Blog

Geo-Specific Insights and Emerging Trends in Global Wealth Management: How Technology Providers Are Transforming the Global Landscape

The global wealth management industry is undergoing a seismic shift, as regional nuances increasingly shape market strategies.

With the rise of digital transformation evolving client demands, and regulatory complexities, regions across the globe present distinct opportunities and challenges.

At the heart of this evolution are technology providers, enabling tailored solutions to meet the unique needs of each geography.

This blog explores regional trends, the role of leading technology providers, and publicly announced deals that exemplify these dynamics, read on to find out more.

Reach out to discuss this topic in depth.

North America – Focus on digital innovation and high-net-worth individuals (HNWI)

North America continues to dominate the global wealth management market, driven by its mature client base and an emphasis on HNWIs. The region prioritizes digital advisory platforms and seamless client engagement tools, with firms increasingly leveraging artificial intelligence (AI) and data analytics to offer hyper-personalized services.

Leaders such as Broadridge and FIS are spearheading this transformation. For example, Broadridge has integrated AI-powered solutions to enhance portfolio management and client advisory capabilities. Recently, the company has also partnered with leading financial institutions to deploy its wealth management platform, exemplifying the region’s emphasis on technological agility. Similarly, FIS’s expansion of cloud-native wealth solutions showcases its commitment to scalability and innovation.

UK – Driven by hybrid advisory models and regulatory focus

The United Kingdom’s wealth management sector on the other hand, is heavily influenced by stringent regulatory requirements and evolving client expectations. Hybrid advisory models, which combine human expertise with digital tools, are gaining traction in this market.

Prominent players like FNZ and SEI are key drivers in this space. FNZ’s end-to-end platform simplifies compliance and enhances operational efficiency, while SEI focuses on scalable technology solutions, tailored to the UK market.

FNZ recently collaborated with leading banks to offer ESG-compliant investment portfolios, highlighting its innovative approach, while SEI’s partnership with boutique wealth firms underscores its flexibility in catering to diverse client needs.

EMEA – Transforming with sustainability, innovation, and governance

The wealth management landscape in EMEA is shaped by evolving client expectations and a focus on diversification. In Europe, firms are prioritizing Environmental, Social, Governance (ESG)-aligned portfolios and leveraging AI-driven platforms and data analytics, in order to deliver hyper-personalized advisory experiences.

Thematic investments, including sustainable energy and technology-focused portfolios, are gaining traction, reflecting the region’s sophisticated investor base.

In the Middle East, intergenerational wealth transfer and the rise of Sharia-compliant investment products are driving growth, alongside increasing demand for global real estate and private equity opportunities.

Wealth managers in the region are adopting hybrid advisory models, balancing traditional relationship-driven approaches with digital tools to engage a younger, tech-savvy clientele.

Across Europe, the Middle East and Africa (EMEA), regulatory frameworks continue to play a crucial role, fostering transparency and accountability while shaping the future of wealth management. These trends highlight the region’s diverse and dynamic approach to addressing the needs of its unique client segments.

APAC – Fueled by mass affluents, wealth transfer, and mobile-first solutions

The Asia-Pacific (APAC) region is rapidly becoming a key growth market for wealth management, fueled by the rising mass affluent segment and significant intergenerational wealth transfer.

Mobile-first platforms and scalable solutions are crucial in addressing the diverse needs of this dynamic client base. Japan, for example, is seeing a shift toward digitization in wealth advisory, with a focus on catering to aging populations while engaging younger, tech-savvy investors.

In markets like India and Southeast Asia, wealth managers are tapping into opportunities presented by first-generation wealth creators, leveraging personalized robo-advisory tools and hybrid advisory models.

Additionally, thematic portfolios such as technology-focused investments and healthcare related assets are increasingly popular, aligning with the region’s evolving investor priorities. These developments underline APAC’s strategic role in shaping the future of global wealth management.

LATAM – Localized Solutions and Family-Centric Wealth Management

Wealth management in Latin America is increasingly shaped by localized, culturally nuanced solutions that cater to the region’s linguistic and social diversity.

Family-centric wealth strategies, including the rise of family offices, reflect the strong emphasis on legacy and community, while fintech-driven platforms are expanding access to emerging affluent segments with tailored, mobile-first offerings.

Providers in Latin America are increasingly leveraging localized messaging and culturally sensitive advisory practices to appeal to a clientele that values personal connections and community ties. This focus on nuanced communication and cultural alignment sets wealth management providers apart in a region as dynamic and diverse as Latin America.

Insights from the Wealth Management Products PEAK Matrix® Assessment and key regional trends fueling growth.

The wealth management landscape is marked by the rapid adoption of digital tools, personalized client experiences, and a heightened focus on sustainability.

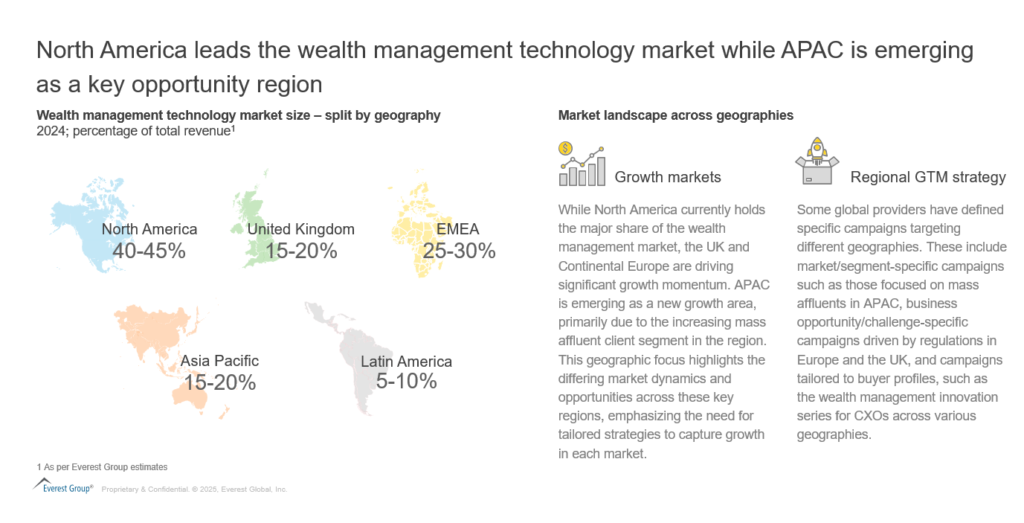

Market segmentation reveals significant regional nuances. North America leads with a commanding 40-45% of the total market, followed by Continental Europe at 25-30%, the United Kingdom at 20-25%, and the Asia-Pacific region emerging with 15-20%. These figures underscore the need for geography-specific approaches.

Several key themes are driving regional strategies in wealth management. Technology-driven personalization is reshaping client engagement, with hybrid advisory models and AI-driven insights becoming central to operations.

Regulatory-driven adaptation is particularly evident in the UK and Europe, where compliance requirements influence technology adoption. Innovation in ESG investing is a central theme in Europe and North America, as wealth managers strive to meet growing investor demands for sustainability.

Technology providers driving innovation in wealth management

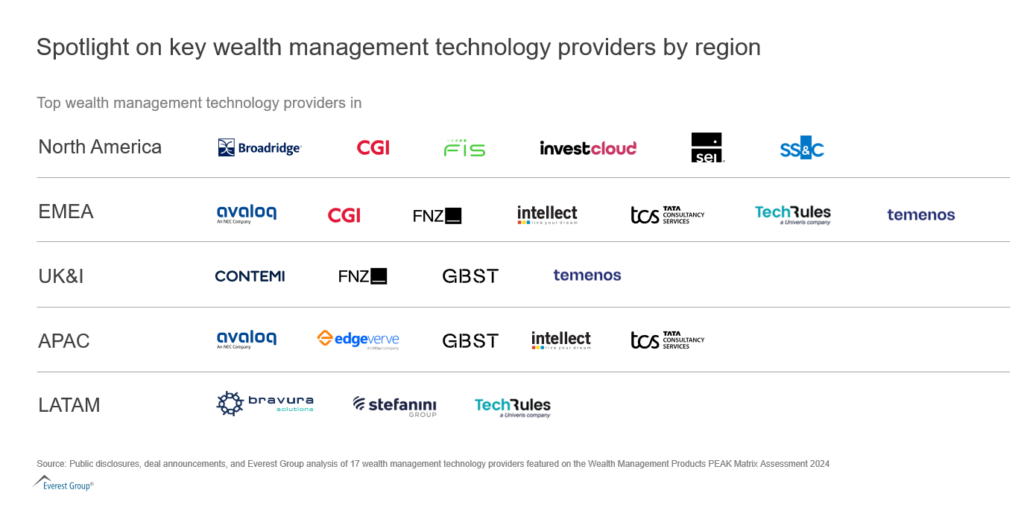

Technology providers are shaping the future of wealth management by addressing region-specific needs. Providers such as Broadridge, Avaloq, and Temenos are known for their innovative platforms.

Broadridge’s AI-powered advisory tools and robust platforms enhance advisor-client relationships. Avaloq’s integration of cloud-based solutions also enables real-time wealth management insights, while Temenos specializes in modular platforms that adapt to regional needs, with a focus on open banking.

FNZ and SEI deliver end-to-end platforms tailored for compliance and operational efficiency, while CGI bridges traditional wealth practices with modern digital solutions. Intellect Design Arena and GBST leverage innovative solutions to address specific market challenges. Intellect Design Arena’s innovative approaches to client onboarding and GBST’s cost-effective tools for smaller firms exemplify their contributions.

Future of wealth management

The wealth management industry’s future lies in understanding and addressing regional dynamics. From North America’s emphasis on personalization to Europe’s ESG-driven approaches and Asia-Pacific’s scalability needs, each region presents unique challenges and opportunities.

Technology providers are at the forefront, driving innovation and market growth. As the industry continues to evolve, tailored regional strategies and partnerships will remain critical to success in 2025 and beyond.

For a closer look at the leading providers shaping the wealth management technology, explore our Wealth Management Products PEAK Matrix® Assessment 2024 report.

If you found this blog interesting, check out our From Banking Giants To Tech Innovators: FNZ’s New Leadership, 1-billion-dollar Investment, And Its Impact On The Wealth Management Industry | Blog – Everest Group blog, which delves deeper into another topic regarding wealth management.

To learn more about wealth management, please contact Ronak Doshi, ([email protected]), Kriti Gupta, ([email protected]), and Pooja Mantri, ([email protected]).