Blog

Genpact Makes Bold Digital Move | Sherpas in Blue Shirts

In the heat of battle in the services industry’s rotation from labor arbitrage to digital, Genpact made a significant move today that signals to everyone it’s playing to win. Genpact announced it signed an agreement to acquire Rage Frameworks, a leader in enterprise Artificial Intelligence (AI) and automation technologies and services. Genpact moved the cheese.

Three aspects of Genpact’s acquisition of Rage are especially significant.

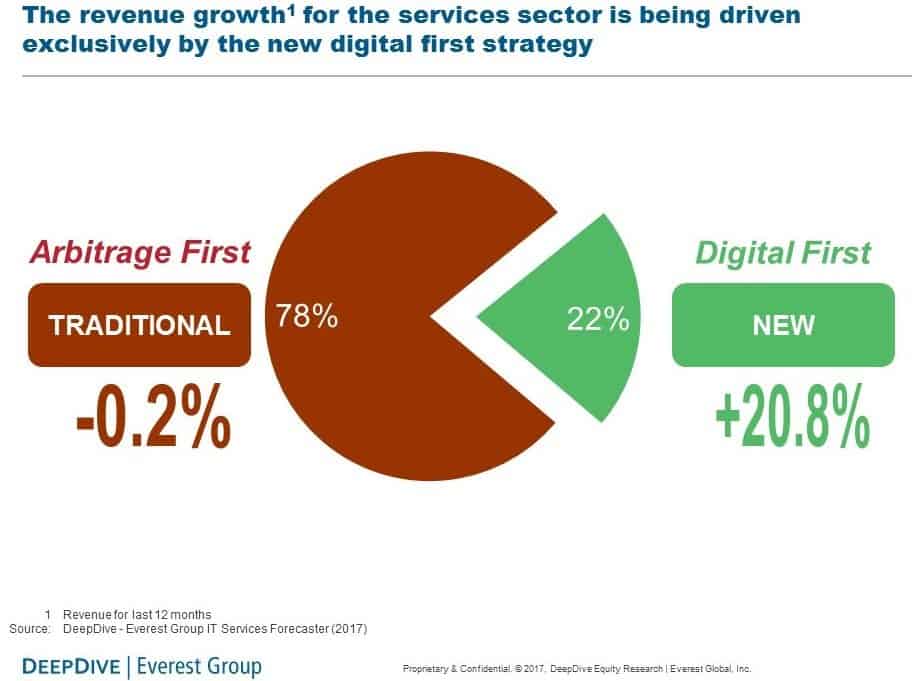

- Serious Commitment: It’s apparent that Genpact recognizes the future of services will be digital. The global services industry is witnessing unprecedented deceleration. At Everest Group, we closely track the top 20 service providers. As illustrated in the chart below, the labor arbitrage-based businesses collectively stopped growing last year and 21 percent of the industry growth is now in businesses with a digital focus.

Among the top 20 providers, growth for arbitrage-first providers actually shrank last year. As we look forward two more years, we think it will further decelerate and go to just under two percent.Accenture has rotated into digital faster than other providers, and already has the highest percentage of work in digital. It’s the biggest and is blowing other providers away. Of note, it’s the only provider that has succeeded in growing its margin while moving into digital. As I’ve recently blogged about the dilemmas at Infosys and Cognizant, for example, the rotation into digital stresses providers’ margins. The faster they grow in digital, the lower their margins are, which is very inconvenient.“Change is inevitable, but growth is optional,” wrote John C. Maxwell, leadership expert and best-selling author. With its Rage acquisition, Genpact bypasses the dilemma other providers are facing and demonstrates its seriousness and its commitment to growth in the digital space.

Among the top 20 providers, growth for arbitrage-first providers actually shrank last year. As we look forward two more years, we think it will further decelerate and go to just under two percent.Accenture has rotated into digital faster than other providers, and already has the highest percentage of work in digital. It’s the biggest and is blowing other providers away. Of note, it’s the only provider that has succeeded in growing its margin while moving into digital. As I’ve recently blogged about the dilemmas at Infosys and Cognizant, for example, the rotation into digital stresses providers’ margins. The faster they grow in digital, the lower their margins are, which is very inconvenient.“Change is inevitable, but growth is optional,” wrote John C. Maxwell, leadership expert and best-selling author. With its Rage acquisition, Genpact bypasses the dilemma other providers are facing and demonstrates its seriousness and its commitment to growth in the digital space. - Accelerating clients’ digital transformation: Everest Group’s research group conducted a study of 132 “best reference” clients of top service providers. Our study found 48 percent of clients are unhappy and 25 percent are very unhappy. A top reason for their dissatisfaction is providers’ capability of helping them with a digital restructure.Rage Frameworks presents an exciting set of technologies that are immediately applicable to Genpact’s existing client base. Leveraging Rage’s no-code development AI platform in cognitive computing, enterprises can gain real-time insights for mission-critical functions, simplify automation, manage risks better and gain competitive advantages. For the last 18 months, Genpact and Rage successfully partnered on strategic client digital engagements including a large global insurer, a global consumer packaged goods leader and several large financial institutions. Their combined capabilities will help clients drive digital transformation at scale and accelerate clients’ digital journey.

- Rebranding: The Rage acquisition also enables Genpact to rebrand itself as a digital company in the broader marketplace, not just an arbitrage service provider. Moreover, the AI capability is quickly becoming mainstream for leading enterprises as it enables organizations to change the way work is done and enhance their value proposition and competitive advantage.

Requirement for Digital Rotation Success

When an arbitrage company such as Genpact thinks about its rotation into digital, it must focus on managing three constituencies: shareholders, internal constituencies and customers.

The Rage Frameworks acquisition helps Genpact manage across all three constituencies, as follows:

- It signals to the shareholders that Genpact is serious about rotating into digital, and it’s joining companies like Accenture, which is the leader of rotation into digital.

- It equips Genpact’s internal organization with the tools and intellectual property to drive the provider’s transformation into a digital services leader.

- It helps reposition Genpact with its customer base in Artificial Intelligence and cognitive computing – a very important and quickly growing emphasis in digital capability.

Genpact’s bold move is important to watch. How many other arbitrage providers will follow this path of serious investment to accelerate their journey to become digital-first service providers?