AI Impact of AI-Powered Physical Devices on Financial Ecosystems: The Next Stage of Connected Banking | Blog

We live in an era where smart devices—smartphones, smart rings, smart glasses, and even connected cars—are embedded with artificial intelligence (AI), creating new opportunities for financial services. These AI-powered physical devices are not just enhancing user experience but are also unlocking new channels for connected banking and payments, enabling seamless financial transactions across everyday interactions. Connected banking is at the core of this transformation, turning every AI-embedded device into a potential financial touchpoint.

As AI becomes deeply integrated into physical devices, it expands the scope of financial innovation through services such as micropayments, AI-driven financial assistance, and real-time credit decision-making embedded in customers lifestyle.

The Banking And Financial Services (BFS) industry is already leveraging AI, but the next wave of transformation is happening as AI extends beyond software automation into the physical world. Connected banking, powered by AI-enabled physical devices, is not just an innovation anymore—it is now a fundamental shift that will redefine financial ecosystems, unlocking new business models, channels, and revenue opportunities for financial institutions in the process.

Reach out to discuss this topic in depth.

Generative AI: transforming BFS with intelligent content and decision support

Generative AI (gen AI) , powered by Large Language Models (LLMs) such as GPT-4 and Llama, has already become a core enabler across BFS enterprises. It has transformed customer service, document processing, fraud detection, and compliance automation by acting as an intelligent assistant, automating tasks that traditionally required human effort.

However, gen AI’s influence is far greater—it is enhancing decision-making, augmenting customer interactions, enabling personalized financial recommendations, and optimizing operational workflows.

Rather than being limited to chatbots and document automation, gen AI is now becoming deeply integrated into BFS workflows. Banks are using it to create AI-driven financial models, detect fraud patterns in real-time, and even generate synthetic financial data to improve risk models without exposing sensitive customer information. This foundational intelligence is what enables the next step—autonomous financial execution and real-time, embedded financial interactions.

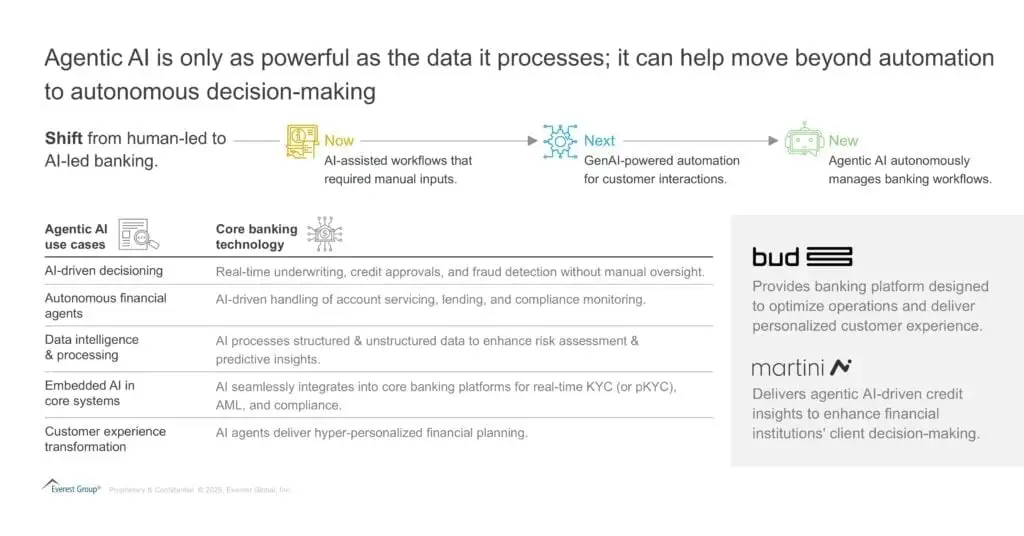

Agentic AI: from decision-support to autonomous financial execution

Agentic AI represents a shift where AI-driven agents do not just analyze data but act upon it autonomously. Unlike gen AI, which primarily assists in knowledge work, Agentic AI brings autonomy, reasoning, and adaptive decision-making to financial services. It is transforming BFS, by enabling AI agents to manage end-to-end financial workflows without constant human intervention.

For example, AI-driven portfolio management systems can autonomously monitor market trends, adjust investment strategies in real-time, and execute trades based on macroeconomic indicators. AI-powered compliance agents can detect suspicious activities and automatically file regulatory reports, reducing fraud risk and ensuring financial integrity.

BFS institutions are leveraging Agentic AI to enhance hyper-personalization, optimize lending processes, and dynamically adjust credit risk models based on evolving financial conditions.

Providers such as Salesforce, AWS, Microsoft, Google, and Automation Anywhere are already integrating AI agents into banking ecosystems, embedding intelligence into automated lending, wealth management, and real-time risk assessment.

But here’s where the shift happens: If AI is deployed on physical devices, it creates Physical AI—where the intelligence of AI moves from software applications to the real-world, through AI-powered interactions, extending AI into new financial use cases and making connected banking a seamless part of everyday life.

Physical AI: AI and the real world

Physical AI is an extension of Agentic AI, bringing AI-powered intelligence into the physical world. This is not just about robots and smart Automated Teller Machines (ATMs)—it is about embedding AI-driven financial capabilities into everyday devices and industrial applications.

The power of physical AI: beyond traditional banking

-

- Connected banking in smart devices: Are smart rings, connected cars, and wearables embedded with AI that enable real-time financial transactions, automated payments, and seamless banking services. Advancements in 6G will bring more smart devices around banking customers in their everyday life, all being beacons of consuming products/services and interacting with the financial services ecosystem

-

- Autonomous business transactions: AI-driven systems in smart factories and warehouses that automate supply chain payments, optimize treasury functions, create intelligent automated billing workflows, and predict financial needs based on operational workflows

-

- Embedded financial services in Internet of Things (IoT): Devices that dynamically interact with banking ecosystems, allowing real-time credit decisions, automated compliance checks, and AI-led investment strategies

-

- Smart retail & embedded finance: AI-driven checkout systems and autonomous Point of Sale (POS) solutions that integrate seamlessly into financial networks for frictionless, real-time transactions

-

- Next-gen sharing and gig-economy: Financial services firms need to be ready to support the growth in the short-term rentals of these AI-powered physical devices and the gig workers offering services around these device ecosystems

-

- Tokenization of assets: The ability to tokenize the cash-flow generated by these AI-powered devices across Business-to-Business (B2B) and Business-to-Consumer (B2C) industries will spawn further growth in the alternative asset market as these devices growth will depend on a strong funding ecosystem

BFS enterprises must recognize that Physical AI is accelerating financial automation and innovation by expanding connected banking into physical environments. This is a major opportunity for financial institutions to rethink product strategies, redefine digital experiences, and develop AI-powered banking solutions that integrate directly into consumer and enterprise ecosystems.

Where are enterprises investing today?

Many BFS organizations are moving beyond just AI-powered use cases—they are investing in AI governance, AI talent, data ecosystems, and Centers of Excellence (CoEs), in order to build sustainable AI-driven financial ecosystems. The focus is now shifting from experimenting with AI to creating the necessary infrastructure to scale AI adoption across all touchpoints.

Key areas of BFS AI investments:

-

- AI governance & risk management: Ensuring ethical AI deployment, regulatory alignment, and risk mitigation for AI-driven decision-making

-

- Building AI talent & CoEs: BFS enterprises are investing heavily in AI training, upskilling, and specialized AI teams to drive AI-led innovation

-

- Developing financial AI infrastructure: Firms are prioritizing data lakes, AI-powered analytics engines, and real-time AI monitoring systems

-

- Expanding AI in connected ecosystems: BFS organizations are partnering with IoT, robotics, and AI hardware providers to embed AI into financial services

BFS firms recognize that AI transformation is not just about deploying AI models, but about fundamentally restructuring AI-driven business processes, in order to drive automation, enhance customer experience , and unlock new revenue streams.

Big message: rethink financial services with AI-enabled devices

Physical AI is focused on accelerating financial enterprises by transforming how financial services are delivered, consumed, and embedded into everyday life. The presence of AI in physical devices means enterprises must rethink:

-

- Product and services innovation: AI-powered financial products tailored for smart connected devices and embedded IoT ecosystems

-

- Channels & customer experience: AI-driven connected banking solutions that create seamless, intuitive financial interactions

-

- Financial ecosystem strategy: Moving beyond traditional banking to AI-enabled, decentralized financial ecosystems where AI-powered devices become the new banking touchpoints

-

- Managing evolving risk, security, and compliance mandates that go along with the growth of these new products and channels

AI is no longer just a tool for optimizing operations—it is a fundamental enabler of new financial experiences. With Agentic AI powering connected devices, BFS firms must rethink their role in a world where financial services are not just provided by banks—but by AI embedded in every single smart device that consumers interact with.

Connected banking, powered by AI-driven smart devices, is redefining the financial landscape. The BFS industry must embrace this shift—not just as an operational upgrade, but as an entirely new way to engage with customers, embed financial services into everyday life, and build the next-generation AI-powered financial ecosystem.

If you found this blog interesting, check out our Agentic Artificial Intelligence (AI): The Next Growth Frontier – Can It Drive Business Success For Banking & Financial Services (BFS) Enterprises? | Blog – Everest Group, which delves deeper into another topic regarding the banking and financial sector.

If you have more questions regarding the impact of AI-powered physical devices on financial ecosystems, or if you need help in answering questions regarding any of the above, please feel free to reach out to Ronak Doshi [email protected] and Laqshay Gupta [email protected]