Blog

Pharma Service Providers’ Role in Tempering Pricing Wars | Sherpas in Blue Shirts

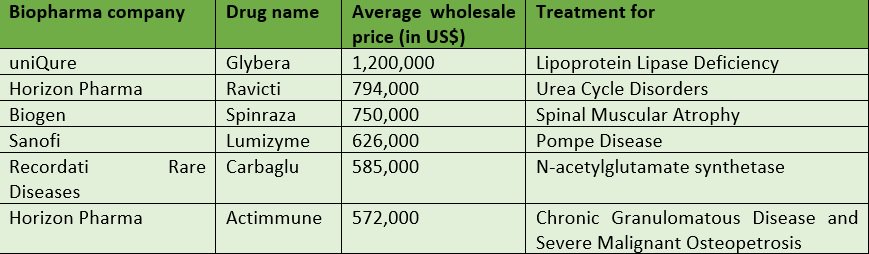

Shortly after the U.S. Food & Drug Administration (FDA) approved Novartis’ CAR T-cell drug, Kymriah – which is used for pediatric B-cell Acute Lymphoblastic Leukemia – last month, Novartis announced its price…a whopping $475,000 per patient. This is certainly not the first market instance of highly expensive drugs (see below.)

But it might just be the tipping point for stakeholders – including regulatory bodies, payers, physicians, advocacy groups, and patients – to start having constructive discussions with drug manufacturers on how to make drugs that treat extremely rare diseases more accessible to the very small share of the population that needs them.

It is certainly time for pharma companies to overhaul their operations in order to mitigate price anger and get such drugs into the hands of those whose lives depend on them.

One way they can do so is by employing pay-for-performance, or outcome-based, contracts, wherein the manufacturer charges for the drug once it proves effective, say one or two months into treatment. Note that this pricing model hasn’t yet really taken off, especially in the United States, where the fragmented multi-payer environment acts as an added roadblock. Indication-based pricing, wherein there are different prices for different conditions, is another model that biopharma companies can use, but the U.S. market does not have mechanisms in place for it, at least as of now.

Other ways of ensuring patients are able to benefit from such critical drugs are through mixes of personalized offline and online marketing campaigns directed specifically to the relevant patient and physician pool, and improved and comprehensive patient support programs to help in solving “last mile connectivity” issues.

But at the end of the day, stakeholder backlash might – and should – force pharma companies to drive down their own costs to make these expensive, personalized medicines more affordable. And this is where outsourcing service providers can help.

The third-party service providers that are already servicing the pharma industry need to prepare or bolster solutions and capabilities around areas including patient and market access, data analytics, omnichannel marketing, IoT, automation, portals, applications, customer support, pricing analytics, infrastructure modernization, and cloud orchestration. Service providers that are struggling to enter the life sciences space should view this as a window of opportunity to get a foot in the door of these companies. Doing so will mean additional business for both these types of vendors; it could also mean reduced pricing pressure for the patients who need such vital treatments.

The future of personalized medicine depends a lot on success of such drugs, and biopharma companies can no longer afford to sit back and operate like they always have. For a detailed discussion and analysis around these solutions, and to learn about other trends in the life sciences market, look out for our soon-to-be-published State of the Market Report.