Blog

The Future of the Wealth Management Industry: The S-curve Shift and the Modernization Opportunity

The wealth management industry has evolved over the years, transitioning from reputation-driven models to technology-led advisory services. Read on to uncover how wealth management firms can develop a digital blueprint to navigate the next digital frontier and better serve their clients in an increasingly hybrid and personalized landscape. Get in touch to discuss further.

In our earlier blog, How Technology Can Help the Wealth Management Industry Navigate Coming Changes in 2023, we discussed how digital disruptions will impact the wealth management industry and the role technology and service providers can play in helping wealth management firms navigate the choppy waters ahead. Continuing with our two-part blog series in the wealth management space, this blog will touch upon how this industry has transitioned through the different eras and how we are now on the cusp of a new digital future. The current question is, what will the digital blueprint be to help wealth management firms be better prepared for this new normal?

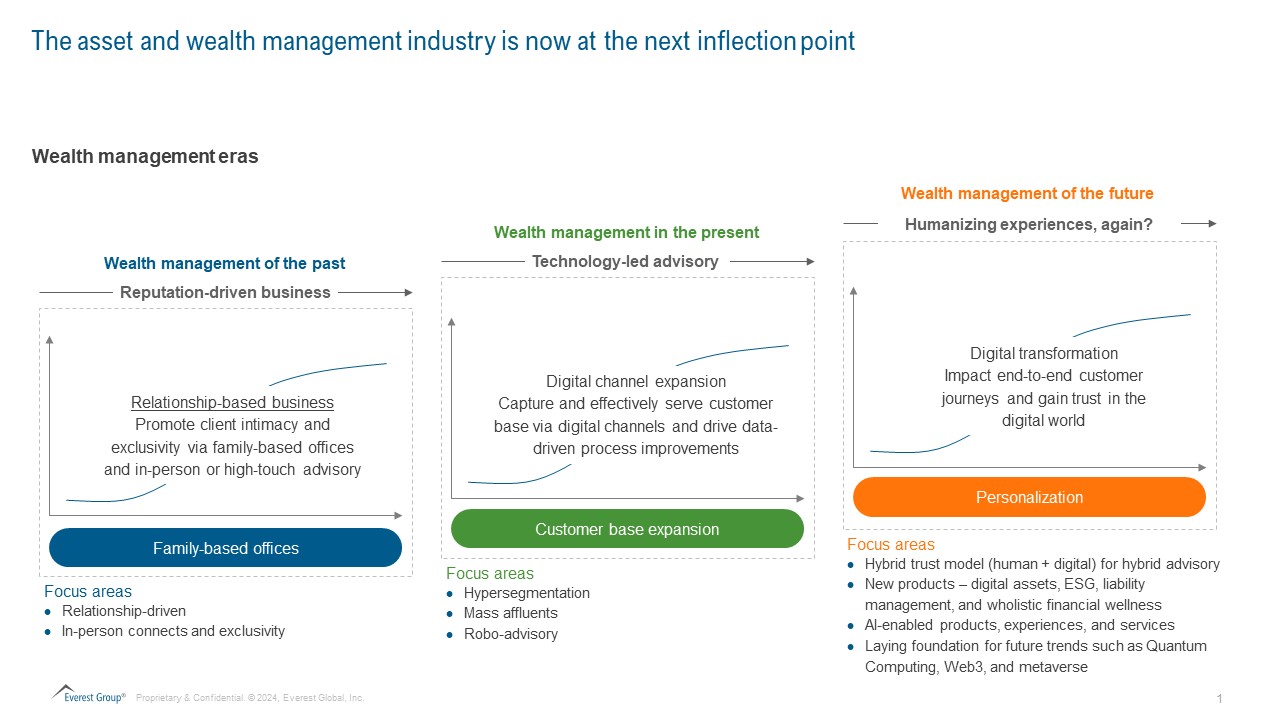

Wealth management eras – is the industry undergoing another S-curve shift?

The wealth management industry has witnessed several s-curve shifts in the past and has evolved from being a reputation-driven business to a technology-led advisory model. We are now witnessing the next inflection point, moving from persona- to person-based personalization through the hybrid trust model. The initial journey of the wealth management industry was about family-based offices and reputation-driven businesses. It was all about having the right intimacy with the client, nurturing the exclusivity, and delivering that strong advisory model. It was driven by large systems of records, but experience remained bespoke and in-person.

After this era, the wave of customer expansion hit with the emergence of mass affluent customers. It became less about serving HNIs and UHNIs and more about capturing the mass affluent segment that demanded access to similar asset classes and WM strategies as HNWI and institutional investors, which led to the rise of robo-advisory models to democratize access to these services. Enterprises wanted to serve this new segment better in a cost-effective model that could help them meet their margin targets as well. This led to rapid technological disruption in the wealth management industry and pushed us into the digital advisory model that we are currently in. We saw this in the case of UBS in late 2022 with the launch of WE.UBS, a digital wealth platform for mass affluent clients in China in partnership with technology provider Tencent.

Currently, we can see that enterprises are focusing on developing a hybrid trust model. In this model, they utilize emerging technologies such as AI to transform end-to-end customer journeys and give their clients access to new products such as digital assets, ESG-linked investments, and overall financial wellness services. This could be seen in action a couple of years ago when HSBC introduced HSBC Prism Advisory in Asia, blending face-to-face and digital interactions in private banking. This service leverages BlackRock’s Aladdin Wealth™ technology, combining data analytics with HSBC advisors’ expertise.

Another notable example is when Citi announced its plan last year to utilize AI as a tool to simplify and automate procedures, enabling private bankers to dedicate more time to client service.

However, the top-of-mind questions are “Are we nearing the end of this era?” and “Is there a new world order coming for the wealth management industry?” This space has already seen a rapid expansion of products to cater to different customer segments, but now enterprises need to provide assistance to customers in navigating the buying experience while creating trust in a model that is now both human and digital. The wealth management industry has multiple siloed channels where the human-assisted channel enables great advice, but as soon as it moves to digital channels, the level of experience starts getting non-uniform and disjointed. Customers often talk about a lack of contextualization as they interact on such channels.

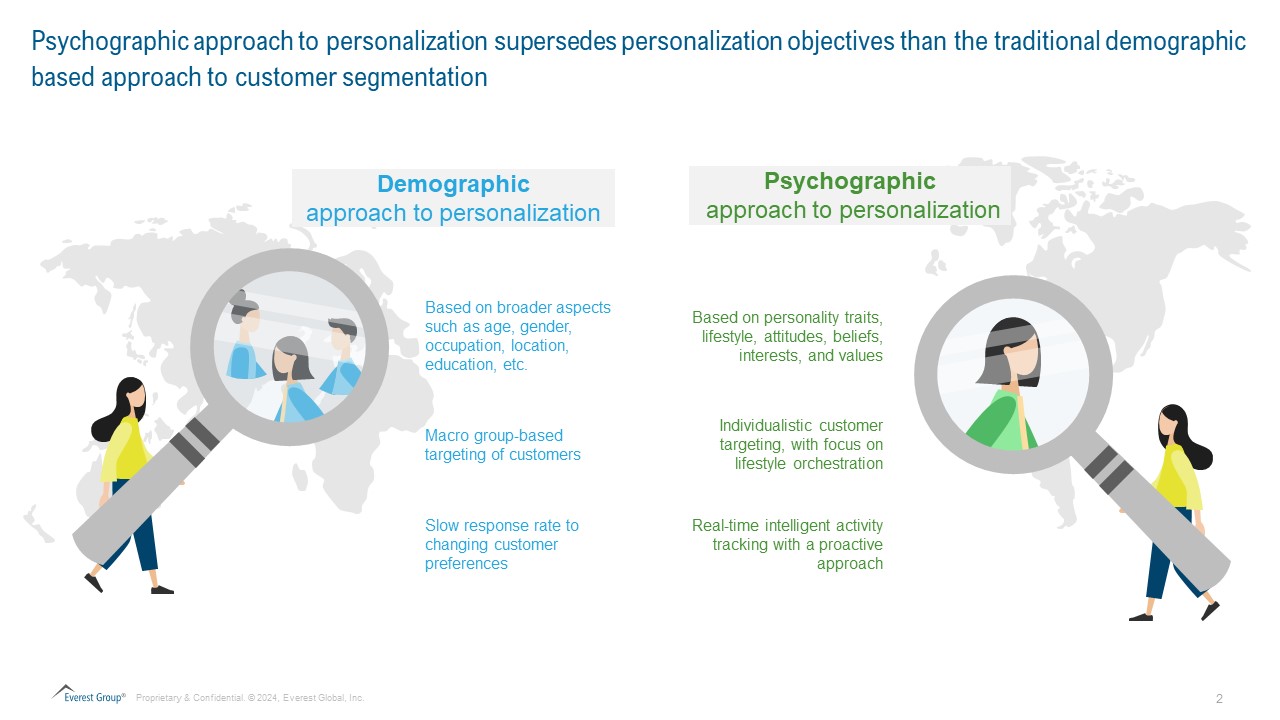

Psychographic segmentation – can it fix what is broken?

Hyperpersonalization has become one of the key focus areas as wealth management firms are trying to drive competitive differentiation in the current macroeconomic landscape. The emerging client segment, comprising of millennials and Gen Z investors, expects tailored services as per their preferences and values seamless experiences across both digital and human advisory channels. In light of these demands, we see the approach towards hyper-personalization shifting from demographic-based to a more psychographic-based segmentation.

Enterprises are now moving away from utilizing broader aspects such as age, gender, occupation, and location to create different personas and are utilizing individual personality traits such as lifestyle, attitudes, beliefs, interests, and values to create unique experiences for clients. This strategy promises to be especially effective in captivating and retaining young investors, a highly desirable client demographic poised to emerge as a lucrative segment amid the intergenerational transfer of wealth spanning diverse geographic regions. To embark on this journey, HSBC recently partnered with a European consulting firm, Zühlke, to revamp its mobile wealth management services for UK clients. Zühlke’s experts conducted a study on the investment preferences of British customers, providing insights that enabled HSBC to tailor its services to better meet their needs.

To excel in this approach, enterprises must possess the necessary technology to seamlessly monitor, acquire, and leverage customer data in real time, empowering them to dynamically create personalized experiences with agility and scalability. They need to establish trust with their customers so that they feel comfortable in sharing this private personality traits-related data, which can eventually lead to personalization-led value creation and drive customer delight. In late 2023, Morgan Stanley announced plans to roll out a gen AI bot for its HNWI clients that will provide functionalities such as summarizing a meeting, drafting a follow-up email for suggested next steps, updating the bank’s sales database, scheduling a follow-up appointment, and acquiring knowledge to aid advisers in managing clients’ finances, covering aspects like taxes, retirement savings, and inheritances.

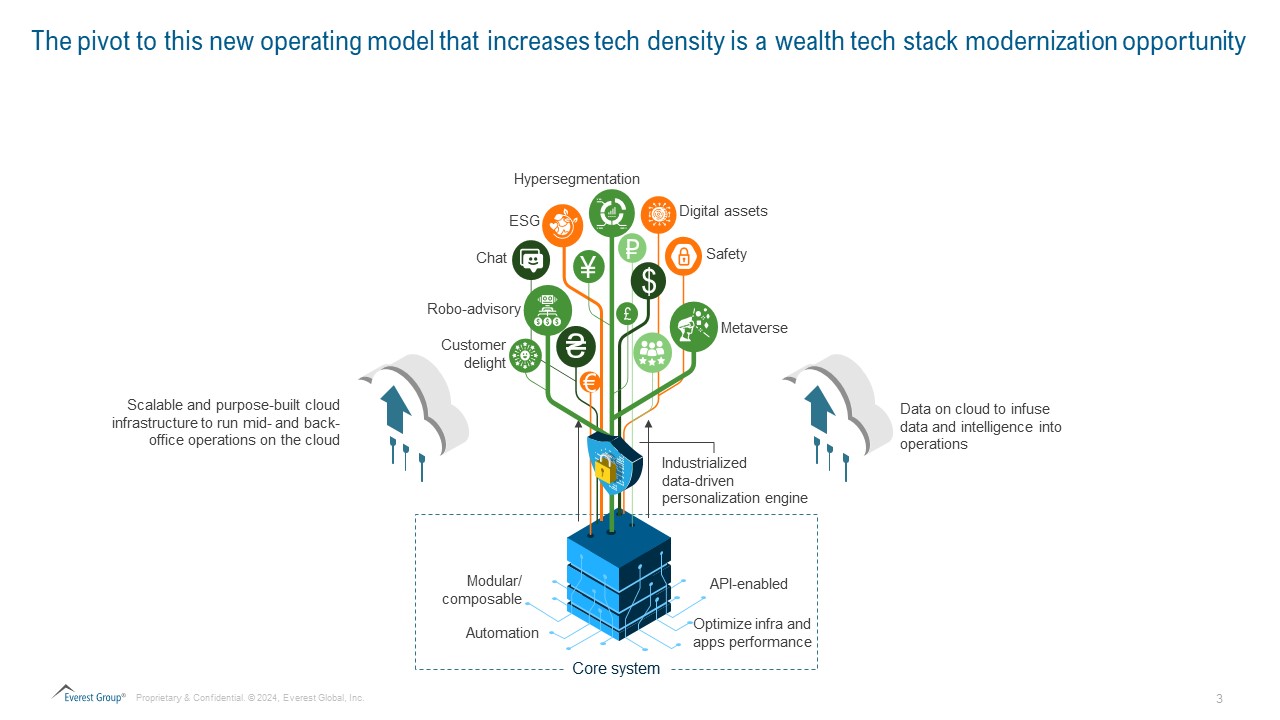

Future of wealth – can the roots of a modular core system power the tree of wealth?

As enterprises embark on this experience innovation journey, it is important for them to have the underlying technology stack to support the industrialized delivery of these data-driven experiences at scale. Currently, they are facing challenges in establishing digital workflows as most of them still have the legacy architecture consisting of Excel spreadsheets and siloed data systems, which makes streamlined data management and analysis difficult.

They are increasingly looking at leveraging cloud-based data management systems that can help them optimize their IT infrastructure costs and improve their ability to process structured and unstructured customer data in real time and at scale. We also saw that a few months ago, Northern Trust collaborated with Finbourne Technology, a UK-based data solutions provider, to adopt its cloud-native data management solution. This partnership aims to modernize Northern Trust’s technology by offering cost-effective and scalable data calculation and processing, enabling near real-time delivery of valuations and other crucial data to clients.

Integrating the cloud into their business and technology operations will also help them roll out new features quickly and keep up with the constantly changing customer demands. In this process of driving data and intelligence in their operations, one of the key focus areas for enterprises is prioritizing and sequencing this migration of workloads to the cloud across the various elements in the wealth management value chain. They want to identify the quick wins that would have the maximum impact while having lesser complexity associated with the transition.

The wealth tree, as seen in the graphic, is what we believe the future of wealth would look like. The fruits and leaves represent wealth for end customers by creating customer delight through innovative products and personalized experiences. This was seen in action in early 2024 when Kinecta Federal Credit Union announced a strategic partnership with cloud-based wealth management solutions provider FusionIQ to enhance its digital investing services by leveraging the platform’s features, such as digital advice, self-directed investing, and other financial well-being solutions. Also, in 2023, J.P. Morgan partnered with TIFIN to launch TIFIN.AI, aiming to accelerate AI-powered fintech innovation in wealth management. This initiative includes using AI for client portfolio insights for advisors, alternative investing, workplace wealth management, and insurance, among other applications.

In this world of personalized experiences, customers want to feel trusted and safe with wealth enterprises as they enable these multi-channel experiences. They want customers to be able to invest in alternative assets and grow their wealth as wealth management enterprises orchestrate all of it.

As enterprises think about this, they want to be compliant and provide a secure and protected environment. There is a need to have a core system that is modular, composable, and automated. There needs to be a lot more API enablement, which can be continuously optimized in terms of the infrastructure and the applications that are running on top of it. To industrialize the data-driven personalization engine, the core system needs to enable it in a trusted, safe, and secured manner so the security aspect becomes paramount. The two big enablers to this journey will be running operations and having data on the cloud.

In the journey to build out this wealth tree, all ecosystem players, from wealth managers and technology providers to service providers, will have a role to play and a different journey to traverse.

We would be interested to hear about your journey in this evolution. Please feel free to reach out to Ronak Doshi, [email protected], Kriti Gupta, [email protected], or Pooja Mantri, [email protected] to discuss further.

Watch the webinar, Transforming to Thrive: Building Winning Operating Models Amid Disruption Across Industries, to learn how enterprises should think about disruptive changes as they go about their transformation agenda.