Blog

BNPL and the CFPB 1033 Mandate: A New Era of Transparency and Opportunity in Digital Credit

Digital Credit

In the latest supervisory overview, the Consumer Financial Protection Bureau (CFPB) has noted the rapid expansion of Buy Now, Pay Later and earned wage, access options in recent years.

The Buy Now, Pay Later (BNPL) model has gained significant prominence recently, partly due to the CFPB’s Section 1033 mandate, which emphasizes the importance of consumer access to financial data in digital credit.

This regulatory focus has accelerated the push for transparency and fair lending practices, reinforcing the legitimacy of BNPL, as a viable alternative to traditional credit options and drawing attention to its transformative potential in the financial landscape.

Reach out to discuss this topic in depth.

Driving market factors for BNPL

The explosive growth of BNPL in the U.S. is underpinned by a convergence of influential factors. Firstly, millennials and Gen Z consumers, who value flexibility, transparency, and simplicity, have driven demand for payment solutions that align with modern, debt-conscious lifestyles. Unlike traditional credit cards, BNPL offers interest-free installments, fostering its appeal among these demographics.

The rise of e-commerce has also further accelerated BNPL adoption. Seamless integration with online retailers enhances the shopping experience, reduces cart abandonment, and drives higher order values. Economic pressures, including inflation and stagnant wages, have made BNPL a compelling alternative to high-interest credit cards, empowering consumers to manage their cash flow more effectively.

Merchants are also capitalizing on BNPL to remain competitive, attract customers, and boost conversion rates. Additionally, technological innovations, such as intuitive platforms and advanced data-driven credit assessments, have broadened access to BNPL, extending its reach to consumers with limited credit histories.

Aggressive marketing strategies and social media influences have heightened awareness, while limited regulatory scrutiny has enabled rapid innovation and expansion. Collectively, these factors have positioned BNPL as a driving force in the evolution of the U.S. financial landscape.

Should large banks embrace BNPL?

Large banks cannot afford to ignore BNPL’s transformative potential either. This payment model is redefining consumer expectations and challenging traditional credit products. Younger consumers, who demand transparency and flexibility, increasingly favor BNPL over conventional credit cards. By integrating BNPL into their offerings, banks can stay relevant, address evolving customer needs, and regain market share from nimble fintech disruptors.

BNPL also provides banks with strategic advantages, such as strengthening merchant relationships by offering payment solutions that enhance customer loyalty and conversion rates. Moreover, it opens up lucrative revenue streams through interest income, transaction fees, and cross-selling financial products.

Neglecting BNPL risks losing ground in a fast-growing market and allowing fintech competitors to erode banks’ dominance within consumer finance. Embracing BNPL is not just a competitive necessity but now a critical step toward future-proofing banking operations in an evolving financial landscape.

The impact of regulatory changes

The CFPB interpretive rule issued in May 2024, mandating BNPL lenders to provide consumers with the same protections as traditional credit cards, marks a significant shift. By enforcing transparency, fair lending practices, and robust dispute resolution mechanisms, the rule enhances consumer trust and aligns BNPL products with established credit standards.

However, this regulatory alignment increases compliance costs, potentially straining smaller providers and driving market consolidation. Traditional financial institutions stand to benefit, as regulatory parity levels the playing field, creating opportunities for banks and credit card issuers to expand their presence in the BNPL market. This development underscores the need for BNPL providers to balance compliance with innovation to maintain their competitive edge.

BNPL’s outlook for 2025

Following the record-breaking BNPL usage during the 2024 holiday season, the outlook for 2025 remains optimistic. Lower interest rates create a favorable environment for consumer spending, making BNPL an attractive option for flexible payment solutions. Providers are also expanding their offerings and entering new markets, capturing both new and existing users.

The CFPB’s regulatory mandate is expected to bolster consumer trust, driving broader adoption. However, challenges such as market saturation, changing consumer behaviors, and economic uncertainties could temper growth.

While 2025 is poised for robust BNPL activity, surpassing 2024’s performance will depend on sustained consumer demand and providers’ ability to innovate and differentiate in an increasingly competitive market.

Technology priorities amid legal scrutiny

Recent legal scrutiny surrounding major BNPL players like PayPal, Affirm, and Klarna is likely to shape their technology priorities in 2025. Compliance, transparency, and consumer protection will take center stage. These companies are expected to enhance their compliance systems with automated monitoring and reporting tools to meet evolving regulations.

Efforts to make user interfaces more transparent, with clear communication of terms, fees, and repayment obligations, will help reduce regulatory risks and build consumer trust. Scalable infrastructure will be essential for adapting to evolving product offerings, such as interest-bearing options or updated payment terms. Additionally, these companies may invest in tools to educate users on responsible borrowing and financial well-being. While regulatory challenges present obstacles, they also offer an opportunity to adopt a more consumer-centric and compliance-driven approach that balances innovation with accountability.

Conclusion

BNPL is reshaping the financial landscape, driven by shifting consumer preferences, technological advancements, and economic pressures. For large banks, embracing BNPL is not just about staying competitive, but about leading innovation in an evolving market. Regulatory changes and legal scrutiny add complexity, but also present opportunities for the sector to mature and build trust.

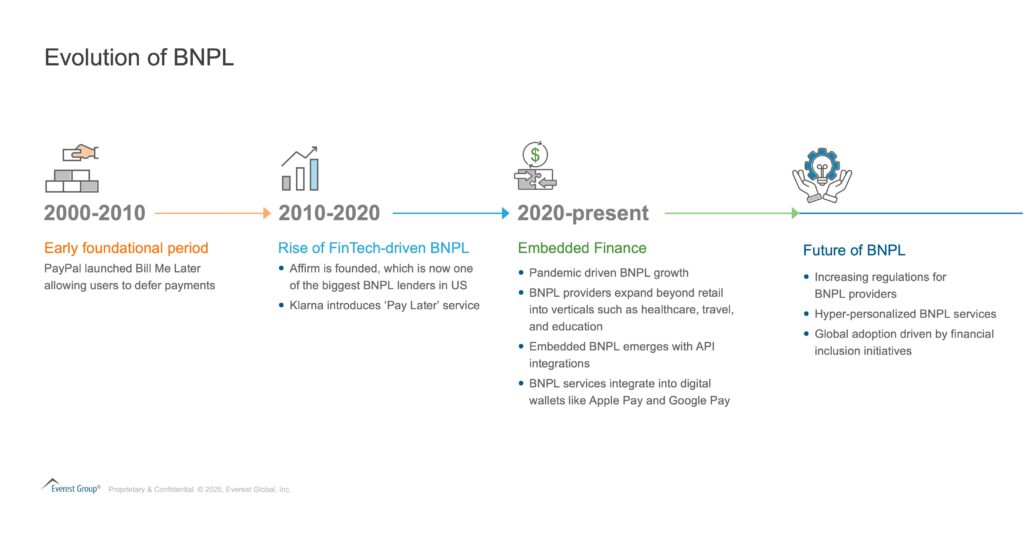

BNPL has come a long way since its inception in the early 2000’s. The exhibit below shows the journey of BNPL over the years.

As BNPL continues to grow, providers must navigate challenges like compliance costs and market saturation, while leveraging opportunities to innovate and expand. The future of BNPL lies in its ability to adapt to regulatory frameworks, meet consumer expectations, and redefine the way financial services are delivered in a dynamic market.

If you found this blog interesting, check out our blog focusing on Agentic Artificial Intelligence (AI): The Next Growth Frontier – Can It Drive Business Success For Banking & Financial Services (BFS) Enterprises? | Blog – Everest Group, which delves deeper into another topic covered by the BFSI service line.

To learn more about core banking and other topics relating to BNPL, contact Pranati Dave ([email protected]) or Saumil Misra ([email protected])