Blog

Uncovering a Massive Insurance Industry Cloud Opportunity

Cloud computing presents a huge opportunity for insurers to drive growth, improve efficiency, and deliver innovation, among other benefits. Read on to learn about the coming phase of industry cloud and the key role system integrators (SIs) can play in advancing cloud adoption in insurance.

As insurance enterprises navigate the volatile and risky macroeconomic environment combined with recessionary market sentiment, increasing operational resiliency and agility and delivering superior speed becomes essential.

Insurers have to work effectively, efficiently, and, most importantly, smartly. The urgent demand to innovate and move beyond risk remediation to risk mitigation is making insurers realize the importance of leveraging cloud as a key enabler of growth and efficiency mandates. Let’s explore this opportunity further.

Cloud rises to the top of the business agenda for insurers

Most insurers currently rely on cloud for non-core operations while they explore stepping up to full production. While cloud’s massive potential is well known, insurance enterprises hold back from completely leveraging it for various reasons, including security concerns, integration issues, and the existing legacy stack. The inability to realize full value from cloud investments also becomes a massive roadblock.

Fortunately, the mindset regarding cloud adoption in insurance is taking a huge turn. A cloud-first approach is becoming important to insurance enterprise business leaders who find its benefits too irresistible to pass up.

In addition to helping meet cost and efficiency mandates, deriving full potential and optimizing cloud investments, and driving business-focused growth and experience are arousing interest in cloud adoption in insurance.

A recent Everest Group study on cloud initiatives with more than 75 insurance enterprises found that 70% of insurance leaders believe that cloud insurance initiatives make up more than 20% of their IT spend, as illustrated in the exhibit below.

Driving business agility and lowering the total cost of ownership has become the most important aspect of cloud transformation for insurers. Achieving data-centricity by seamlessly integrating external data with internal datasets, facilitating real-time analysis of large data volumes, and enabling data-driven decision-making across the value chain are other desires gaining prominence among insurers.

The near future is industry cloud

Slowly and gradually, innovation is taking a front seat in managing the IT estate for the insurance industry. As insurers embark on their next growth phase, they increasingly need to run industry-specific workloads on cloud, such as premium payment processing, policy administration, loss notification, multi-channel sales and distribution management, and claims management and fraud detection.

With insurers moving away from a one-size-fits-all approach, industry cloud is expected to drive the cloud spend going forward to future-proof the technology estate, monetize data to generate alternate revenue streams, and re-think value delivery to end customers. Insurance leaders have started realizing that industry cloud can be a catalyst for transforming and automating industry-specific business processes.

Industry cloud allows industry leaders to get all the assets organized in one place which are specific to the use cases of the industries they operate in. This platform is becoming the next big thing in cloud computing and insurance as it easily allows enterprises to customize processes based on usage, differentiate faster, and innovate in a better way.

SIs need to support hyperscalers and carriers to shape industry cloud

As the need to develop the industry cloud story gains prominence, the concept of co-creating also is booming. Generally, hyperscalers provide the building blocks for cloud, and SI partners assist insurers in creating and customizing specific applications and business processes on top of that foundation.

Insurers increasingly expect cloud providers to create customized and insurance-specific core solutions that address their unique needs and enable modular business processes. However, industry cloud is the missing piece in full-stack capability for hyperscalers.

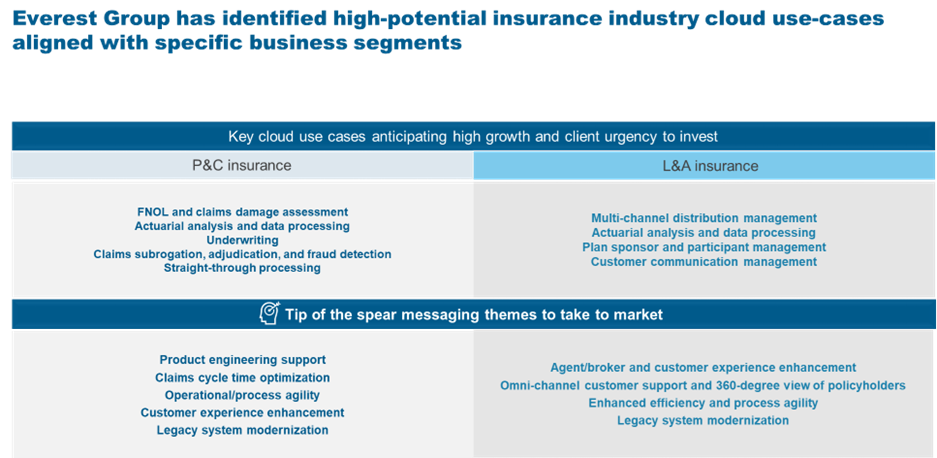

As a result, they need support from SIs to realize their vision of catering to the entire enterprise IT stack. SIs need to support hyperscalers in identifying high-potential insurance industry cloud use cases aligned with specific business segments, as shown below.

Cloud computing has moved beyond being ‘just a digital infrastructure’ to replace on-premise servers. The latest cloud services are more aligned towards integrating advanced technologies such as Artificial Intelligence/Machine Learning (AI/ML), the Internet of Things (IoT), and data analytics to transform the insurance value chain.

For example, cloud computing can take claims management to the next level by managing and automating claims handling and offering a superior claims experience. By combining cloud capabilities with data and AI, insurers can fundamentally change how they manage claims. Infusing AI/ML in claims processes can help insurers tap the plethora of data they possess and unlock immense value to come out on top.

Cloud enables insurers to reduce manual handling, lower error rates, and perform more straight-through processing, eventually leading to faster claims processing and a superior claims experience.

Everest Group research shows about 35% of P&C insurers’ priorities across claims management focused on enhancing customer experience (based on an analysis of 60-plus case studies involving claims modernization/transformation).

Cloud computing also allows insurers to drive superior efficiency by enabling data and analytics-driven claims processing and focusing on effective service delivery to reduce claims expenses and improve claims handling accuracy – all while ensuring greater customer satisfaction.

The time for insurers to go big on cloud has come

Cloud computing is no longer a choice but a mandate for insurance leaders. The insurance industry is finally catching up to the momentum of integrating SaaS into IT systems. As insurers replace outdated mainframe and on-premise infrastructure that has become harder to update and inefficient to scale and maintain, they must leverage the skills and experience SIs offer. Close partnerships between insurers and SIs also can help drive innovation and is where the future is leading.

Everest Group is launching an inaugural Cloud Services in Insurance PEAK Matrix® Assessment 2023. Please reach out to [email protected] and [email protected] for more information on cloud adoption in the insurance industry and to participate in the Cloud Services in Insurance PEAK Matrix® Assessment 2023.

You can also watch our webinar to learn about software and cloud pricing and contract negotiations and to keep spend in check.