Blog

Payments Modernization: It’s Now or Never

The rapid shift to digital payments due to the recent COVID-19 pandemic has accelerated the need for banks to modernize their antiquated payments infrastructure as demand rises for contactless payments and automation of accounts payables.

While banks’ corporate and retail customers have constantly strived for faster and secure payment experiences to ensure seamless business operations and fulfill commerce needs, now is the time to act.

According to GlobalData, in the next decade, 2.7 billion transactions worth $48 trillion will shift away from cash to cards, interbank payments, and alternative payments instruments. This can be attributed to changing customer demands in this digital era, where users want immediate execution, security, transparency, and a low-cost and omnichannel payments experience.

Payments modernization is also a key imperative for banks as the industry transitions to real-time payments infrastructure. Across the globe, government and private organizations are collaborating to launch real-time payment schemes to support innovation in low-cost multi-currency payments processing. This is pushing banks to invest in the consolidation of fragmented legacy payments systems to achieve interoperability and support these payment schemes.

Regulations also are creating pressure. Market infrastructures such as the Federal Reserve, The Society for Worldwide Interbank Financial Telecommunication (SWIFT), European Central Bank, and Bank of England have announced the go-live date for the ISO 20022 payments messaging format. ISO 20022 will become the de-facto standard by 2025 for high-value payments systems of all reserve currencies. As banks face compliance deadlines for ISO 20022, they need to invest in convertors or translation systems to upgrade their existing payments infrastructure that cannot support the new messaging format and leverage opportunities it presents.

On top of this, the cloud-native and integrated platforms offered by BigTechs and FinTechs to disrupt the digital payments industry are also forcing banks to rethink their payments strategies. As central banks do not completely regulate these new market entrants, they have more freedom to innovate in the payments market. They can leverage their customer base to commercially distribute payments to end-users and utilize payments data to build other profitable overlay services.

Key Considerations for Successful Payments Modernization

As banks face the triple mandate to meet customer requirements, comply with emerging payment regulations, and control costs, it has become imperative for them to either build a proprietary system or leverage a third-party modular payments platform.

Banks should keep the following in mind in their modernization journey:

- Take a phased migration approach – Ripping and replacing the entire payments system in a single project may lead to a failed attempt and higher costs. Select an integrated platform that enables phased migration across payment types such as real-time payments or high-value transactions

- Deploy the payments application on cloud – As payment processing volumes are volatile, leverage a platform that is cloud-native and can be scaled based on business needs to ensure flexibility and operational efficiency

- Invest in agile and future-proof solutions – Select a platform that is agile enough to enable the addition of new payment types, channels, and device types. It also should be configurable to integrate payment types that create big, quick wins

- Leverage open-API and microservices-based architecture – Adopt a modular platform built on microservice architecture to launch and scale new transaction types such as Request to Pay (RtP) with Application Programming Interface (API) integrations to provide third-party payments services atop existing payment rails

- Upgrade data infrastructure to support payment innovation – Seek a platform that transforms and stores different payment messaging types into a single form (ISO 20022). This can be leveraged for analytics to drive predictive performance management and enable new payment products and data/insights services

- Embed fraud prevention and compliance across the value chain – Secure high-risk real-time payments on digital channels by investing in a platform that offers a solution for fraud prevention or provides integration of fraud management solution into the existing architecture

Investments by Payment Technology Vendors

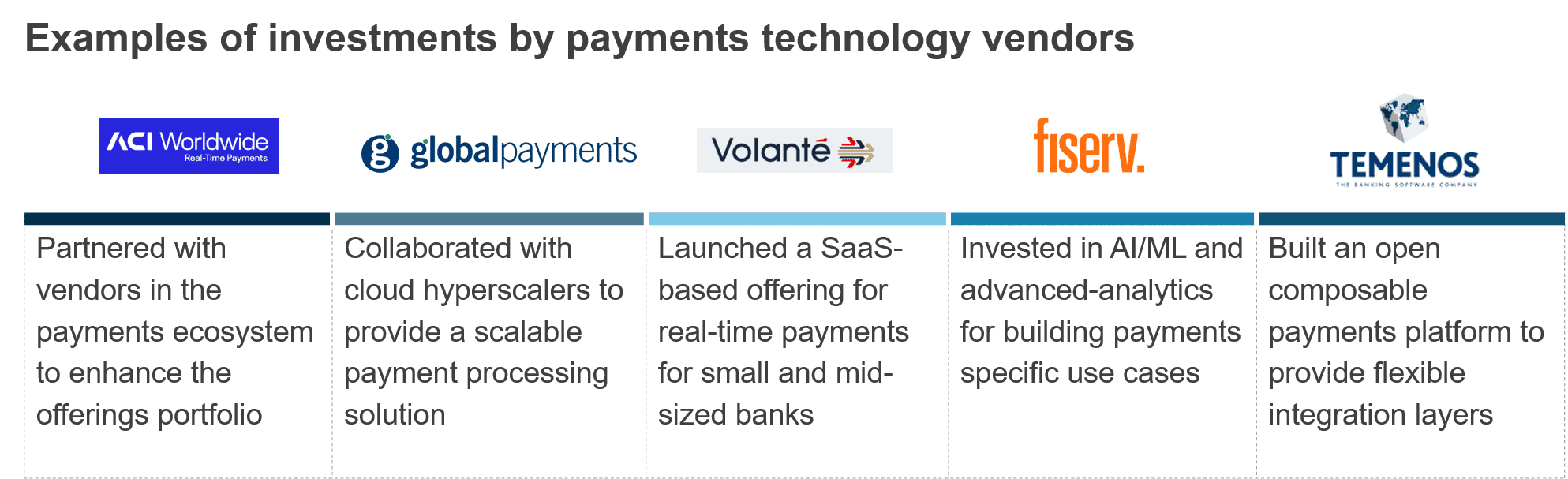

As banks undergo their payments modernization journey to bring payments innovation for their customers, reduce the cost of payments processing, and manage evolving regulations across geographies, they are leveraging payments platforms from third-party vendors such as ACI Worldwide, Global Payments, and Temenos.

These payments technology vendors are expanding their payments offerings to deliver integrated payments solutions and provide support for multiple global real-time payments schemes by investing in partnerships and augmenting their digital technology capabilities.

Some examples of these investments by payment technology vendors include:

- Partnering with other payments technology vendors to provide value-added digital payment overlay services such as in-app payments, QR-code enabled payments, and Request-to-Pay (RtP)

- Accelerating investments in cloud-based payments solutions and SaaS to enable enterprises with cost-effective, scalable solutions and reduce time-to-market for innovative payments services

- Investing in Artificial Intelligence (AI) and Machine Learning (ML) and advanced analytics-driven solutions to support banks in effective payments fraud management and bring personalization to their payment offerings

- Building microservices-enabled and open API-driven integrated payments platforms to enable banks to leverage the open payments ecosystem and provide innovative offerings to customers

In our recently released report, Payments State of the Market Report 2021: Modernizing Data, Applications, and Infrastructure for the Next Phase of the Payments Revolution, we take a deeper look at the payment technology market trends across products, experiences, infrastructure, regulations, data, and technology themes. We also study how technology vendors and service providers are gearing up their investments to cater to these demand trends.

Please feel free to reach out to [email protected] to share your experiences.