Blog

Strong Performance in US GBS Model Expected to Continue in 2021

New Market Report Shows Digital Services Among Trends Driving GBS Growth

Despite the massive spread of COVID-19 across the US, the Global Business Services (GBS) model continued to grow in this market in 2020, demonstrating that the model, in its many different forms, continues to be integral to enterprise sourcing strategy.

Building on the success over the last two to three decades, GBS organizations diversified extensively and experienced growth in new verticals (such as healthcare and life sciences) and functions (such as legal, R&D, and digital).

Everest Group’s US Global Business Services Market Report provides an extensive assessment of the US GBS landscape and adoption trends, along with a deep dive into the trends leading to increased onshoring in the recent past. The report is based on Everest Group’s proprietary GBS database of more than 5,000 GBS centers.

Among the compelling findings detailed in the research are:

- GBS organizations are embracing digital transformation

Both the outsourcing and GBS models continued to grow in the US in 2020, with more than 40 new GBS centers in the first three quarters. However, the pace of growth and new setups were relatively lower than the prior year. Some of the new GBS center setups in 2020 include Amazon, Denso, JP Morgan, and General Motors, to name just a few.

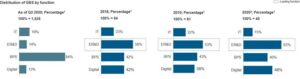

While traditionally, organizations have used US-based GBS organizations for customer care and back-office work, a focus on engineering and R&D (ER&D) and digital services have driven new setups in recent years. Enterprises are increasingly leveraging US-based GBS organizations to build digital hubs, especially for automation, AI, and analytics, with more than 45 percent of the setups in 2020 focused on delivering digital services. This is driven by a couple of factors. First, onshore locations can provide access to high-end talent for innovation and R&D and facilitate closer integration with business stakeholders. Secondly, resiliency shown by GBS organizations during the crisis has increased enterprises’ confidence.

This image illuminates how GBS markets are steadily moving toward digital transformation.

- New adopters are driving GBS growth

Surprisingly, the majority of the new GBS setups in the US in the past years were driven by new adopters of the GBS model. This continued in 2020, with more than 70 percent of the new setups by first-time implementers. The growing maturity of the GBS model, success demonstrated by peers, and decreasing obstacles related to transitions, and legal and regulatory environments have enabled new firms to move to the GBS model.

- US locations are attractive for GBS

The technology and communication verticals continue to dominate the GBS market in the US, accounting for more than one-third of the total activity. This is followed by manufacturing, which has experienced a significant increase in the share of total setups.

Historically, approximately 90 percent of firms have preferred non-tier-1 locations for GBS set up given attractive cost-talent proposition (within the US) and proximity to select industries. This continued in 2020, with tier-3/4 locations accounting for about 60 percent of new setups. Key tier-3/4 locations include Austin and Pittsburgh.

Positive Trends Emerge for Onshoring

Traditionally, key factors driving enterprises towards onshoring, especially in the US, have been ease of setup, the proximity of CS services with business and customers, and a familiar operating environment. However, in recent times, the following new drivers have emerged that will continue to contribute to a spike in GBS in the US going forward:

- Rising demand for digital services – Enterprises are rethinking the role of onshore GBS to build and drive capabilities required to fulfill the demand for digital services

- Tightening regulatory environment – Tightening regulatory environment (in certain verticals), increased trade protectionism, and rising stringency of visa norms have led to a recent increase in onshore center setups

- COVID-19-led disruption – While the resiliency shown by GBS organizations during the crisis has increased enterprises’ confidence, they also need to ensure greater control and proximity and reduce their offshore concentration to diversify their risk portfolio

Explore the complete details of the US Global Business Services Market Report by downloading the full report here.