Blog

Deep Discounts in IT Infrastructure Services Pricing – Is This the New Normal? | Sherpas in Blue Shirts

The IT services industry is going through a tremendous change with the onset of new technologies, geo-political uncertainty, and disruption of traditional business models.

Deal renewals have fallen significantly, leading to intense price competition among service providers trying to meet their top-line revenue expectations. As expected, the pricing pressure is higher in some of the more commoditized services such as IT Infrastructure operations. Indeed, recent Engagement Reviews for numerous North American clients suggests that pricing for some mature services within the IT infrastructure domain, such as storage and backup management, server management, and database management, has fallen significantly. Our analysis suggests that the Indian service providers have upped their ante, and have become even more competitive in terms of pricing.

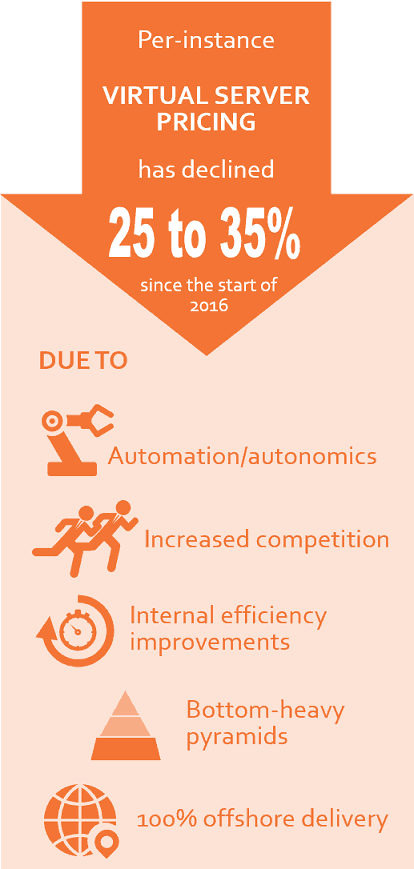

As a case in point, the per instance pricing for virtual server management has fallen by 25-35 percent over the last 12 months. The fall in pricing for some other resource units has been even steeper.

What’s driving these deeply reduced prices? Numerous solution-related changes have impacted pricing dynamics in this market.

- Maturity of internal automation/autonomics capabilities of service providers

While these have largely been buzzwords in the last 12-18 months, we believe that the impact of some of these investments has finally started to show up in deals. - Further improvement of internal productivity

Just when we thought that the solution effort ratios such as servers managed per FTE, databases managed per FTE, etc., had reached their true, optimum levels, we have seen instances of further changes in some of these solution metrics. Some of these can potentially be attributed to the above point. - Complete offshore operations

We are seeing more and more deals where 100 percent offshore delivery is the norm. This enables service providers to quote very competitive per unit pricing. It will be interesting to observe how this metric changes going forward if new regulations come into play by the new U.S. president’s administration. - Increased competition, smaller deal sizes, and deal durations

The past 12 months have been difficult for most IT service providers, with increasing competitive intensity and delayed enterprise decision making due to geo-political uncertainty. As a result, they are going all guns blazing to win new accounts.

Most of this low pricing has been observed in new deal situations. We have seen very few occurrences of providers proactively reducing prices in existing deals, unless faced with the threat of the deal going into a competitive situation. Of course, it would be unfair to expect service providers to reduce unit prices significantly in all deals, since each deal level pricing scenario is very contextual and a deeper analysis of the underlying environment is warranted.

Have you had discussions with your infrastructure provider about recalibrating prices?