Blog

Core Banking in the Age of Transformation: A Ride from Legacy to Modernity

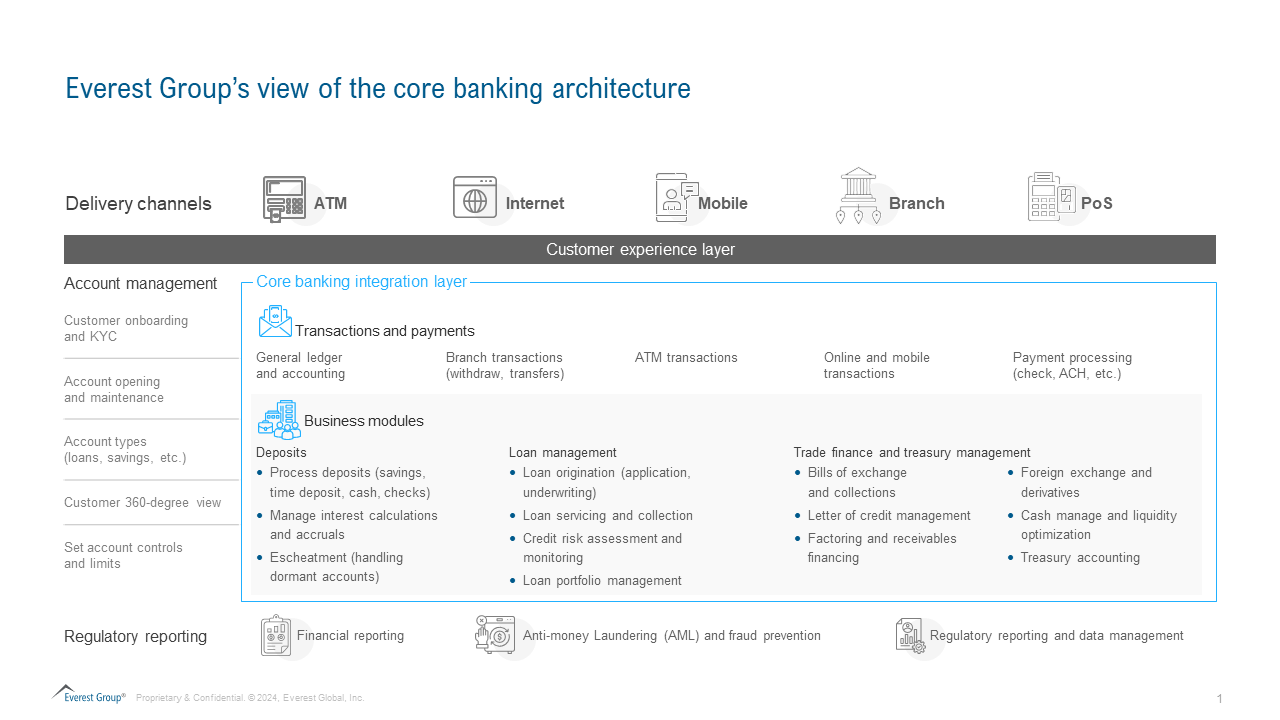

For years, core banking systems have been the backbone of financial institutions. But the landscape is shifting, and customers have high expectations. Nimble FinTech startups with cloud-based solutions are challenging traditional banks. In this dynamic environment, core banking systems are under more scrutiny than ever before. Reach out to discuss with us.

Legacy core systems, while reliable, are monolithic and struggle to meet today’s needs for hyper-personalization and real-time experiences. They’re expensive to maintain, slow to adapt, and can’t deliver the seamless, personalized experiences customers now expect. As the volume of transactions increases, the rise of open banking accelerates, and the need for real-time processing picks up, these limitations become clear.

The winds of change: M&A, strategic partnerships, and modernization

The core banking landscape is shifting. Mergers, acquisitions, and partnerships between technology providers and financial institutions are on the rise. This consolidation sends a clear message: modernization is no longer optional, it’s essential for survival. For instance, Visa’s acquisition of Pismo, a cloud-native core banking platform provider. This move strengthens Visa’s ability to offer banks next-generation solutions, while Pismo gains access to Visa’s vast network and expertise.

Banks across various markets are recognizing the need for modernization and are actively partnering with service providers to upgrade their core systems. These collaborations highlight the growing understanding that modernization is key to staying competitive and meeting evolving customer demands.

Progressive banks are adopting next-generation core banking platforms offered by leading technology providers that are:

- Cloud-native: Built for scalability and agility in the cloud, enabling banks to adapt quickly

- API-driven: Open APIs make it easy to integrate with fintech solutions, fostering a more personalized banking experience

- Microservices-based: This modular design allows for faster innovation because components can be swapped out and updated independently

Demystifying modernization: A roadmap for success

Banks are understandably cautious about core modernization due to its critical role in daily operations. Several approaches are available, each with its own pros and cons:

- Journey-led progressive modernization: This step-by-step approach prioritizes flexibility by building a digital layer around the core. APIs are exposed for better integration, while legacy parts are gradually replaced with modern microservices. Based on our conversations, this is the most preferred choice (5 out of 10 banks) as it minimizes disruption and allows for incremental changes

- Big bang replacement: A complete switchover to a new platform, a faster but riskier approach that requires careful planning and execution. Smaller banks with less complex systems often choose this route (2 out of 10 banks)

- Other approaches: Re-platforming, re-factoring, and leveraging a new tech stack for greenfield banking are other options, each suited to specific needs and risk tolerances

However, these approaches are not without their challenges. Change management and the need to decommission legacy systems can be challenging, while progressive change can result in higher costs and the need to adapt to constant technological shifts. Data migration, the availability of a scalable talent pool, vendor lock-in, and cost overruns are additional hurdles that banks must navigate.

Implications and opportunities for service providers

The core banking transformation journey presents a significant opportunity for SPs. Banks will need increased consulting and implementation support as they navigate this complex transition.

The journey-led progressive modernization approach, the most preferred by banks, is a long process that requires extensive guidance. Banks will seek expertise in areas such as modernization and decommissioning strategy, change management, data migration, talent acquisition, and system integration. This translates into a higher demand for consulting services, where providers can leverage their industry knowledge and technical expertise to guide banks through the transformation journey.

The road ahead: A collaborative future

The future of core banking is a collaborative one. Banks and SPs will need to work together to unlock the full potential of next-generation core banking solutions. By embracing innovation and forging strategic partnerships, banks can stay competitive and deliver the exceptional experiences that customers demand. This transformation goes beyond just a modernized core; it paves the way for a future of hyper-personalized financial experiences.

Currently, technology providers can participate in our Core Banking Technology Top 50™ Report assessment. We will rank technology providers based on their scale of core banking business, client geography mix, and significance within the core banking platforms market (retail and commercial). Submit a request to participate.

To learn more about core banking, contact Ronak Doshi, [email protected], Pranati Dave, [email protected], Kriti Gupta, [email protected], and Laqshay Gupta, [email protected].

Sourcing BFSI leaders can also request to join the exclusive virtual roundtable, Banking, Financial Services, and Insurance Leaders Discuss: 2024’s Top Trends in Tech and Ops Sourcing, to learn about the latest trending issues shaping tech and ops sourcing within the BFSI sector.