Blog

The Battle Unfolds: MGAs as the Next Frontier for InsurTechs, Services, and Technology Providers

The Managing General Agent (MGA) sector is a bright spot in a turbulent insurance market. Technology investments and strategic partnerships will be key to redefining risk and driving innovation for these specialized insurance agents/brokers. Read on to learn more about the opportunities that await MGAs, or contact us to discuss further.

Despite the economic turmoil, global instability, prevalent inflation, and a volatile year shaking the insurance industry, faith in the MGA sector has not wavered. In this challenging environment, MGAs need to demonstrate steadfast strategic underwriting prowess, build a solid business case heavily focused on cost optimization, and exhibit excellent data and engineering capabilities.

Increasing demand for specialized products, the need to underwrite newer business lines, and a push for efficiency are driving insurers to build relationships with MGAs – all suggesting the upcoming years could be a golden era for MGAs.

The data provides a compelling sense that MGAs have a bright future ahead. Conning’s analysis of statutory filings found that premiums generated by MGAs for US insurance companies grew at a startling rate of 27% in 2022. Interest in the MGA market also has significantly rekindled in Europe and the US, gradually garnering prominence and capturing interest among carriers. Everest Group’s research shows just about half of the major US-based property and casualty (P&C) insurers utilize MGAs to cover specialized risk.

Unleashing the potential of technology

In this era of expanding MGA channels and relations, forward-looking enterprises have already made significant strides toward capitalizing on technology solutions. By strategically investing, they are enhancing the overall experience for agents, brokers, and policyholders. Simultaneously, they are seeking to enhance operational efficiencies and carve out a larger market share. Nevertheless, this merely marks the inception of a far-reaching goal, as there remains a multitude of tasks to be undertaken to fulfill the above-stated aims.

To support their vision, MGAs need modern, flexible technology that enhances customer experience and increases new business and retention. Additionally, these agents require a well-integrated and comprehensive partner ecosystem that can provide support while augmenting technical capabilities.

The prevailing economic sentiment has accelerated the trend toward investing in technology and data in more impactful ways. Regardless of MGA type, technology serves as a driving force to propel growth and enable innovation.

Clyde & Co research highlights that MGAs’ willingness to invest in technology far surpasses their insurer counterparts, with 80% of MGAs investing in technology or InsurTech in the past year, compared to only 55% of carriers. Automation, digital platforms, and data and analytics are the most prominent areas that have garnered considerable investment attention during this transformation era.

Notably, a growing number of MGAs have harnessed the potential of Artificial Intelligence (AI) and Machine Learning (ML) to optimize operational performance. Specifically, they are using these technologies to streamline and advance capabilities and underwriting processes, assess risk, and handle claims.

Digital platforms have assumed a ubiquitous presence within the MGA community, facilitating seamless engagement with customers, brokers, and carriers. They also empower MGAs to extend online quoting capabilities, expedite policy issuance, and streamline claims handling digitally.

Data and analytics play a pivotal role in delivering insights that can potentially unlock boundless possibilities in MGA’s operations. This intelligence can help them track specialized and upcoming risks that need attention, identify business opportunities for carrier partners, and develop more responsive and accurate pricing models. Additionally, these solutions can allow carriers to underwrite risks at higher margins, as well as offer more personalized coverage for policyholders.

Some examples include:

- ZestyAI, an AI-powered specialist provider of climate and risk analytics solutions, partnered with Coterie Insurance, a focused MGA, to provide instant quotes and issue small business insurance policies leveraging data and AI

- Gallagher recently partnered with Novidea to transform its services for a specialty client base and execute and tailor its broking cloud-based data platform to automate processes. The platform will save time, create efficiency, and turn data into actionable insights

MGAs: a low-hanging opportunity for the ecosystem partners

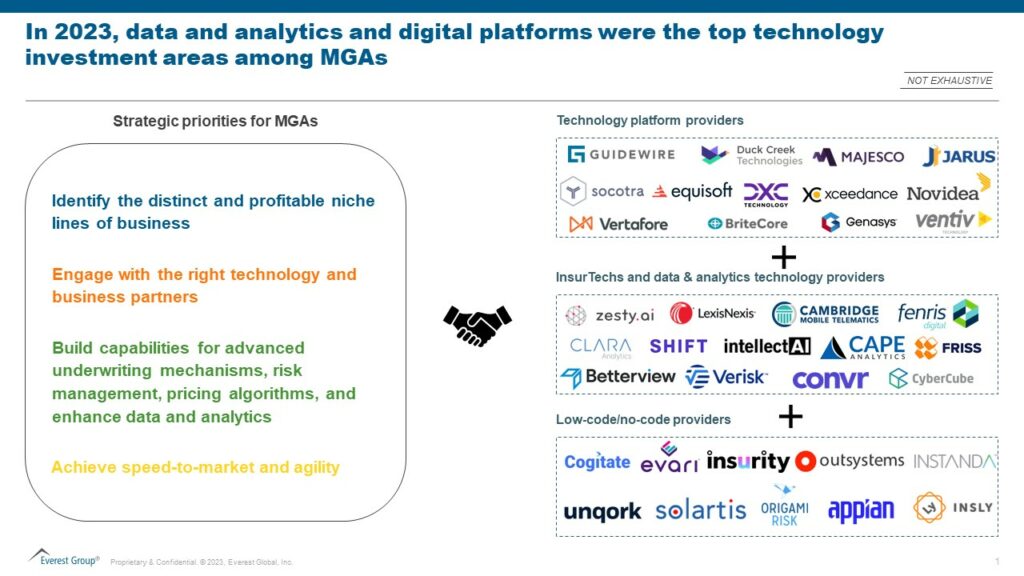

Platform and technology partners, as well as various InsurTechs and low-code/no-code providers, are making strides toward building dedicated playbooks and products to assist MGAs. Service provider partners have heavily invested in developing broader capabilities and solutions to tap into the growing technology adoption demands from MGAs.

Various platform providers such as Socotra, Majesco, Novidea, Cogitate, Insurity, and Instanda are launching cloud and Application Programming Interface (API)-based dedicated core platforms for MGAs. These platforms will help MGAs strengthen relationships with insurers, expand distribution, leverage a vast collection of third-party data and microservices for underwriting and customer experience, as well as achieve scalability. The solutions also will quickly offer products for complex insurance lines such as general liability, physical damage, auto liability, cargo insurance, and insurance for complex terrain or hard-to-underwrite commercial property.

Let’s take a look at the key strategic priorities for MGAs and an illustrative provider landscape in the exhibit below:

Emerging risks fuel further tech investments and partnerships to drive innovation and redefine risk management

The evolving risk landscape and uncertainty are major drivers for MGAs to invest in data-driven technology tools because the current models may be inadequate for the growing number, types, and complexity of risks.

While MGAs have the expertise and models to evaluate risk, the industry is failing to capture the full spectrum of potential losses, and simultaneously capture and analyze newer data sources. The historical loss data that these traditional models rely on is less useful for projecting future losses, giving rise to the need for fostering strategic collaborations with third-party data intelligence and analytics partners, as well as other technology players.

We are seeing increased traction from the MGA sector in the following product and risk segments:

- Cyber risk: The lack of historical data and inability to accurately price cyber risks remain a key challenge for traditional MGAs, leading to increasing loss ratios and declining profitability

- Many InsurTechs dedicatedly track this space such as Coinnect, helping loss adjusters, brokers, MGAs, insurers, and reinsurers handle cyber risk

- They offer a cloud platform and APIs and leverage proprietary cyber intelligence data to assess, mitigate, and respond to cyber risks of prospects and insured clients

- Excess & Surplus (E&S): The inherent uncertainty of a changing environment, which leads to extreme climate events, is a major driver of premium growth in excess & surplus (E&S) lines. According to an AM Best Market Segment Report, the direct premium for E&S lines grew by 25% to a record US$82 billion in 2021

- Parametric insurance: Parametric insurance demand also is on the upswing, requiring MGAs to pay attention and substantially invest in cutting-edge technology to develop relevant and targeted solutions

Forward-looking MGAs are progressively seeking to embrace cloud-based solutions and develop niche and sophisticated underwriting expertise as they shift their focus toward streamlining operations, driving cost efficiencies, and improving their ability for advanced risk modeling and resilience.

The MGA market is undergoing substantial transformations fueled by the desire to invest in tech, data, and AI to build robust risk selection and underwriting capabilities and foster good carrier relationships. Elevating the emphasis on bolstering the partnership ecosystem will be important, fueled by prevailing market dynamics, including faster speed-to-market, higher profitability, and maximizing value.

At the same time, focusing on emerging risk categories, growth in E&S lines, and high parametric insurance demand has created an urgency for MGAs to build close relationships with InsurTechs, carriers, service providers, platform and technology providers. This strategy will help MGAs drive value creation, capitalize on new opportunities, innovate and launch newer products to the market, and, ultimately, deliver exceptional value.

To discuss this topic further, please reach out to [email protected] and [email protected].

Don’t miss our annual webinar, Key Issues 2024: Creating Accelerated Value in a Dynamic World, to learn the major concerns, expectations, and trends for 2024.