI-led analytics, synthetic bots for application performance testing, and proactive alerts help IT resources within a BFSI enterprise effectively monitor and manage their desktop infrastructure, achieving operational excellence

- User empowerment: Personified Virtual Machines (VMs), a self-help marketplace, and DevOps-based feature development enable organizations to empower their end users and improve their experience

- IT efficiency: Scalable architecture and limited upfront investment support expansion to alternative business models, geographies, and product lines. Cloud-hosted models also allow firms to seamlessly integrate with other IT stacks during mergers and acquisitions (M&As), and divestitures

- Security and reliability: Automated patch management, trust zones, centralized security controls, and role-based access are some DIT features that enable continuous compliance with industry regulations and help BFSI enterprises avoid security breaches

Making DIT Real for BFSI Enterprises: Balancing Stability and Change

Let’s walk through the following use cases of DIT in various BFSI segments to demonstrate its value for employees ranging from investment traders to data scientists and knowledge workers:

| Use case 1: Ensure zero downtime in a trading environment | Scope: DaaS | ||||

| Industry: BFSI | Sub-segment: Investment banking | Category: Emerging | Persona: Power worker (traders) | ||

The business need:

|

DaaS Benefits:

|

||||

| Use case 2: Facilitate data-driven, rapid decision-making | Scope: VDI, DaaS | |||

| Industry: BFSI | Sub-segment: All | Category: Emerging | Personas: Data scientists, business analysts | |

The business need:

|

Benefits:

|

|||

| Use case 3: Realize synergies from M&A activities sooner | Scope: VDI, DaaS | |||

| Industry: BFSI | Sub-segment: All | Category: Prevalent | Personas: Knowledge workers and power workers | |

The business need:

|

Benefits:

|

|||

These use cases demonstrate the substantial value DIT offers in addressing the vital requirements of the BFSI sector and mitigating market disruptions. Several key benefits of DIT include cost optimization, operational excellence, user empowerment, and enhanced IT efficiency.

Yet, it is essential to recognize and thoroughly assess the associated risks of this technology, such as user acceptance and training challenges, as well as potential dependencies on network infrastructure. By carefully evaluating these factors, enterprises can make informed decisions about investments like DIT aimed at enhancing the IT infrastructure and diminishing market disruptions.

Ultimately, however, understanding the risk of inaction is critical. As Tony Robbins, life coach and author, aptly notes, “Risk comes in many forms, but the most common one is simply not investing.”

To discuss Desktop Infrastructure Transformation, contact Prabhneet Kaur and Udit Singh.