Blog

Buyer Reality Check: Are Your Outsourcing Suppliers Bringing You Value?

Over years of tracking outsourcing demand patterns and service provider performance, Everest Group has noted a persistent trend: value from outsourced services often falls short of organizations’ expectations. Despite long-term engagements, organizations frequently find inadequacies in services delivered by their suppliers.

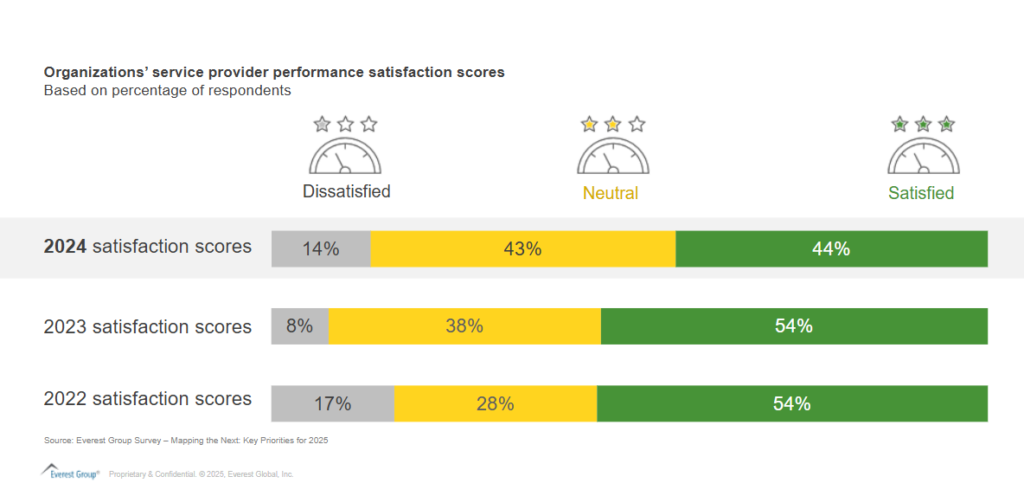

The latest Everest Group survey, “Mapping the Next: Key Priorities for 2025” (Exhibit 1), reveals widespread dissatisfaction with both the quality of services and the Return on Investment (ROI), they receive from their regular outsourcing spend. This dissatisfaction, seen across all geographies, is further reflected in low satisfaction scores and a growing need for new supplier mix.

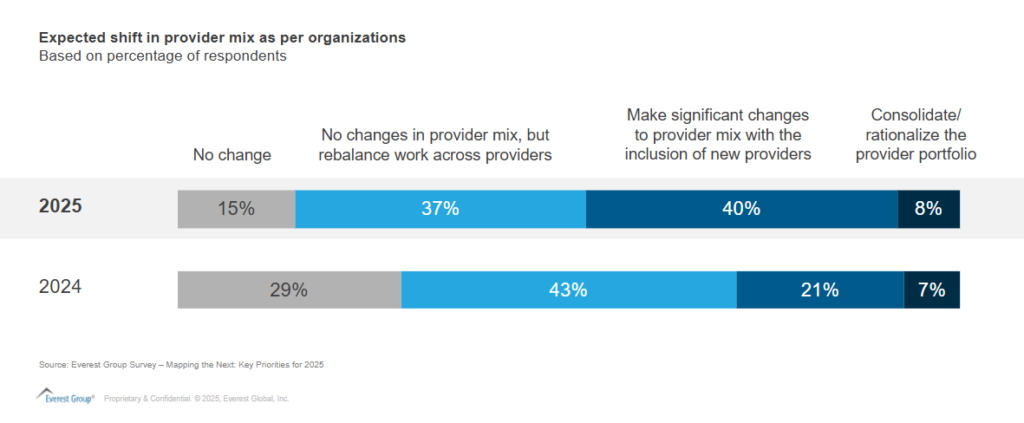

This ongoing discontent has also created a recurring cycle, as organizations constantly adjust their partner strategies: rebalancing workloads across existing providers, onboarding new partners, or rationalizing their portfolios (Exhibit 2). Yet, these changes fail to significantly improve outcomes, leaving organizations stuck with low satisfaction scores, as our analysts explain below.

Reach out to discuss this topic in depth.

What’s holding service providers back from winning over their customers?

The reasons for this dissatisfaction are numerous, but four key challenges from service providers’ delivery capabilities stand out as critical contributors to the problem:

Problem 1: Service pricing issues

Organizations struggle with inconsistent pricing models, role definitions, pricing structures that lead to unpredictable costs. Buyers may find it challenging to manage all in costs, especially in time and materials deals. Organizations value providers that offer transparent, predictable costs without compromising service quality.

Problem 2: Lack of delivery prioritization

To grow revenues, service providers often adopt two strategies:

-

- Maximizing value from the existing accounts through stable delivery and cross-selling initiatives

-

- Expanding client outreach through increased sales efforts or competitive pricing

Many customers are turned off by service providers prioritizing new revenue over improving existing service. When providers prioritize aggressive expansion over maintaining strong relationships with their clients, service quality, responsiveness, and strategic alignment suffer. Organizations expect service providers to balance growth ambitions with consistent and committed account management.

Problem 3: Frequent team changes disrupting continuity

Organizations find value in having steady persistent teams to keep up high delivery quality and a consistent relationship. However, service providers often struggle with a high talent turnover, damaging the relationship with their client organizations.

Providers that can maintain a strong talent retention ratio along with a higher headcount growth have more flexibility to align their employees’ skills with client needs. This alignment not only meets client expectations but also fosters long-term satisfaction by ensuring continuity and expertise in service delivery.

Problem 4: A lack of innovation and strategic investment

Organizations expect their service providers to bring fresh ideas and continuous improvement to engagements. However, many providers prioritize short-term financial gains by focusing more on share repurchases to boost the investor sentiments over investing in innovation. This lack of forward-thinking capabilities leaves buyers feeling stuck with outdated solutions rather than benefiting from cutting-edge advancements.

Enter: The service provider health check

Organizations buying and managing outsourced service providers can avoid these challenges by using market and financial data to monitor the positioning of their service provider. A regular cadence of reviewing financial and organizational structure data can aid in predicting both short-term and long-term implications.

Data on growth trajectory, investment in talent and technology, and financial stability offer insights into service providers’ capability to innovate and their negotiation stance.

By systematically monitoring these parameters, buyer organizations can make informed decisions about their outsourcing strategies and foster better alignment between expectations and service delivery. Through our quarterly report, “Service Provider Health Check”, we keep a continuous tab on these metrics and parameters to:

-

- Track progress of individual service providers

-

- Compare them on these parameters

-

- Highlight financial and structural changes crucial to organization’s decision-making process

These further aid the buyer organizations in –

-

- Serving as a preliminary check in evaluating and shortlisting suppliers in for Request for Proposals (RFPs)

-

- Outlining service providers’ evolving behaviors and actions in a changing macro environment, which can feed into negotiation strategies

-

- Enhancing supplier risk assessments with an external fact base

If you find this blog interesting, you can also read more of our latest reports – Report and Report, which delves deeper into the parameters of this topic. Stay tuned for further updates throughout 2025.

If you are interested in discussing how Everest Group can help you further or speaking about these parameters in more depth, please reach out to Sanyam Gupta at [email protected].