Blog

UK Banks Ramp Up Digital Banking Services and Redefine Operations. What are the Implications for the Outsourcing Industry?

Facing macroeconomic challenges and shifting consumer demands, UK banks are reimagining their operations to stay competitive. This transformation involves cost-cutting, digitalization, and a focus on core business areas. The restructuring opens new opportunities for the outsourcing industry as banks seek third-party support to drive efficiency and innovation. Reach out to us to learn more.

A wave of macroeconomic shifts and evolving consumer demand are driving UK banks to rethink their operating model. The UK financial sector is under pressure amid high inflation, lower interest margins, shrinking profits, and a rise in digital banking services. The top banks of the UK, which have historically concentrated their core business in specific segments such as lending and investment banking, are particularly jolted as the two segments witness a dry business amid the slowdown.

While there were a few banks that began strategic restructuring during the pandemic, the number of banks accelerating transformation efforts has surged in the past two years amid the slowdown. Following are the current key factors that are leading UK banks to reimagine their business:

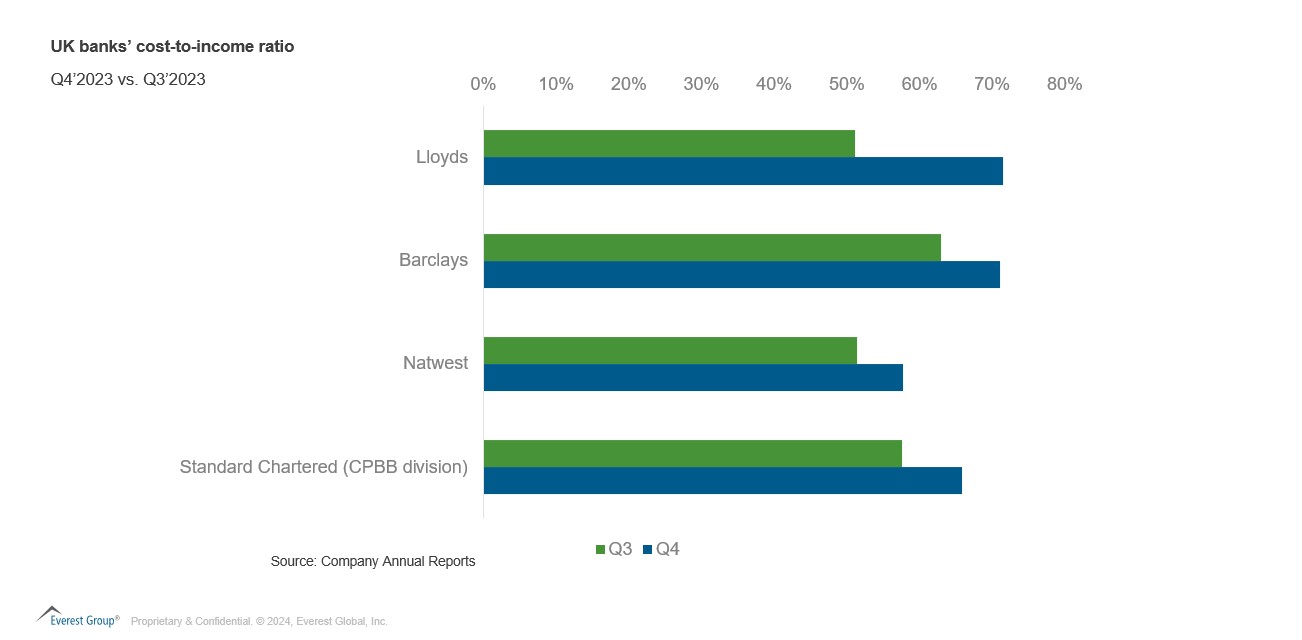

1. Cost pressure: A competition for deposits has been rising for UK banks as clients shifted to higher-rate products, while new originations have decreased amid a volatile interest-rate environment. Mortgage rates on new loans fell toward the end of 2023 due to a fall in market swap rates. Even as originations recover, lower mortgage rates imply a reduced net interest margin for banks. The cost-to-income ratio increased visibly for key banks in Q4’ 2023 when compared to Q3’ 2023, as highlighted in the exhibit below

2. The need for diversification: A few banks in the UK have begun looking at diversification of their business. Some moved toward restructuring as part of their internal strategic plan, while others, that have their revenue concentration in interest rate-reliant segments took a reactive measure amid a pressured, volatile interest rate environment

-

- In 2022, Lloyds announced that it would strive to move away from mortgages to business lines less dependent on interest rates, including wealth management and insurance

- In the beginning of 2024, Barclays announced its acquisition of Tesco’s retail banking business to further expand its presence in the segment. It was also planning to cut jobs in the investment banking segment

- In February 2024, Standard Chartered was reported to have been looking at restructuring plans for its investment banking division

3. Evolving customer needs

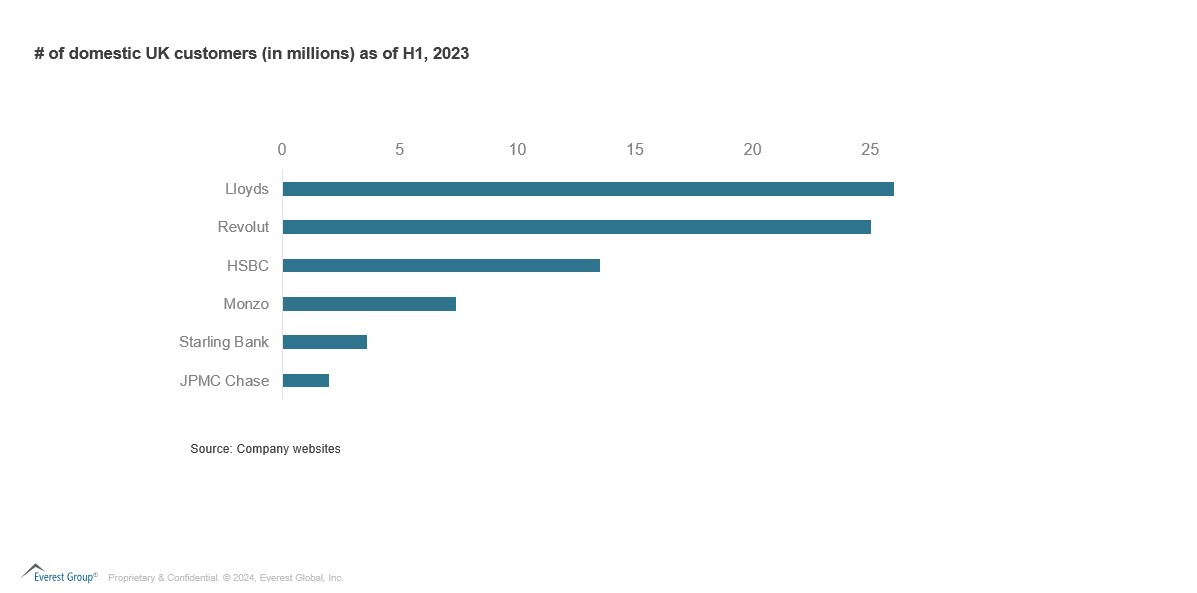

: With the rise in new-age banks such as neobanks, customers in the UK are increasingly switching to these online banks due to their services. By the first half of 2023, neobanks such as Revolut and Monzo were neck and neck with traditional banks such as HSBC when it came to the number of customers in the UK, as highlighted in the exhibit below

As the competition from these banks rises for traditional banks, leading institutions are changing the way they serve their customers. In the past two years, most of the top banks have closed their physical branches due to lesser footfall and a greater move to bring all the services online. A representative list of such branch closures is mentioned below.

| Bank | Year of shutdown | Number of branches closed in the UK |

| Virgin Money | 2023 | 40 |

| Natwest | 2024 | 98 |

| Barclays | 2024 & 2025 | 96 |

| Lloyds Bank (including Halifax and Bank of Scotland) | 2024 & 2025 | 176 |

How are banks planning to restructure their operations?

Most of the major banks in the UK have begun taking steps to align their internal structure according to market demands. While some banks are focusing on becoming digitally equipped institutions for customers, other banks are undertaking strategic measures to overhaul their business segments. A few of the examples are mentioned below:

- Digital banking services transformation:

- In 2022, Lloyds committed to a £1 billion IT spend as part of its digital transformation strategy, with an aim to increase its digitally active customers by more than 10% by 2024

- Santander UK also started its core banking digital banking services journey in 2022. It has migrated its UK commercial customers to a new digital banking platform, Gravity on Google Cloud

- Asset sale: In 2023, Metro Bank, which currently has a troubled balance sheet, was considering the sale of £3bn of its residential mortgages, but later withdrew from the decision

- Structural / leadership changes:

- In February 2024, Barclays declared an operational overhaul, including substantial cost cuts, asset sales, and the division of the business into five business segments

- In March 2024, Standard Chartered announced changes to its group management team, as part of which the leadership structure of its major divisions has been overhauled

- Switch to private ownership: Natwest is on its way to returning to private ownership, after the UK government announced in May 2024 to cut its stake to less than 23%

What does it mean for the outsourcing industry?

The UK financial industry is finally opening to outsourcing and catching up with global peers. The post-pandemic environment accelerated the digital push but slowed business for institutions. This is driving banks to transform operations through third-party support. Thus, while operations outsourcing slowed in other regions, it grew in the UK by over 10% in FY2023. With many banks still on their way to the restructuring journey, the UK poses a slew of opportunities for the outsourcing industry. Here is our take:

- The demand for technology levers such as automation and AI will rise from banks looking to become more digital

- Financially distressed banks could look for sale or carveout of their loss-making divisions to revive profits

- Banks that have restructured their business divisions may revisit their sourcing strategies. For instance, new business divisions may warrant a new sourcing plan. Meanwhile, the divisions that have come under common leadership may follow similar sourcing strategies, such as having a common vendor at both front- and back-offices

The era of transformation in the UK financial sector has brought about a diverse set of opportunities for outsourcing. In a market that has remained tough to crack in the past, this serves as a good chance for providers looking to make a headway and expand their presence in the region. For questions or to explore this topic further, reach out to Sakshi Maurya at [email protected] or [email protected].

Catch our webinar, What’s Next in Financial Services? Driving Transformation Through Sourcing, Technology, and Operations, to learn about driving business transformation in response to the macroeconomic environment, evolving customer needs, the tightening regulatory landscape, and the rapid adoption of AI and cloud technologies.