AI is Reshaping CX in Banking: Why CX Providers Must Evolve Beyond the Front Office | Blog

Customer Experience (CX) services have long driven transformation in Banking And Financial Services (BFS), but artificial intelligence (AI), especially Generative AI (gen AI), is rapidly changing how customer interactions are delivered.

In BFS, tasks such as tier-1 query resolution for account servicing, proactive borrower communication, and the personalization of product offers are increasingly managed by AI, reducing the reliance on large-scale human support and reshaping how banks approach both efficiency and engagement.

But rather than viewing this as a threat, CX providers now have a unique opportunity to pivot, expanding their value proposition beyond front-office services and becoming strategic partners in digital operations.

Opportunities are emerging in high-impact BFS back-office areas such as Financial Crime and Compliance (FCC) and lending operations domains that demand both efficiency and domain expertise. This is not the end of the CX journey, but a turning point toward broader, outcome-driven transformation, as we discover below.

Reach out to discuss this topic in depth.

AI has changed the rules CX needs to change the game

One of the most profound changes AI has triggered is in how BFS enterprises define success, structure engagements, and measure outcomes, particularly around cost, efficiency and customer experience. With an increased adoption of AI, traditional CX metrics like average handle time, Net Promoter Score (NPS), or Service Level Agreement (SLA) adherence would gradually be replaced or at least reframed under a more holistic, outcome-led model. Rather than asking, “What is my customer satisfaction score this month?”, enterprises will be asking, “How can I compress the customer onboarding timeline to drive a better NPS and improve conversion by X%?”

This shift is leading to a new commercial dynamic where providers are expected to:

- Co-own outcomes like loan processing turnaround time, fraud case closure rates, or dispute resolution speed

- Deliver integrated solutions, blending front-office engagement with back-office operations to unlock enterprise-wide value

- Align to OKRs (objectives and key results) instead of isolated Key Performance Indicators (KPIs), linking every function to tangible business goals. For instance,

- A back-office lending team’s performance would be judged by how fast and accurately they process applications and how that impacts customer lifetime value and net promoter scores

- FCC operations are being assessed not only by how many alerts are cleared, but how effectively risk is managed, how many false positives are avoided, and how quickly high-risk cases are escalated

This evolution is further accelerated by the emergence of agentic AI, autonomous systems that not only complete tasks but actively pursue business goals across complex workflows.

In a BFS context, agentic AI can monitor and optimize outcomes across both front- and back-office domains. For example, an agentic system supporting a loan operation might continuously refine document processing accuracy, flag credit anomalies, escalate high-risk applications, and proactively trigger borrower communications, all in the service of reducing end-to-end loan cycle times and improving approval rates. In collections, such agents can adapt outreach strategies dynamically, combining digital nudges and human interaction to improve recovery outcomes while preserving customer goodwill. These systems mark a shift from “assistive” AI to “goal-driven” orchestration of tasks and resources exactly the type of intelligence BFS enterprises now demand.

For CX providers, this represents both a challenge and a huge opportunity to move beyond labor arbitrage or headcount-based commercials and embrace value-based models that reflect their role in business success.

How AI enables the expansion into back office

AI possesses the potential for transformation. With capabilities like intelligent document processing, natural language understanding, predictive analytics, and decision automation, CX providers can now deliver services that were previously seen as outside their remit.

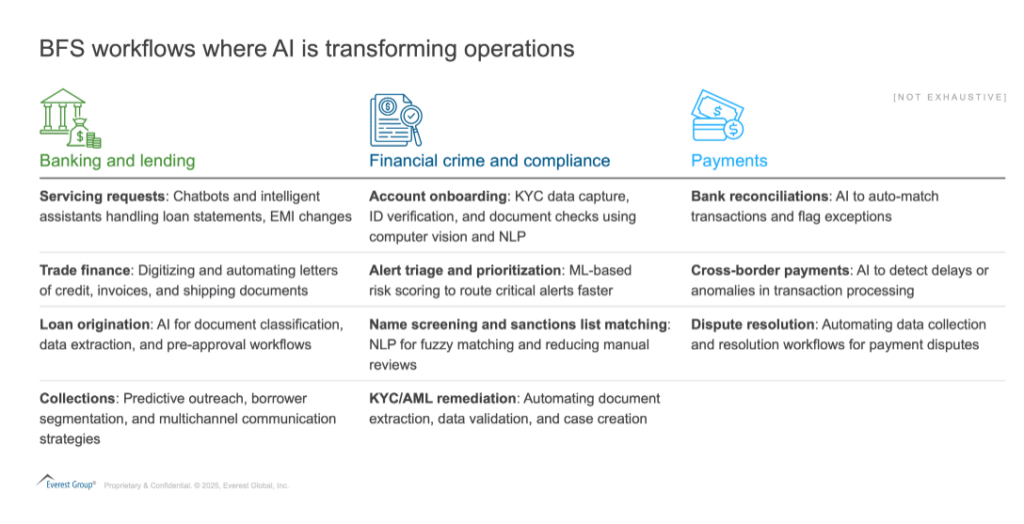

Several back-office functions in BFS are ripe for AI-led transformation, and CX providers are already starting to make inroads. Below are a few BFS workflows where AI integration is improving operations for enterprises:

A deep dive of select BFS segments is discussed below:

1. Financial Crime and Compliance (FCC)

FCC continues to be a top area of concern for BFS firms globally, with rising regulatory scrutiny, growing alert volumes, and increasing pressure to improve investigation speed and accuracy.

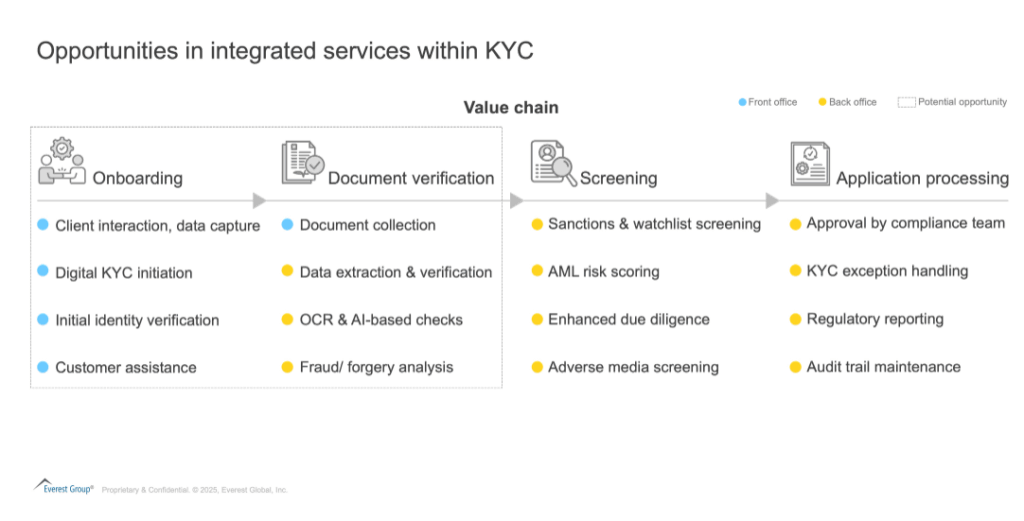

CX providers have started leveraging AI-powered tools to support:

- AI-based customer checks and fraud alerts

- Customer due diligence and a Know Your Customer (KYC) refresh

- Case management and quality assurance

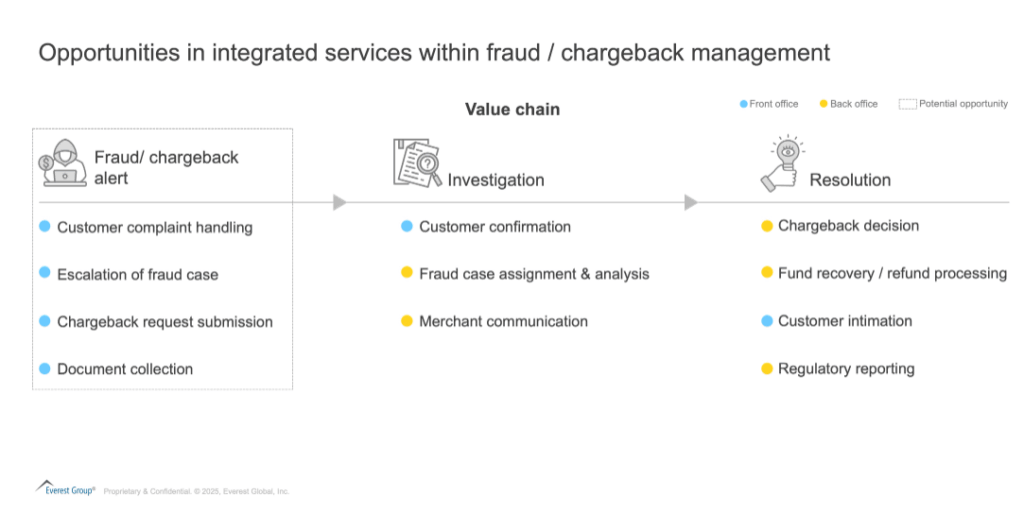

Below are a few other pockets of opportunity that front-office providers can explore within FCC:

Firms like Genpact and TCS have already embedded AI to improve false positive reduction and investigator productivity. Meanwhile, front-office providers such as Concentrix and Telus are making in-roads in this space.

2. Lending and collections operations

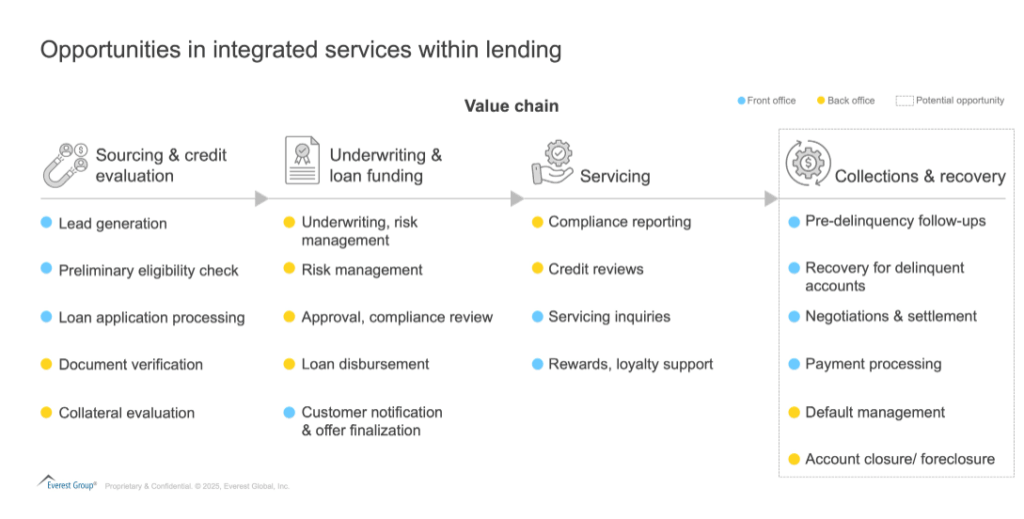

The lending value chain, from onboarding to servicing and collections, is another area seeing strong CX provider interest. With rising credit risks and delinquencies in some markets, banks are looking for smarter ways to manage collections and enhance customer outreach.

CX providers can help with:

- AI-driven borrower segmentation and risk modeling

- Intelligent collections outreach (voice, Short Message Service (SMS), chatbot)

- Agent augmentation and performance optimization

Players like Teleperformance and Alorica have dedicated team handling lending processes for their clients.

3. Mortgage processing and loan servicing

Loan origination and servicing are rich with document-heavy, rule-based processes. AI tools such as optical character recognition (OCR), Natural Language Processing (NLP), and Robotic Process Automation (RPA) enable CX providers to help BFS clients:

- Extract and validate borrower documents

- Automate compliance checks

- Streamline servicing requests and escrow management

The lending and mortgage industry offers huge expansion opportunities for front-office providers, particularly in collections, which have a front-office-heavy workflow. Mentioned below is an illustration:

From CX to holistic BFS operations partner

The global operations (back- and front-office) outsourcing market within the BFS industry currently stands at about $30 billion. The expansion into BFS back-office services is not just tactical, it represents a strategic shift in how CX providers define their value.

To succeed in this evolution, CX providers must:

- Brand themselves as holistic partners: CX players need to reposition from “call center” and “customer support” messaging to being seen as end-to-end digital operations enablers for BFS clients. They should design a Go-To-Market (GTM) strategy and offerings around business value journeys and not just SLAs or NPS

- Invest in BFS domain expertise: Compliance and lending are complex areas. Providers must hire domain specialists, train frontline staff, and develop governance frameworks to ensure credibility

- Embed AI across processes: Providers should invest in adjacencies like fraud and collections powered by the same tech stack that they use for CX: AI, orchestration, analytics

- Integrate front-to-back services: Delivering seamless experience across customer acquisition, onboarding, servicing, and recovery will differentiate providers from narrowly focused BPO or tech vendors

Final thoughts

The rise of AI in BFS is a growth catalyst. By leveraging their experience-centric DNA, embracing AI, and expanding into complex back-office areas like FCC and lending operations, CX providers can cement their role as strategic partners in BFS transformation.

This evolution isn’t just about new revenue streams, it’s about building deeper relationships with BFS clients, solving higher-order problems, and playing a more integral role in their digital journey.

If you found this blog interesting, check out our The Great Core Banking Shakeup: Why System Integrators And Consulting Firms Must Act On This Modernization Wave | Blog – Everest Group, which delves deeper into another topic regarding BFS.

If you have any questions or want to discuss more about the AI-driven BFS back-office operations, please contact Srawesh Subba ([email protected]) or Sakshi Maurya ([email protected]).