Blog

Understanding Strategic Investments by Decentralized Clinical Trials (DCT) Product Vendors

COVID-19 put the spotlight on Decentralized Clinical Trials (DCTs) that will last well beyond the pandemic-stricken years as the industry increasingly adopts digital solutions for conducting remote, virtualized, or decentralized trials. In this digital ecosystem, vendors need to focus on several strategic areas to provide a holistic DCT experience and stay ahead of the competition. Discover in this blog the five priorities that can help product vendors take the lead in the DCT ecosystem.

Decentralized clinical trials rose to popularity during the pandemic. As people around the world were advised to stay indoors, sponsors and Clinical Research Organizations (CROs) scrambled for an alternative solution. DCTs catapulted to the mainstream and disrupted the clinical trial landscape.

DCTs offer reduced dependency for on-site visits, increased patient convenience, and improved insights from real-time patient data. While the pandemic may slowly subside with increased vaccinations, decentralized trials are here to stay – continuously elevating the trial experience for patients, sponsors, and investigators.

Everest Group’s Decentralized Clinical Trial Products PEAK Matrix® Assessment 2021 found improving patient recruitment and retention are the top reasons behind sponsors adopting DCT solutions.

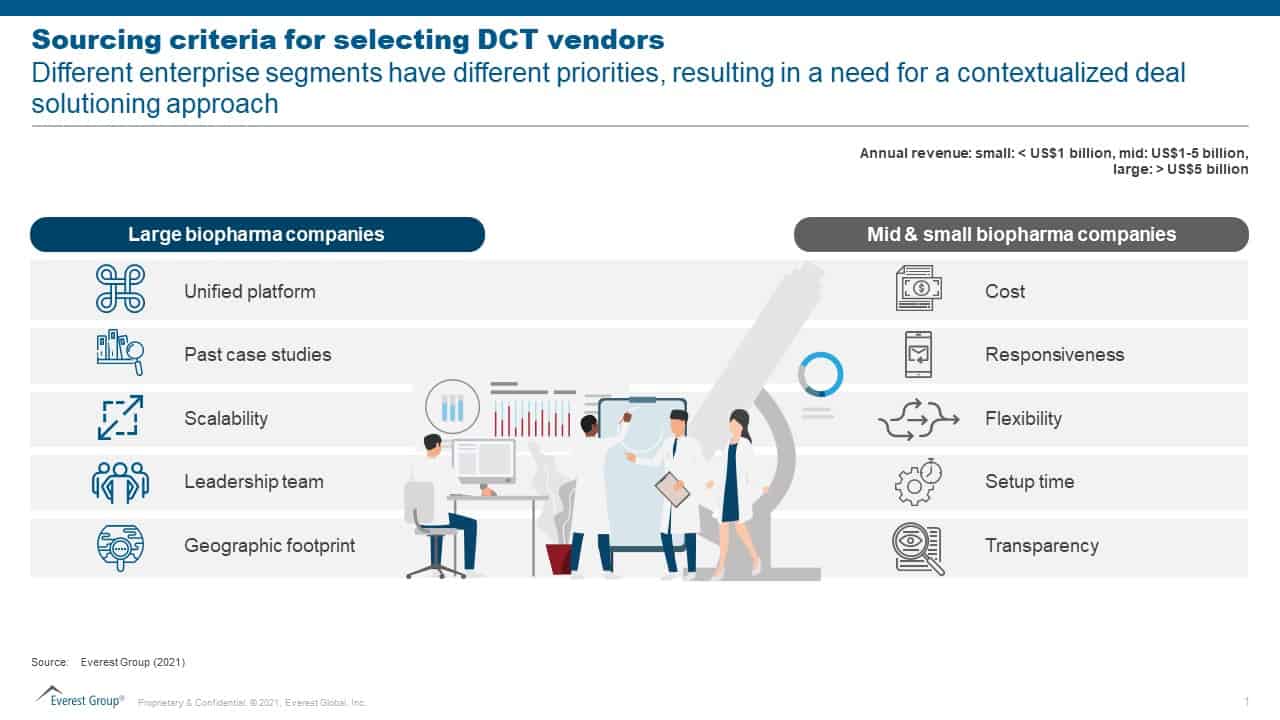

With DCT adoption growing significantly, sponsors have varied sourcing criteria based on their priorities. We have observed that large biopharma companies prefer a unified platform while mid-and small-sized players are more interested in cost as their top sourcing criteria for DCT vendors.

Biopharma companies want vendors who feel the market pulse and offer tailor-made deal solutioning for increased DCT adoption, as illustrated below.

Sourcing criteria for selecting DCT vendors

Five focus areas for DCT vendors to enhance their value proposition

To increase DCT adoption and run trials holistically, sponsors and CROs require matured technology products as well as auxiliary services. Hence, DCT vendors should not only strengthen their product offerings but also up their game in delivering auxiliary services.

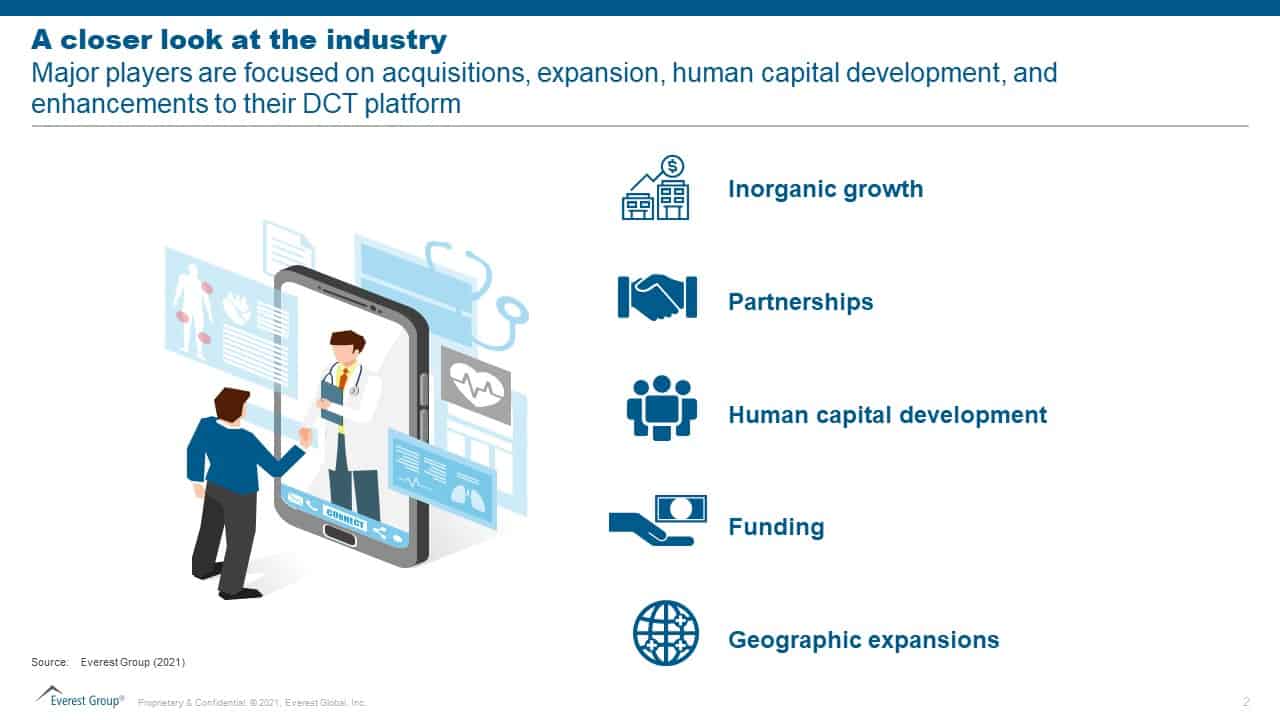

With the exponential rise in DCT adoption, new players are rapidly entering the DCT landscape. In this marketplace, how can vendors offer value and stay on top of the competition? Our analysis reveals the following five areas that can help DCT vendors elevate their offerings above others:

- Inorganic growth – Considering the speed of digital disruption in the clinical trial landscape, inorganic growth is the fastest way to grow and expand capabilities. Technology-based DCT product vendors are focusing on improving their consultative positioning by combining high-tech and high-science under one platform. Two recent examples are THREAD acquiring Modus Outcomes, an organization that supports eCOA selections, designs patient-centric trials, and fosters scientific delivery of DCTs. Similarly, Clinical Ink acquired Digital Artefacts to enrich the data coming from patient-reported outcomes with situational awareness and active and passive digital assessments

- Partnerships – DCT product vendors increasingly seek to partner with specialists to enhance the delivery of auxiliary services. These unions aim to increase trial efficacy and eliminate risks and delays while improving the experience for patients and site practitioners. Some recent deals include Science 37 collaborating with Foundation Medicine to accelerate the patient selection process for oncology trials. THREAD has entered alliances with Almac Clinical Technologies to reduce trial delays and risks and also with endpoint Clinical to simplify trial operations for site personnel

- Human capital development – Investments in human capital are either focused on designing a simple unified platform for seamless patient experience during trials or on expansion and marketing operations. This has led product vendors to add new positions like Chief Growth Officer, Chief Design Officer, Chief Strategy and Expansion Officer, etc. Medable, Science 37, THREAD, Castor, and ObvioHealth have made significant investments in hiring or opening multiple roles directly or indirectly related to DCT solutions to expand their services and establish strategic partnerships

- Funding – Multiple DCT vendors have raised significant funding to enhance their DCT program. Science 37 has recently become a public-listed company, thereby making enough funds available for DCT expansion and growth. On the same lines, Medable has secured a US$ 304 million Series D funding, taking the total company valuation to just over US$ 2 billion. It plans to use the funds to improve access to clinical trials worldwide and accelerate new drug development. ObvioHealth had raised US$ 31 million in its latest round of funding, while Castor raised US$ 45 million in its series B funding. While ObvioHealth plans to direct funding to enhance its proprietary IT capabilities and make new hires, especially keeping in mind the APAC region, Castor is focusing on accelerating trials and maximizing the impact of research data on patient lives. These activities clearly echo the positive investor sentiments towards DCT solutions

- Geographic expansions – Enterprises are looking for studies that are global or beyond the North American (NA) region, pushing DCT vendors outside their established geographies into the Europe, Middle East, and Africa (EMEA) and Asia Pacific (APAC) markets. Both THREAD and Medable have established offices in Dublin, Ireland to expand their presence and grow the market for decentralized trials in the EMEA region. ObvioHealth has partnered with Anatara Lifesciences to launch DCTs in Australia, and Science 37 has partnered with CMIC Holdings to enable and advance its DCT offerings for Japan and the APAC region

The age of decentralized trials has begun, and sponsors are shifting away from the site-anchored approach to hybrid or completely decentralized trials. They are looking to convert their piecemeal deployments into a comprehensive strategy aimed at enhancing the trial experience for patients, sponsors, and CROs.

To cater to this rising demand, DCT product vendors need to leverage advancements in digital technology and enhance their value proposition. With a deep focus on inorganic growth, partnerships, human capital, funding, and geographic expansions, providers can offer a seamless DCT experience in 2022 and well into the future.

What areas should product vendors focus on to stay ahead in the DCT ecosystem? Reach out to [email protected] and [email protected] to discuss.

Explore more information about DCT adoption trends and providers. Learn more