In the first blog of this three-part series, Riding the Real-time Wave: How Enterprise Demand for Payments BPS is Poised for Growth, we explored how real-time payment rails and rising customer expectations are driving up the complexity of payment operations. As a result, enterprises are now increasingly partnering with Payments Business Process Services (BPS) providers for compliance, fraud management, and round-the-clock processing.

In the second blog, Payments BPS for Conventional and Emerging Buyers: Meeting Evolving Needs in a Real-time Payments World, we examined the buyer landscape, noting how traditional payments players and newer entrants (retailers, travel platforms, FinTechs) have distinct needs and are expanding their BPS adoption.

Now, in this third and final installment, we turn our attention to how Payments BPS providers themselves are reinventing their strategies.

Reach out to discuss this topic in depth.

Market consolidation: Strategic realignments in payments

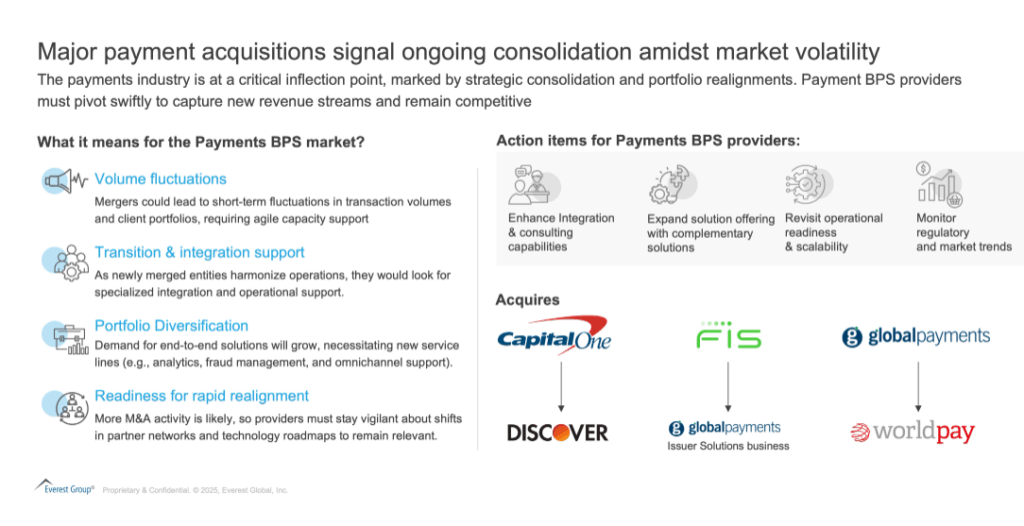

A new wave of payments industry consolidation is unfolding, with banks, card networks, and payment processors merging or acquiring peers, as shown in Exhibit 1. This activity is accelerating due to four key factors:

- Macroeconomic pressures: Volatility, rising interest rates, and cost pressures push large enterprises to optimize margins and stabilize revenue. Consolidation is often a defensive strategy in uncertain times, enabling players to scale, streamline operations, and weather market fluctuations

- Historically low valuations: Payment and FinTech asset prices have dipped from prior highs, creating a sweet spot for well-capitalized firms to snap attractive targets at lower costs. These timely acquisitions help buyers acquire critical capabilities or expand geographically

- End-to-end capabilities in a post-downturn environment: As the dust of the downturn settles, enterprises want to build complete payments ecosystems internally. By owning more of the value chain (issuing, acquiring, network operation), they can offer holistic solutions and extract higher margins

- Revenue and product expansion: Many deals aim to accelerate growth by entering new markets or launching new products. This raises demand for BPS support in enabling operations, compliance, and customer onboarding at speed

Exhibit 1: Major payment acquisitions signal ongoing consolidation amidst market volatility

Recent strategic moves are reshaping the payments landscape: Capital One’s acquisition of Discover positions it as the largest U.S. credit card issuer, integrating Discover’s network and raising antitrust considerations. FIS’s purchase of Global Payments’ Issuer Solutions business, alongside its divestment of Worldpay, reflects a strategic focus on core issuer services and capital efficiency. Concurrently, Global Payments’ acquisition of Worldpay aims to enhance its merchant services and expand global reach. These developments challenge incumbents like Visa and Mastercard to innovate and strengthen partnerships to maintain their market positions.

Implications for Payments BPS

- Integration and transition support: Newly merged entities need help unifying processes, technology platforms, and compliance frameworks. Payments BPS providers can offer integration services, data migration, and day-to-day process harmonization

- Expanded outsourcing scope: Mergers and Acquisitions (M&A) often prompts reevaluation of in-house vs. outsourced operations. BPS demand spikes when companies consolidate and seek cost efficiencies, prompting them to outsource activities such as fraud management, disputes, and customer support

- Strategic partnering for growth: As enterprises combine, they look for partners who can support larger volumes and broader services, from advisory to omnichannel support. BPS providers that invest in flexible, cloud -based delivery and domain expertise will be well-positioned to seize these opportunities

How can payments BPS providers win?

Payments BPS firms should bolster post-merger integration capabilities, stay agile to accommodate shifting volumes, and enhance service portfolios. Beyond cost takeout, they should partner with clients on innovation (e.g., co-developing analytics, artificial intelligence (AI)-driven automation, or new product lines) to become integral to the next growth wave in the consolidated payments landscape.

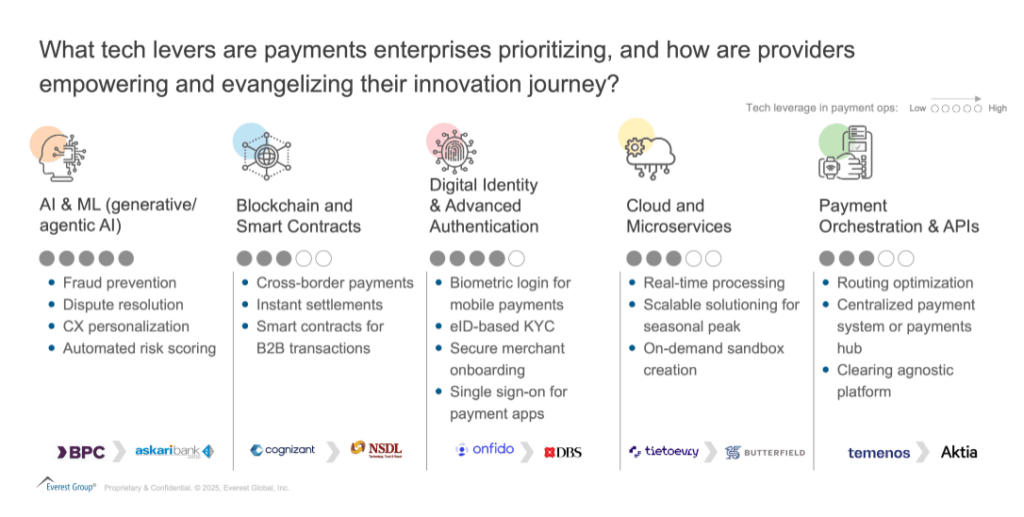

Technology levers: AI, blockchain, and microservices as differentiators

Even as market consolidation picks up, technology stands out as a prime enabler for BPS providers to offer more than just labor arbitrage. Exhibit 2 provides a compact view of how AI, blockchain, digital identity, and microservices are powering modern Payments BPS offerings.

Exhibit 2: Tech levers that payments enterprises are prioritizing in their innovation Journey

AI and Machine Learning (ML) Generative AI (gen AI) / agentic AI):

AI is transforming payments BPS by automating tasks and enhancing fraud detection. For instance, Askari Bank partnered with BPC to launch an AI-powered fraud management system that enables real-time risk control and reduces manual reviews. Beyond FCC, AI streamlines reconciliation by matching transactions across systems in near real time and supports micro-verticalization through personalized workflows for industries like luxury retail elective healthcare and subscription billing.

Digital identity & authentication:

Digital identity tech is streamlining Know Your Customer (KYC)/ Know Your Business (KYB) and customer service. DBS Bank used Onfido’s AI-based verification to hit 98% auto-approvals in digital onboarding, cutting manual effort and speeding up access.

For a deeper analysis, read our latest report on Digital Identity market opportunity here.

Blockchain & distributed ledger:

Blockchain is gaining traction for cross-border payments and smart contract automation. Some BPS players are teaming with FinTechs like Ripple to enable real-time settlement and reduce reconciliation risks for banks.

Cloud & microservices:

Cloud-native, Application Programming Interface (API)-driven architecture offers agility and easy integration. Aktia Bank adopted Temenos’s microservices-based Payments Hub to enable instant payments and consolidate payment rails across Europe.

In summary, technology is no longer an afterthought for payments BPS providers, it’s front and center in their go-to-market narrative. By showcasing AI-driven operational intelligence, exploring blockchain for next-gen payment networks, and rebuilding on digital identity, microservices and cloud, leading providers differentiate themselves as innovation partners.

AI-infused evolution of commercial and engagement models: From outsourcing to outcome-based and Business Process as a Service (BPaaS)

As enterprise buyers demand more flexibility and alignment with their strategic goals, Payments BPS providers are transforming both how services are delivered (engagement models) and how they are priced (commercial models). The result is a spectrum of options that go beyond traditional time-and-materials outsourcing.

| Engagement/delivery model | Key tenets |

| Staff Augmentation (Traditional BPO) | – Provider supplies skilled personnel, while client retains control over process and tools – This model offers quick capacity additions but can limit the provider’s ability to drive strategic transformation |

| Managed Services | – Provider runs operations on client or third-party platforms with accountability for process delivery – Key benefits include well-defined SLAs and outcomes, plus the potential for deeper process optimization as the vendor owns more of the delivery stack |

| Platform-Only Delivery | – Provider supplies the technology platform, client manages operations – Often a good fit for buyers that need advanced technology but want to maintain control of execution and talent management in-house |

| BPaaS (Business Process as a Service) | – Provider delivers both platform and operations as a bundled end-to-end service – Clients simply consume the “service” (e.g., card issuance, real-time payments, risk management) on a per-transaction or subscription basis, minimizing capital outlay |

| Pricing/commercial model | Key tenets |

| Input-Based (FTE/Time & Materials) | – Traditional billing tied to effort (number of full-time equivalents, labor hours, or resources deployed) – Straightforward but does not inherently incentivize efficiency gains or performance improvements |

| Output/Transaction-Based | – Fees depend on transaction volume or output (e.g., cost per dispute handled, cost per new account opened) – Encourages providers to streamline processes to handle higher volumes more efficiently |

| Outcome-Based | – Compensation hinges on key performance indicators (e.g., dispute resolution turnaround time, chargeback reduction rates, straight-through processing (STP) rates, or real-time payment success rates) – Aligns provider incentives with the client’s strategic objectives, fostering continuous improvement |

In practice, many deals blend these models. For instance, a managed services engagement may include a transaction-based pricing structure plus outcome-based bonuses for reducing chargeback volumes below a target threshold. Meanwhile, BPaaS arrangements often charge per transaction at tiered volumes, but might also incorporate performance metrics such as dispute resolution speed or compliance adherence.

By decoupling how payments BPS is delivered (staff augmentation, managed services, platform-only, BPaaS) from how it’s priced (input-, output-, or outcome-based), both buyers and providers gain greater clarity. This flexibility allows them to craft contracts that match their unique operational, financial, and strategic goals, ultimately driving a more collaborative and innovative payments ecosystem.

Bringing it all together: The next frontier of Payments BPS

In this era of rapid payments transformation, BPS providers are no longer just back-office problem solvers; they are co-innovators enabling global enterprises to thrive in real time. Market consolidation is expected to increase enterprise reliance on service partners for post-merger integration, while cutting-edge technologies, AI, blockchain, digital identity, and microservices, are reshaping the service delivery playbook. Furthermore, success hinges on regional adaptability and a willingness to adopt flexible commercial models that align with outcomes rather than labor counts.

Key takeaways for payments enterprises:

- Look beyond cost: Seek providers that bring digital transformation expertise and regulatory insight to handle post-merger complexities and real-time operational demands

- Align on outcomes: Explore engagement structures that tie provider success to your performance metrics – like fraud reduction or speed of service rollout

- Think global, act local: Choose partners adept at tailoring solutions to varying real-time rails and compliance mandates worldwide

- Prioritize monetization potential: Partner with providers that can help turn operational infrastructure into revenue streams, like Allica Bank’s cross-border play with Wise or JP Morgan’s digital identity solution with LexisNexis, to drive platform-led growth

Key takeaways for payments BPS providers:

- Agility is essential: Scale quickly to manage volume swings, especially following major M&A deals

- Lead with technology: Invest in AI, digital identity, cloud-native, and blockchain solutions to stand out from mere “lift-and-shift” outsourcers

- Adapt engagement models: Offer outcome-based, co-innovation led deals that resonate with clients looking for deeper, strategic collaboration

- Package for micro-verticals: Reconfigure proven capabilities into tailored service bundles that address the distinct needs of industries like healthcare, retail and Consumer Packaged Goods (CPG), and travel and hospitality helping payment enterprises serve their end clients better

Consolidation pressures, technological leaps, and surging demand for real-time, frictionless payments have converged to shape a new frontier in payments BPS. As we conclude this series, the overarching theme remains clear: the future belongs to providers that can seamlessly integrate operations, embrace advanced tools, tailor solutions to local markets, and partner with clients on true co-innovation. Those who execute well on these fronts will be ideally positioned to drive – and profit from – the ongoing real-time payments revolution.

For an in-depth analysis of payment trends, explore our recent reports:

If you found this blog interesting, check out our The Great Core Banking Shakeup: Why System Integrators And Consulting Firms Must Act On This Modernization Wave | Blog – Everest Group, which delves deeper into another topic regarding BFS.

For insights from our Payments BPS experts or to schedule a consultation, connect with Ronak Doshi ([email protected]), Suman Upardrasta ([email protected]) and Ritwik Rudra ([email protected]).

Stay tuned for the publication of our inaugural Payments Operations Services PEAK Assessment 2025, set to be released later this quarter.